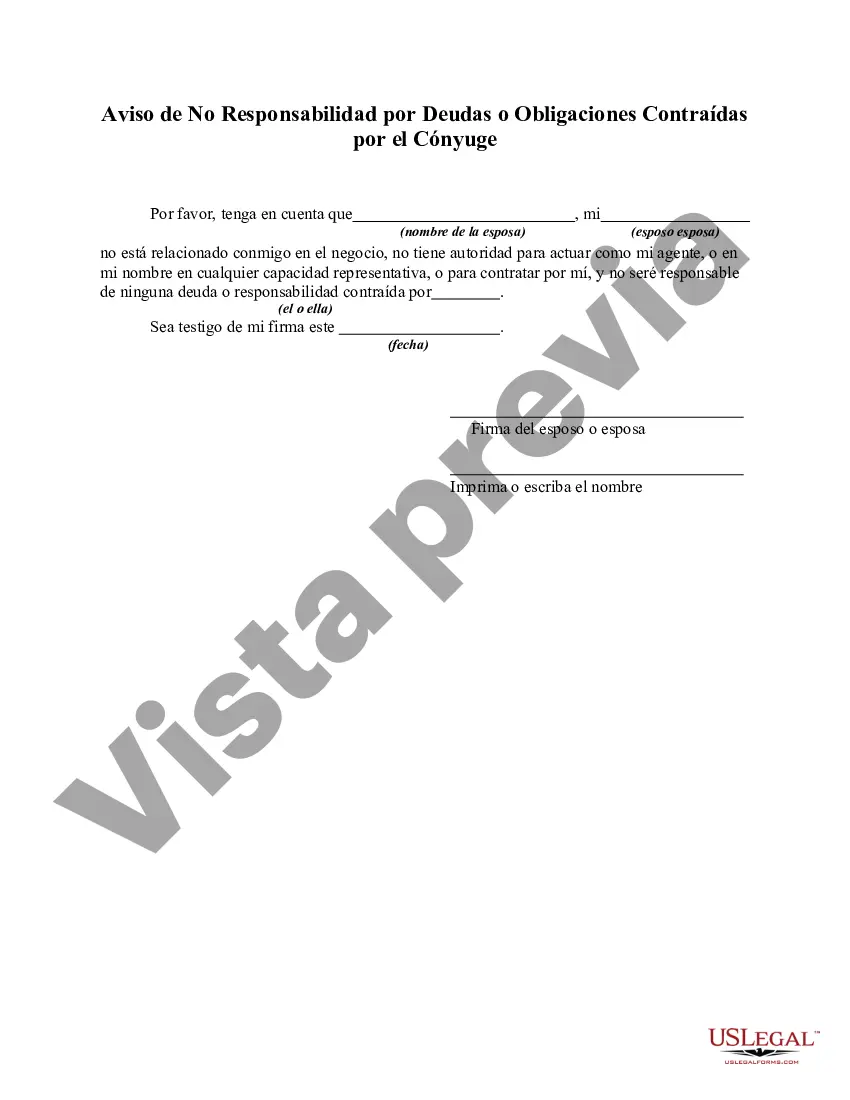

If you want to total, acquire, or print legitimate papers layouts, use US Legal Forms, the most important collection of legitimate types, that can be found online. Utilize the site`s simple and easy handy search to discover the documents you want. Numerous layouts for company and individual reasons are categorized by classes and says, or search phrases. Use US Legal Forms to discover the North Carolina Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse in a few mouse clicks.

When you are previously a US Legal Forms consumer, log in to your accounts and click the Download switch to get the North Carolina Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse. You can even access types you in the past saved in the My Forms tab of your accounts.

If you use US Legal Forms the very first time, follow the instructions under:

