Nebraska Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife / Two Individuals to Individual

Definition and meaning

The Nebraska Transfer on Death Deed, also known as a TOD or Beneficiary Deed, is a legal document that allows a property owner to designate a beneficiary who will inherit real estate upon their death. This deed enables property transfer without the need for probate, simplifying the process for both the property owner and their heirs. It is particularly beneficial for couples or individuals wanting to ensure their property is passed on directly to a named beneficiary.

How to complete a form

Completing the Nebraska Transfer on Death Deed requires you to follow these steps:

- Identify the property you are conveying and enter its legal description.

- Provide the names and addresses of all owners or transferors involved in the deed.

- Designate your primary beneficiary and their contact information.

- Optionally, specify alternate beneficiaries in case the primary does not survive you.

- Sign the deed in front of witnesses and a notary public.

Ensure you record the completed deed with the appropriate county office within thirty days of signing to make it effective.

Who should use this form

The Nebraska Transfer on Death Deed is suitable for homeowners, particularly couples or individuals, who wish to ensure a seamless transfer of property ownership after their passing. It is ideal for those who want to avoid the probate process and ensure their designated beneficiaries can inherit property directly. If you have specific beneficiaries in mind and want to simplify the transfer process, this form is appropriate for your needs.

Key components of the form

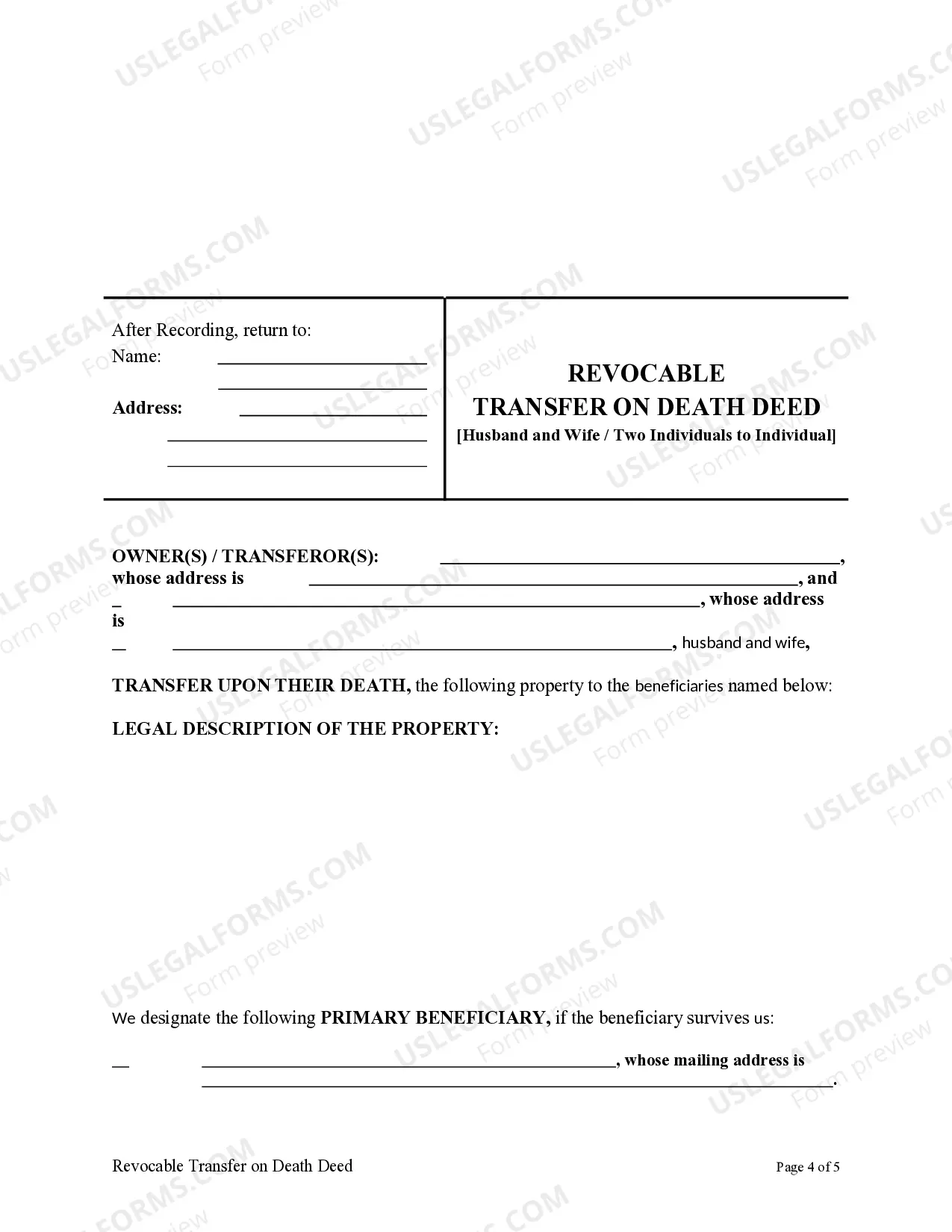

The form consists of several crucial sections, including:

- Owner(s)/Transferor(s): Identifies the current property owners.

- Property Description: Provides the legal description of the property.

- Beneficiary Details: Names the primary and alternate beneficiaries.

- Signatures: Requires the signatures of all transferors and witnesses, along with notarization.

Each component is vital for ensuring the form's validity and compliance with Nebraska law.

State-specific requirements

In Nebraska, the Transfer on Death Deed must be executed and recorded within thirty days of signing to be effective. It requires signatures from all transferors and must be notarized. Additionally, it must be filed with the local county registrar of deeds. Failure to comply with these state-specific requirements may invalidate the deed.

Common mistakes to avoid when using this form

When completing the Nebraska Transfer on Death Deed, be wary of the following common mistakes:

- Failing to provide a complete legal description of the property.

- Not identifying all owners or transferors involved.

