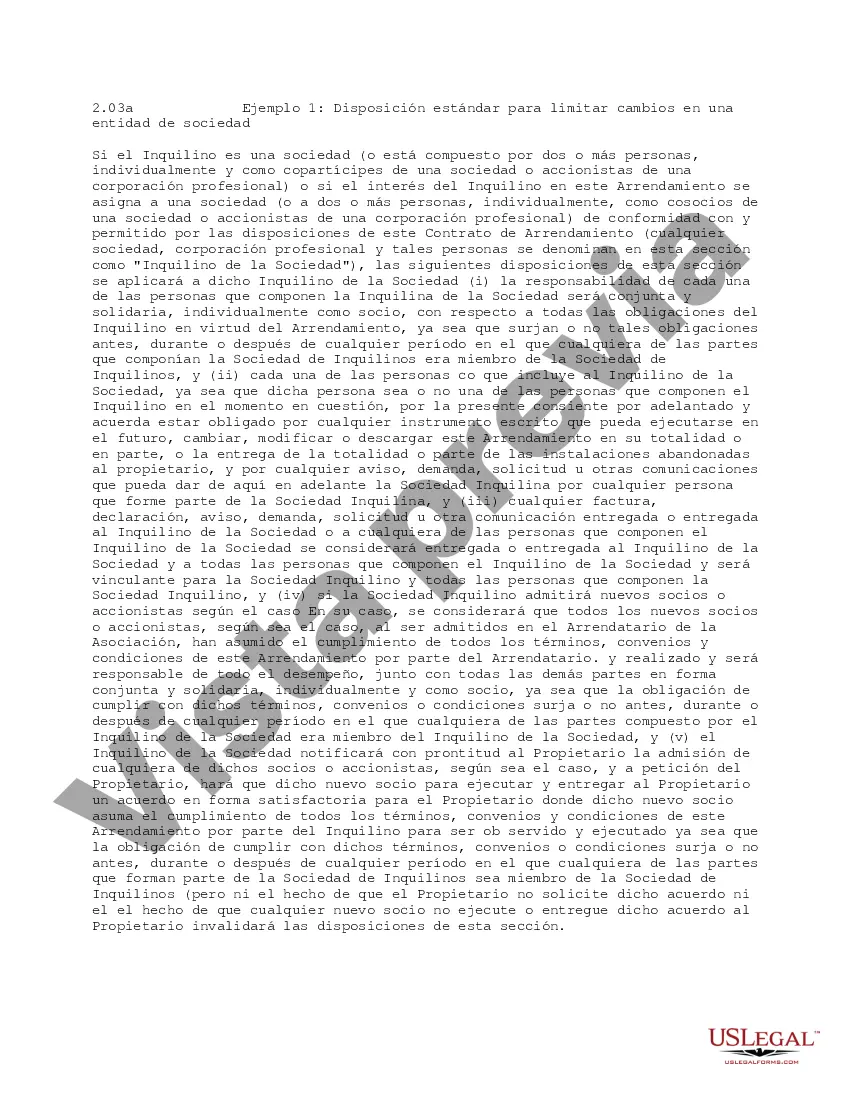

The Iowa Standard Provision to Limit Changes in a Partnership Entity is a legal safeguard implemented to protect the stability and continuity of a partnership. This provision aims to restrict substantial changes in the partnership structure, decision-making authority, and ownership rights of partners, ensuring that the partnership operates in accordance with the agreed-upon terms outlined in its governing documents. One type of Iowa Standard Provision to Limit Changes in a Partnership Entity is the provision related to partner admission or withdrawal. This provision outlines the specific procedures and requirements that must be followed when admitting a new partner to the existing partnership or facilitating the withdrawal of an existing partner. It typically includes provisions such as unanimous consent of all partners, adherence to a specific timeframe, and necessary documentation to ensure transparency and fairness. Another type of provision focuses on restrictions regarding the transfer or assignment of partnership interests. This provision limits partners from freely transferring their ownership stakes to third parties without prior approval from the other partners. It ensures that any changes in ownership are carefully evaluated and aligned with the interests and objectives of the partnership. Additionally, an Iowa Standard Provision may address limitations on changes to the partnership agreement itself. This provision stipulates that any amendments or modifications to the partnership's governing documents can only be made upon the unanimous agreement of all partners. It safeguards against unilateral or unapproved alterations, ensuring the partnership's stability and protecting the interests of all partners. Furthermore, the provision may contain clauses related to limiting changes in the partnership's capital structure. This ensures that any significant changes in the allocation of profits, losses, or capital contributions require the consensus of all partners. It prevents actions that could potentially undermine the financial equilibrium or disproportionately benefit specific partners. In summary, the Iowa Standard Provision to Limit Changes in a Partnership Entity encompasses various provisions regarding partner admissions and withdrawals, transfer or assignment of partnership interests, amendments to the partnership agreement, and changes in the capital structure. These provisions play a crucial role in maintaining the stability, integrity, and long-term viability of the partnership by ensuring that any changes are made in a fair and controlled manner, with the consent of all partners.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Iowa Disposición estándar para limitar los cambios en una entidad de sociedad - Standard Provision to Limit Changes in a Partnership Entity

