Oregon Assignment of Interest in Trust is a legal process where a person transfers their ownership rights and interests in a trust to another party. This assignment allows the assignee to assume the beneficiary's rights and responsibilities, including receiving distributions, managing assets, and making decisions related to the trust. Keywords: Oregon Assignment of Interest in Trust, legal process, transfer ownership rights, beneficiary, assume rights and responsibilities, distributions, managing assets, making decisions, trust. There are different types of Oregon Assignment of Interest in Trust, which include: 1. Absolute Assignment: This type of assignment involves a complete transfer of the beneficiary's interests in the trust to the assignee. The assignee assumes all rights and obligations associated with the trust, including receiving income, managing assets, and making decisions on behalf of the trust. 2. Partial Assignment: In a partial assignment, the beneficiary transfers only a portion of their interest in the trust to another party. This allows the assignee to share in the benefits and responsibilities associated with the assigned portion of the trust while the original beneficiary retains control over the remaining interest. 3. Conditional Assignment: A conditional assignment of interest in trust occurs when the transfer of ownership rights is subject to certain conditions or requirements. These conditions may include specific events or milestones that need to occur before the assignment becomes effective. 4. Revocable Assignment: A revocable assignment allows the beneficiary to revoke or modify the assignment of their interest in the trust at a later point in time. This gives the beneficiary flexibility in managing their trust assets and allows them to make changes based on changing circumstances or preferences. 5. Irrevocable Assignment: Unlike a revocable assignment, an irrevocable assignment of interest in trust cannot be changed or revoked by the beneficiary. Once the assignment is made, the rights and interests in the trust are permanently transferred to the assignee. In summary, Oregon Assignment of Interest in Trust is a legal process where a beneficiary transfers their rights and responsibilities in a trust to another party. Whether it is an absolute, partial, conditional, revocable, or irrevocable assignment, it allows the assignee to assume control over the trust's assets and decision-making.

