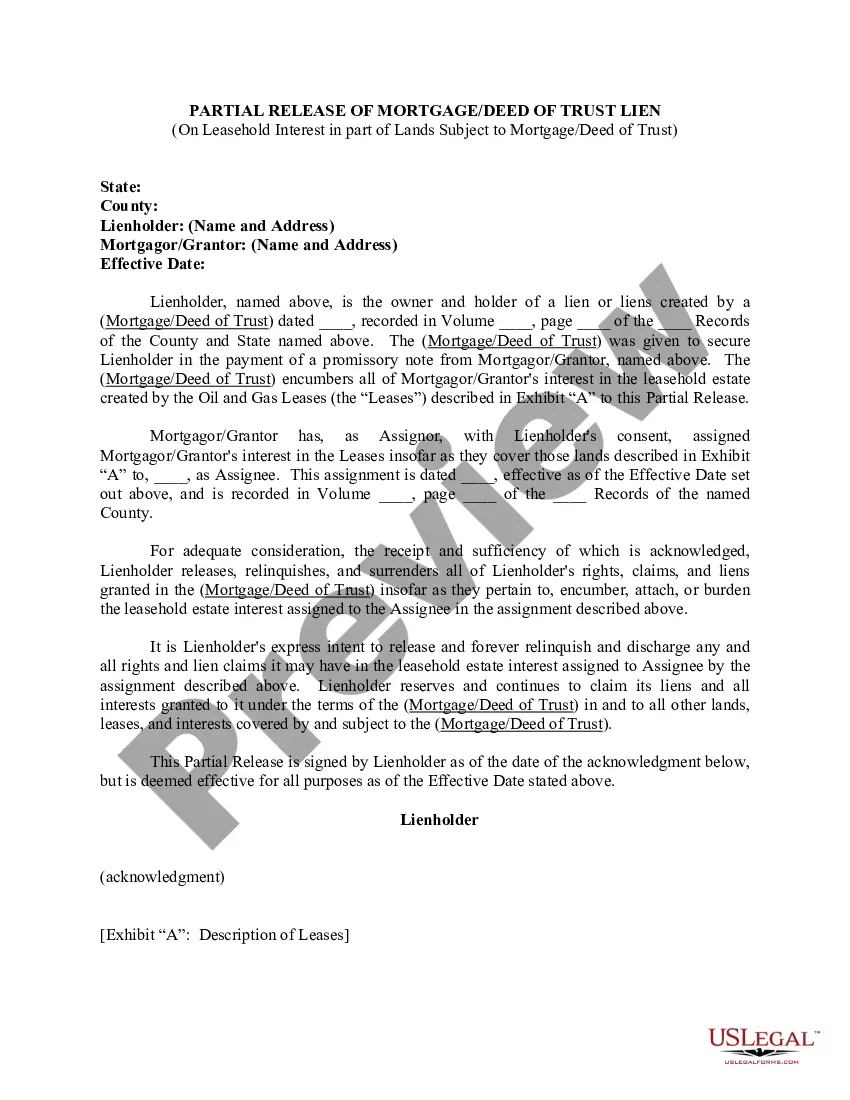

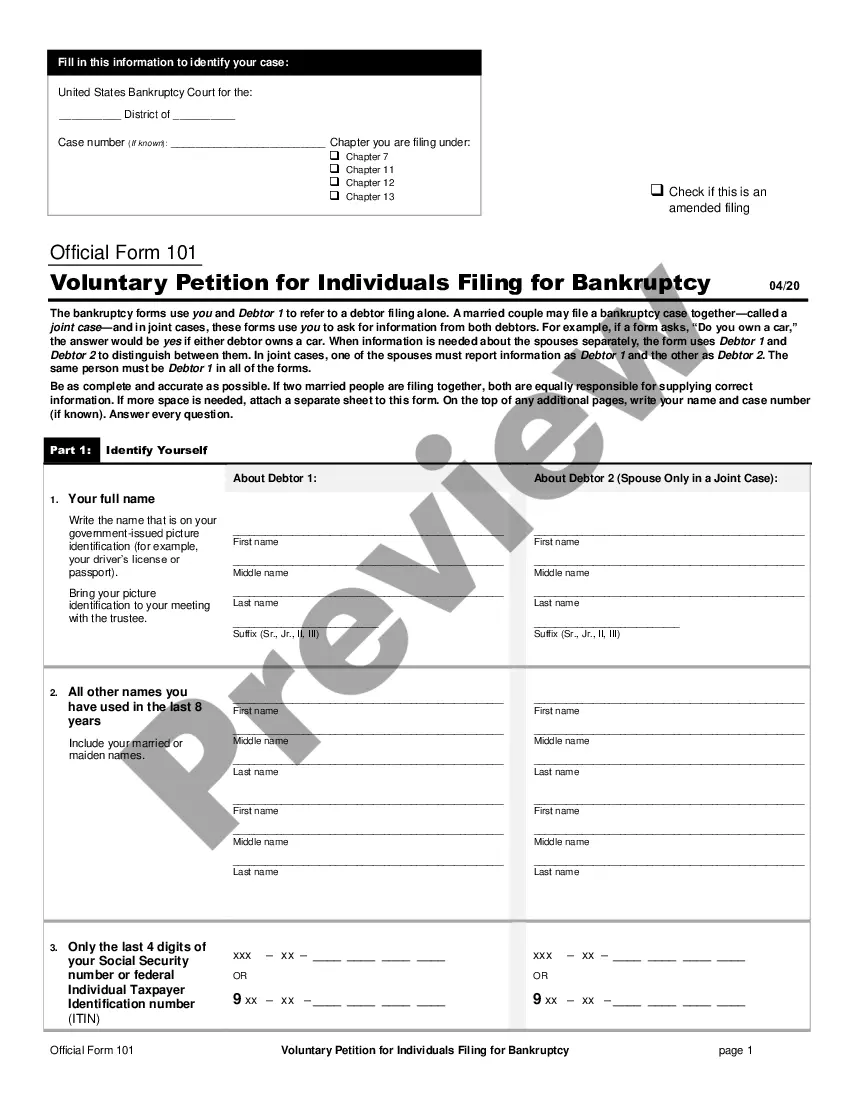

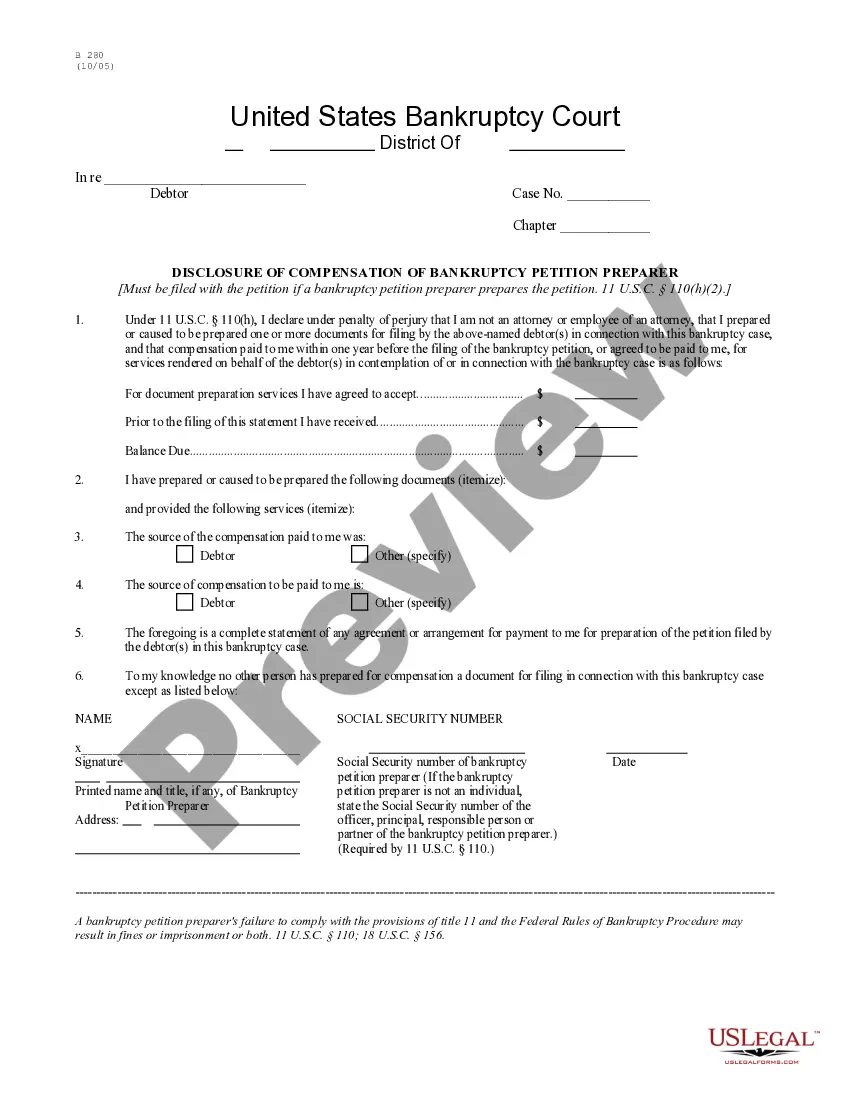

Montana Assignment of Debt: A Comprehensive Guide Introduction: The Montana Assignment of Debt refers to a legal process wherein a creditor transfers their rights to collect a debt to another party, known as the assignee. This document is commonly utilized in Montana when a creditor wishes to transfer their rights and responsibilities associated with a debt to a third party. Understanding the various types of Montana Assignment of Debt can be essential for both creditors and debtors. 1. Voluntary Assignment of Debt: One type of Montana Assignment of Debt is the voluntary assignment. In this scenario, a creditor willingly transfers their rights to collect the debt to an assignee. Both parties involved should enter into a written agreement that specifies the details of the assignment, including the assigned amount, terms, and conditions. 2. Involuntary Assignment of Debt: In situations where a debtor fails to fulfill their financial obligations, a creditor may pursue legal action to obtain a judgment against the debtor. Once the judgment is obtained, the creditor may initiate an involuntary assignment of debt. This type of assignment allows the creditor to transfer their rights to collect the debt to a third party, ensuring that they receive the owed amount. 3. Montana Assignment of Debt in Business Transactions: In the context of business transactions, the Montana Assignment of Debt becomes particularly relevant. When a business sells another business or relevant assets, the debt associated with those assets can also be assigned to the buyer. This type of assignment often involves complex agreements and negotiations between the parties involved. 4. Medical Debt Assignment: Montana Assignment of Debt also encompasses medical debt. In some cases, medical providers may assign their debts to collection agencies or other medical finance companies. This enables medical providers to focus on their core operations while ensuring that the outstanding balances are properly pursued for recovery. 5. Assignment of Debt in Real Estate: Real estate transactions in Montana can involve an Assignment of Debt. For instance, if a property owner sells their property with an existing mortgage, the parties involved may agree to an assignment of debt, allowing the new property owner to assume the mortgage responsibilities. Conclusion: The Montana Assignment of Debt serves as a mechanism for transferring debt rights from one party to another. It encompasses voluntary and involuntary assignments, and plays a significant role in business transactions, medical debt recovery, and real estate dealings. Understanding the various types of Montana Assignment of Debt is crucial for individuals, businesses, and creditors involved in legal and financial matters in the state. It is advisable to consult legal professionals experienced in Montana's debt assignment laws for accurate guidance in specific cases.