The Iowa Resolution Selecting Depository Bank for Corporation and Account Signatories is a legal document that outlines the process of choosing a depository bank for a corporation in the state of Iowa, as well as determining the account signatories for the corporation's bank accounts. This resolution is necessary for establishing a formal agreement between the corporation and the selected depository bank, ensuring transparency and accountability in financial matters. By adopting the Iowa Resolution Selecting Depository Bank for Corporation and Account Signatories, corporations can effectively manage their finances, safeguard their assets, and maintain compliance with state regulations. This resolution is an essential step in the establishment and growth of a corporation in Iowa. Different types of Iowa Resolution Selecting Depository Bank for Corporation and Account Signatories may exist based on various factors, such as the size and nature of the corporation, its specific industry, and the unique requirements of its financial operations. These variations might include: 1. General Iowa Resolution Selecting Depository Bank: This resolution is a standard document suitable for most corporations in Iowa. It outlines the general process of selecting a depository bank and designating account signatories. 2. Specific Industry Iowa Resolution Selecting Depository Bank: Some industries, such as banking and finance or healthcare, might have specific regulations or requirements for depository banks and account signatories. This type of resolution tailors the selection process and signatory designations to meet the industry-specific needs. 3. Small Business Iowa Resolution Selecting Depository Bank: Small businesses typically have different financial operations compared to larger corporations. A resolution tailored for small businesses addresses their unique banking needs and allows for flexibility in selecting a depository bank. 4. Non-Profit Organization Iowa Resolution Selecting Depository Bank: Non-profit organizations have particular financial considerations, including the need for transparency and accountability. This resolution specifically caters to the requirements of non-profit organizations in Iowa. Regardless of the specific variation, the Iowa Resolution Selecting Depository Bank for Corporation and Account Signatories is a crucial legal document that ensures appropriate financial management and oversight for corporations in Iowa. Through this resolution, corporations can select a depository bank that aligns with their financial goals, establish authorized account signatories, and maintain compliance with state regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Iowa Resolución de Selección de Banco Depositario para Corporaciones y Signatarios de Cuentas - Resolution Selecting Depository Bank for Corporation and Account Signatories

Description

How to fill out Iowa Resolución De Selección De Banco Depositario Para Corporaciones Y Signatarios De Cuentas?

You are able to devote several hours online trying to find the lawful document design that meets the state and federal specifications you want. US Legal Forms supplies a huge number of lawful types which are evaluated by experts. You can easily download or print out the Iowa Resolution Selecting Depository Bank for Corporation and Account Signatories from your services.

If you currently have a US Legal Forms bank account, you can log in and click on the Download option. After that, you can complete, change, print out, or sign the Iowa Resolution Selecting Depository Bank for Corporation and Account Signatories. Every lawful document design you buy is yours for a long time. To obtain yet another duplicate of the purchased form, visit the My Forms tab and click on the related option.

If you are using the US Legal Forms web site initially, adhere to the easy guidelines below:

- Initial, make certain you have chosen the correct document design to the county/area of your choice. Look at the form information to make sure you have selected the appropriate form. If available, use the Review option to look from the document design at the same time.

- If you wish to get yet another model from the form, use the Look for discipline to discover the design that meets your requirements and specifications.

- Once you have discovered the design you desire, just click Acquire now to carry on.

- Pick the pricing strategy you desire, type your references, and sign up for your account on US Legal Forms.

- Complete the financial transaction. You should use your credit card or PayPal bank account to cover the lawful form.

- Pick the structure from the document and download it to your device.

- Make changes to your document if necessary. You are able to complete, change and sign and print out Iowa Resolution Selecting Depository Bank for Corporation and Account Signatories.

Download and print out a huge number of document layouts utilizing the US Legal Forms web site, which offers the greatest assortment of lawful types. Use skilled and condition-specific layouts to tackle your business or individual needs.

