A guaranty is an undertaking on the part of one person (the guarantor) which binds the guarantor to performing the obligation of the debtor or obligor in the event of default by the debtor or obligor. The contract of guaranty may be absolute or it may be conditional. An absolute or unconditional guaranty is a contract by which the guarantor has promised that if the debtor does not perform the obligation or obligations, the guarantor will perform some act (such as the payment of money) to or for the benefit of the creditor.

A guaranty may be either continuing or restricted. The contract is restricted if it is limited to the guaranty of a single transaction or to a limited number of specific transactions and is not effective as to transactions other than those guaranteed. The contract is continuing if it contemplates a future course of dealing during an indefinite period, or if it is intended to cover a series of transactions or a succession of credits, or if its purpose is to give to the principal debtor a standing credit to be used by him or her from time to time.

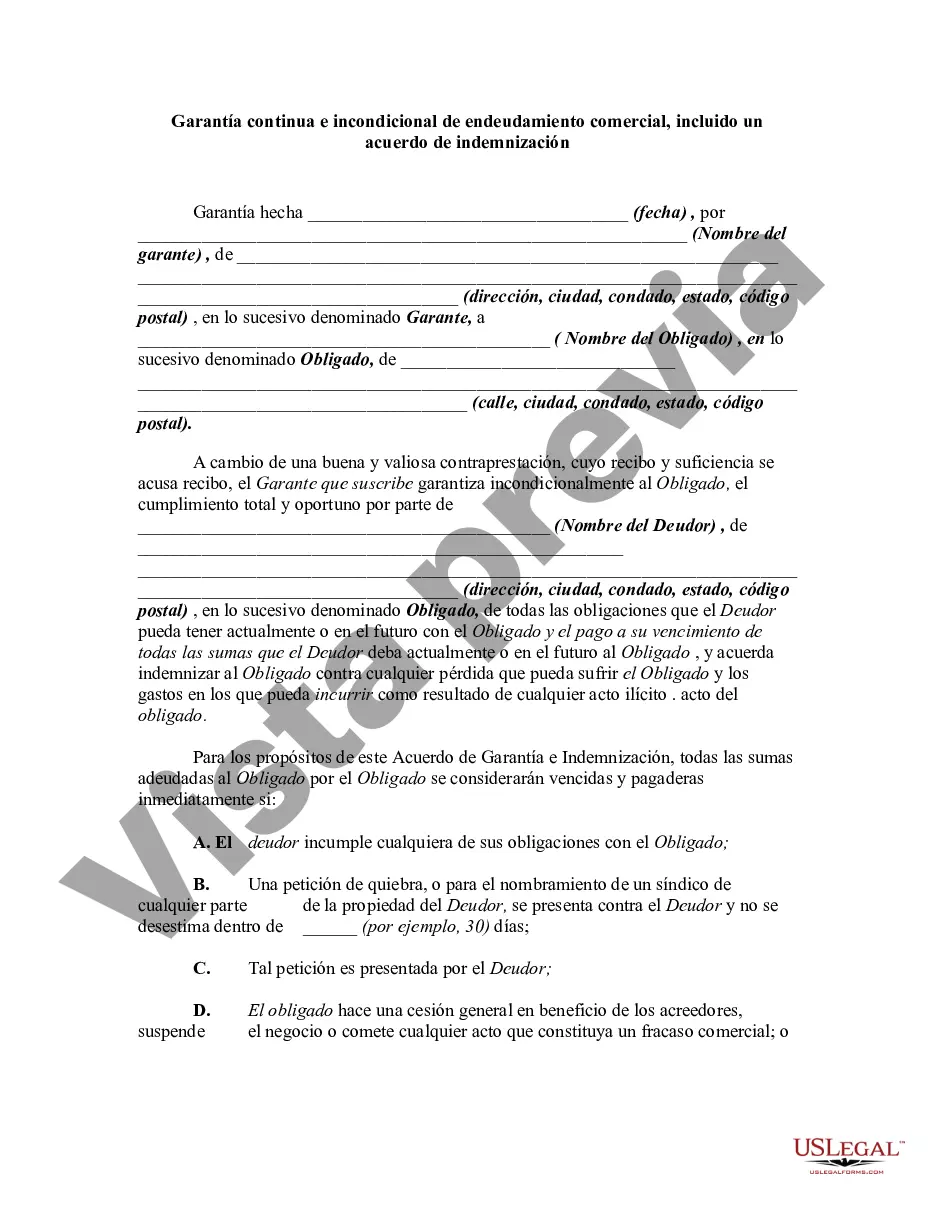

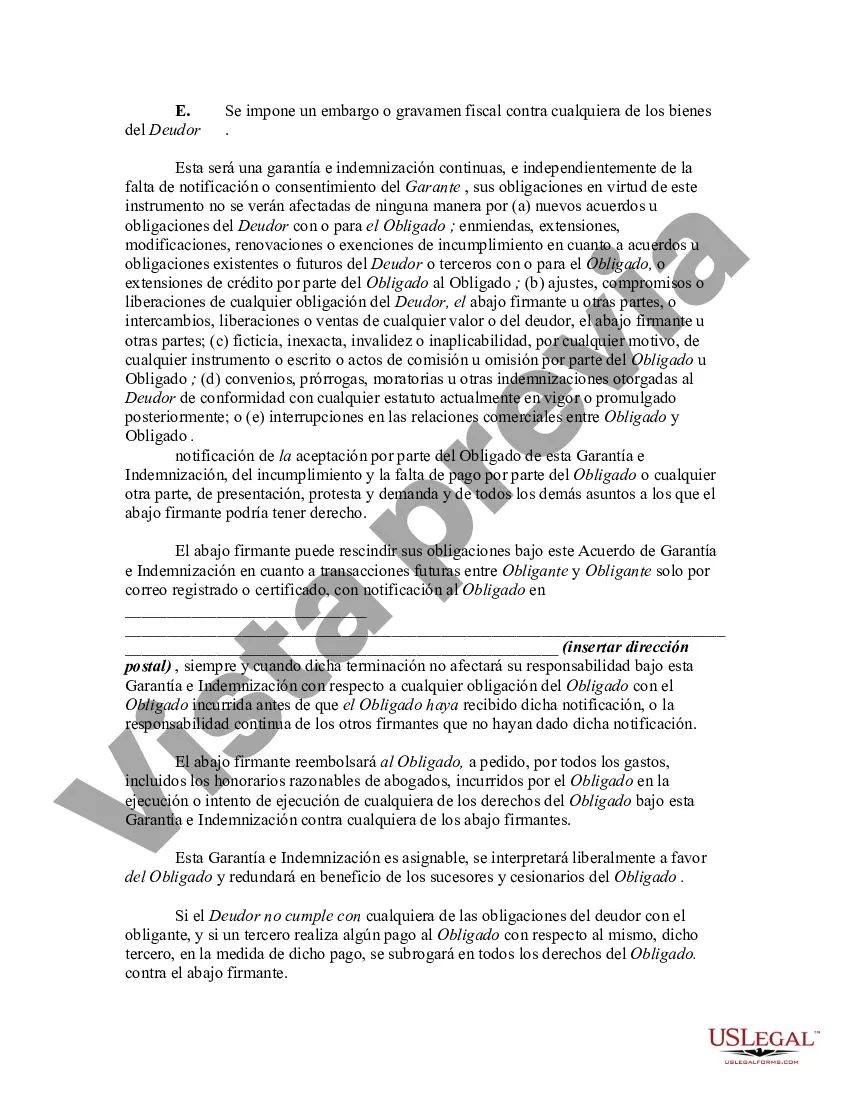

Massachusetts Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement is a legal document that outlines the obligations and responsibilities of a guarantor in the state of Massachusetts. This guaranty is often required by lenders when a business is seeking financial assistance or entering into a loan agreement. Keywords: Massachusetts, continuing, unconditional, guaranty, business indebtedness, indemnity agreement In Massachusetts, a continuing and unconditional guaranty of business indebtedness refers to a legal undertaking where an individual or entity agrees to be held personally responsible for the repayment of a business's debts. This guaranty serves as a form of security for lenders, offering them reassurance that they will be able to recoup their losses even if the business defaults on the loan. The guarantor, often the business owner or a related party, agrees to take on financial