Hawaii Estado de cuenta para agregar al informe de crédito - Statement to Add to Credit Report

Description

How to fill out Hawaii Estado De Cuenta Para Agregar Al Informe De Crédito?

US Legal Forms - one of many biggest libraries of lawful forms in the States - delivers a wide range of lawful document layouts it is possible to download or print out. Using the website, you can find 1000s of forms for enterprise and specific functions, categorized by types, says, or keywords.You can find the latest types of forms much like the Hawaii Statement to Add to Credit Report in seconds.

If you already possess a membership, log in and download Hawaii Statement to Add to Credit Report from your US Legal Forms library. The Down load option will show up on each and every develop you view. You gain access to all in the past delivered electronically forms within the My Forms tab of your accounts.

If you want to use US Legal Forms for the first time, here are easy guidelines to obtain started out:

- Ensure you have picked out the proper develop for your personal area/county. Go through the Review option to analyze the form`s articles. See the develop information to ensure that you have chosen the correct develop.

- If the develop does not satisfy your needs, use the Research industry on top of the screen to get the one who does.

- Should you be pleased with the shape, validate your choice by clicking on the Get now option. Then, opt for the pricing prepare you like and provide your credentials to register on an accounts.

- Approach the transaction. Make use of your credit card or PayPal accounts to complete the transaction.

- Find the format and download the shape on your own product.

- Make changes. Fill out, change and print out and sign the delivered electronically Hawaii Statement to Add to Credit Report.

Each and every web template you included in your account lacks an expiry date which is yours forever. So, in order to download or print out one more duplicate, just check out the My Forms portion and click about the develop you need.

Gain access to the Hawaii Statement to Add to Credit Report with US Legal Forms, the most comprehensive library of lawful document layouts. Use 1000s of skilled and status-distinct layouts that meet up with your organization or specific needs and needs.

Form popularity

FAQ

You simply can write to the credit bureaus and ask them to remove the consumer statement from your credit report.

You simply can write to the credit bureaus and ask them to remove the consumer statement from your credit report. TransUnion definitely allows you to easily do this.

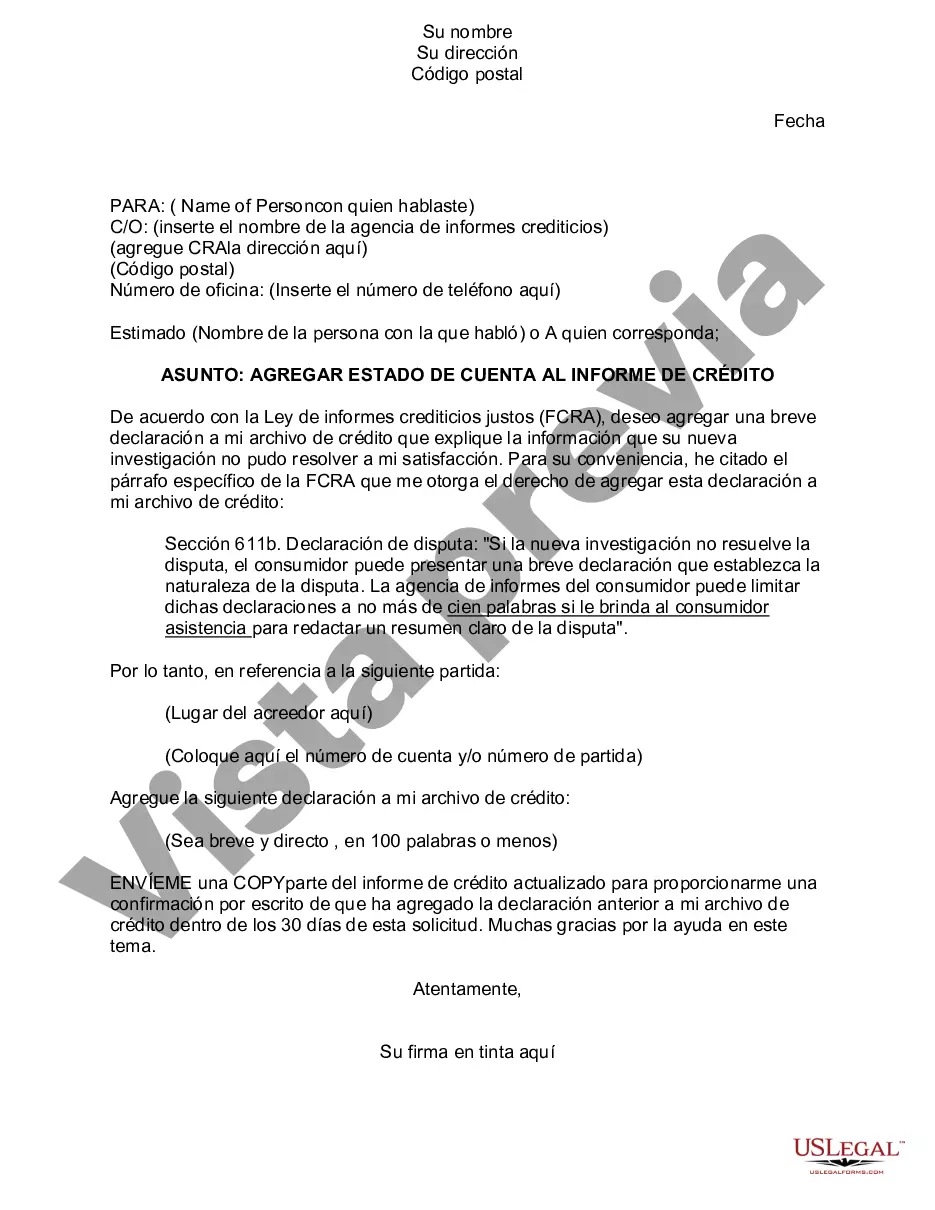

Consumer statements can be added to your credit report at your request through each of the three major credit bureaus (Experian, TransUnion and Equifax). These statements are generally limited to pre-written options or up to 100 words you write yourself.

Consumer statements can be added to your credit report at your request through each of the three major credit bureaus (Experian, TransUnion and Equifax). These statements are generally limited to pre-written options or up to 100 words you write yourself.

Signing up for Experian Boost lets you add phone and utility bills to your Experian report, and a history of on-time payments can boost your credit score. You can also sign up for UltraFICO, a new service that includes your bank account balances in your credit score.

Under the Fair Credit Reporting Act, you are allowed to add a 100-word Consumer Statement to any of your credit reports if you have disputed an item in your credit files, but the item was not removed because it was verified by a creditor.

If you want to remove your fraud alert or victim statement before it expires, you can do so either online at Experian's Fraud Center or by mail. To remove the alert online, you can upload the documentation verifying your identity along with your request to have the alert removed.

Your credit report does not include your marital status, medical information, buying habits or transactional data, income, bank account balances, criminal records or level of education. It also doesn't include your credit score.

You can remove closed accounts from your credit report in three main ways: dispute any inaccuracies, write a formal goodwill letter requesting removal or simply wait for the closed accounts to be removed over time.