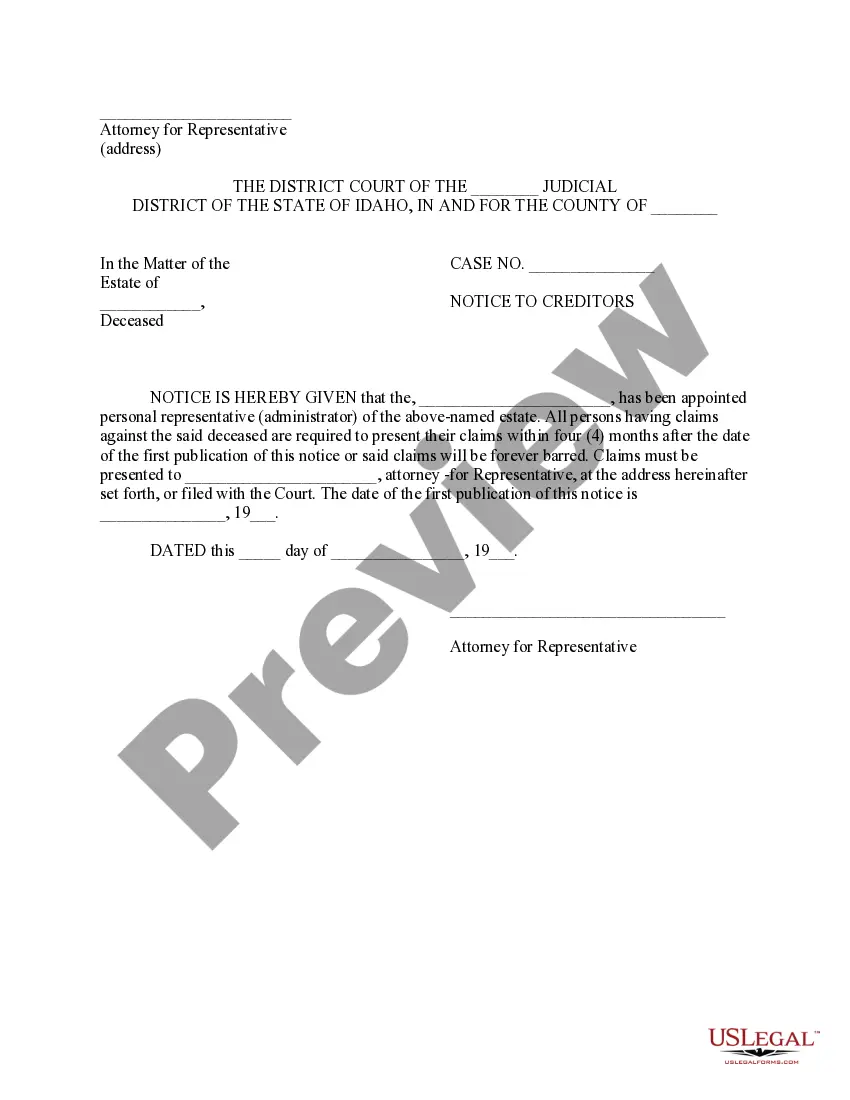

A Notice form provides legal notification to a party of an important aspect of a legal matter. Failure to provide proper notice is often the cause of delays in the progress of lawsuits and other legal matters. This model form, a Notice of Creditors, provides notice of the stated matter. Because each case is unique, you will need to adapt the form to fit your specific facts and circumstances. Available for download now. USLF control number ID-16016

Idaho Notice of Creditors

Description

How to fill out Idaho Notice Of Creditors?

Obtain one of the most extensive directories of legal documents.

US Legal Forms is a platform where you can discover any state-specific document in just a few clicks, such as samples of Idaho Notice of Creditors.

There's no need to waste time searching for a court-acceptable example.

Utilize the Preview feature if available to examine the document's content. If everything is satisfactory, click on the Buy Now button. After choosing a pricing plan, establish your account. Make payment via credit card or PayPal. Download the document to your device by clicking Download. That's it! You should submit the Idaho Notice of Creditors form and verify it. To ensure that everything is accurate, consult your local legal advisor for assistance. Register and effortlessly browse through over 85,000 valuable templates.

- Our certified professionals guarantee that you receive updated samples every time.

- To access the document library, select a subscription and create an account.

- If you have already established it, simply Log In and then click Download.

- The Idaho Notice of Creditors sample will promptly be saved in the My documents section (a section for all documents you download on US Legal Forms).

- To set up a new profile, adhere to the straightforward instructions below.

- If you're planning to use state-specific documents, make sure to specify the correct state.

- If possible, review the description to understand all the details of the form.

Form popularity

FAQ

You can find notice to creditors by accessing official court records or checking local publications that include legal notices. The Idaho Notice of Creditors should be available for public viewing, ensuring transparency in the process. Using platforms like USLegalForms can simplify your search and provide comprehensive resources for your needs.

Creditors will be shown in the official notices published in newspapers. These notices will detail the Idaho Notice of Creditors, your rights, and any necessary actions you must take. This public announcement ensures all creditors are informed about the proceedings involving your estate or bankruptcy, enhancing transparency.

Preferred Creditors vs. Unsecured creditors are generally placed into two categories: priority unsecured creditors and general unsecured creditors.

