An accounting by a fiduciary usually involves an inventory of assets, debts, income, expenditures, and other items, which is submitted to a court. Such an accounting is used in various contexts, such as administration of a trust, estate, guardianship or conservatorship. Generally, a prior demand by an appropriate party for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting.

Indiana Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian

Description

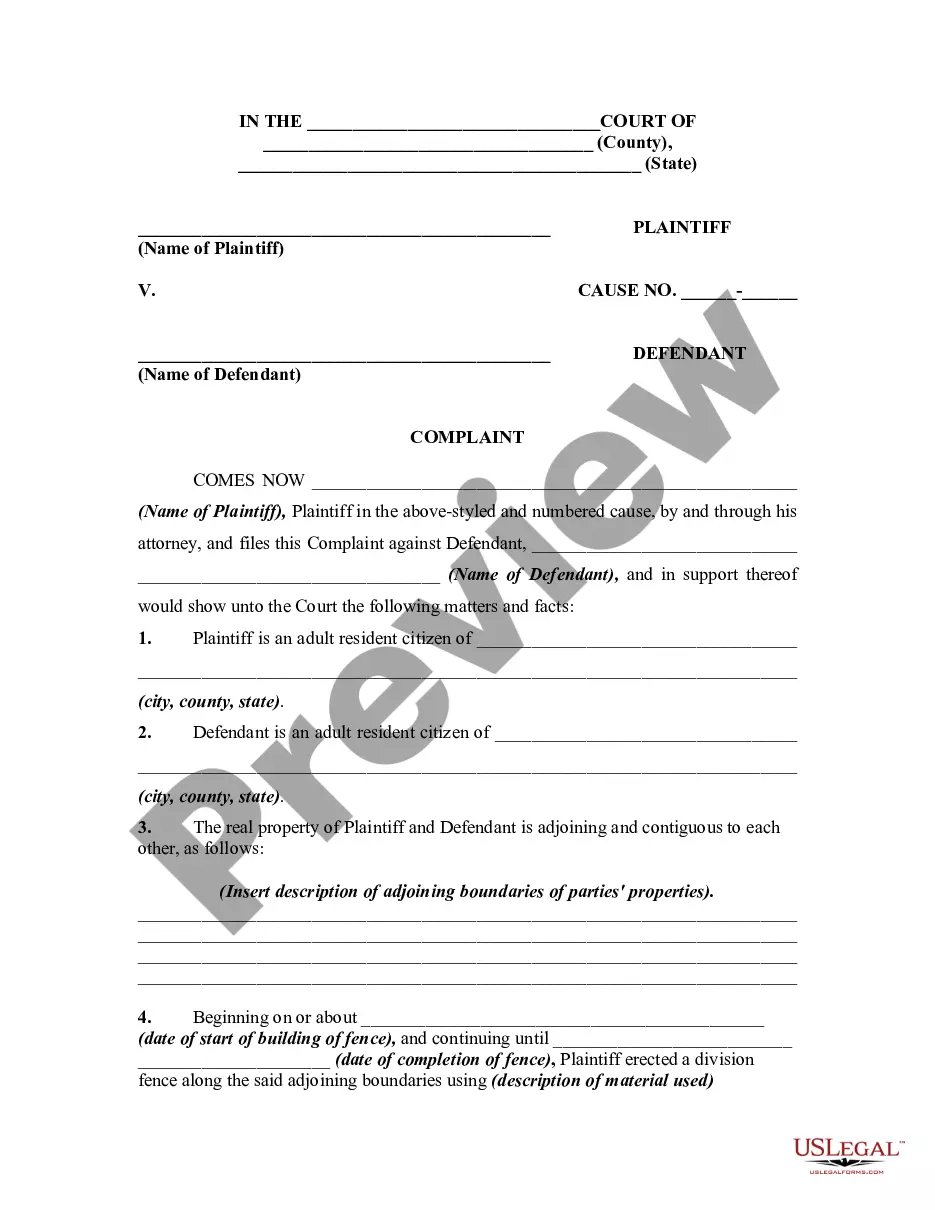

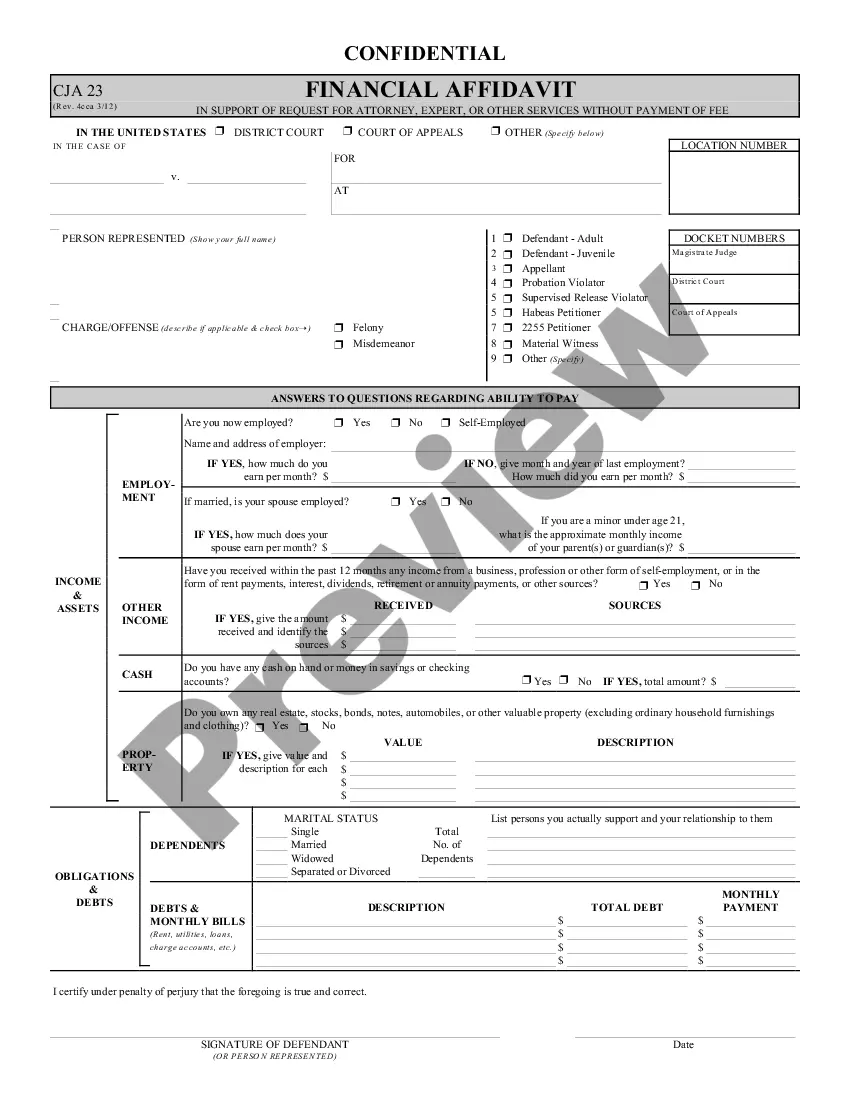

How to fill out Demand For Accounting From A Fiduciary Such As An Executor, Conservator, Trustee Or Legal Guardian?

US Legal Forms - one of the most prominent collections of legal templates in the United States - provides a variety of legal document formats that you can download or print.

By using the website, you can find thousands of forms for professional and personal purposes, categorized by type, state, or keywords. You can quickly locate the latest forms such as the Indiana Demand for Accounting from a Fiduciary like an Executor, Conservator, Trustee, or Legal Guardian.

If you currently hold a monthly subscription, Log In to download the Indiana Demand for Accounting from a Fiduciary like an Executor, Conservator, Trustee, or Legal Guardian from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make modifications. Fill out, revise, print, and sign the downloaded Indiana Demand for Accounting from a Fiduciary like an Executor, Conservator, Trustee, or Legal Guardian. Each form you add to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Gain access to the Indiana Demand for Accounting from a Fiduciary like an Executor, Conservator, Trustee, or Legal Guardian with US Legal Forms, which is one of the largest libraries of legal document formats. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- To begin using US Legal Forms for the first time, here are straightforward steps to assist you.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the form's content.

- Check the form description to confirm you have chosen the proper form.

- If the form does not meet your requirements, utilize the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, validate your choice by clicking the Purchase now button.

- Then, choose the payment plan that you prefer and enter your information to create an account.

Form popularity

FAQ

A trustee has a fiduciary duty to provide regular accounting to beneficiaries, detailing income, expenses, and distributions of the trust or estate. This duty ensures that beneficiaries remain informed about the management of trust assets. Understanding this duty can empower you to issue an Indiana Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian if accounting is not provided.

If a trustee refuses to provide an accounting, beneficiaries can escalate the issue by formally requesting the information or taking legal action if necessary. Filing a case in court may ultimately compel the trustee to comply. Taking steps to issue an Indiana Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian can help protect your rights as a beneficiary.

