This state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new non-profit corporation. The form contains basic information concerning the corporation, normally including the corporate name, names of the incorporators, directors and/or officers, purpose of the corporation, corporate address, registered agent, and related information.

Nebraska Articles of Incorporation for Domestic Nonprofit Corporation

Description

Definition and meaning

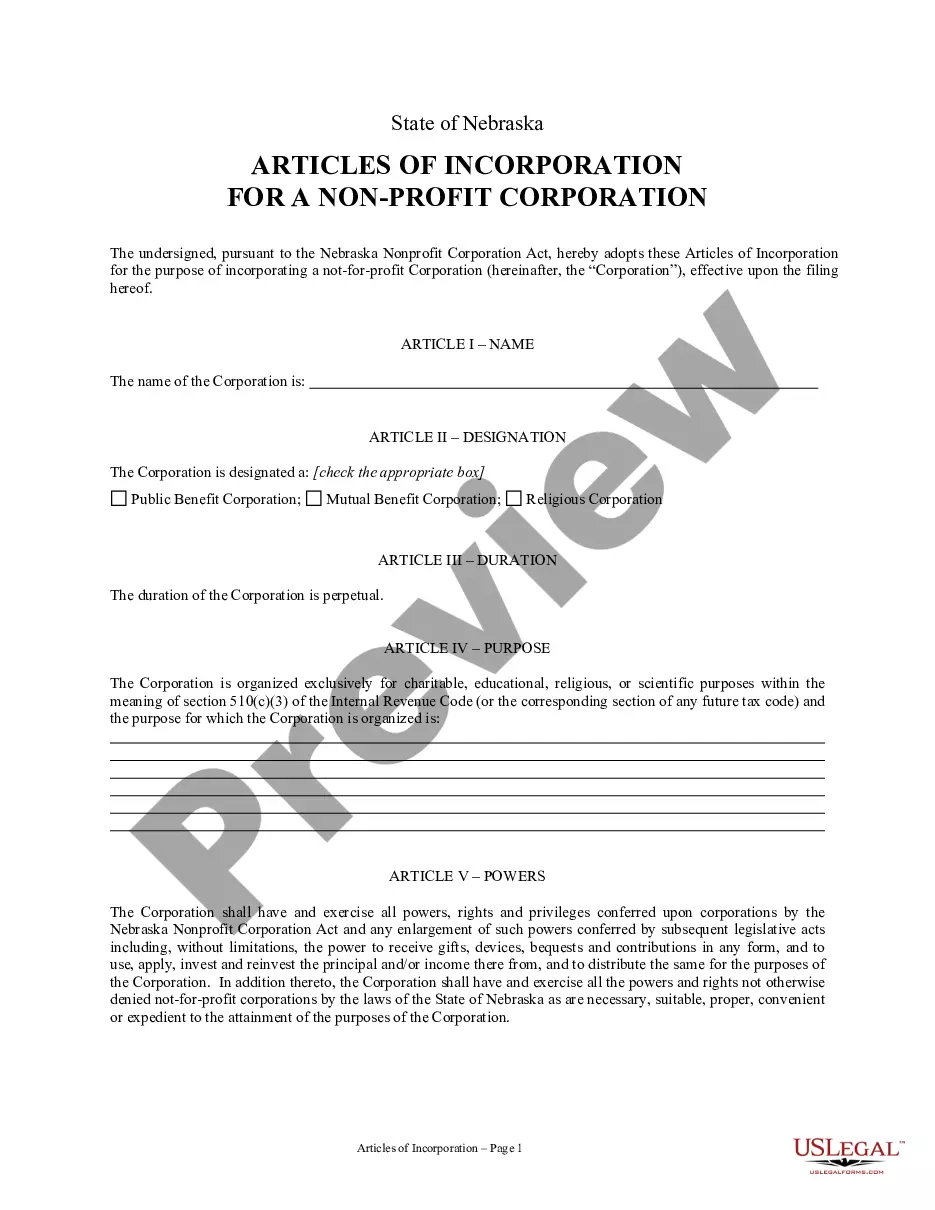

The Nebraska Articles of Incorporation for a Domestic Nonprofit Corporation is a legal document that establishes a nonprofit corporation in the state of Nebraska. This document serves several purposes: it defines the organization’s structure, outlines its purpose, and provides essential information about the governing body. Once filed with the Nebraska Secretary of State, the Articles grant the corporation legal status, enabling it to operate within the state while enjoying certain legal protections and privileges.

