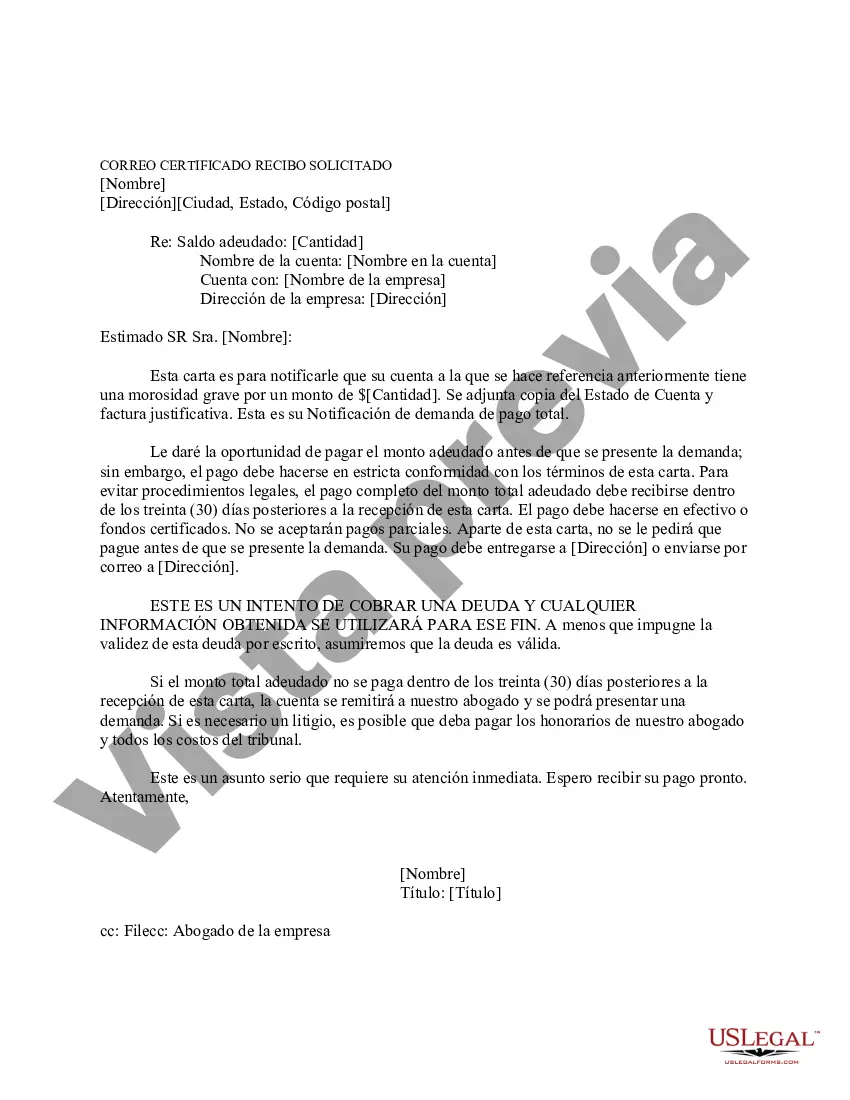

Iowa Demand for Payment of Account by Business to Debtor is a legal document used by businesses in the state of Iowa to formally demand payment from a debtor for a past due account. This document serves as a clear signal to the debtor that they are obligated to settle their outstanding debts promptly. The Iowa Demand for Payment of Account by Business to Debtor is an essential tool employed by businesses when their attempts to collect payment through less formal means have been unsuccessful. This formal demand letter outlines the amount owed, payment terms, and consequences of continued non-payment. Several types of Iowa Demand for Payment of Account by Business to Debtor may exist, depending on the specific circumstances of the debt. These may include: 1. Initial Demand Letter: This is the first communication sent to the debtor to notify them of the outstanding debt and request immediate payment. It generally outlines the amount owed, the due date, and provides a detailed breakdown of the charges. 2. Final Demand Letter: If the debtor fails to respond or make payment after receiving the initial demand letter, a final demand letter is usually sent. This letter serves as a final warning before legal action is taken against the debtor. 3. Legal Demand Letter: In cases where the debtor remains non-responsive even after receiving the final demand letter, a legal demand letter can be sent. This letter informs the debtor of the intent to escalate the matter by pursuing legal action, such as a lawsuit, if the debt is not settled promptly. 4. Demand for Payment of Account with Interest: If the original contract or agreement between the parties includes provisions for the accrual of interest on overdue accounts, a demand letter can be tailored to include the interest owed. This helps emphasize the urgency for prompt payment and the potential increase in the total amount owed if not settled promptly. 5. Demand for Payment of Account with Late Payment Fees: Similar to interest, if the agreement includes provisions for imposing late payment fees on overdue accounts, a demand letter with specific mention of these fees can be sent. This acts as an additional incentive for the debtor to settle their debt quickly, as failure to do so will result in added financial penalties. It is important to note that these variations of demand letters are adaptable to different business contexts and legal requirements. Businesses in Iowa should consult with legal professionals or use reputable templates to ensure their Demand for Payment of Account by Business to Debtor adheres to applicable laws and regulations while effectively communicating their intentions to the debtor.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Iowa Demanda de Pago de Cuenta por Empresa a Deudor - Demand for Payment of Account by Business to Debtor

