Mississippi Letter to Creditor Requesting a Temporary Payment Reduction

Description

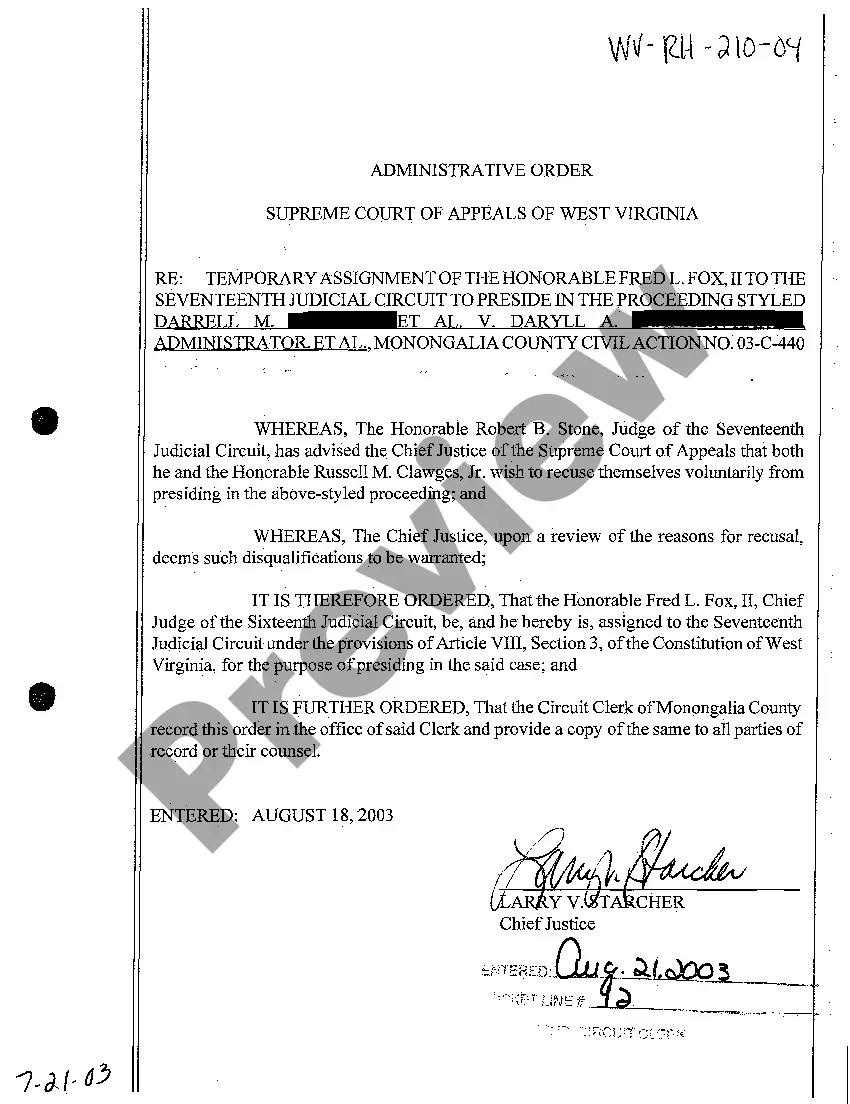

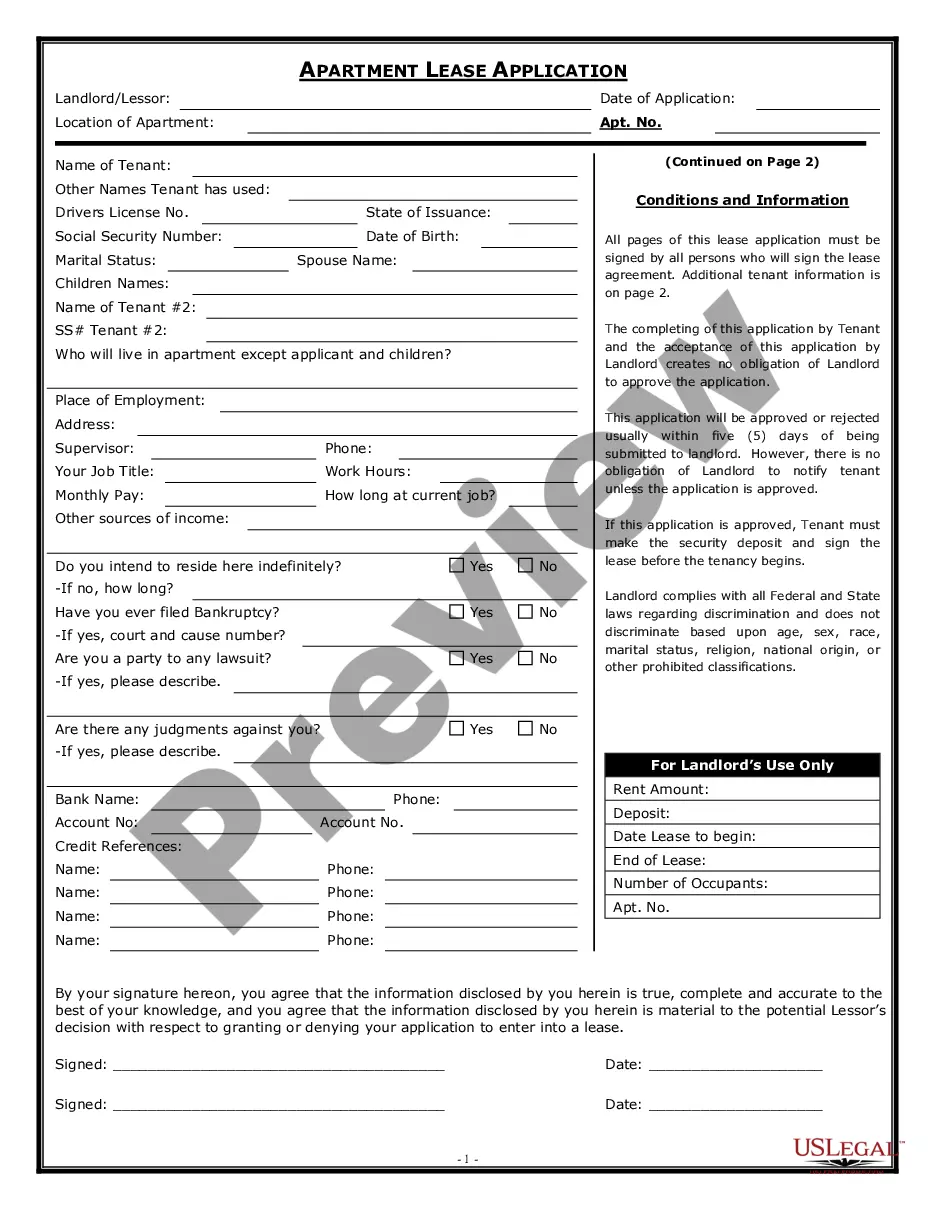

How to fill out Letter To Creditor Requesting A Temporary Payment Reduction?

If you wish to total, download, or print validated document templates, utilize US Legal Forms, the premier collection of legal forms, that are accessible online.

Take advantage of the site’s user-friendly search feature to find the documents you require. A variety of templates for business and personal purposes are organized by categories and states, or keywords.

Use US Legal Forms to locate the Mississippi Letter to Creditor Requesting a Temporary Payment Reduction in just a few clicks.

Each legal document template you purchase is yours indefinitely. You will have access to every form you saved in your account. Click the My documents section and select a form to print or download again.

Be proactive and download, and print the Mississippi Letter to Creditor Requesting a Temporary Payment Reduction with US Legal Forms. There are thousands of professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the Mississippi Letter to Creditor Requesting a Temporary Payment Reduction.

- You can also access forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your correct state/country.

- Step 2. Use the Preview option to review the form’s content. Remember to read the description.

- Step 3. If you are dissatisfied with the form, utilize the Search area at the top of the screen to discover alternative versions of the legal form template.

- Step 4. After you have located the form you need, click the Acquire now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Mississippi Letter to Creditor Requesting a Temporary Payment Reduction.

Form popularity

FAQ

When writing a debt settlement letter, it's important to be explicit and detailed. Treat the letter as a contract between you and your creditor. Include your personal information and account number for easy identification. You'll need to outline the amount you can pay and what you expect in return.

