Mississippi Assignment of Debt refers to the legal process through which a creditor transfers or sells their rights to collect a debt to another party, known as the assignee. This assignment can occur for various reasons, such as when a creditor wants to free up resources or when a debt is deemed uncollectible. In Mississippi, assignment of debt is governed by state laws and regulations, which outline the requirements and procedures for a valid assignment. The Mississippi Assignment of Debt can be categorized into different types based on the nature of the debt and the parties involved. One common type is the assignment of consumer debt, where an individual's unpaid debts, such as credit card debt, medical bills, or personal loans, are transferred to a debt collection agency or a third-party debt buyer. This type of assignment generally occurs when the original creditor believes it is no longer cost-effective to pursue the debt and decides to sell it to a specialized company. Another type is the assignment of commercial debt, which involves the transfer of debts between businesses. This can include outstanding invoices, loans, or other financial obligations owed by one business to another. Such assignments often happen when a company needs to improve its cash flow or wants to focus on its core operations rather than engaging in debt collection activities. It is important to note that Mississippi Assignment of Debt must comply with relevant federal laws, such as the Fair Debt Collection Practices Act (FD CPA), which imposes certain rules and regulations on debt collection practices. The assignee, or the party acquiring the debt, must adhere to these laws and treat debtors fairly and respectfully throughout the collection process. In Mississippi, to ensure a valid assignment, certain requirements must be met. These typically include a written agreement between the creditor and the assignee, clearly stating the intention to transfer the debt and the rights and obligations associated with it. The debtor must also be notified of the assignment, informing them about the new party to whom the debt is owed. This notification often includes information such as the assignee's contact details, the amount of the debt, and any other relevant terms. In conclusion, Mississippi Assignment of Debt is the legal process of transferring or selling a debt from one party to another. It can involve different types of debts, such as consumer or commercial debts, and must comply with applicable state and federal laws. By understanding the intricacies of assignment of debt, both creditors and debtors can navigate the process more effectively.

