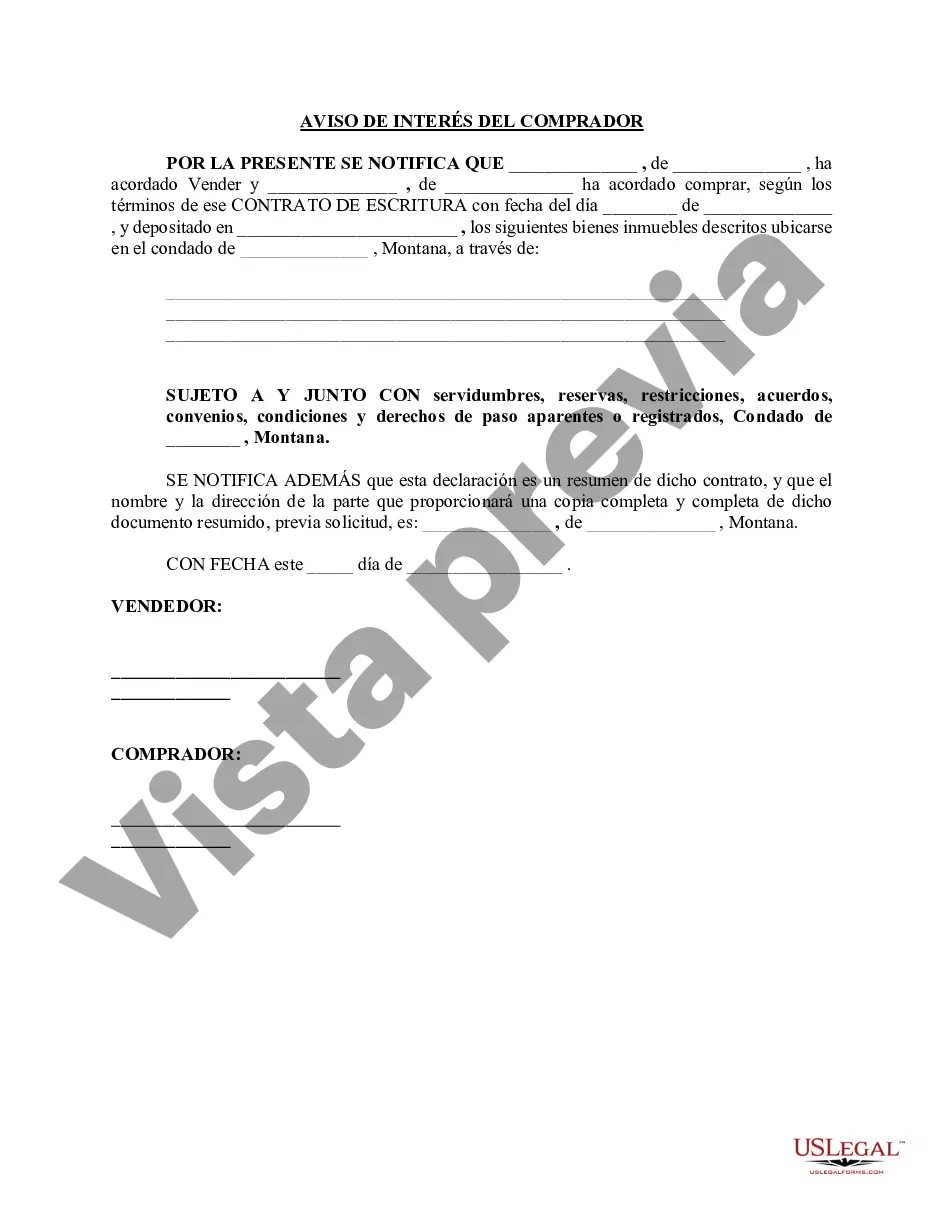

Notificación de Interés del Comprador - Montana Notice of Purchaser's Interest

Description

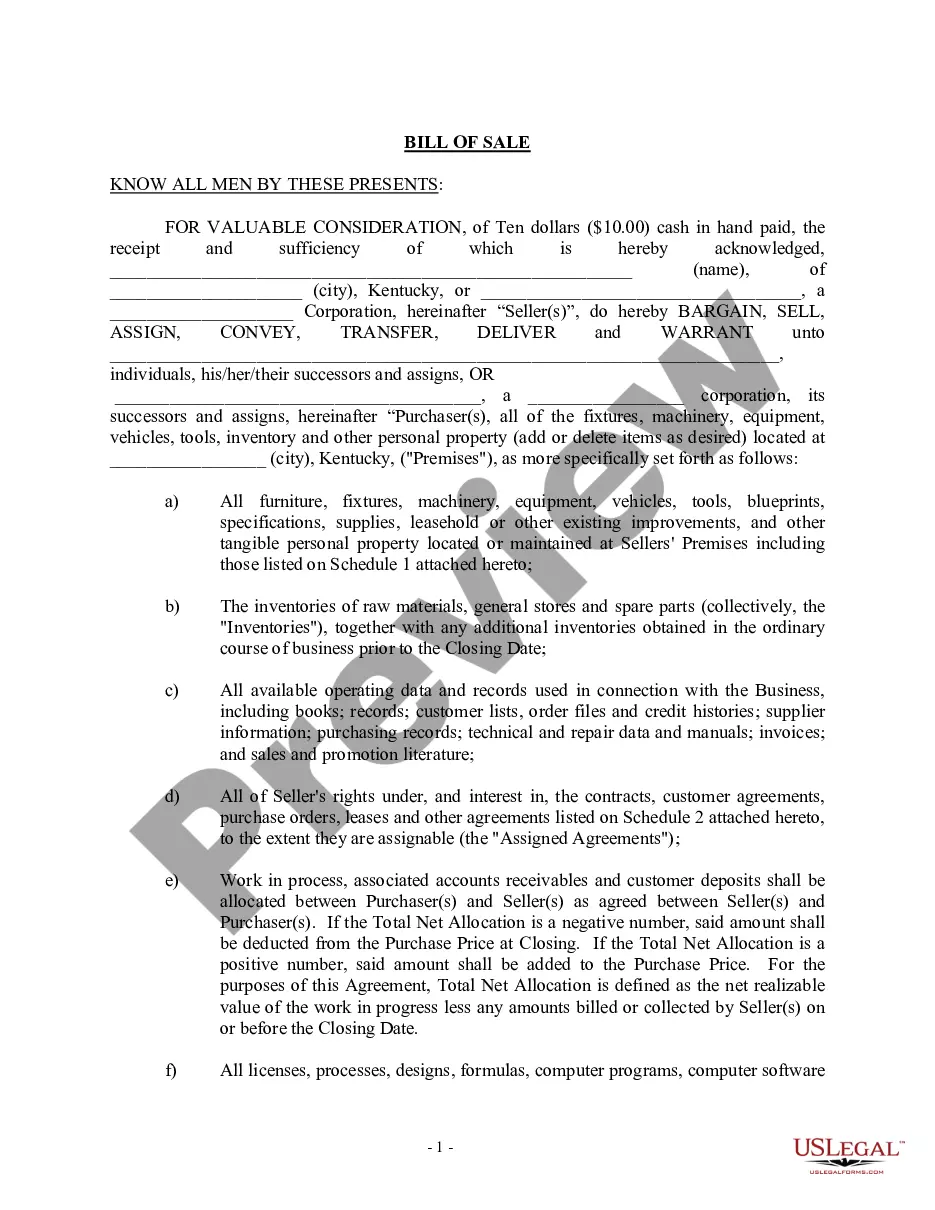

Unless an assignment is qualified in some way, it is

generally considered to be a transfer of the transferor's

entire interest in the interest or thing assigned. Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.