Description

How to fill out Iowa Demanda De Pago De Cuenta Por Empresa A Deudor?

If you want to comprehensive, down load, or printing authorized papers themes, use US Legal Forms, the largest variety of authorized types, which can be found online. Utilize the site`s simple and practical lookup to discover the files you require. A variety of themes for business and individual purposes are sorted by classes and says, or key phrases. Use US Legal Forms to discover the Iowa Demand for Payment of Account by Business to Debtor with a handful of clicks.

If you are presently a US Legal Forms consumer, log in in your profile and then click the Down load switch to obtain the Iowa Demand for Payment of Account by Business to Debtor. You can even accessibility types you previously downloaded from the My Forms tab of the profile.

If you are using US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Make sure you have selected the shape for the appropriate town/country.

- Step 2. Take advantage of the Preview method to look through the form`s content material. Don`t forget to see the explanation.

- Step 3. If you are not satisfied using the type, make use of the Look for discipline near the top of the monitor to discover other versions in the authorized type template.

- Step 4. Once you have identified the shape you require, click the Buy now switch. Pick the rates strategy you like and include your accreditations to sign up to have an profile.

- Step 5. Approach the purchase. You can use your credit card or PayPal profile to finish the purchase.

- Step 6. Choose the structure in the authorized type and down load it in your gadget.

- Step 7. Full, change and printing or sign the Iowa Demand for Payment of Account by Business to Debtor.

Each and every authorized papers template you get is your own property forever. You have acces to each type you downloaded within your acccount. Click the My Forms portion and choose a type to printing or down load once again.

Compete and down load, and printing the Iowa Demand for Payment of Account by Business to Debtor with US Legal Forms. There are millions of specialist and express-specific types you may use to your business or individual needs.

Form popularity

FAQ

Customers who don't pay for products or services up front are debtors to your business, which serves as the creditor in this instance. Similarly, you are in debt to your suppliers if they've provided you with goods which you're yet to pay for in full.

Under Iowa state law, creditors have 10 years to sue for any unpaid debt that stems from a written contract. For debts based on oral agreements, the statute of limitations is five years.

A debtor is someone who owes money. A business, corporation, or an individual may be a debtor. You can be a debtor because you borrowed money to pay for goods or services or because you bought goods or services and haven't paid for them yet.

Creditors are stakeholders who are owed money by the business. Creditors are typically suppliers that have delivered goods or services to the business but the business has not yet paid the supplier for those goods and services.

Understanding the difference between debtors and creditors Creditors are individuals/businesses that have lent funds to another company and are therefore owed money. By contrast, debtors are individuals/companies that have borrowed funds from a business and therefore owe money.

A debtor is an individual, business or any other entity that owes money to another entity because they have been provided with a service or good, or borrowed money from an institution. There are two types of debtors to be aware of as a business owners - (i) staff loans and (ii) trade debtors.

Are debts really written off after six years? After six years have passed, your debt may be declared statute barred - this means that the debt still very much exists but a CCJ cannot be issued to retrieve the amount owed and the lender cannot go through the courts to chase you for the debt.

Debtors are individuals or businesses that owe money. Debtors can owe money to banks, or individuals and companies. Debtors owe a debt that must be paid at some time in the future.

The time limit is sometimes called the limitation period. For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts.

Once entered, a judgment is enforceable in Iowa for twenty years.