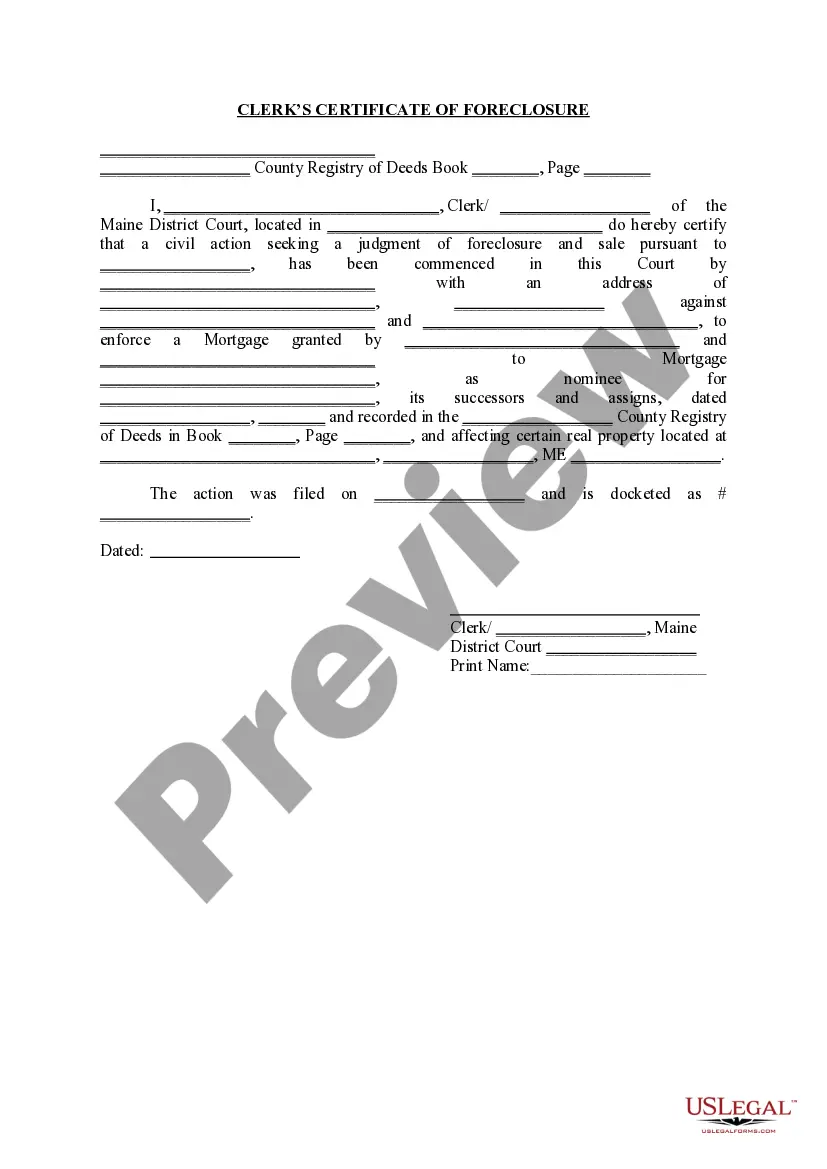

Maine Clerk's Certificate of Foreclosure

Description

Key Concepts & Definitions

Clerk's Certificate of Foreclosure: A legal document issued by the court clerk after the completion of a foreclosure sale, certifying that the sale has been conducted in compliance with all legal requirements. Foreclosure Sale: A public auction where properties that have been foreclosed upon due to non-payment of mortgages are sold to the highest bidder. Documentary Stamp: A tax imposed on documents that transfer interest in Florida property, such as deeds and mortgages.

Step-by-Step Guide to Acquiring a Clerk's Certificate of Foreclosure

- Final Judgment: Ensure a final judgment in the foreclosure suit has been made, confirming the amount due and directing the sale of the property.

- Foreclosure Sale: Attend the foreclosure sale, which is typically held at the mortgagee premises or another specified location.

- Successful Bidder: Become the highest bidder at the sale to acquire the property.

- Certificate of Title & Recording: After successful payment, the clerk issues a certificate of title. Take this certificate to the property recording office to ensure the property deed is transferred under your name.