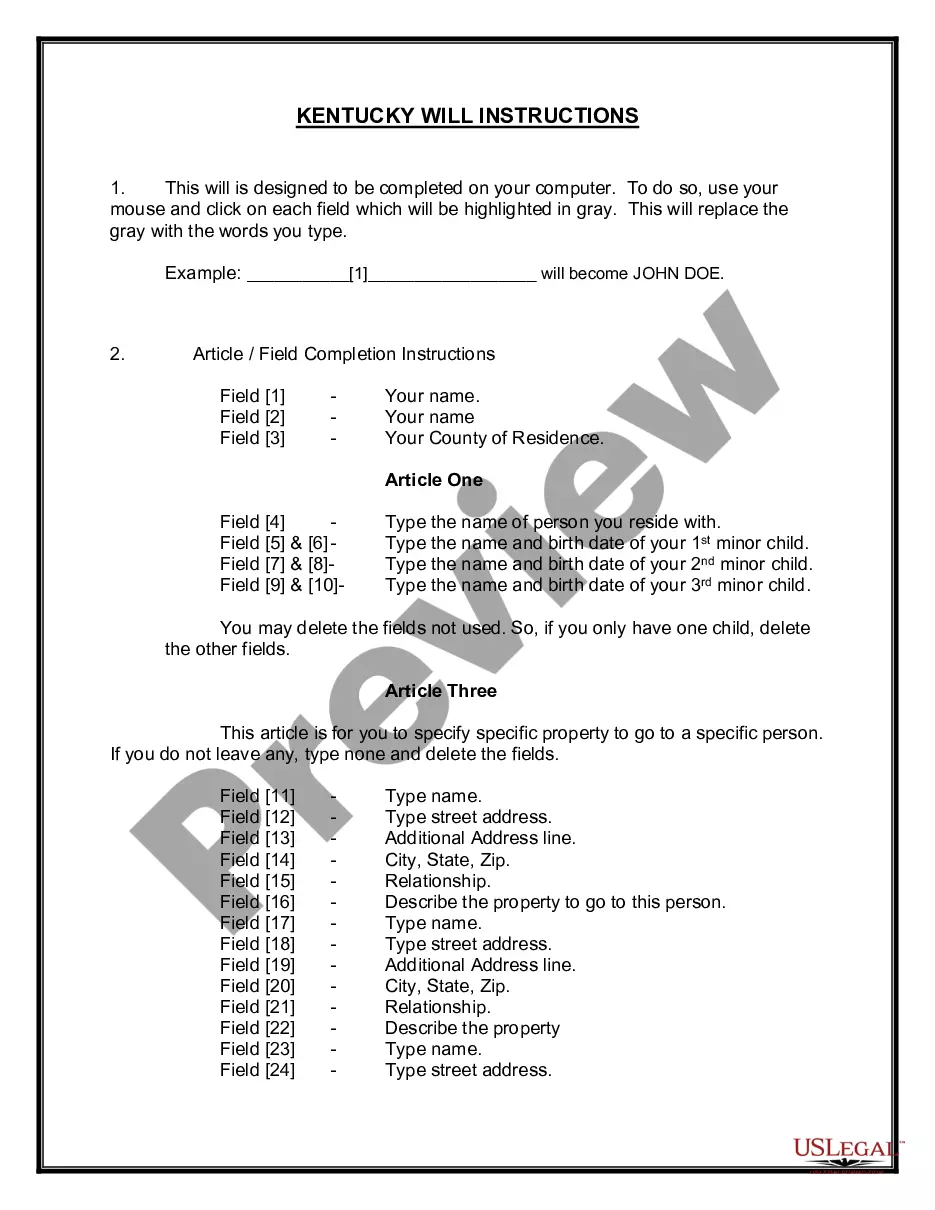

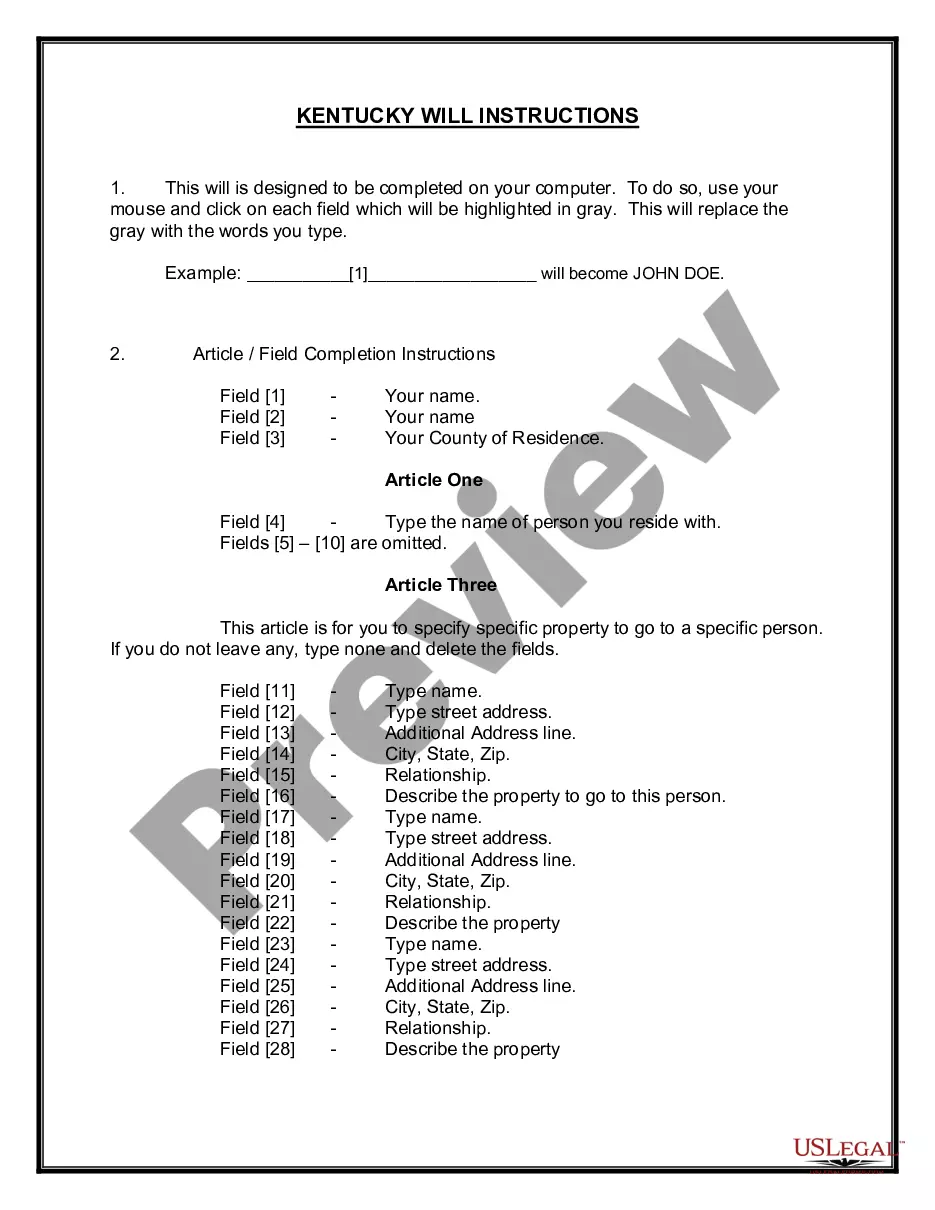

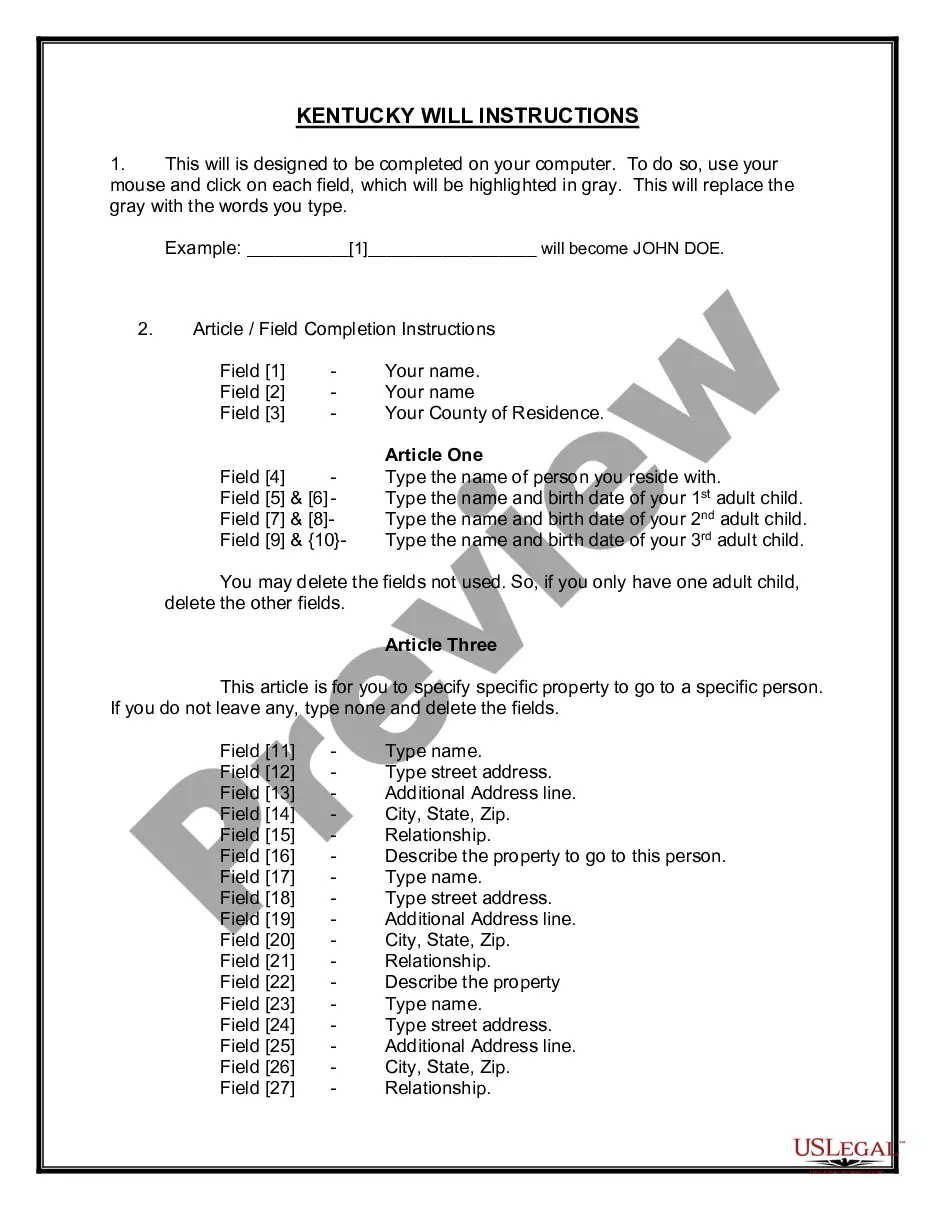

How to fill out Montana Aviso De Interés Del Comprador?

Steer clear of expensive attorneys and locate the Montana Notice of Purchaser’s Interest you require at a reasonable cost on the US Legal Forms site.

Utilize our straightforward groups feature to discover and obtain legal and tax documents. Examine their descriptions and review them thoroughly before downloading.

