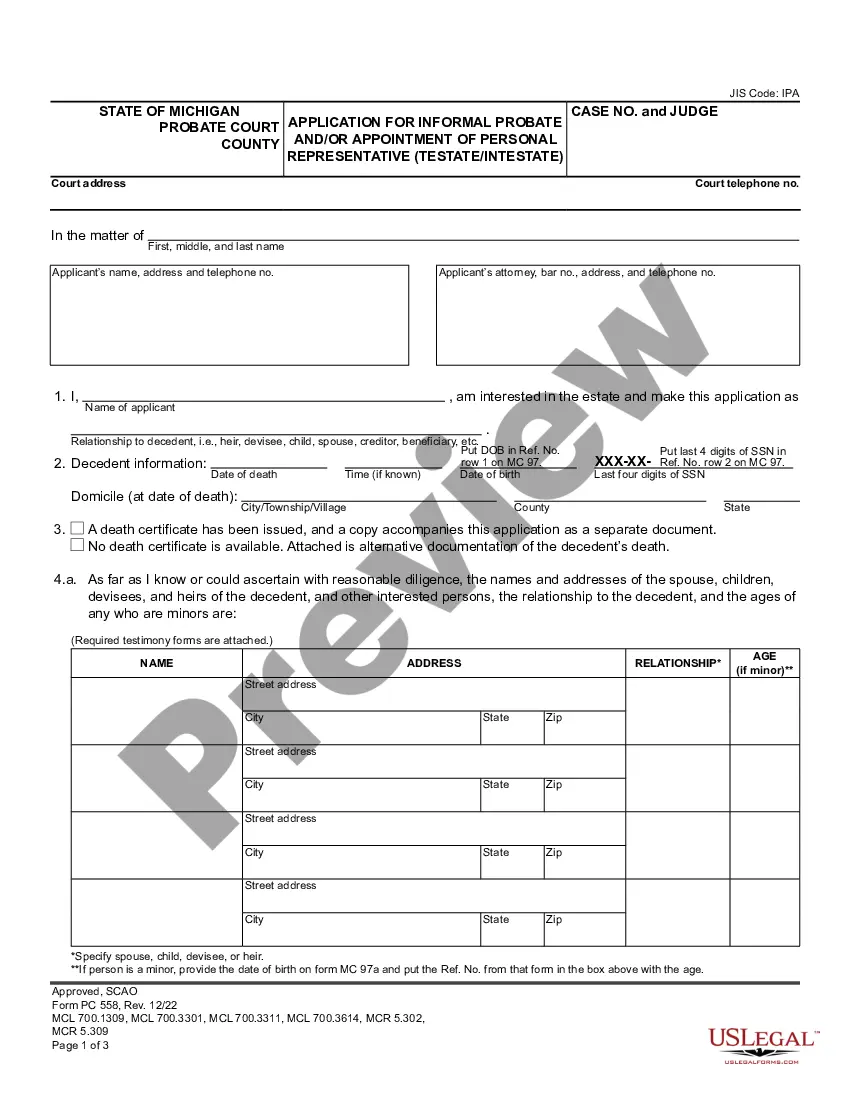

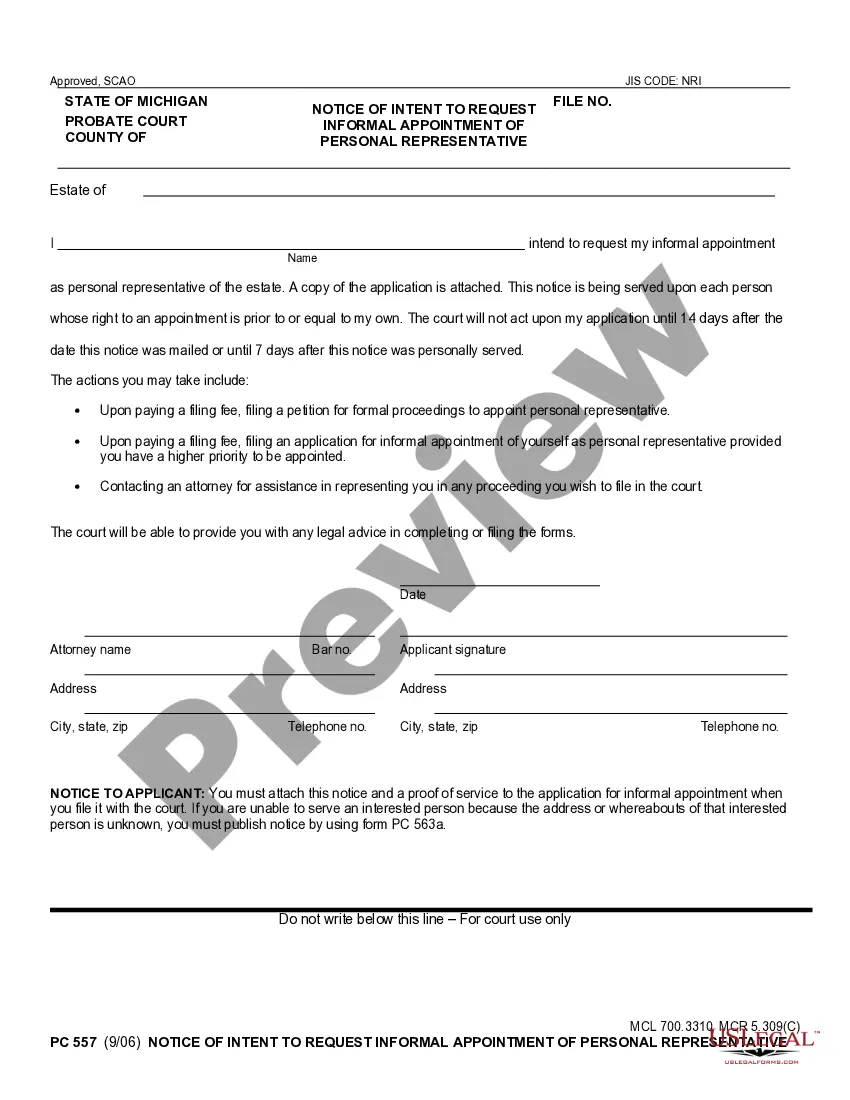

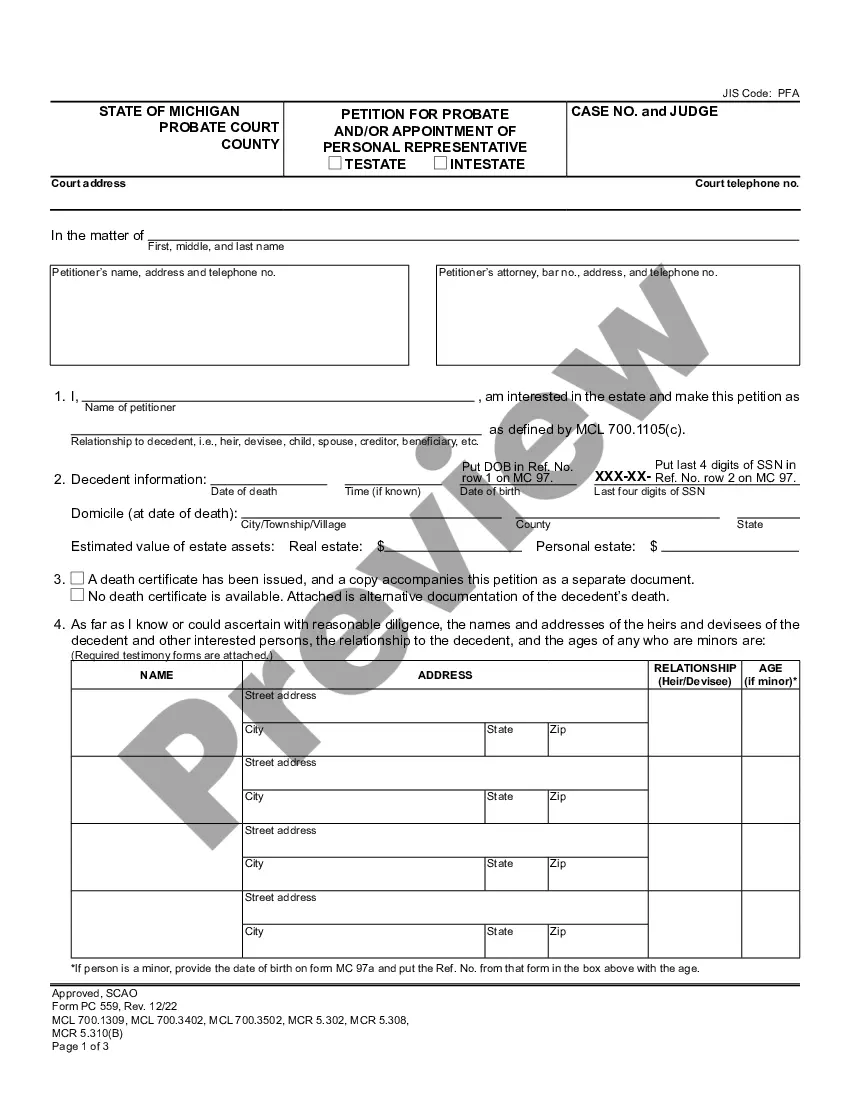

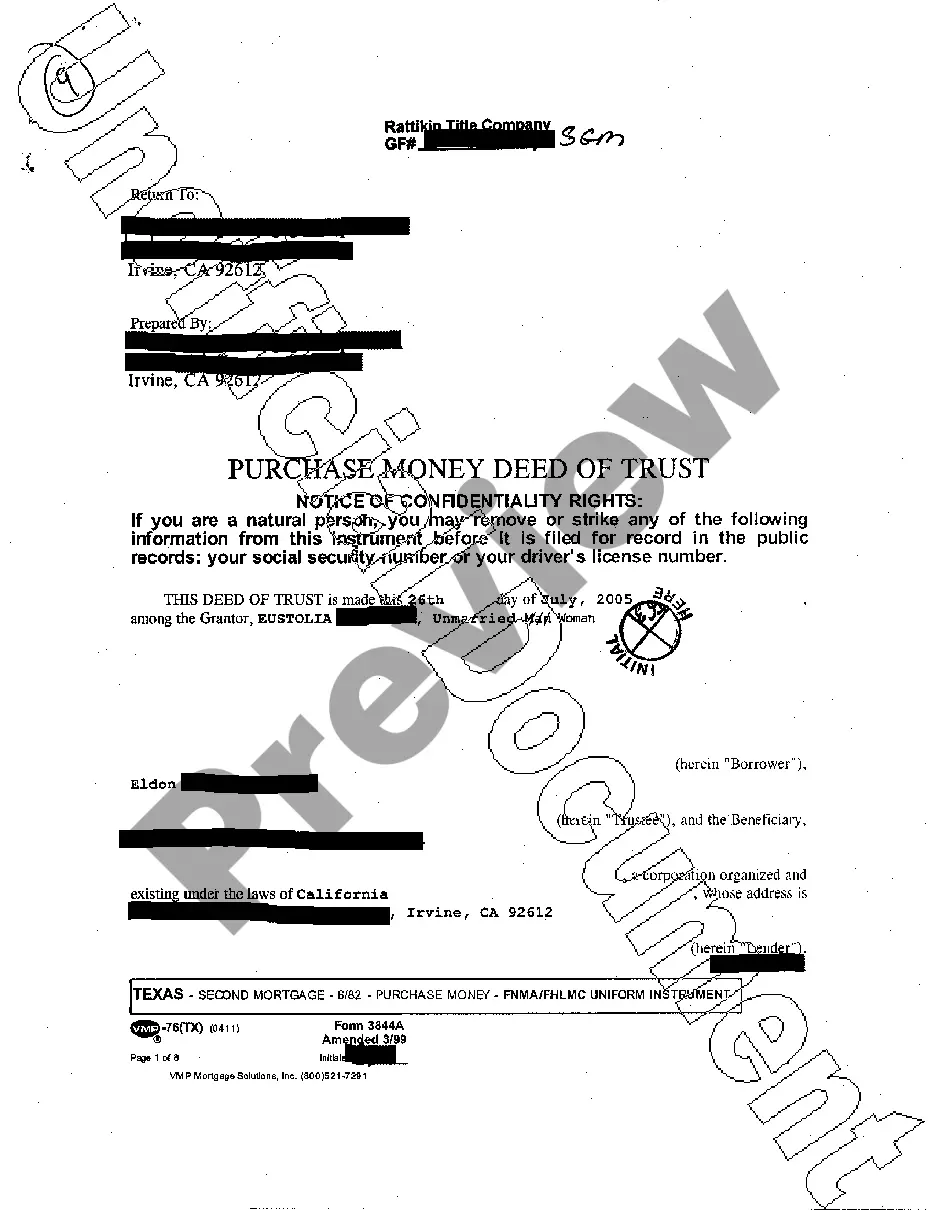

Kentucky Invoice is an electronic document used to record transactions between businesses operating in the state of Kentucky. It is used to record the sale of goods or services between the seller and the buyer. It typically includes details of the purchase such as the date of the transaction, the amount of the purchase, and the name and address of both parties. Kentucky Invoice is a legal document required for tax filing purposes and must be retained as evidence of the transaction. There are two main types of Kentucky Invoice: Sales and Use Tax Invoice and Withholding Tax Invoice. The Sales and Use Tax Invoice is used to record the sale of goods and services and the Withholding Tax Invoice is used to record the withholding of taxes from employee wages.

Kentucky Invoice

Description

How to fill out Kentucky Invoice?

Managing legal documentation necessitates focus, precision, and the utilization of well-prepared templates. US Legal Forms has been assisting individuals nationwide for 25 years, ensuring that when you select your Kentucky Invoice template from our service, it adheres to federal and state laws.

