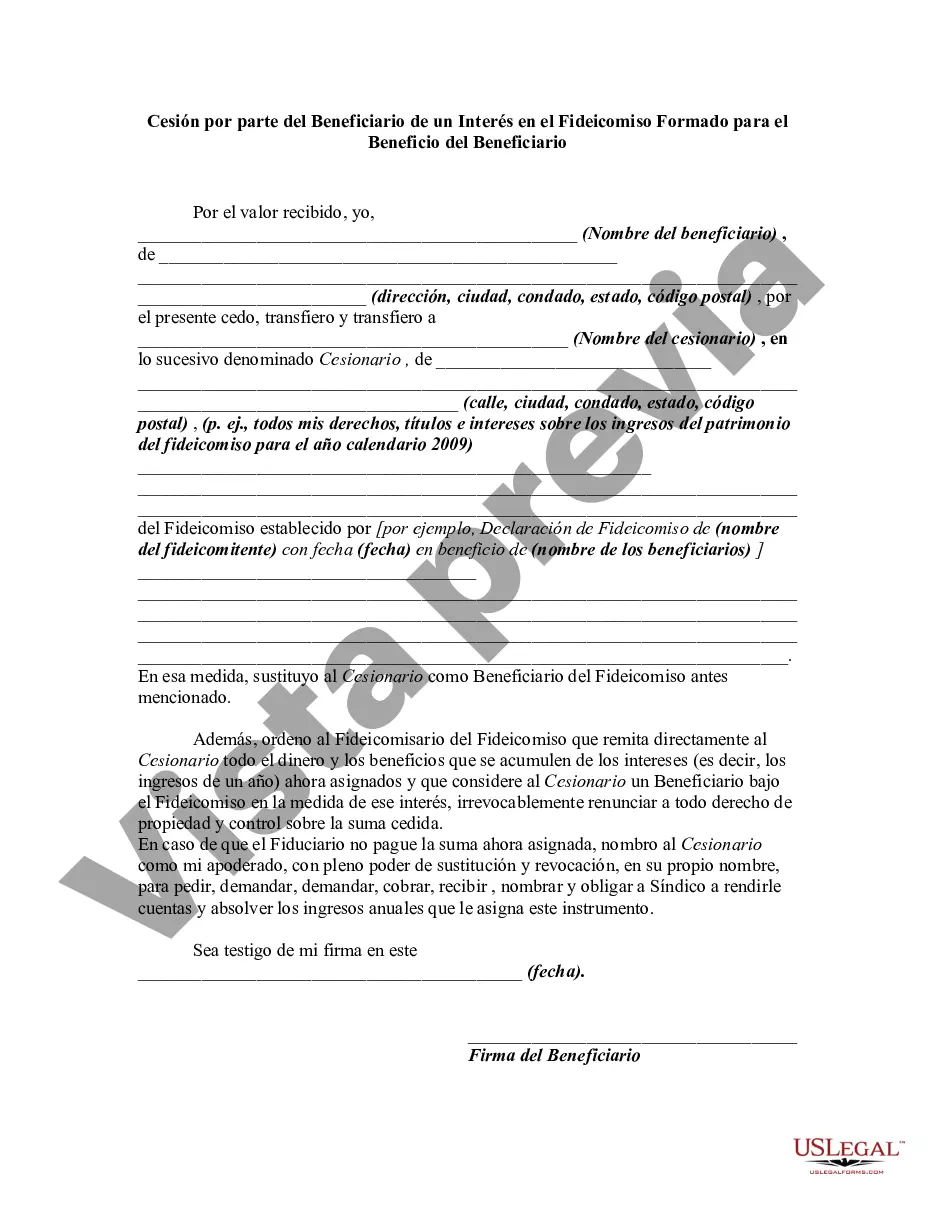

An assignment by a beneficiary of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