Description

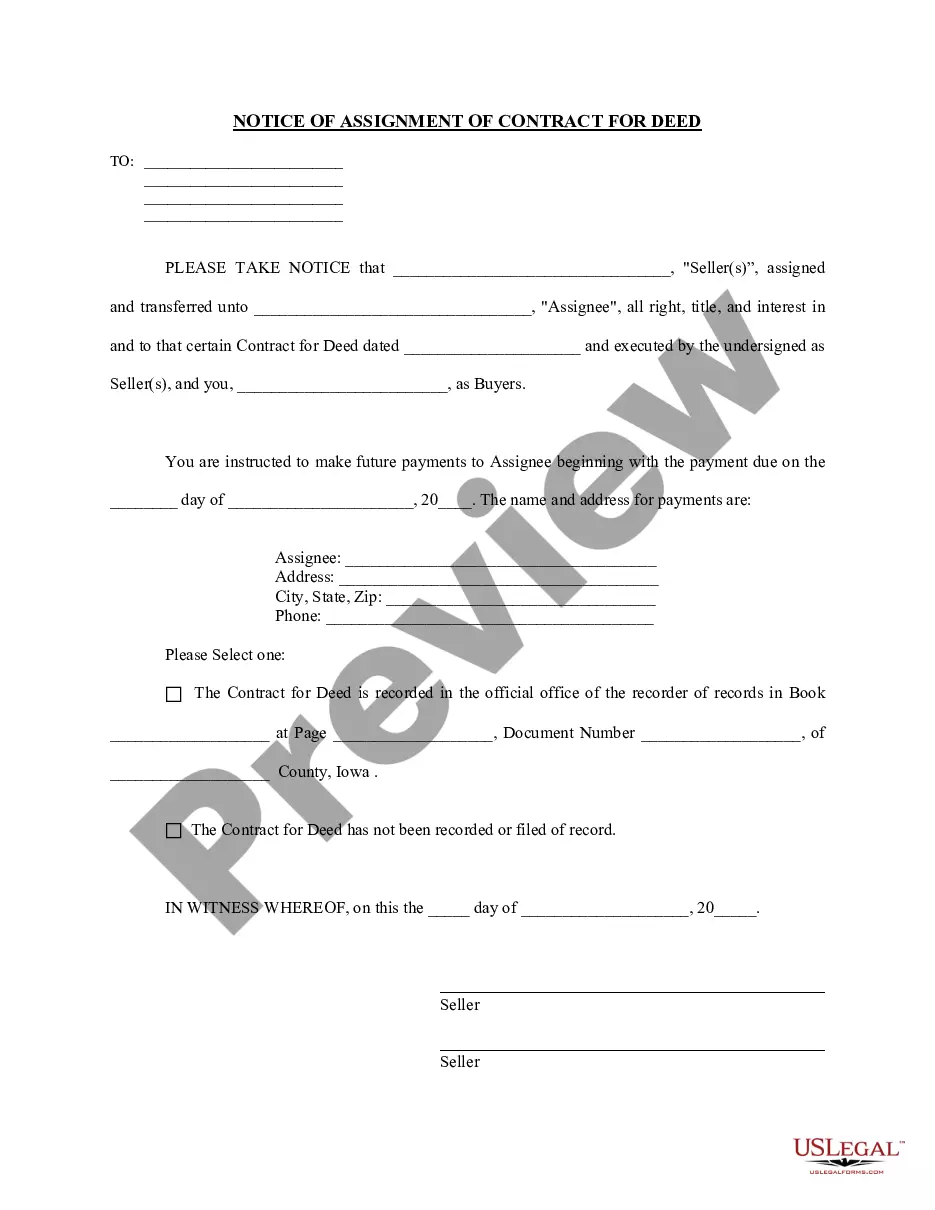

How to fill out Iowa Disposición Estándar Para Limitar Los Cambios En Una Entidad De Sociedad?

US Legal Forms - among the biggest libraries of legitimate forms in the States - provides a wide array of legitimate record web templates you may acquire or print out. Using the website, you may get 1000s of forms for organization and specific reasons, sorted by groups, claims, or key phrases.You will find the most up-to-date versions of forms such as the Iowa Standard Provision to Limit Changes in a Partnership Entity in seconds.

If you already possess a registration, log in and acquire Iowa Standard Provision to Limit Changes in a Partnership Entity in the US Legal Forms library. The Acquire key will appear on every develop you view. You gain access to all earlier acquired forms within the My Forms tab of your respective account.

If you want to use US Legal Forms initially, listed here are straightforward recommendations to help you started out:

- Be sure to have chosen the right develop for your personal city/region. Click the Review key to examine the form`s content. Look at the develop outline to ensure that you have chosen the correct develop.

- In case the develop does not fit your demands, make use of the Lookup discipline on top of the screen to get the one that does.

- In case you are pleased with the shape, validate your decision by simply clicking the Acquire now key. Then, choose the costs program you favor and provide your qualifications to sign up for the account.

- Approach the purchase. Use your charge card or PayPal account to complete the purchase.

- Find the formatting and acquire the shape on the product.

- Make alterations. Fill out, edit and print out and signal the acquired Iowa Standard Provision to Limit Changes in a Partnership Entity.

Every template you included with your account lacks an expiration day which is yours eternally. So, if you want to acquire or print out another duplicate, just visit the My Forms section and click on around the develop you will need.

