Guam Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust

Description

How to fill out Termination Of Grantor Retained Annuity Trust In Favor Of Existing Life Insurance Trust?

If you wish to acquire, download, or create legitimate document templates, utilize US Legal Forms, the largest collection of legal documents available online.

Take advantage of the site's straightforward and convenient search to find the forms you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Acquire now button. Choose the pricing option you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the payment.

- Utilize US Legal Forms to obtain the Guam Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to obtain the Guam Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the following steps.

- Step 1. Ensure you have chosen the form for your appropriate city/state.

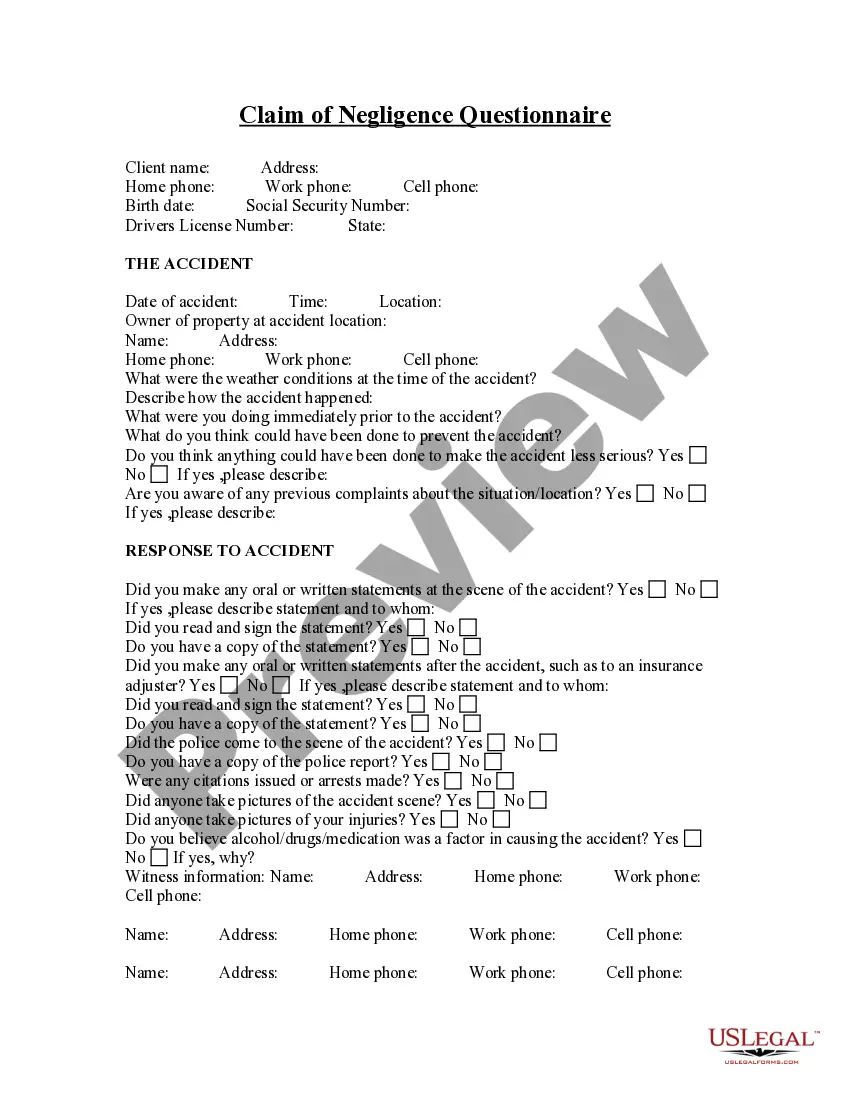

- Step 2. Use the Review feature to examine the form's content. Be sure to read the description.

- Step 3. If you are unsatisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

