Generally, a contract to employ a certified public accountant need not be in writing.

However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Massachusetts General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping

Description

How to fill out General Consultant Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping?

You might spend numerous hours on the internet searching for the legal document template that fulfills the federal and state requirements you will require.

US Legal Forms offers thousands of legal forms that are reviewed by professionals.

You can easily acquire or print the Massachusetts General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping from our platform.

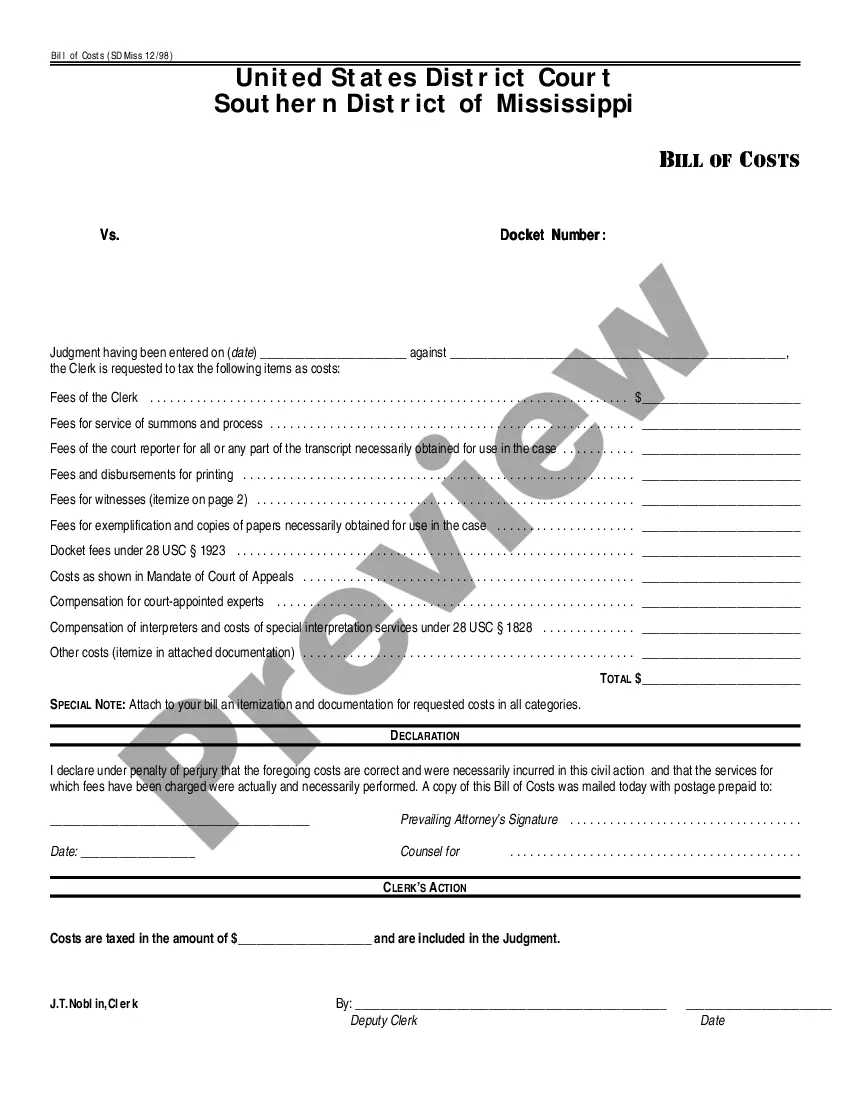

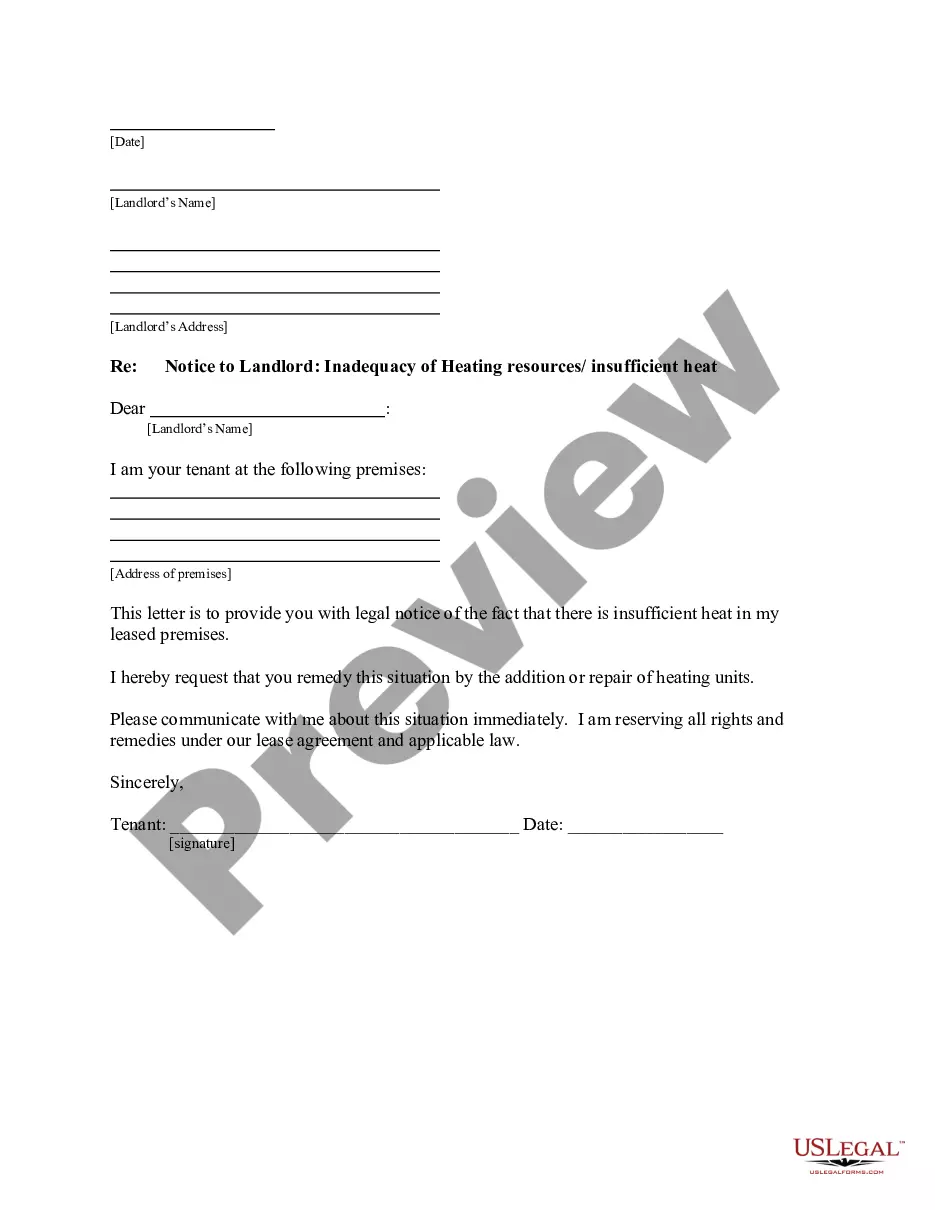

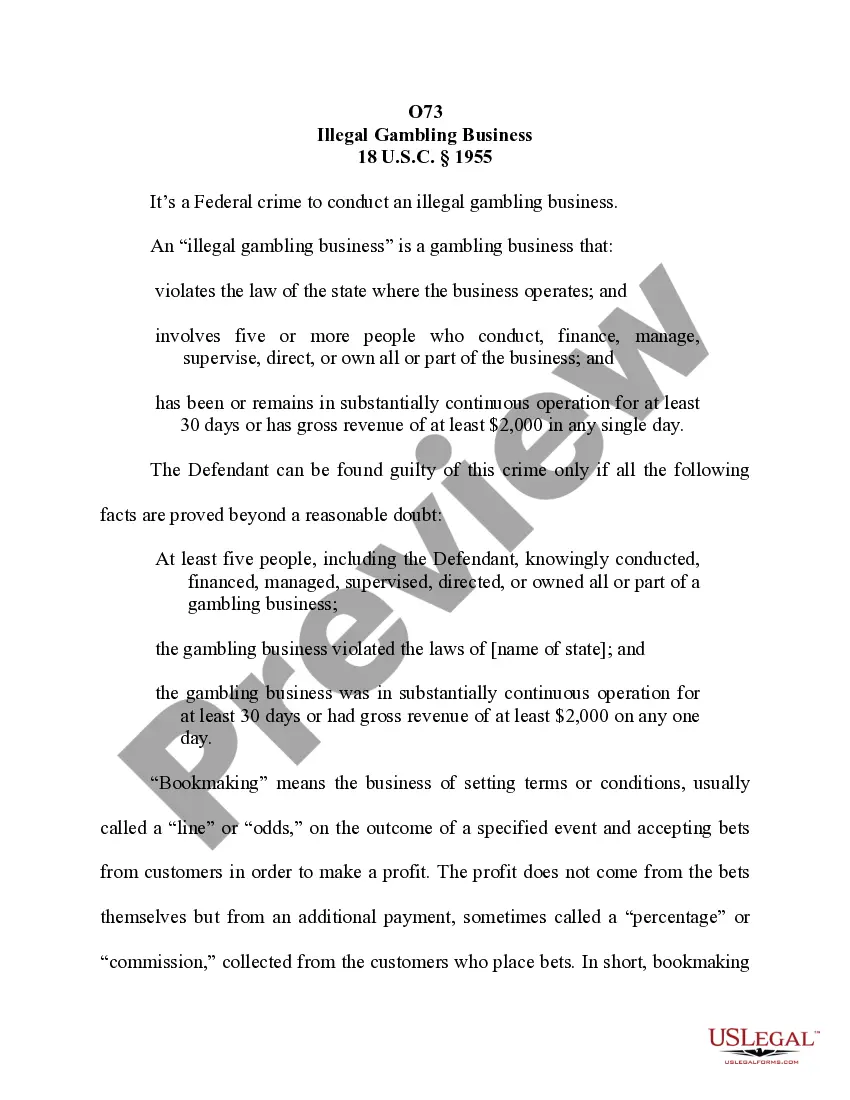

If available, use the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, edit, print, or sign the Massachusetts General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping.

- Every legal document template you obtain is yours indefinitely.

- To receive another copy of any purchased form, navigate to the My documents tab and click the corresponding button.

- If you're visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the appropriate document template for your area/town of choice.

- Review the form description to confirm you have selected the correct template.

Form popularity

FAQ

Yes, having a contract as a consultant is essential to protect your interests and outline the terms of the engagement. A Massachusetts General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping serves as a formal contract that defines the relationship between you and your client. It helps clarify expectations, limits liabilities, and can assist in resolving disputes if they arise. You can easily find comprehensive templates through uslegalforms to create an effective agreement.