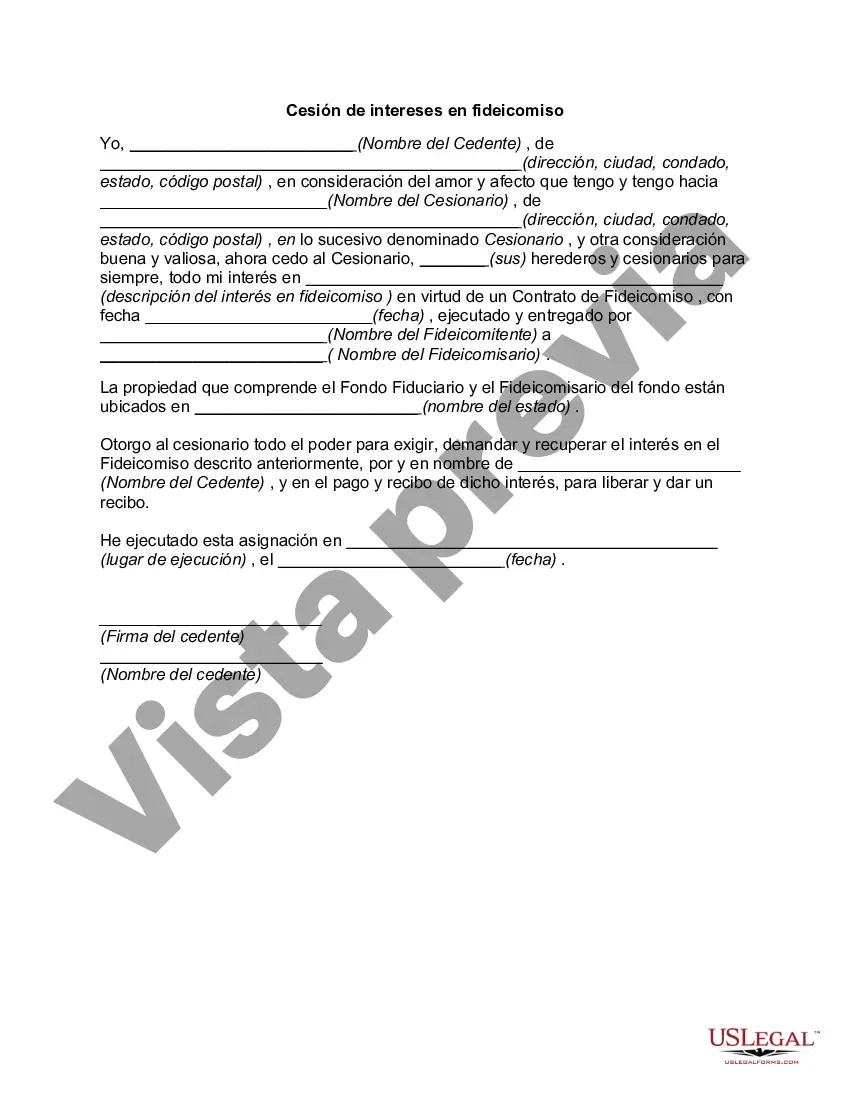

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oregon Cesión de intereses en fideicomiso - Assignment of Interest in Trust

Description

How to fill out Oregon Cesión De Intereses En Fideicomiso?

It is possible to commit hrs on-line searching for the lawful file design that meets the state and federal demands you will need. US Legal Forms gives a huge number of lawful forms which can be examined by professionals. It is possible to acquire or print the Oregon Assignment of Interest in Trust from your assistance.

If you currently have a US Legal Forms bank account, you may log in and click on the Down load key. Following that, you may complete, revise, print, or signal the Oregon Assignment of Interest in Trust. Each lawful file design you get is the one you have for a long time. To acquire an additional duplicate of the acquired form, check out the My Forms tab and click on the related key.

If you use the US Legal Forms web site the first time, follow the simple instructions below:

- Initially, make sure that you have selected the correct file design for your region/town that you pick. See the form outline to make sure you have picked the right form. If offered, take advantage of the Review key to check throughout the file design also.

- If you would like find an additional version of your form, take advantage of the Lookup field to find the design that meets your needs and demands.

- Once you have discovered the design you want, click Get now to move forward.

- Choose the costs program you want, enter your credentials, and register for your account on US Legal Forms.

- Complete the financial transaction. You can utilize your Visa or Mastercard or PayPal bank account to cover the lawful form.

- Choose the formatting of your file and acquire it for your gadget.

- Make adjustments for your file if needed. It is possible to complete, revise and signal and print Oregon Assignment of Interest in Trust.

Down load and print a huge number of file web templates making use of the US Legal Forms web site, that offers the largest variety of lawful forms. Use expert and condition-distinct web templates to tackle your company or individual requires.

Form popularity

FAQ

Assignment of Beneficial Interest means the instrument pursuant to which a BI Seller conveys right, title and interest to the beneficial interest of a LIFT Entity to a Purchaser, the form of which is attached as Exhibit A hereto.

Collateral Assignment of Beneficial Interest: This is the agreement that secures the lenders interest in the beneficial interest of the trust and puts a lien on the beneficial interest in the trust. It is the land trust equivalent of the mortgage.

Assignment of Note and Deed of Trust means an assignment of all of the Participating Lending Institution's right, title, and interest in a Note and Deed of Trust, in substantially the form provided in the applicable Lender's Manual.

When your original lender transfers your mortgage account and their interests in it to a new lender, that's called an assignment of mortgage. To do this, your lender must use an assignment of mortgage document. This document ensures the loan is legally transferred to the new owner.

Beneficial interest refers to a right to income or use of assets in a trust. People with a beneficial interest do not own title to the property, but they have some right to benefit from the property. This is to be contrasted with trustees and other agents of the trust who only have managing duties.

A beneficial interest is the right that a person has arising from a contract to which they are not a party, or a trust. For example, "if A makes a contract with B that A will pay C a certain sum of money, B has the legal interest in the contract, and C the beneficial interest."

A trust deed is always used together with a promissory note that sets out the amount and terms of the loan. The property owner signs the note, which is a written promise to repay the borrowed money.

When your mortgage lender decides he wants to sell your mortgage loan to another lender, your mortgage lender will sign an assignment of deed of trust in favor of the new lender. This assignment gives the new lender the same lien on your property that your original lender had under the mortgage loan.

In exchange for a deed of trust, the borrower gives the lender one or more promissory notes. A promissory note is a document that states a promise to pay the debt and is signed by the borrower. It contains the terms of the loan including information such as the interest rate and other obligations.

A General Assignment is a document that declares that certain property is held and vested in the name of a trust. Since a trust only works when it holds property, this document is crucial for the funding of a Revocable Trust.