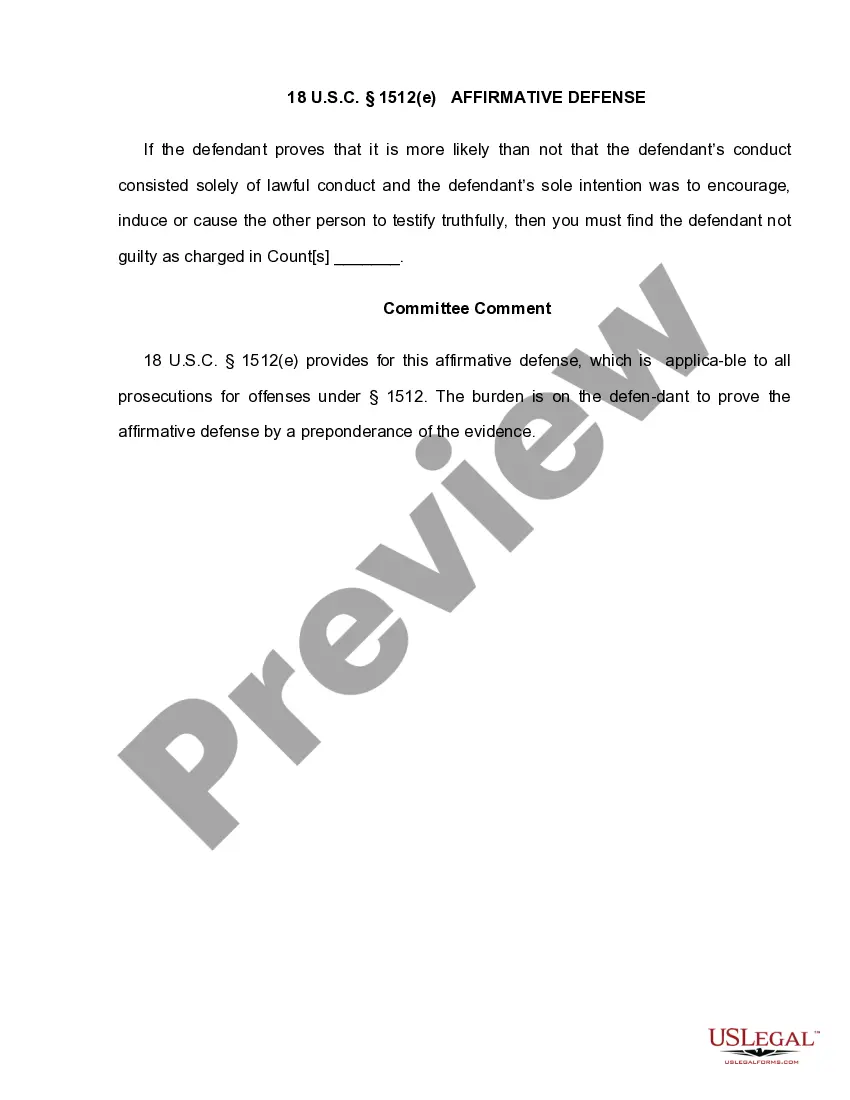

The grantor can also establish an irrevocable life insurance trust (usually a separate trust) to provide liquidity to the heirs if the he/she dies during the term of the GRAT.

Is an irrevocable life insurance trust (ILIT) a grantor trust? A13. Usually, yes. Most ILITs are grantor trusts since these trust instruments typically provide that income may be applied toward the payment of premiums on policies insuring the grantor's life (or the grantor's spouse's life).

A grantor trust is a trust in which the individual who creates the trust is the owner of the assets and property for income and estate tax purposes. Grantor trust rules are the rules that apply to different types of trusts. Grantor trusts can be either revocable or irrevocable trusts.

A life insurance trust is an irrevocable, non-amendable trust which is both the owner and beneficiary of one or more life insurance policies. Upon the death of the insured, the trustee invests the insurance proceeds and administers the trust for one or more beneficiaries.

Non-grantor trusts are treated as separate entities (like a C-Corporation). But grantors of grantor trusts maintain significant rights to the trust's assets and income. Because of that, they're treated as if they are direct owners of the trust assets (like a sole proprietorship).

GRATs may provide payments for a term of years or for the life of the Grantor.

In other words, if the grantor (or a non-adverse party) has the power to revoke any part of a trust and reclaim the trust assets, then the grantor will be taxed on the trust income.

A grantor retained annuity trust is a type of irrevocable gifting trust that allows a grantor or trustmaker to potentially pass a significant amount of wealth to the next generation with little or no gift tax cost. GRATs are established for a specific number of years.

Trust-owned life insurance is a type of life insurance housed inside a trust. TOLI is commonly used by individuals as a tool for estate planning purposes. The assets bequeathed to beneficiaries that are housed within the trust can sidestep onerous tax obligations.

The grantor is the person who creates a trust, and the beneficiaries are the persons identified in the trust to receive the assets. The assets in the trust are supplied by the grantor. The associated property and funds are transitioned into the ownership of the trust.