- Inadequate naming of beneficiaries, which may lead to confusion.

- Neglecting to have the deed notarized or failing to sign in front of witnesses.

Avoiding these mistakes ensures that the deed is executed properly and remains effective.

Form popularity

FAQ

A TOD designation supersedes a will. For bank accounts, you can set up a similar account known as payable-on-death, sometimes referred to as a Totten trust. Your beneficiaries can't touch the account while you're alive, and you're free to change beneficiaries or close the accounts at any time.

A beneficiary form states who will directly inherit the asset at your death. Under a TOD arrangement, you keep full control of the asset during your lifetime and pay taxes on any income the asset generates as you own it outright. TOD arrangements require minimal paperwork to establish.

Accounts or assets with named beneficiaries may be transferred without going through the probate process.If there is a TOD on the account, the assets will only go to the beneficiary if both joint owners pass away. In either case, the asset will not likely go through probate.

An account holder may choose to list both of their children as equal beneficiaries. However, an account holder can also choose to list individuals in unequal amounts. For example, you could designate a primary beneficiary to receive 50 percent of the funds and two secondary beneficiaries who receive 25 percent each.

On a nonretirement account, designating a beneficiary or beneficiaries establishes a transfer on death (TOD) registration for the account. For an individual account, a TOD registration generally allows ownership of the account to be transferred to the designated beneficiary upon your death.

TOD becomes effective for joint accounts if both owners pass away simultaneously. Joint and TOD registration generally allow an account to pass outside the probate estate, enabling the surviving owner or beneficiaries to avoid the time and expense of that process for this account.

If you own an account jointly with someone else, then after one of you dies, in most cases the surviving co-owner will automatically become the account's sole owner. The account will not need to go through probate before it can be transferred to the survivor.

A TOD designation supersedes a will. For bank accounts, you can set up a similar account known as payable-on-death, sometimes referred to as a Totten trust. Your beneficiaries can't touch the account while you're alive, and you're free to change beneficiaries or close the accounts at any time.

TOD account holders can name multiple beneficiaries and divide assets any way they like.However, the beneficiaries have no access or rights to a TOD account while its owner is alive. Those beneficiaries can also be changed at any time, so long as the TOD account holder is deemed mentally competent.