Engaging with our service is simple and efficient. To obtain the necessary document, all you need is an account with an active subscription. Here are some quick steps to help you locate your Kentucky Invoice in just minutes.

All documents are designed for multiple uses, like the Kentucky Invoice displayed on this page. If you require them again, you can fill them out without additional charges - just access the My documents tab in your profile and complete your document whenever needed. Experience US Legal Forms and prepare your business and personal paperwork quickly and in complete legal compliance!

- Ensure to thoroughly verify the form's content and its alignment with general and legal standards by previewing it or reviewing its description.

- Search for an alternative official document if the one currently available does not fit your circumstances or state regulations (the option for that is located at the top page corner).

- Log in to your account and save the Kentucky Invoice in your preferred format. If this is your first visit to our website, click Buy now to continue.

- Create an account, select your subscription plan, and pay using your credit card or PayPal account.

- Decide on the format in which you wish to save your form and click Download. Print the document or upload it to a professional PDF editor for electronic submission.

Form popularity

FAQ

Senate Bill 148 AN ACT establishing the Government Teleworking Task Force.

Electronic payment: Choose to pay directly from your bank account or by credit card. Service provider fees may apply. Tax Payment Solution (TPS): Register for EFT payments and pay EFT Debits online. Filing Login: Utility Gross Receipts License Tax online filing.

Normally, the Governor has 12 days after receiving a bill to decide to sign or veto it, or a bill will become law automatically without his or her signature. However, the Governor has 30 days to make this decision on bills submitted to him or her when the annual winter recess is near at hand.

Bill is signed by the governor into law, becomes law without signature, or is vetoed. If bill is vetoed, it goes back to each chamber. If approved by a constitutional majority in each chamber, the veto is overridden and the bill becomes law.

House Bill 1 AN ACT relating to income taxation. Amend KRS 141.020 to reduce the individual income tax to 4.5% for taxable years beginning January 1, 2023, and to 4% for taxable years beginning January 1, 2024.

Steps Step 1: The bill is drafted.Step 2: The bill is introduced.Step 3: The bill goes to committee.Step 4: Subcommittee review of the bill.Step 5: Committee mark up of the bill.Step 6: Voting by the full chamber on the bill.Step 7: Referral of the bill to the other chamber.Step 8: The bill goes to the president.

The bill is sent to the President for review. A bill becomes law if signed by the President or if not signed within 10 days and Congress is in session. If Congress adjourns before the 10 days and the President has not signed the bill then it does not become law ("Pocket Veto.")

Following debate and amendments, a final vote on the bill is taken. To pass, a bill must be approved by at least two-fifths of the members of the chamber (40 representatives or 16 senators) and a majority of the members present and voting.