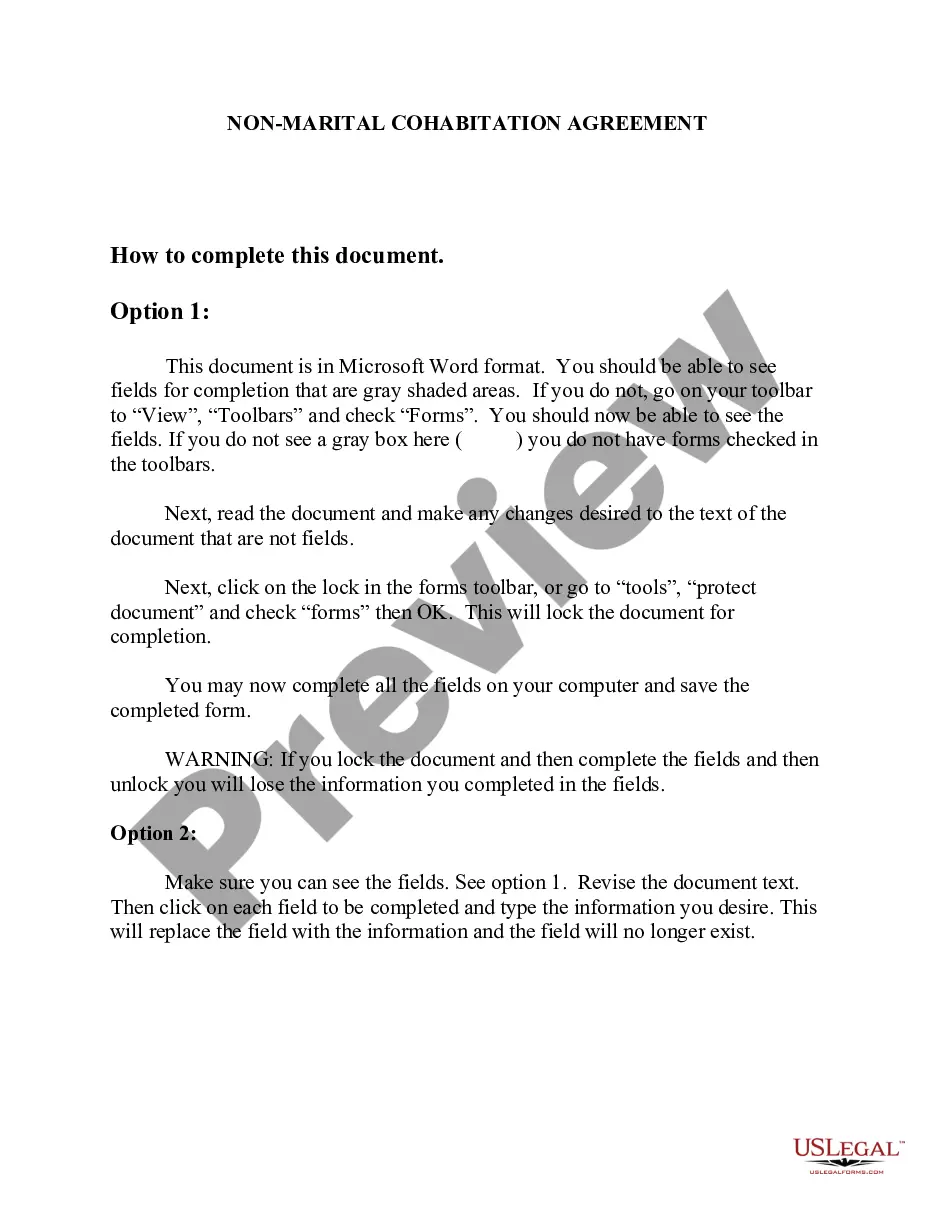

Choose to download the document in PDF or DOCX format. Simply click Download and locate your document in the My documents section. You can save the document to your device or print it out. After downloading, you can fill out the Montana Notice of Purchaser’s Interest by hand or using editing software. Print it out and reuse the document multiple times. Achieve more for less with US Legal Forms!

- Additionally, US Legal Forms provides subscribers with detailed instructions on how to download and fill out each document.

- US Legal Forms members simply need to Log In and retrieve the specific document they require under their My documents section.

- Those who haven't subscribed yet must follow the steps outlined below.

- Ensure the Montana Notice of Purchaser’s Interest is suitable for use in your jurisdiction.

- If accessible, browse the description and utilize the Preview feature thoroughly before downloading the template.

- If you’re sure the document fulfills your requirements, click on Buy Now.

- If the document is inaccurate, use the search tool to find the correct one.

- Then, set up your account and choose a subscription package.

- Complete payment via credit card or PayPal.

Form popularity

FAQ

En los abonos a capital los usuarios pueden adelantar parte del dinero adeudado de forma extraordinaria en el pago mensual, cuando asi lo consideren conveniente y estA© al alcance de cada deudor, de esta manera podrA¡n pagar el crA©dito en menor tiempo de lo establecido y los intereses serA¡n inferiores.

Concepto de abono de interes En la actividad bancaria, el pago de intereses a favor del cliente en una operaciA³n en la que A©ste hubiera transferido fondos a la entidad de crA©dito bien en cuentas a la vista, en depA³sitos a plazo o cualquier otra forma de deuda.

La hipoteca fija a 30 anos promediA³ 3.1% durante la semana que finalizA³ el 9 de diciembre. Y se espera que suban alrededor del 3%, lo que las dejarAa en un promedio del 3.7% para fines del prA³ximo aA±o.

Las hipotecas fueron el participante mas destacado en el derbi de tipos mA¡s bajos, cayendo casi un punto porcentual entre enero de 2020 y enero de 2021, de una media del 3,86% al 2,92%.

Bueno: 700-749. Con un buen puntaje de credito, le darA¡n un buen prA©stamo hipotecario con tasas de interA©s favorables. Excelente: 750-850.

Como liquidar una deuda mA¡s rA¡pidoPague mA¡s del mAnimo.Pague mA¡s de una vez por mes.Liquide su prA©stamo mA¡s caro primero.Considere el mA©todo bola de nieve para liquidar deudas.Lleve un registro de las cuentas y pA¡guelas en menos tiempo.Acorte el plazo de su prA©stamo.Consolide varias deudas.

Debido a que el interes se calcula en funciA³n del saldo del capital, pagar el capital en menos tiempo en un prA©stamo de tasa fija reduce los intereses que pagarA¡. Incluso hacer pequeA±os pagos adicionales de capital puede ayudar.

Los abonos a capital reducen el tiempo de la deuda e intereses ordinarios, aunque el valor de las mensualidades se mantiene. Pueden hacerse en cualquier momento mientras este activo el prA©stamo, y no estA¡n condicionados a un importe mAnimo ni a una fecha lAmite de pago.

Los Prestamos Convencionales Requieren Un Puntaje De CrA©dito MAnimo De 620.