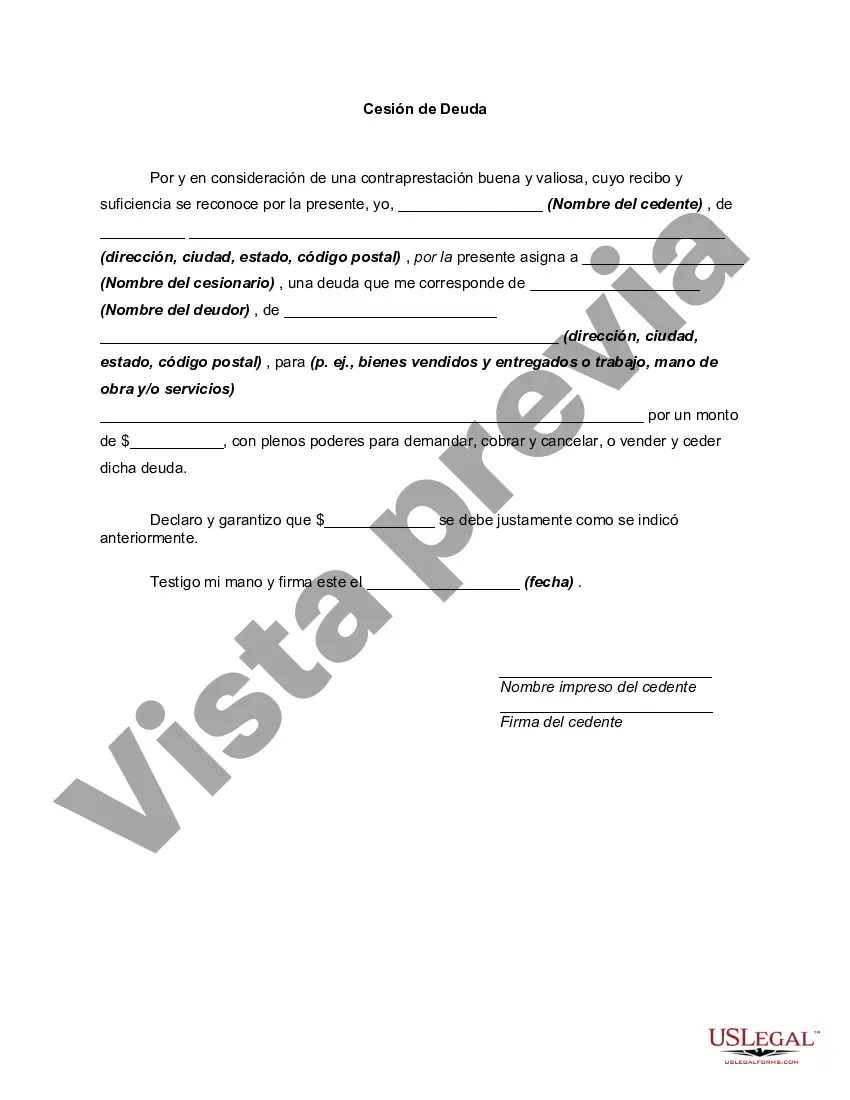

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mississippi Cesión de Deuda - Assignment of Debt

Description

How to fill out Mississippi Cesión De Deuda?

Are you currently in a location where you frequently need paperwork for either business or personal reasons.

There are many legal document templates accessible online, but locating reliable ones can be challenging.

US Legal Forms offers a vast array of form templates, such as the Mississippi Assignment of Debt, that are crafted to comply with state and federal regulations.

Once you find the correct form, click on Buy now.

Select your desired pricing plan, fill in the necessary details to process your payment, and complete the transaction using your PayPal or credit card. Choose a suitable document format and download your copy. Retrieve all the document templates you have purchased from the My documents section. You can obtain an additional copy of the Mississippi Assignment of Debt anytime if needed. Just access the form to download or print the template. Use US Legal Forms, the largest collection of legal documents, to save time and minimize mistakes. The service provides professionally crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- After that, you can download the Mississippi Assignment of Debt template.

- If you do not have an account and wish to utilize US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

- Use the Review button to examine the form.

- Read the description to confirm that you have selected the right form.

- If the form is not what you need, utilize the Search field to find a form that meets your requirements.

Form popularity

FAQ

The 11 word phrase to stop debt collectors is a practical tool when dealing with the pressure of debt recovery. If you find yourself overwhelmed, a Mississippi Assignment of Debt can provide you with the necessary protection. This process allows you to legally assign your debt to another party, relieving you of further collections. Utilize resources like USLegalForms to streamline your assignment and regain peace of mind.

In Mississippi, the statute of limitations for most debts is three to six years, depending on the type of debt. Once this period elapses, creditors can no longer take legal action to collect the debt. However, debts can still affect your credit report for up to seven years. Exploring a Mississippi Assignment of Debt might be beneficial if you're looking for ways to reduce your financial burden.