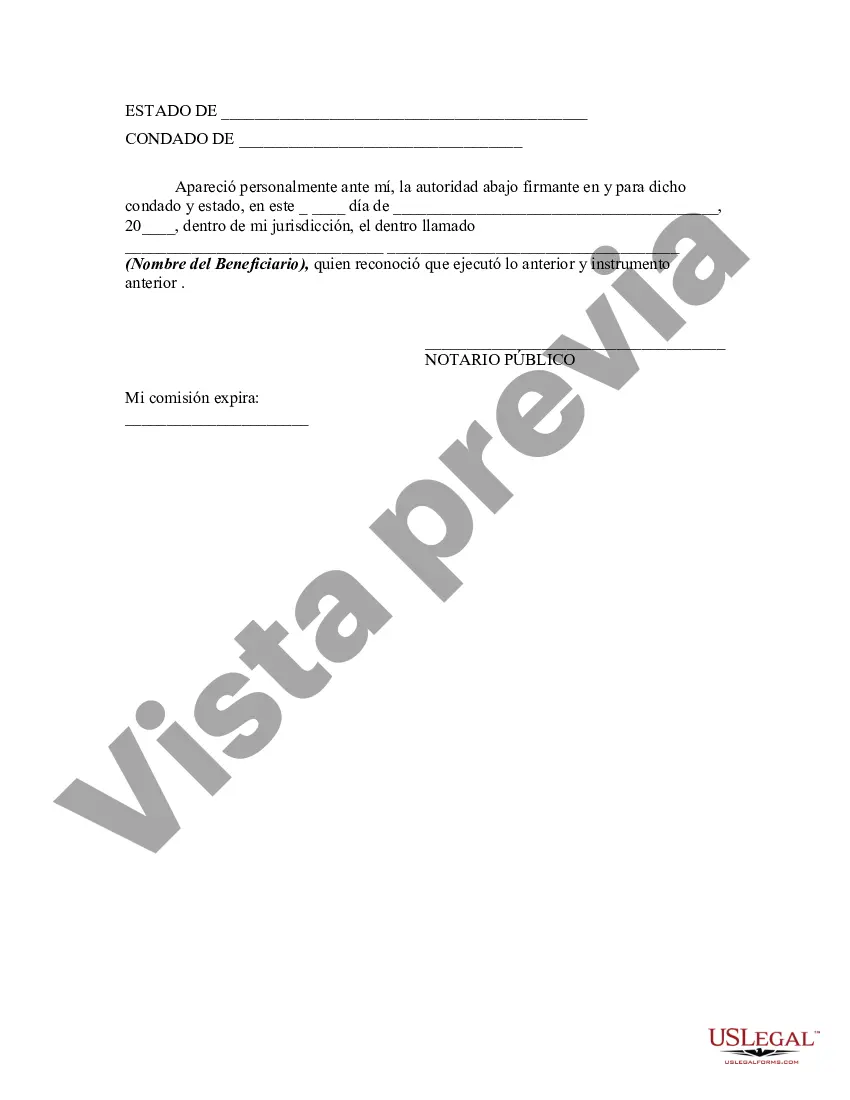

Title: Understanding the Missouri Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary Keywords: Missouri Assignment by Beneficiary, Trust Formed for the Benefit of Beneficiary, Interest in the Trust, Types Introduction: Missouri Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary is a legal process that allows beneficiaries of a trust in Missouri to transfer their interest or rights to another individual or entity. This detailed description will provide insights into the various aspects of this assignment, including its purpose, procedures, and types. Purpose of the Assignment: The primary purpose of the Missouri Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary is to enable a beneficiary to assign their rights or interests in the trust to another party. This allows beneficiaries to manage their assets or receive a lump sum amount when they are in need of funds or wish to distribute their interests among multiple parties. Procedures for the Assignment: 1. Obtain the Assignment Form: The beneficiary needs to acquire the official Assignment Form for Missouri, available from trusted legal sources, or from the attorney responsible for overseeing the trust. 2. Provide Required Information: The beneficiary fills out the Assignment Form, including their name, address, and other relevant identification details, along with a clear description of the interest being assigned. 3. Select the Assignee: The beneficiary must designate an assignee, i.e., the individual or entity who will receive the assigned interest. The assignee can be an individual, a group of individuals, or a legal entity capable of holding trust interests. 4. Notarize the Assignment: The beneficiary must sign the Assignment Form in the presence of a notary public to ensure its authenticity. 5. Notify the Trustee: The completed and notarized Assignment Form should be sent to the trustee overseeing the trust, informing them about the assignment and providing any necessary supporting documentation. Types of Missouri Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary: 1. Partial Assignment: Beneficiaries can choose to assign only a portion of their interest or rights in the trust, allowing them to retain ownership of the remaining interest. 2. Lump Sum Assignment: Beneficiaries may opt to assign their entire interest in the trust as a lump sum to another party, commonly seen in cases of selling the trust interest for financial liquidity. 3. Conditional Assignment: In some instances, beneficiaries may assign their interest in the trust subject to specific conditions. These conditions could include survival of a certain period, the occurrence of an event, or the completion of certain obligations. Conclusion: The Missouri Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary provides beneficiaries of trusts in Missouri the flexibility to assign their rights or interests to others. By following the necessary procedures, beneficiaries can manage their assets and distribute benefits as per their requirements. Understanding the various types of assignments allows beneficiaries to make informed decisions regarding their trust interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.