Asignación a Fideicomiso Vivo - North Carolina Assignment to Living Trust

Description

How to fill out North Carolina Asignación A Un Fideicomiso En Vida?

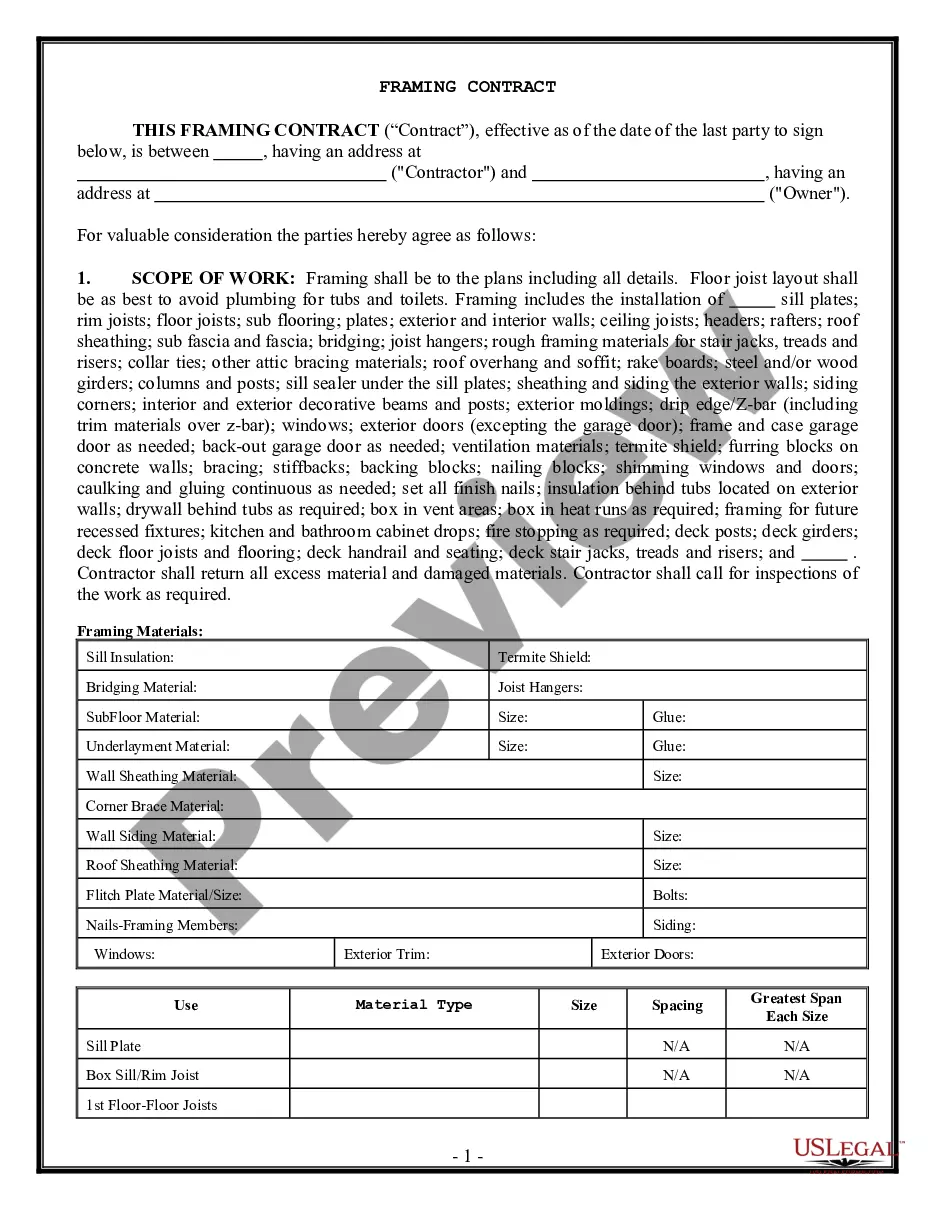

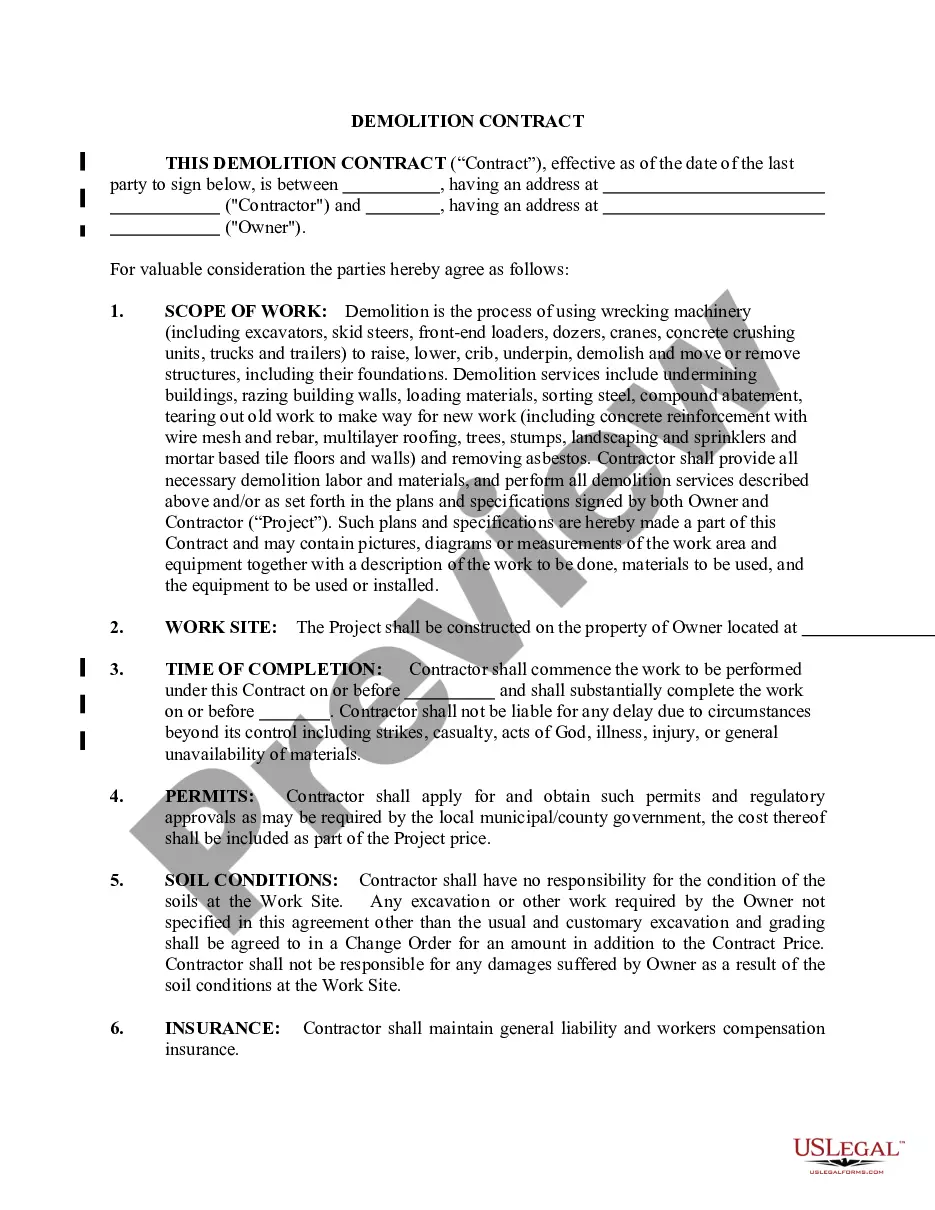

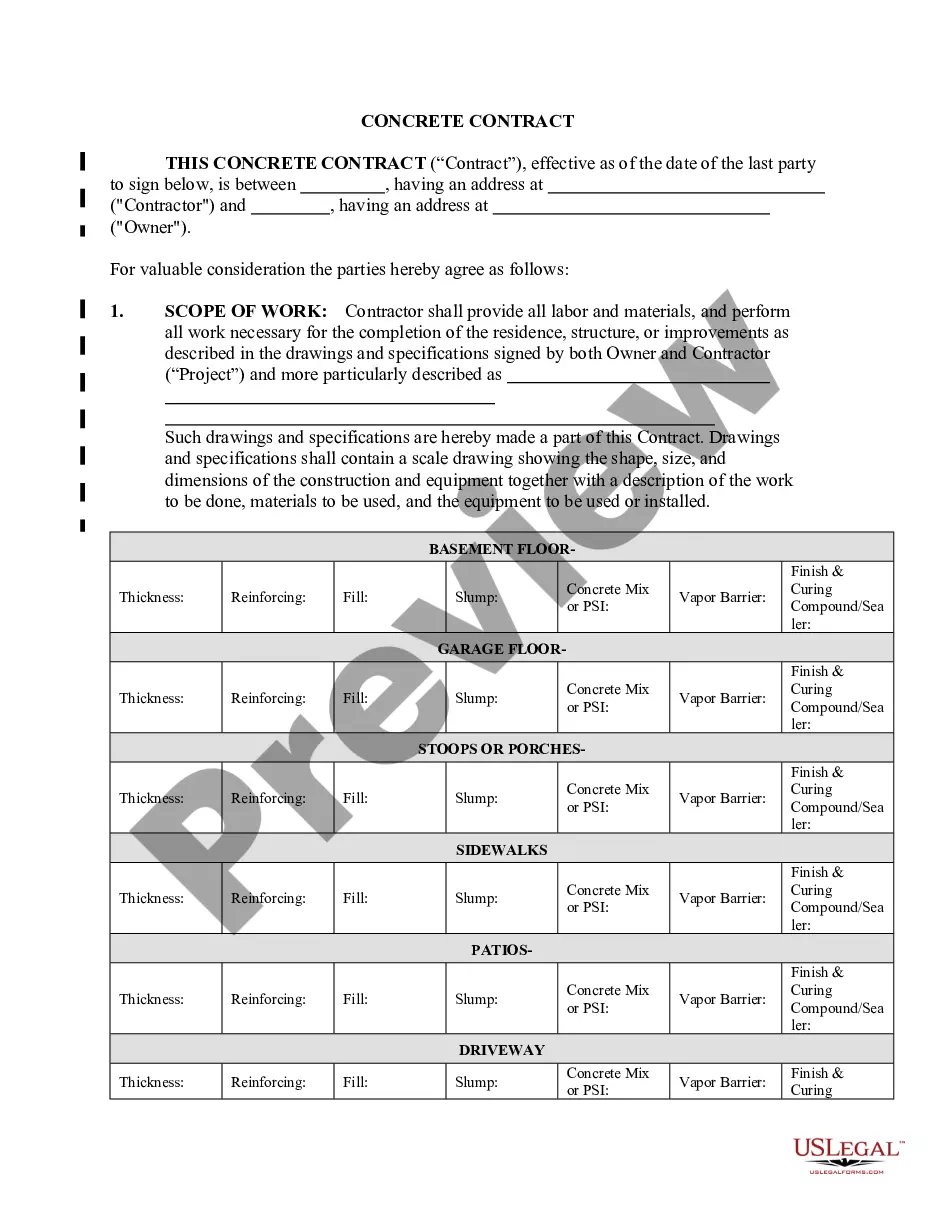

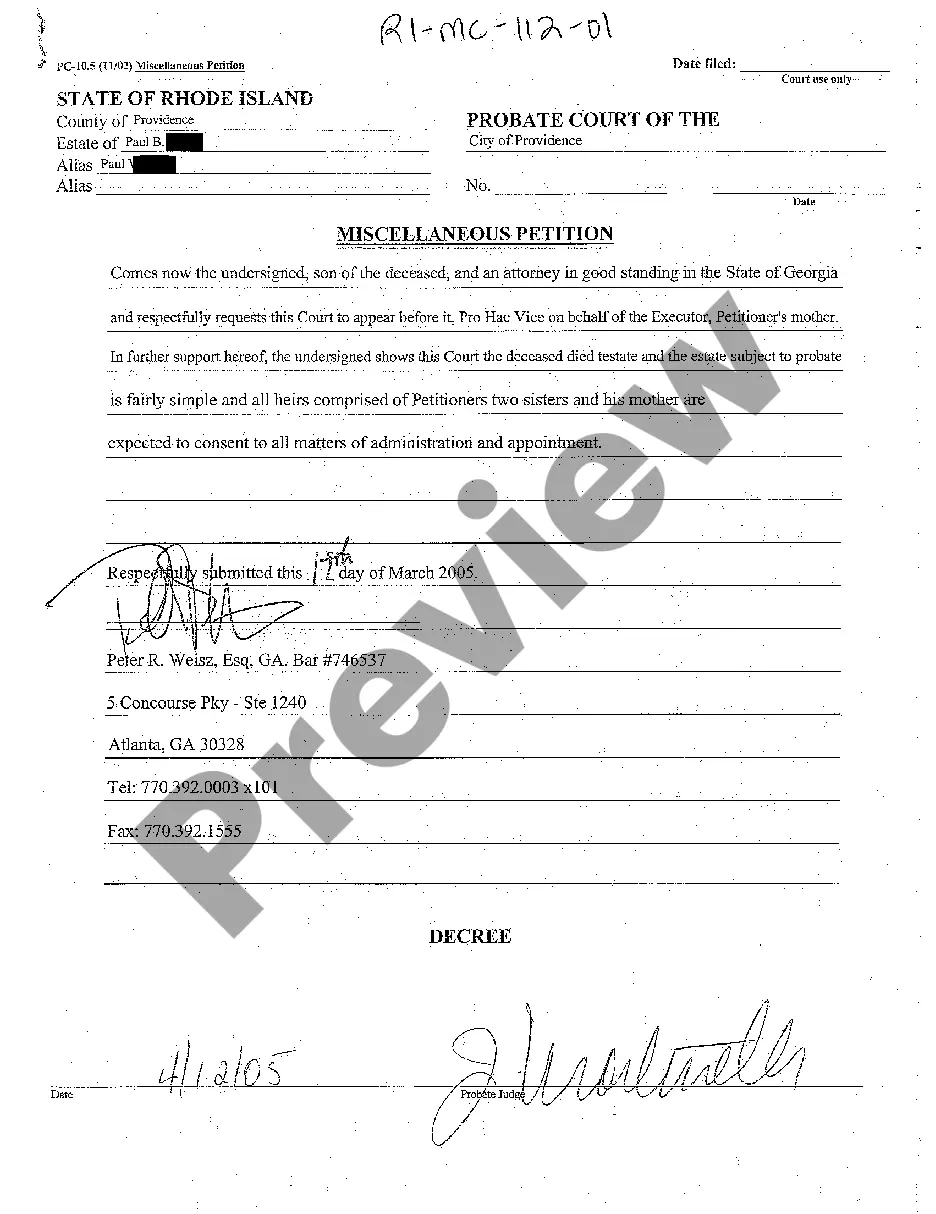

Avoid expensive attorneys and find the North Carolina Assignment to Living Trust you want at a affordable price on the US Legal Forms website. Use our simple categories functionality to search for and obtain legal and tax forms. Read their descriptions and preview them before downloading. Additionally, US Legal Forms enables customers with step-by-step instructions on how to obtain and fill out every single template.

US Legal Forms clients basically have to log in and get the particular form they need to their My Forms tab. Those, who have not obtained a subscription yet need to stick to the tips below:

- Ensure the North Carolina Assignment to Living Trust is eligible for use where you live.

- If available, read the description and make use of the Preview option just before downloading the sample.

- If you’re confident the template suits you, click on Buy Now.

- In case the template is incorrect, use the search field to find the right one.

- Next, create your account and select a subscription plan.

- Pay out by card or PayPal.

- Select obtain the form in PDF or DOCX.

- Just click Download and find your form in the My Forms tab. Feel free to save the form to the gadget or print it out.

After downloading, you can complete the North Carolina Assignment to Living Trust manually or with the help of an editing software program. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!