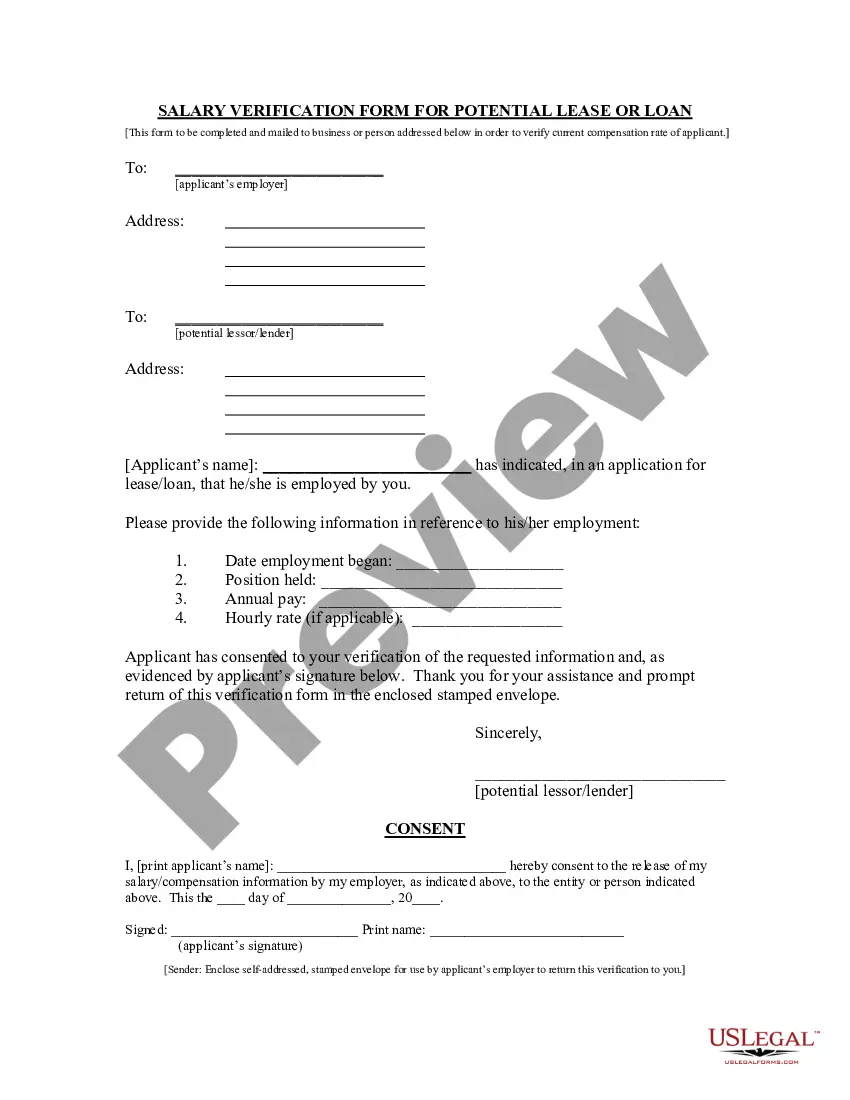

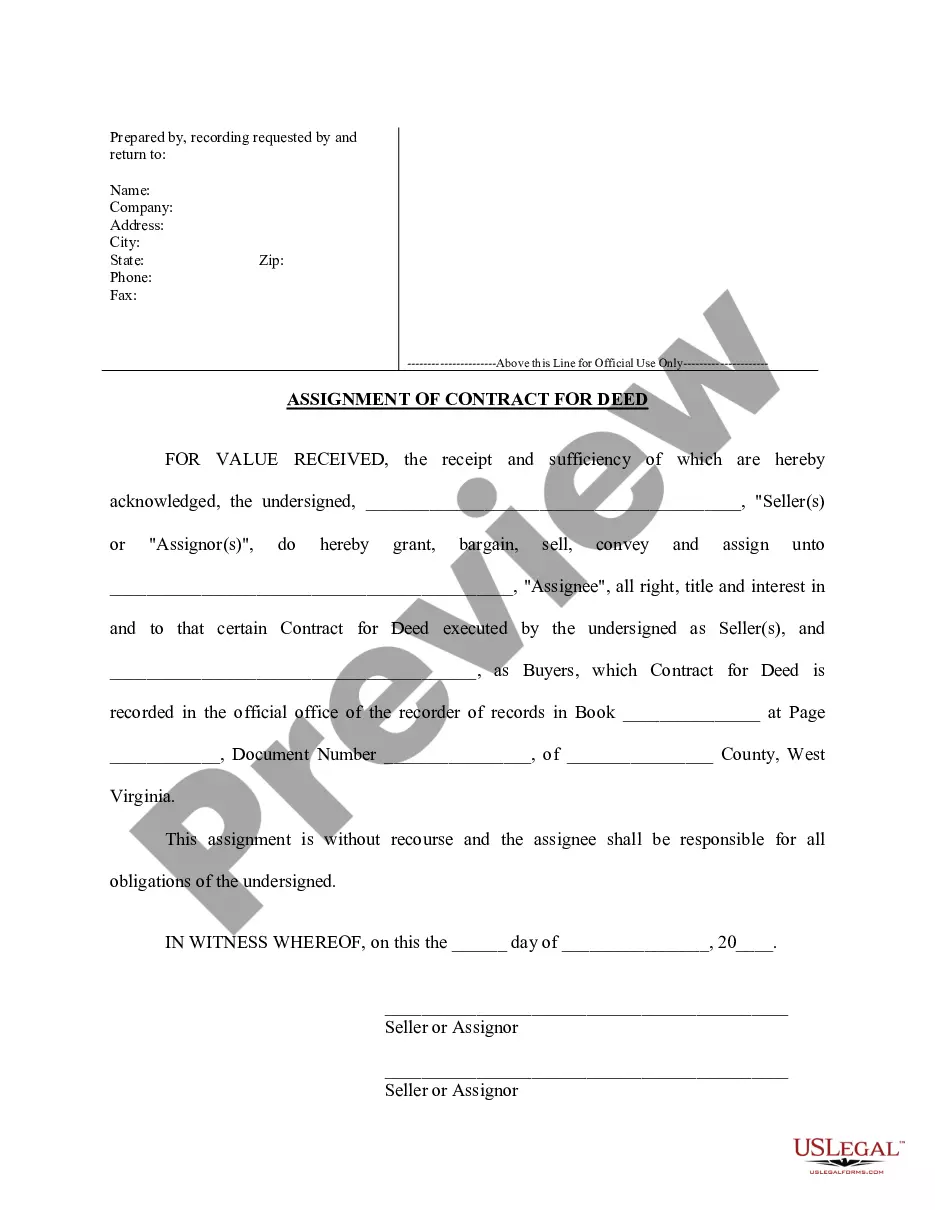

The process of debt assignment involves creating a formal agreement that outlines the transfer from the original creditor to the assignee. This written document should specify all relevant details, including the amount owed and the obligations of both parties. After execution, the lender typically must notify the debtor of this assignment to ensure clarity. Utilizing resources for Mississippi Assignment of Debt can simplify each step of this process.

To assign debt, the original creditor must draft a written agreement detailing the transfer to the new party. The document should include specifics such as the debtor's name, outstanding balance, and terms of the transfer. This provides legal standing and clarity for all parties involved. For assistance, platforms like US Legal Forms can help you navigate the Mississippi Assignment of Debt process.

In Mississippi, a debt usually becomes uncollectible after the statute of limitations, which is generally between three to six years. Once reached, creditors can no longer legally pursue payment through the court system. It’s beneficial to stay ahead of your financial obligations to prevent debts from becoming uncollectible. Understanding Mississippi Assignment of Debt can provide valuable insights into this timeline.

Yes, an assignment of debt must be documented in writing to be enforceable. This protects both parties, ensuring clarity on the terms involved in the transfer of debt. A clear contract can prevent misunderstandings and disputes later on. Consider using reliable resources for your Mississippi Assignment of Debt needs to craft solid agreements.

A creditor in Mississippi typically has between three to six years to collect a debt, depending on its nature. After this period, the creditor loses the right to file a lawsuit for collection. Staying informed can help you better manage your finances and make strategic decisions. Educating yourself about the nuances of Mississippi Assignment of Debt will aid you in this regard.

Creditors have a limited window to sue you for unpaid debts in Mississippi. The statute of limitations typically ranges from three to six years, depending on the type of debt. If you receive a lawsuit after this timeframe, you can request dismissal based on the statute. Knowing more about Mississippi Assignment of Debt can help you navigate legal matters effectively.

In Mississippi, a 10-year-old debt may no longer be collectible if it exceeds the statute of limitations. Creditors cannot legally force collection on debts that are too old. However, if you acknowledge the debt or make a payment, it might reset the statute. Stay informed about Mississippi Assignment of Debt to understand your status and options.

A debt generally becomes uncollectible when it surpasses the statute of limitations period, which in Mississippi is typically three to six years, depending on the type of debt. Once this period elapses, creditors lose their legal right to sue. Therefore, addressing your outstanding debts early can help you avoid reaching this stage. Understanding the timeline of Mississippi Assignment of Debt can empower you to manage your financial obligations effectively.