To set up a consulting agreement, you should outline the scope of services, compensation, and duration of the agreement. A well-structured Massachusetts General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping clearly specifies each party's responsibilities and expectations. You can start by drafting a template, or consider using platforms like uslegalforms to ensure legal compliance and clarity.

A consulting agreement typically includes sections outlining the project scope, responsibilities, payment terms, and confidentiality clauses. It may also specify the duration of the project and conditions for termination. Reviewing a standard Massachusetts General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping can provide you with a clear idea of what to expect in such documents.

A consulting agreement should clearly outline the roles, responsibilities, and expectations of both parties. Start with basic information, such as the parties involved and the project scope, followed by payment and terms of service. A Massachusetts General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping can help provide a comprehensive framework for your agreement.

To structure a consulting contract effectively, start by identifying the scope of work, payment terms, and duration of the agreement. It should also include confidentiality and termination clauses. Utilizing a template like the Massachusetts General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping can streamline this process and ensure you include all necessary elements.

The best legal structure for a consulting business often depends on factors like liability, tax implications, and the number of owners. Many consultants choose to operate as sole proprietors or Limited Liability Companies (LLCs), which provide flexibility and protection. Understanding the available structures is essential when preparing a Massachusetts General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping.

Consultants should use a consultancy agreement tailored to their specific services and business needs. This type of contract, like the Massachusetts General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping, should cover critical aspects such as payment, deliverables, and timelines. A properly constructed agreement ensures both parties are on the same page and helps prevent misunderstandings.

A consultancy agreement is a legal document that defines the terms of a consulting relationship. This agreement often includes the consultant's responsibilities, compensation, and duration of service, making it important for clarity. A well-drafted Massachusetts General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping can provide a solid foundation for your consulting engagements.

The contract for provision of accounting services is a formal document that outlines the expectations and responsibilities between an accountant and their client. This type of agreement, which can be structured as a Massachusetts General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping, clarifies the scope of work, payment terms, and confidentiality requirements. It helps ensure that both parties understand their commitments.

A service agreement typically outlines the terms for providing specific services, while a consulting agreement focuses on expert advice and guidance. Generally, a Massachusetts General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping emphasizes advisory roles and deliverables specific to client needs. Understanding these differences can help you choose the right contract for your situation.