A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer.

Maine Checklist — Items to Consider for Drafting a Promissory Note: 1. Introduction: Provide a brief explanation of what a promissory note is and its importance in financial agreements. 2. Parties involved: Clearly identify the names and contact information of both the borrower and the lender. 3. Loan amount and terms: Specify the exact amount of money being borrowed and provide detailed information regarding the repayment terms, including the interest rate, repayment schedule, and any penalties for late payments. 4. Collateral: If the loan is secured, outline the collateral that the borrower is using to secure the loan, such as a property, vehicle, or valuable assets. 5. Usury laws: Familiarize yourself with Maine's usury laws to ensure that the interest rate being charged is legal and does not exceed the state's maximum limit. 6. Default and late payment provisions: Clearly state the consequences of default or late payments, such as increased interest rates, penalties, or potential legal actions. 7. Applicable law and jurisdiction: Specify that the promissory note is governed by Maine law and determine the appropriate jurisdiction in case of any legal disputes. 8. Signatures and witnesses: Both the borrower and lender should sign the promissory note in the presence of witnesses to ensure its validity and enforceability. Types of Maine Checklist — Items to Consider for Drafting a Promissory Note: 1. Secured Promissory Note: This type of promissory note includes collateral to secure repayment. It is crucial to outline the specific collateral being used and its value. 2. Unsecured Promissory Note: This type of promissory note does not require any collateral for repayment. However, it is important to clearly establish repayment terms and consequences for default. 3. Demand Promissory Note: This type of promissory note allows the lender to demand repayment in full at any time, regardless of the repayment schedule initially agreed upon. 4. Installment Promissory Note: This type of promissory note establishes a specific repayment schedule, with borrowers making regular payments over a set period until the full amount is repaid. 5. Interest-Only Promissory Note: This type of promissory note allows the borrower to make interest-only payments during a designated period, with the principal amount due at the end. By considering these essential items when drafting a promissory note in Maine, both borrowers and lenders can ensure clear and legally enforceable loan agreements that protect their respective interests.

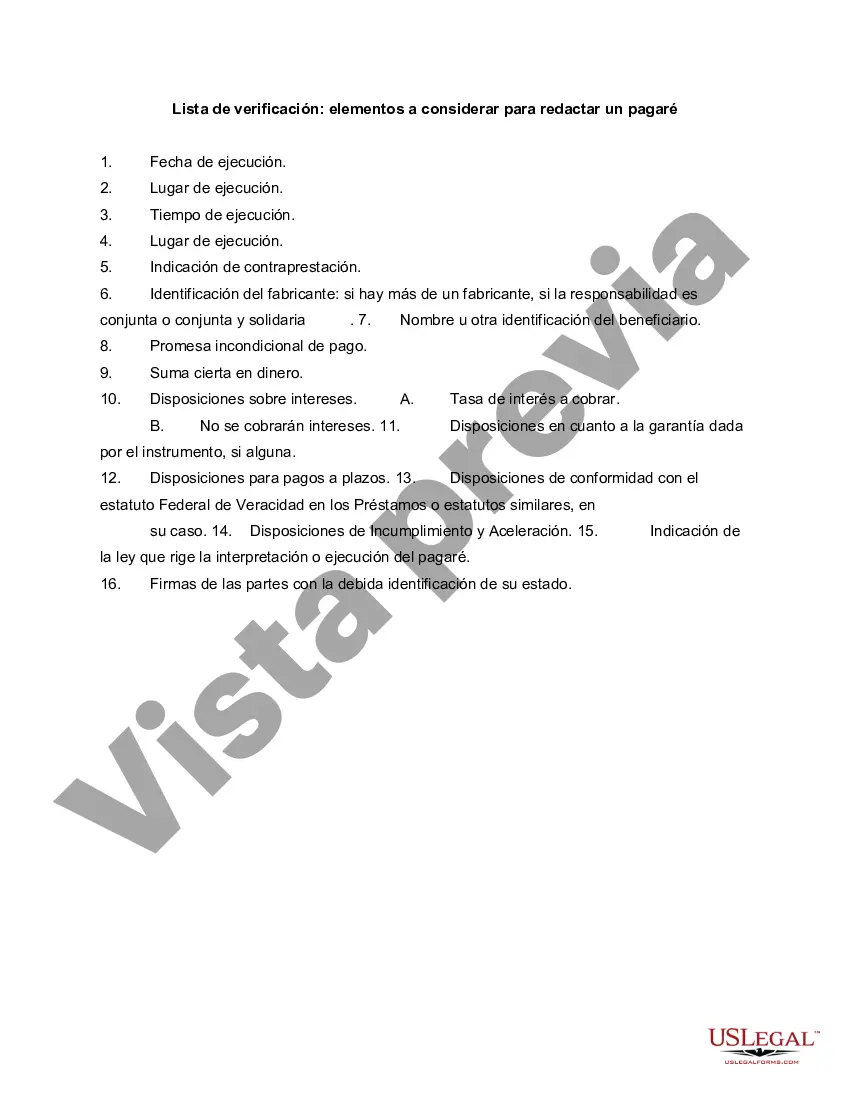

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.