Form popularity

FAQ

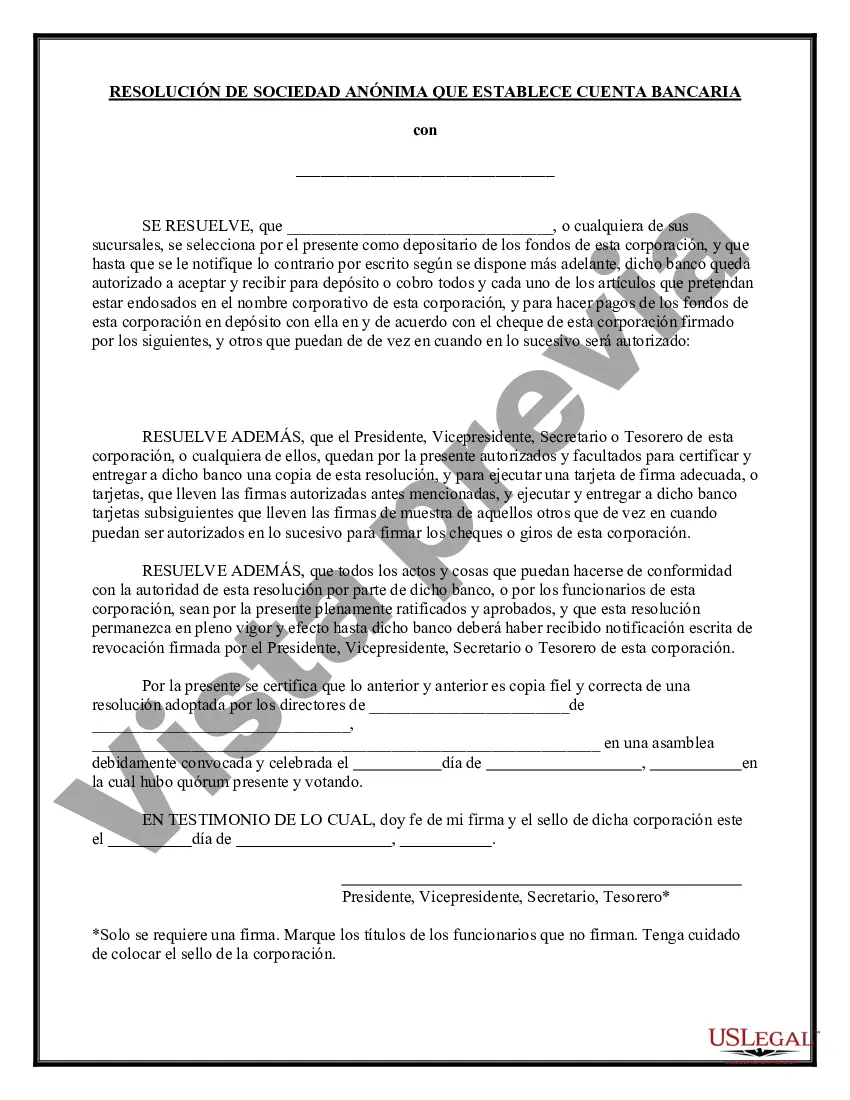

A corporate banking resolution is a formal document adopted by a corporation that outlines who is authorized to act on its behalf in banking matters. This resolution helps to clarify roles and responsibilities, especially when it comes to signing checks or making withdrawals. Understanding the Iowa Resolution Selecting Depository Bank for Corporation and Account Signatories can help your corporation navigate banking relationships effectively while ensuring regulatory compliance.

A corporate resolution outlines critical decisions made by a corporation’s board, such as designating bank signatories and establishing banking policies. This document creates an official record that ensures banking transactions occur smoothly and with proper authorization. By following the Iowa Resolution Selecting Depository Bank for Corporation and Account Signatories, your corporation can maintain control over its finances while reducing the risk of fraud or unauthorized transactions.

Yes, you typically need a corporate resolution to open a bank account for your corporation. This resolution serves as proof that the board has authorized specific individuals to manage the account, thus protecting the company's financial interests. By addressing the Iowa Resolution Selecting Depository Bank for Corporation and Account Signatories, you ensure that you comply with banking regulations and internal policies when opening your corporate bank account.

To write a resolution letter for a bank, start by clearly stating the name of your corporation and the purpose of the resolution. Include details such as the names and titles of officers who are authorized to manage bank accounts. Ensure you align with the Iowa Resolution Selecting Depository Bank for Corporation and Account Signatories to confirm which signatories can act on behalf of the corporation. It is important to have the letter signed by the board members to validate its authenticity.

A corporate resolution in banking is a formal document that outlines the decisions made by a corporation’s board of directors regarding the management of the company's accounts. This document typically specifies which individuals are authorized to open and manage bank accounts on behalf of the corporation. When dealing with the Iowa Resolution Selecting Depository Bank for Corporation and Account Signatories, this document provides clarity and helps prevent unauthorized access to corporate funds.

The failure to appear code in Iowa addresses legal obligations for individuals summoned to appear in court. If a person fails to show up, it can lead to additional legal consequences. This information is crucial, especially when dealing with corporate legal matters connected to the Iowa Resolution Selecting Depository Bank for Corporation and Account Signatories. Should you find yourself uncertain about legal proceedings, seek out professional legal counsel to guide you.

Iowa code 524.905 plays a role in the governance of financial practices for banks. This section is important for corporations in understanding their rights and obligations concerning account management. Familiarizing yourself with this code can greatly aid in the Iowa Resolution Selecting Depository Bank for Corporation and Account Signatories. It is wise to consult with a financial expert to ensure compliance.

The Iowa code 524.703 pertains to the financial regulations governing banks operating within the state. This specific code outlines the duties and compliance requirements for depository institutions. Understanding these codes is beneficial when you navigate the Iowa Resolution Selecting Depository Bank for Corporation and Account Signatories process. For accurate interpretations, consider reviewing legal advice or resources.

Phone codes in Iowa primarily follow the North American Numbering Plan. The area codes for Iowa include 515, 319, 563, and 712, which serve various regions of the state. When contacting banks concerning Iowa Resolution Selecting Depository Bank for Corporation and Account Signatories, use these area codes to ensure your calls reach the right institutions. Make sure to verify the phone number, especially when discussing sensitive account information.

In Iowa, aiding and abetting is generally addressed under the Iowa Criminal Code. Specifically, these statutes articulate that individuals who assist in the commission of a crime can be held equally responsible. Understanding the legal implications of aiding and abetting can be crucial, especially when you are involved with financial transactions as stated in Iowa Resolution Selecting Depository Bank for Corporation and Account Signatories. Consulting legal resources or professionals may clarify these codes further.