How to complete a form

To successfully complete the Nebraska Articles of Incorporation, follow these steps:

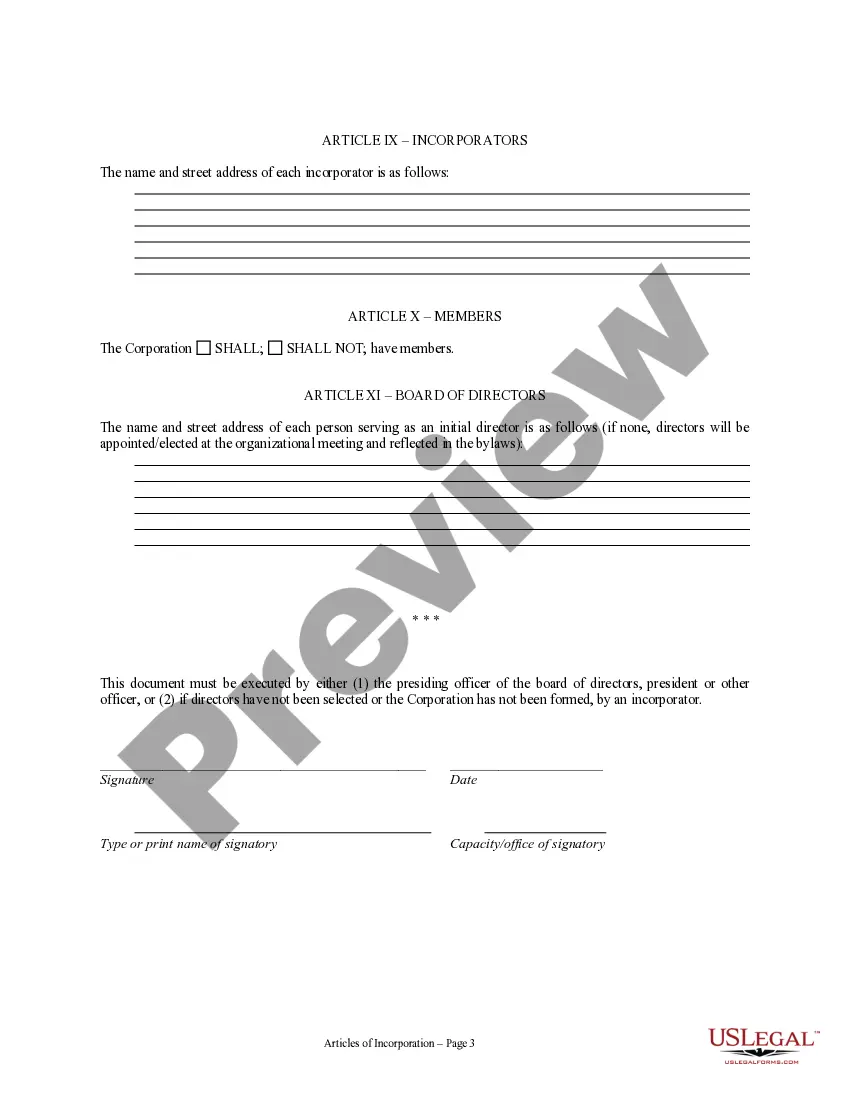

- Gather necessary information: Collect details such as the name of the corporation, the purpose, the registered office address, and names of incorporators.

- Choose the correct designation: Indicate whether the corporation is a public benefit, mutual benefit, or religious corporation.

