The Maryland General Form of Assignment as Collateral for Note is a legal document used in Maryland to secure a loan or debt by assigning collateral to the lender. This document specifies the terms and conditions under which the collateral will be transferred in case of default or non-payment. Key terms and elements involved in the Maryland General Form of Assignment as Collateral for Note include: 1. Collateral: This refers to the asset or property being pledged to secure the loan. It can be in the form of real estate, vehicles, stocks, bonds, or any valuable item that holds monetary value. 2. Debtor: The individual or entity borrowing money and pledging the collateral as security. The debtor agrees to repay the loan amount within a specified time period. 3. Lender: The person or institution providing the loan and receiving the assigned collateral as security for the debt. 4. Note: It is a written promise to repay a specified amount of money at a determined interest rate within a given timeframe. The note serves as evidence of the loan agreement and includes repayment terms. 5. Assignment Clause: This clause states that the debtor transfers ownership and rights of the collateral to the lender until the loan is repaid in full. It outlines the conditions under which the collateral can be sold or liquidated by the lender to recover the outstanding debt. 6. Default: If the debtor fails to meet the repayment obligations outlined in the note, it constitutes a default. The Maryland General Form of Assignment as Collateral for Note will specify the consequences of default, including the lender's rights to take possession of the collateral. Types of Maryland General Form of Assignment as Collateral for Note include: 1. Mortgage Assignment: When real estate is used as collateral, the assignment is known as a mortgage assignment. This type of assignment gives the lender the right to foreclose on the property in case of default. 2. Security Agreement: This assignment covers personal property, such as vehicles, stocks, or equipment. It grants the lender the right to take possession of the collateral upon default and sell it to recover the debt. 3. Pledge Agreement: This assignment involves the transfer of ownership of financial assets, such as shares, stocks, or bonds. The lender holds onto the assets as collateral until the loan is repaid. In summary, the Maryland General Form of Assignment as Collateral for Note is a legally binding document that outlines the terms and conditions of securing a loan with collateral. It is essential for both debtors and lenders to understand the implications of this assignment, ensuring a fair and transparent transaction.