Get access to the Iowa Standard Provision to Limit Changes in a Partnership Entity with US Legal Forms, the most considerable library of legitimate record web templates. Use 1000s of professional and condition-certain web templates that satisfy your company or specific requirements and demands.

Form popularity

FAQ

Section 489.108 - [Effective 1/1/2024] Permitted names 1. The name of a limited liability company must contain the phrase "limited liability company" or "limited company" or the abbreviation "L.L.C.", "LLC", "L.C.", or "LC". "Limited" may be abbreviated as "Ltd.", and "company" may be abbreviated as "Co.".

There are two common kinds of partnerships: limited partnerships (LP) and limited liability partnerships (LLP). Limited partnerships have only one general partner with unlimited liability, and all other partners have limited liability.

Limited liability partnerships (LLPs) allow for a partnership structure where each partner's liabilities are limited to the amount they put into the business. Having business partners means spreading the risk, leveraging individual skills and expertise, and establishing a division of labor.

?Foreign limited partnership? means a partnership formed under the laws of a jurisdiction other than Iowa and required by those laws to have one or more general partners and one or more limited partners. The term includes a foreign limited liability limited partnership.

What is the code 489.302 in Iowa? Code 489.302 in Iowa is a statement of authority that must be filed with the Secretary of State for limited liability companies.

In general partnerships, every partner remains personally liable for the debts and obligations of the partnership. The LP separates at least one general partner with unlimited personal liability from limited partners whose liability typically will not exceed their contribution to the partnership.

A general partnership is a business with at least two owners, or partners, who agree to share the responsibilities involved in running the business. A partner has unlimited personal liability for any and all debts and obligations of the company.

In a partnership firm, the liability of partners is unlimited.