- Prepare the document: Fill out the form with the gathered information, ensuring accuracy in each section.

- Sign the document: Ensure that it is signed by either an officer of the corporation or an incorporator.

- File with the Secretary of State: Submit the completed form along with the required filing fee to the Nebraska Secretary of State.

Key components of the form

The Nebraska Articles of Incorporation includes several key components that are necessary for its validity:

- Name of the Corporation: Must include a unique name that complies with state regulations.

- Designation: The selected type of corporation (public benefit, mutual benefit, or religious).

- Duration: Typically perpetual unless stated otherwise.

- Purpose: Clearly articulated purpose of the corporation aligned with the terms of nonprofit status.

- Powers: Outline of the powers granted to the corporation under the Nebraska Nonprofit Corporation Act.

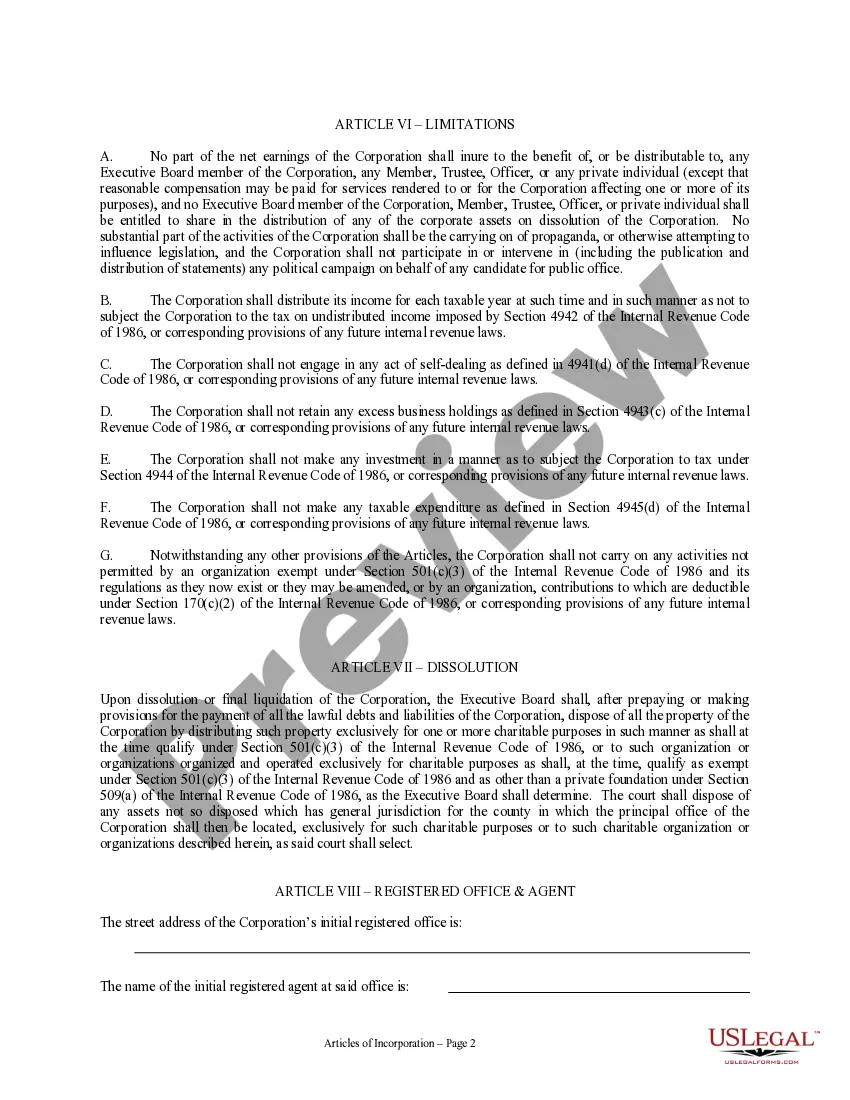

- Limitations: Specific clauses that restrict certain activities to maintain nonprofit status.