What Is a Secured Claim? A creditor with a secured claim in bankruptcy has two things: a debt that you owe and a lien (also called a security interest) on a piece of property you own.

The court in declined to interpret sections 149 and 150 of having the combined effect that if a notice to prove a claim has been sent, a creditor who fails to file a proof of claim is forever barred from making a claim and participating in any subsequently paid dividend.

A creditor is an entity, a company or a person of a legal nature that has provided goods, services, or a monetary loan to a debtor. Keep track of money your company is owed with online accounting software.

A creditor is a person, corporation, or other entity to whom debtor owes a debt that was incurred before the date of the bankruptcy filing. See 11 U.S.C. §101 (10). A claim is the creditor's right to receive payment for a debt owed by the debtor on the date of the bankruptcy filing.

A creditor is an entity, a company or a person of a legal nature that has provided goods, services, or a monetary loan to a debtor. Keep track of money your company is owed with online accounting software.

You must have regular income. Your unsecured debt cannot exceed $394,725, and your secured debt cannot exceed $1,184,200. You must be current on tax filings. You cannot have filed for Chapter 13 bankruptcy in the past two years or Chapter 7 bankruptcy in the past four years.

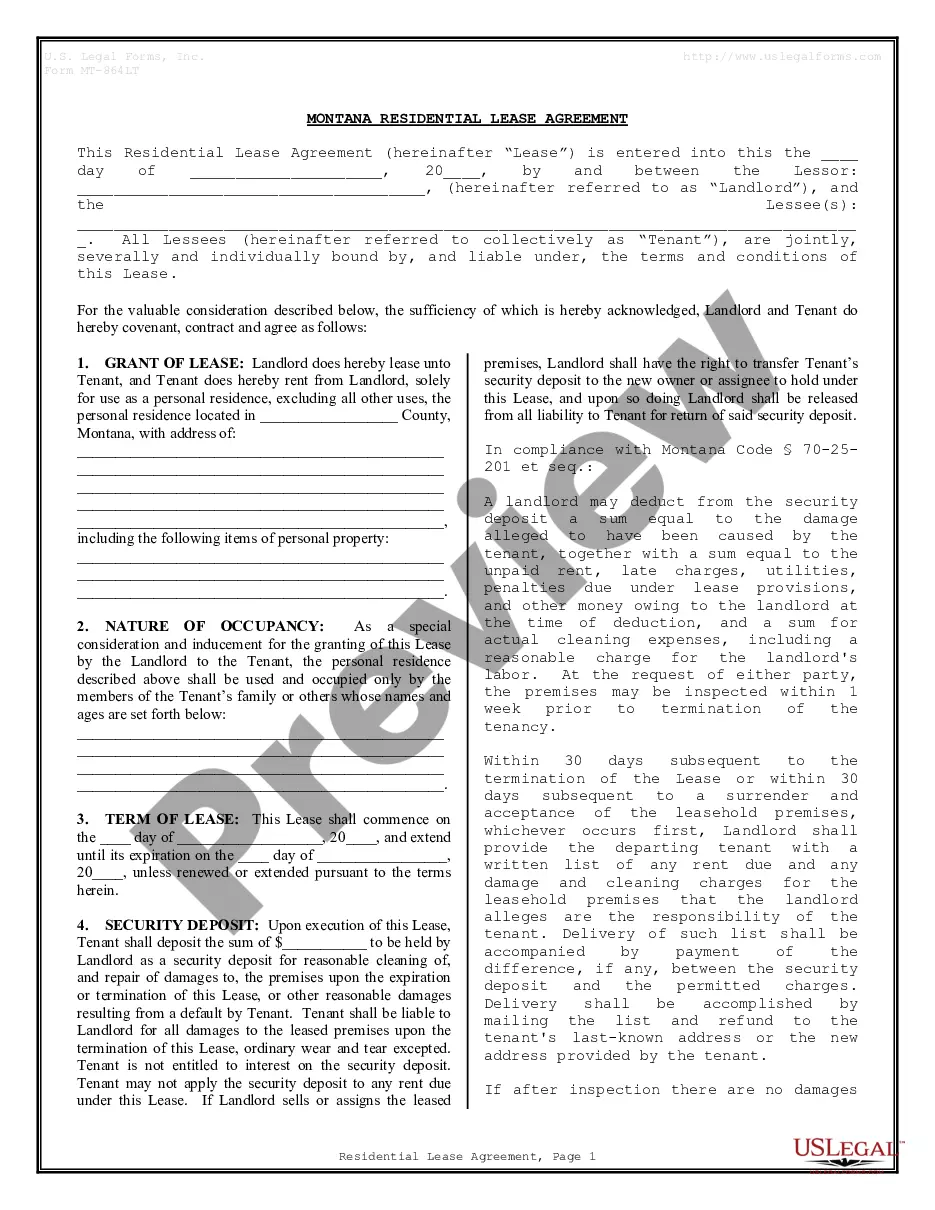

Tax returns for the past 4 years. Paystubs or other proof of income for the last 6 months before filing. Bank account statements from the past 3 to 6 months. Recent mortgage statement(s) and real estate tax bills. Residential lease agreement if applicable.