If you can't pay the collector the amount he is demanding, or refuse to give your bank account or debit card number to make the payment, the debt collector may threaten to put you down for 'refusal to pay.

Believe it or not, though, it's possible to negotiate with a collection agent and end up paying less than you owe. Why is that? Because the collection agency bought the original debt from your creditor, most likely for a substantial discount. That means they don't have to recover the entire amount to make a profit.

Some examples of events that a lender may consider to be a financial hardship include:Layoff or reduction in pay.New or worsening disability.Serious injury.Serious illness.Divorce or legal separation.Death.Incarceration.Military deployment or Permanent Change of Station orders.More items...?19-Nov-2021

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

Legal Options for CreditorsCreditors can legally refuse partial payments and demand payment in full, including interest and extra charges like late fees. There are no laws that require them to accept your payments or partial payments. Some creditors are more willing to work with you than others.

If the collection agency refuses to settle the debt with you, or if the agency or creditor agrees to settle, but you renig on your end of the agreement, the collection agency or creditor may decide to pursue more aggressive collection efforts against you, which may include a lawsuit.

Tips for Writing a Hardship LetterKeep it original.Be honest.Keep it concise.Don't cast blame or shirk responsibility.Don't use jargon or fancy words.Keep your objectives in mind.Provide the creditor an action plan.Talk to a Financial Couch.

Bank statements showing a reduction of income, essential spending and reduced savings. a report from a financial counselling service. debt repayment agreements. any other evidence you have to explain your circumstances.

Speak to the Original Creditor Inform the original creditor that you want to find a way to settle the debt, and ask if they're willing to negotiate. The creditor may choose to accept your initial offer, negotiate a new amount, or refuse outright and refer you back to the collection agency.