- Dissolution procedures: Guidelines for asset distribution upon dissolution.

Who should use this form

The Nebraska Articles of Incorporation for a Domestic Nonprofit Corporation is designed for individuals or groups looking to establish a nonprofit organization in Nebraska. This form is suitable for:

- Charitable organizations seeking to provide community services.

- Religious organizations aiming to formalize their operations.

- Educational institutions wanting to operate without profit motives.

- Any group or association that plans to operate as a nonprofit entity for social or mutual benefits.

State-specific requirements

When preparing the Nebraska Articles of Incorporation, it is essential to adhere to specific state requirements:

- The incorporation document must be delivered in English and typewritten or printed.

- It requires the original document along with an exact or conformed copy for filing.

- A filing fee must accompany the submission, with the amount specified by the Nebraska Secretary of State.

- The articles must state whether the corporation will have members or not.

- A legal notice of incorporation must be published for three successive weeks in a local newspaper.

How to fill out Nebraska Articles Of Incorporation For Domestic Nonprofit Corporation?

Avoid costly lawyers and find the Nebraska Articles of Incorporation for Domestic Nonprofit Corporation you want at a reasonable price on the US Legal Forms site. Use our simple groups functionality to look for and obtain legal and tax documents. Read their descriptions and preview them well before downloading. Additionally, US Legal Forms provides users with step-by-step tips on how to download and complete each template.

US Legal Forms customers simply need to log in and obtain the specific form they need to their My Forms tab. Those, who have not got a subscription yet need to follow the tips below:

- Make sure the Nebraska Articles of Incorporation for Domestic Nonprofit Corporation is eligible for use where you live.

- If available, read the description and make use of the Preview option just before downloading the sample.

- If you are confident the document suits you, click Buy Now.

- In case the template is wrong, use the search field to find the right one.

- Next, create your account and select a subscription plan.

- Pay by credit card or PayPal.

- Select download the form in PDF or DOCX.

- Click Download and find your form in the My Forms tab. Feel free to save the form to your device or print it out.

Right after downloading, you can fill out the Nebraska Articles of Incorporation for Domestic Nonprofit Corporation manually or by using an editing software program. Print it out and reuse the template many times. Do more for less with US Legal Forms!

Form popularity

FAQ

The name of your corporation. your corporation's principal place of business. the name and address of your corporation's registered agent. a statement of the corporation's purpose. the corporation's duration. information about the number of shares and classes of stock the corporation is authorized to issue.

Legal Name of the Organization (Not taken by other companies in your State) Address of the Organization (Should be in the Incorporating State) Incorporator of the Nonprofit Organization.

Broadly, articles of incorporation should include the company's name, type of corporate structure, and number and type of authorized shares. Bylaws work in conjunction with the articles of incorporation to form the legal backbone of the business.

Legal Name of the Organization (Not taken by other companies in your State) Address of the Organization (Should be in the Incorporating State) Incorporator of the Nonprofit Organization. Registered Agent of the Organization (Should reside in the Incorporating State)

Filing articles of incorporation is legally required for any business owners planning to structure a new or established company as a professional corporation, nonprofit corporation or other classification. Each state has different required paperwork and rules for filing articles of incorporation.

Are articles of incorporation public? The answer is yes. These documents, which are filed with the Secretary of State or similar agency to create a new business entity, are available for public viewing.In some states, including Arizona, the articles of incorporation can be downloaded by anyone for free.

In order to form a nonprofit corporation, you must file articles of incorporation (sometimes called a "certificate of incorporation" or "charter document" or "articles of organization") with the state and pay a filing fee.

In order to form a nonprofit corporation, you must file articles of incorporation (sometimes called a "certificate of incorporation" or "charter document" or "articles of organization") with the state and pay a filing fee.

Your nonprofit articles of incorporation is a legal document filed with the secretary of state to create your nonprofit corporation. This process is called incorporating. In some states, the articles of incorporation is called a certificate of incorporation or corporate charter.