- Payment of Taxes: Pay any due property taxes and documentary stamps required by Florida statutes to finalize the sale.

Risk Analysis

- Market Volatility: Property values in foreclosure can be unpredictable, affecting the potential profitability of such investments.

- Legal Complications: Inaccuracies in the legal process or in the paperwork, such as the certificate of foreclosure, can lead to disputes or voiding of the sale.

- Additional Costs: Costs such as taxes, documentary stamps, and other liens on foreclosed properties can accumulate, impacting the overall budget.

Key Takeaways

- A Clerks Certificate of Foreclosure confirms the legality and finality of a foreclosure sale.

- Understanding local statutes, such as Floridas requirements for documentary stamps and property taxes, is crucial in foreclosure purchases.

- Risks associated with buying foreclosed properties include market uncertainties and potential hidden costs or legal hurdles.

How to fill out Maine Clerk's Certificate Of Foreclosure?

Welcome to the greatest legal documents library, US Legal Forms. Right here you can get any example such as Maine Clerk's Certificate of Foreclosure forms and download them (as many of them as you wish/need). Get ready official papers within a few hours, instead of days or weeks, without spending an arm and a leg with an attorney. Get your state-specific example in a few clicks and be confident knowing that it was drafted by our accredited lawyers.

If you’re already a subscribed user, just log in to your account and click Download next to the Maine Clerk's Certificate of Foreclosure you require. Because US Legal Forms is online solution, you’ll generally get access to your saved templates, no matter the device you’re using. Locate them in the My Forms tab.

If you don't have an account yet, what are you awaiting? Check our guidelines listed below to get started:

- If this is a state-specific document, check its validity in your state.

- See the description (if available) to learn if it’s the proper example.

- See much more content with the Preview function.

- If the example fulfills your requirements, just click Buy Now.

- To make your account, pick a pricing plan.

- Use a credit card or PayPal account to sign up.

- Download the document in the format you want (Word or PDF).

- Print the file and complete it with your/your business’s details.

After you’ve completed the Maine Clerk's Certificate of Foreclosure, send out it to your attorney for confirmation. It’s an extra step but a necessary one for being sure you’re totally covered. Sign up for US Legal Forms now and access a mass amount of reusable samples.

Form popularity

FAQ

It takes a minimum of 120 days to complete a foreclosure in California; in other states, twelve or more months may pass before you're required to leave your home.

Foreclosures are generally judicial in the following states: Connecticut, Delaware, District of Columbia (sometimes), Florida, Hawaii, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana (executory proceeding), Maine, Nebraska (sometimes), New Jersey, New Mexico, New York, North Dakota, Ohio, Oklahoma (if the

The auction notice, or Notice of Sale, is your final notice that the lender intends to sell the property at auction. The county prints the location, time and date of the trustee's auction on the Notice of Sale. It also contains the name and contact information for the trustee in charge of the sale.

In Maine, lenders may foreclose on mortgages in default by using either a judicial or strict foreclosure process. Although Maine allows lenders to pursue foreclosure by judicial methods, which involves filing a lawsuit to obtain a court order to foreclose, it is only used in special circumstances.

Judicial foreclosure involves filing a lawsuit to get a court order to sell the home (foreclose). It is used when there is no power-of-sale clause in the mortgage or deed of trust. Generally, after the court orders the sale of your home, it will be auctioned off to the highest bidder.

You can stop the foreclosure process by informing your lender that you will pay off the default amount and extra fees. Your lender would prefer to have the money much more than they would have your home, so unless there are extenuating circumstances, this should work.

Foreclosures can take a long time because lenders and servicers must comply with the requirements under these laws. Mediation laws. Some states, cities, and municipalities have passed foreclosure mediation laws that can delay the foreclosure process. Mortgage servicing laws changed in 2014.

Generally, a homeowner has to be at least 120 days delinquent before a mortgage servicer starts a foreclosure. Applying for a foreclosure avoidance option, called loss mitigation, might delay the start date even further.

The Notice of Default starts the official foreclosure process. This notice is issued 30 days after the fourth missed monthly payment. From this point onwards, the borrower will have 2 to 3 months, depending on state law, to reinstate the loan and stop the foreclosure process.