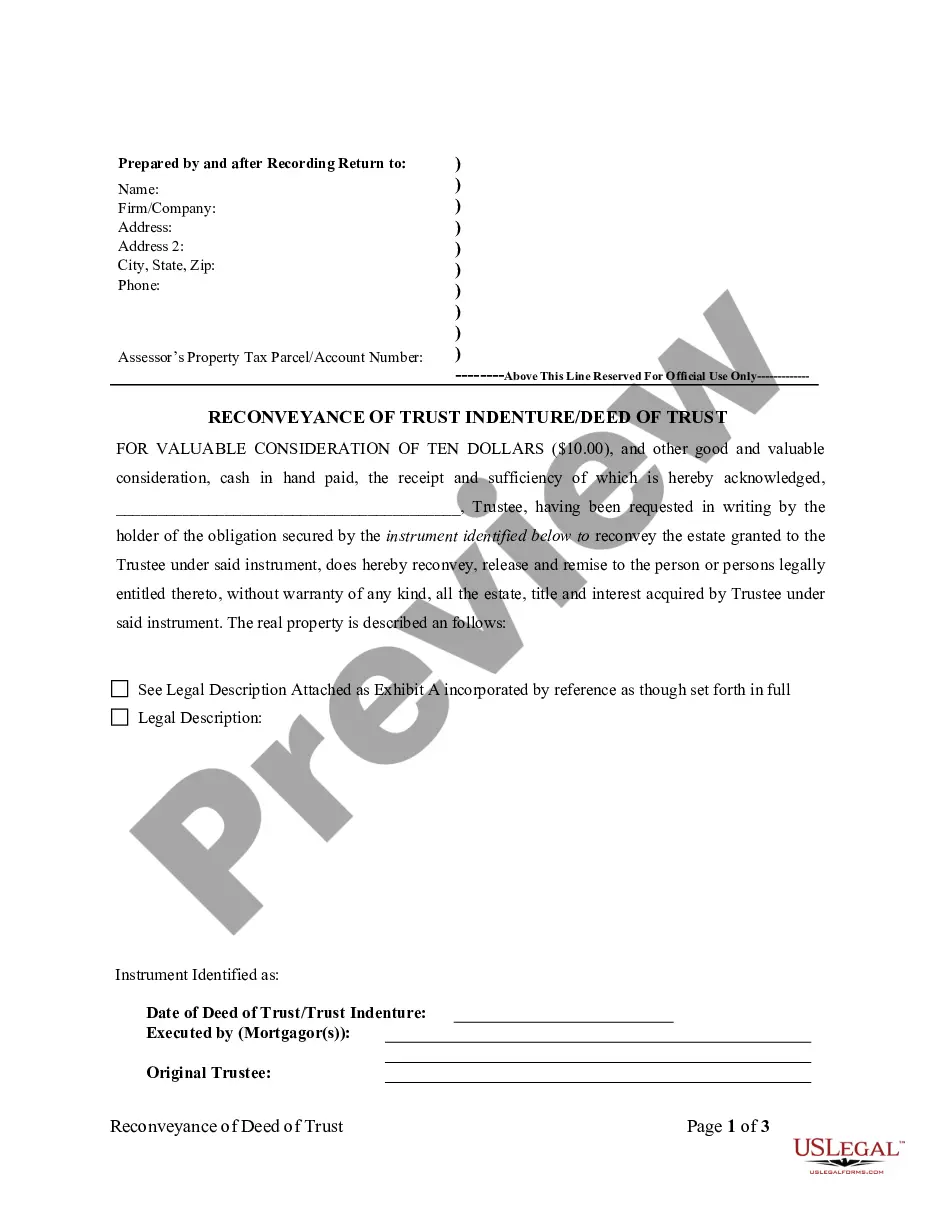

Montana Reconveyance - Satisfaction, Release or Cancellation of - Trust Indenture Deed of Trust by Corporate Trustee

What this document covers

The Reconveyance - Satisfaction, Release or Cancellation of Trust Indenture Deed of Trust by Corporate Trustee is a legal document used to release a property from a mortgage held by a corporate lender. This form serves to satisfy or cancel an existing deed of trust in the state of Montana, thereby confirming that the mortgage is no longer in effect. By using this form, property owners can ensure that their real estate is officially released from the financial encumbrance.

What’s included in this form

- Identifies the trustee and borrower involved in the transaction.

- Includes a detailed legal description of the real estate, referenced as Exhibit A.