Yes, a beneficiary can request bank statements from an executor of an estate. Under Indiana law, beneficiaries have the right to receive an accounting that includes relevant financial documents. This is part of securing a Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian, to ensure transparency and proper management of estate funds.

In Indiana, a trustee typically has a reasonable amount of time to provide accounting, which may vary by case specifics. Generally, this timeframe spans anywhere from 30 days to a few months after a request is made. If you need to enforce a Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian, ensure you understand your rights and the obligations of the trustee.

To compel an accounting from a reluctant trustee, you may need to formally request the information in writing. If this informal method does not work, consider filing a petition with the court. In Indiana, a Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian can often prompt action from the trustee to fulfill their duty.

Beneficiaries generally have the right to access information about accounts related to the estate or trust. In Indiana, this access is crucial for beneficiaries to stay informed about the financial status. An Indiana demand for accounting from a fiduciary, such as a trustee or executor, can help facilitate this transparency. Gaining insight into these accounts empowers beneficiaries to make informed decisions.

Yes, a trustee is required to provide an accounting to beneficiaries upon demand. This accounting typically includes financial information about the trust's assets, liabilities, income, and expenses. In Indiana, beneficiaries have the right to request this information to ensure proper management by the fiduciary. Having access to this information can significantly aid beneficiaries in understanding the trust's performance.

Yes, creditors can pursue beneficiaries for debts owed by the decedent, depending on the estate's assets and liabilities. When settling an estate in Indiana, understanding this aspect is crucial for beneficiaries. An Indiana demand for accounting from a fiduciary can clarify any outstanding debts. By being informed, beneficiaries can navigate potential claims more effectively.

An executor is generally obligated to provide bank statements as part of the accounting process. This ensures beneficiaries can verify how estate funds are being managed. In Indiana, the demand for accounting from a fiduciary, such as an executor, typically includes the need for relevant financial records like bank statements. This transparency promotes trust and accountability.

Yes, a beneficiary can demand an accounting from a fiduciary, such as an executor or trustee. This demand is often necessary to ensure that the estate or trust is being managed properly. In Indiana, making a demand for accounting is essential for beneficiaries who wish to stay informed about the distribution of assets. Understanding your rights helps facilitate transparency in the fiduciary's actions.