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montana Cesión de Deuda - Assignment of Debt

Description

How to fill out Montana Cesión De Deuda?

If you intend to gather, acquire, or print valid document templates, utilize US Legal Forms, the largest repository of legitimate forms available online.

Take advantage of the site's straightforward and user-friendly search to locate the documents you require.

Various templates for business and personal purposes are organized by categories and states or keywords. Use US Legal Forms to find the Montana Assignment of Debt with just a few clicks.

Every legal document template you purchase is yours to keep indefinitely.

You will have access to all forms you downloaded in your account. Go to the My documents section and choose a form to print or download again.

- If you are already a US Legal Forms customer, Log In to your account and click on the Acquire button to download the Montana Assignment of Debt.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions outlined below.

- Step 1. Ensure you've chosen the form for the correct region.

- Step 2. Use the Review option to examine the form's details. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you've identified the form you need, click the Get now button. Choose the pricing plan you prefer and provide your credentials to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Montana Assignment of Debt.

Form popularity

FAQ

The 777 rule for debt collectors emphasizes ethical behavior and transparency in collection practices. It involves three key components: proper validation of the debt, a reasonable timeframe before pursuing further actions, and multiple attempts to resolve the issue amicably. Keeping this rule in mind can help you navigate your rights when facing a Montana Assignment of Debt.

Yes, debt collectors are required to provide written validation of the debt within five days of their first contact with you. This written notice should include the details of the Montana Assignment of Debt, including the amount owed and the name of the creditor. Receiving this documentation helps you keep track of your financial obligations and your rights.