liability for the entire indebtedness of the business. This means that if the business fails to meet its payment obligations, the guarantor will be obligated to repay the outstanding balance personally. The guaranty is not limited to a specific amount or timeframe, extending its coverage until all obligations have been fully satisfied. Furthermore, the guarantor's obligation remains in force even if there are changes in the business's ownership, structure, or financial condition. This ensures that lenders are protected regardless of happening within the business. Massachusetts law requires the guaranty to be in writing and signed by the guarantor to be enforceable. It is crucial for both the guarantor and the lender to carefully review and understand the terms and conditions outlined in the guaranty agreement before entering into any financial arrangements. Additionally, an indemnity agreement is often attached to the guaranty, further enhancing the guarantor's obligations and liability. This agreement serves as a promise from the guarantor to indemnify and hold harmless the lender from any losses, damages, or expenses incurred due to the borrower's default. Different types of Massachusetts Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement may vary based on the specific terms and conditions set forth by the lender. Some agreements may have additional clauses, such as acceleration clauses that allow the lender to demand immediate repayment upon certain events or defaults by the borrower. In conclusion, a Massachusetts Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement is a legal document that provides lenders with an added layer of financial security when extending credit to businesses. By signing this document, the guarantor assumes personal liability for the business's debts and promises to indemnify the lender. It is essential for all parties involved to seek legal counsel and fully comprehend the implications of this guaranty before entering into any financial agreements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.