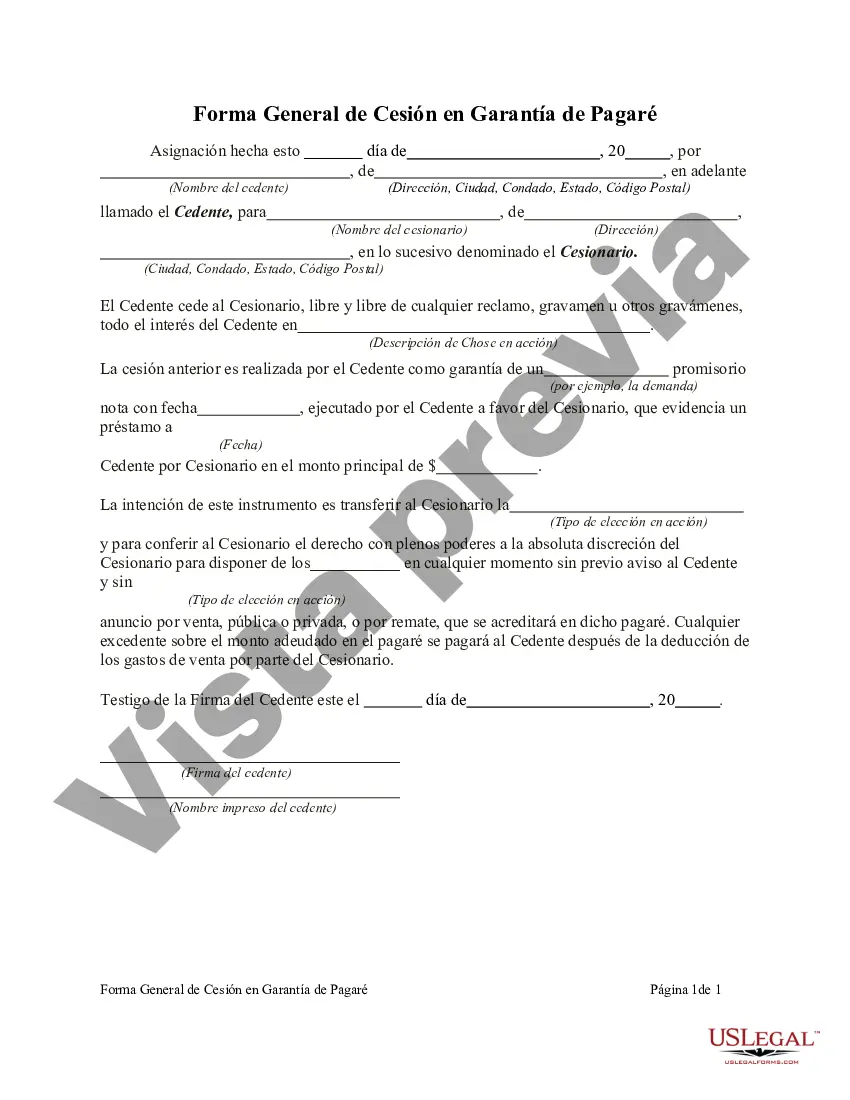

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maryland Forma General de Cesión en Garantía de Pagaré - General Form of Assignment as Collateral for Note

Description

How to fill out Maryland Forma General De Cesión En Garantía De Pagaré?

You can invest hrs on the Internet trying to find the lawful papers format which fits the state and federal specifications you need. US Legal Forms supplies a large number of lawful types that happen to be reviewed by pros. You can easily acquire or printing the Maryland General Form of Assignment as Collateral for Note from your support.

If you already possess a US Legal Forms bank account, you may log in and click on the Download button. Next, you may comprehensive, edit, printing, or signal the Maryland General Form of Assignment as Collateral for Note. Every lawful papers format you acquire is your own eternally. To get yet another copy for any obtained develop, visit the My Forms tab and click on the corresponding button.

Should you use the US Legal Forms internet site for the first time, adhere to the straightforward guidelines under:

- Initially, make sure that you have chosen the proper papers format to the state/town of your choosing. Read the develop explanation to make sure you have chosen the correct develop. If available, make use of the Review button to appear throughout the papers format too.

- If you would like find yet another model in the develop, make use of the Lookup field to find the format that fits your needs and specifications.

- After you have discovered the format you desire, click Buy now to continue.

- Choose the pricing strategy you desire, type in your qualifications, and register for an account on US Legal Forms.

- Comprehensive the deal. You may use your Visa or Mastercard or PayPal bank account to purchase the lawful develop.

- Choose the formatting in the papers and acquire it in your system.

- Make changes in your papers if necessary. You can comprehensive, edit and signal and printing Maryland General Form of Assignment as Collateral for Note.

Download and printing a large number of papers themes making use of the US Legal Forms website, that offers the biggest variety of lawful types. Use expert and state-particular themes to deal with your small business or personal requires.

Form popularity

FAQ

A valid legal assignment only occurs when all underlying elements of a lawfully binding contract are included in it, including intent. A trial court can determine if an assignment has occurred. To prevent disputes or miscommunications, it's important that the subject matter is clearly identified in the assignment.

A collateral contract is usually a single term contract, made in consideration of the party for whose benefit the contract operates agreeing to enter into the principal or main contract, which sets out additional terms relating to the same subject matter as the main contract.

Some contracts may contain a clause prohibiting assignment; other contracts may require the other party to consent to the assignment. Here's an example of a basic assignment of a contract: Tom contracts with a dairy to deliver a bottle of half-and-half to Tom's house every day.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

Assignment of Contract Explained Assignment of contract allows one person to assign, or transfer, their rights, obligations, or property to another. An assignment of contract clause is often included in contracts to give either party the opportunity to transfer their part of the contract to someone else in the future.

Collateral assignment of life insurance lets you use a life insurance policy as an asset to secure a loan. If you die while the policy is in place and still owe money on the loan, the death benefit goes to pay off the remaining debt. Any money remaining goes to your beneficiaries.

Unless specifically prohibited in the language of the note, a promissory note is assignable by the lender. That is, the lender can sell or assign the note to a third party who the borrower must then repay.

Collateral Assignment of Contracts means the assignment of representations, warranties, covenants, indemnities and rights to the Agent, in respect of the Loan Parties' rights under that certain Escrow Agreement executed in connection with the Riverstone Acquisition delivered on the Original Closing Date.

To transfer a promissory note, it must be negotiable and/or have a provision that allows and explains transfer. In addition, it must comply with state statutes governing promissory notes and assignments thereof. Create a Promissory Note Transfer Agreement.

This Assignment creates a valid and binding first priority security interest in the Collateral securing the payment and performance of the Obligations.