The 777 rule is a guideline for debt collectors that highlights the importance of ethical practices. It generally refers to a three-step process: valid verification of the debt, a seven-day waiting period before further collection actions, and allowing three attempts to resolve the issue amicably. Following these steps promotes fairness in debt collection, especially concerning a Montana Assignment of Debt.

Generally, most debts become uncollectible after six years in Montana, depending on the type of debt. After this period, creditors may not be able to pursue legal action to collect the debt. However, this timeframe can vary, so it's essential to understand your specific situation regarding the Montana Assignment of Debt.

Debt collection agencies must adhere to strict regulations and cannot engage in practices that are deemed unfair. They cannot threaten the debtor with violence or harm, misrepresent themselves, or contact the debtor at inconvenient times. Understanding these limitations can empower you when dealing with collection agencies related to a Montana Assignment of Debt.

For a Montana Assignment of Debt to be valid, certain requirements must be met. First, the original debtor must clearly express their intention to assign the debt to another party. Additionally, both parties involved must consent to the assignment, and it should be executed in a way that reflects an agreement. Ensuring these elements are in place supports the enforceability of the assignment.

Yes, an assignment of debt generally must be in writing to be legally enforceable. A written agreement helps clarify the terms of the debt transfer and protects both parties involved. Ensuring all assignments are documented reduces misunderstandings and potential disputes in the future.

In Montana, most debts typically become uncollectible after ten years, when they fall outside the applicable statute of limitations. This means the creditor can no longer legally pursue collection. However, it's advisable to consult local laws or an attorney for specific situations, as there are exceptions.

Proof of debt should include the amount owed, the parties involved, the original agreement terms, and date of the transfer or assignment. Additional documentation may include payment history or communications regarding the debt. All this information creates a comprehensive picture, essential for resolving any issues.

A valid proof of debt includes documentation that confirms the existence and specifics of the debt owed. This may contain invoices, contracts, or written agreements that substantiate the amount, terms, and parties involved. Having valid proof is crucial during any disputes regarding the debt.