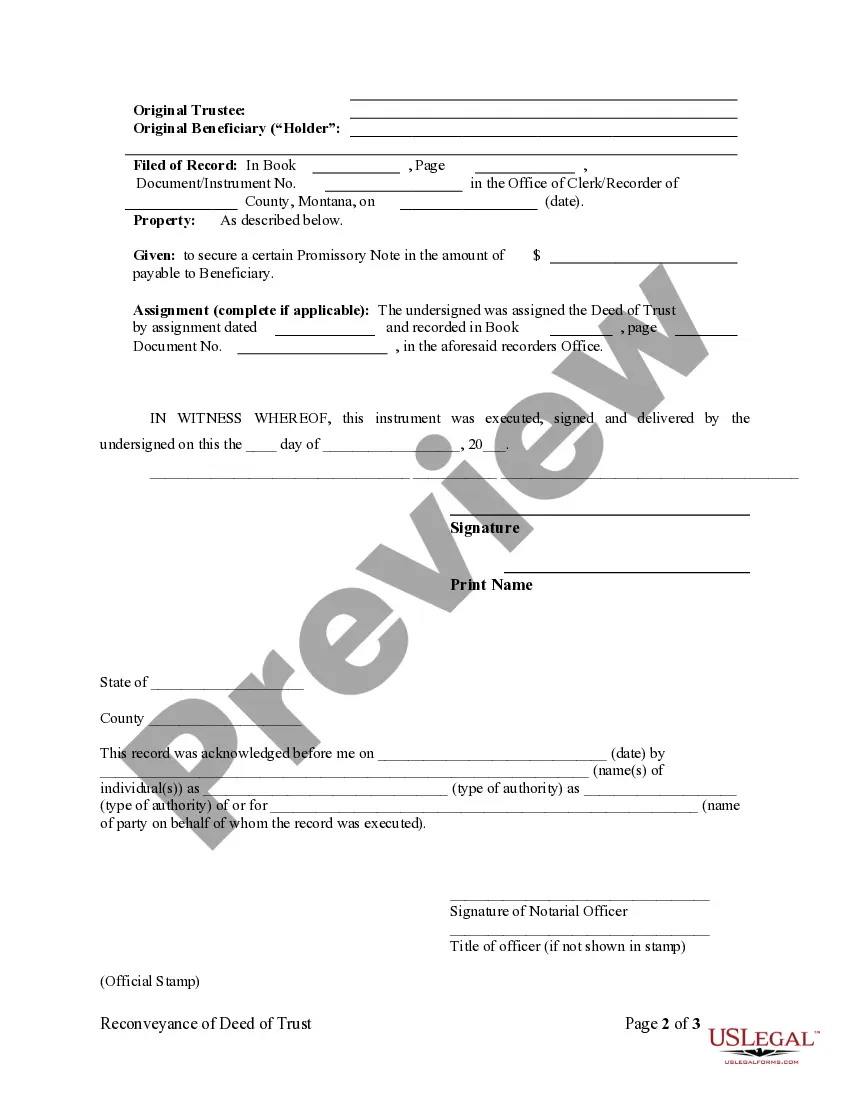

- Provides space for signatures of the corporate trustee and notarization.

- Specifies the date of satisfaction or release of the deed of trust.

- Confirms compliance with state statutory requirements for Montana.

When to use this form

This form should be used when a corporate lender has fulfilled their financial obligation under a mortgage or deed of trust, and it is necessary to officially release the property. Typical scenarios include the full payment of a loan or refinancing of the property, where the existing mortgage must be cancelled to allow for new financing arrangements.

Who should use this form

- Property owners in Montana who have paid off a mortgage held by a corporate lender.

- Corporate trustees responsible for managing the deed of trust on behalf of the lender.

- Individuals handling real estate transactions or legal matters related to property financing.

Completing this form step by step

- Identify the parties involved, including the corporate lender and the property owner.

- Specify the property by including the legal description as outlined in Exhibit A.

- Enter the date on which the mortgage is being satisfied or released.

- Obtain the necessary signatures from the corporate trustee and ensure the document is notarized.

- Submit the completed form to the appropriate local recording office for filing.

Notarization requirements for this form

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to include the complete legal description of the property.

- Not obtaining notarization, which is required for the form to be valid.

- Omitting dates or signatures, which can lead to processing delays.

- Using outdated forms that do not comply with current state laws.

Benefits of completing this form online

- Convenient access to downloadable forms at any time.

- Editability allows users to tailor the form to their specific needs.

- Reliability as the forms are drafted by licensed attorneys, ensuring compliance with legal standards.

- Immediate confirmation of completion helps streamline the filing process.

Key takeaways

- The Reconveyance - Satisfaction, Release or Cancellation of Trust Indenture Deed of Trust by Corporate Trustee is essential for releasing a property from mortgage obligations.

- Ensure all sections are fully completed and notarized for the document's validity.

- This form is tailored specifically for Montana property laws and requirements.

- Utilizing online services for form completion and notarization can simplify the process significantly.

Looking for another form?

Form popularity

FAQ

The assignment transfers all of the interest the original lender had under the mortgage to the new bank. By tracking loan transfers electronically, MERS eliminates the long-standing practice that the lender must record an assignment with the county recorder every time the loan is sold from one bank to another.

Mortgage Electronic Registration Systems, Inc. (MERS) is a wholly-owned subsidiary of MERSCORP Holdings, and its sole purpose is to serve as mortgagee in the land records for mortgages registered on the MERS® System.

The servicer of a MERS-registered loan has the legal authority to discharge the mortgage on behalf of MERS because, as a member of MERS, authority was granted to their officers through a corporate resolution. The person authorized to sign discharges is sometimes referred to as a certifying officer by MERS.

No. MERS, MERSCORP Holdings or the MERS® System do not service mortgages. Mortgage lenders, or other mortgage servicing companies, collect payments from borrowers and manage their loans.

Originated by MERSCORP Holdings, Inc.'s MERS system, the mortgage identification number (MIN) is a unique 18-digit number used to track a mortgage loan throughout its life, from origination to securitization to payoff or foreclosure.

The MERS® eRegistry is the only national registry for eNotes used by the mortgage industry and is the system of record for identifying the Controller and Location of the authoritative copy of an eNote.

The loan servicer will send a lien release to the county recorder's office. The release should contain the MIN and the telephone number to access the MERS VRU, which is the number the general public may call to obtain information about the MERS servicer. The number for the VRU is 1-888-679-MERS (679-6377).

In most cases, a MIN status of "inactive" means that the debt has been paid in full. Mortgages are deactivated when you make all the payments but also when you refinance.