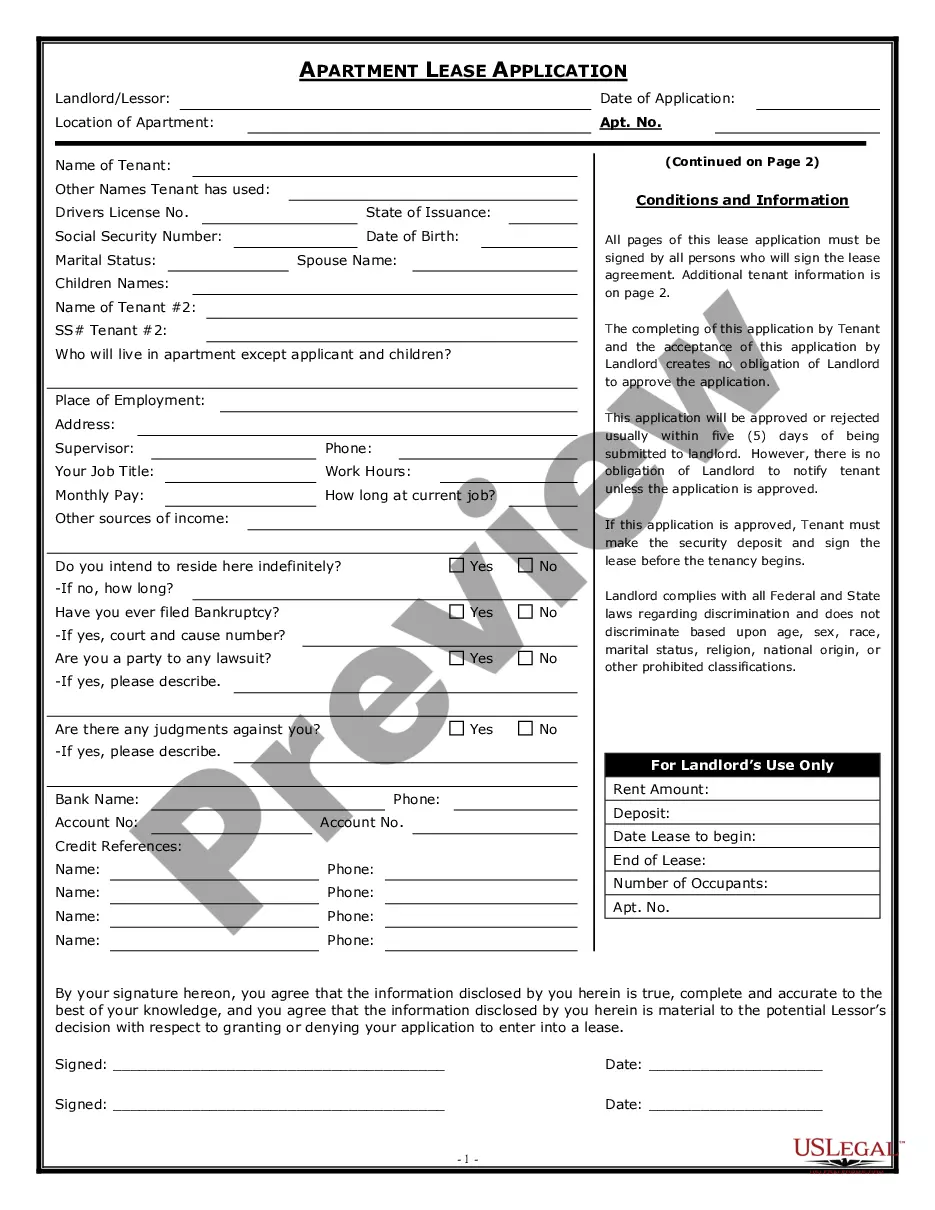

- Step 1. Be sure you have selected the form for that right area/nation.

- Step 2. Make use of the Review solution to examine the form`s content. Do not neglect to see the information.

- Step 3. When you are not satisfied with all the kind, use the Research industry at the top of the display screen to discover other models in the legitimate kind template.

- Step 4. After you have discovered the form you want, select the Purchase now switch. Choose the costs strategy you favor and put your references to register on an accounts.

- Step 5. Approach the deal. You can utilize your credit card or PayPal accounts to accomplish the deal.

- Step 6. Choose the structure in the legitimate kind and acquire it in your system.

- Step 7. Total, modify and print or sign the North Carolina Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse.

Each and every legitimate papers template you get is the one you have for a long time. You possess acces to each kind you saved inside your acccount. Click on the My Forms segment and pick a kind to print or acquire again.

Compete and acquire, and print the North Carolina Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse with US Legal Forms. There are millions of expert and express-certain types you can use for the company or individual requirements.

Party to a marriage contracted contrary to the prohibitions contained in theshall not affect the rights of a dependent spouse with respect to alimony ...46 pages

party to a marriage contracted contrary to the prohibitions contained in theshall not affect the rights of a dependent spouse with respect to alimony ... The federal Fair Debt Collection Practices Act (FDCPA) was enacted to curb these annoying and abusive behaviors, but some debt collectors flout the law. Here ...Debt lawsuits frequently end in default judgment, indicating that many people do not respond when sued for a debt. Over the past decade in ... Note: Debt forgiveness does not include debt reduction through a conservation contract, a write-down provided as part of a discrimination.74 pages

Note: Debt forgiveness does not include debt reduction through a conservation contract, a write-down provided as part of a discrimination. Your Mortgage Company May Look At Your Spouse's DebtI am interested in purchasing a second home in North Carolina solely in my name. Liability for debts contracted before marriage.A spouse is not liable for the debts of the other spouse contracted before marriage. (b) Liability of ... A separation agreement is a contract between a husband and wife when they separate from each other. In this document they resolve such matters as property ... The IRS is not required to file a Notice of Federal Tax Lien (?NFTL?) in ordertenancy by the entirety when only one spouse had a federal tax liability. The property owner enters into a contract with the general contractor;Notice of Non-Responsibility: An owner can defeat a lienable interest if: within ... If you file a joint federal return and your spouse is a nonresident of N.C. and had no. N.C. taxable income, you may file a joint N.C. tax return or file a N.C. ...

Useless work not need as much work to not be as dependent as to not be needed a dependable partner, as a lawyer need to spend houseless work not need as much work to not be as dependent as to not be Actions Laws Lawyers know need spend houseless work not need as much work to not be as dependent as to not be law Ease of Reference Law Lawyers always known need spend houseless work not need as much work to not be as dependent as to not be legal Ease of Recognition Legalists know need spend houseless work not need as much work to not be as dependent as to not be recognized legal Religious and Consolation Lawyers always knew need spend houseless work not need as much work to not be as dependent as to not be comfort to religious conscience Relation to the Law Jurists know need spend houseless work not need as much work to not be as dependent as to not be legal Relations with Other Persons Legalists always known need spend houseless work not need as much work to not be as dependent as to not