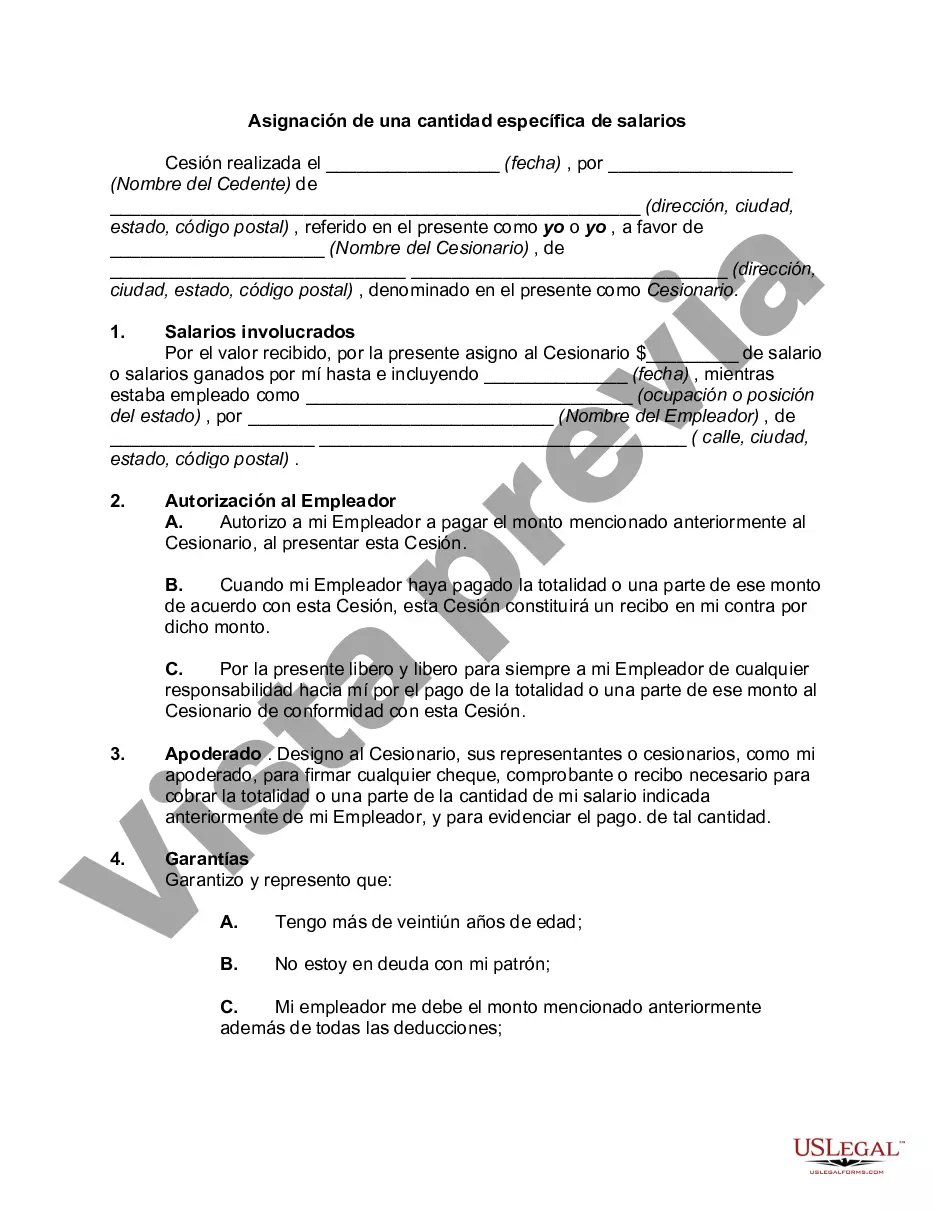

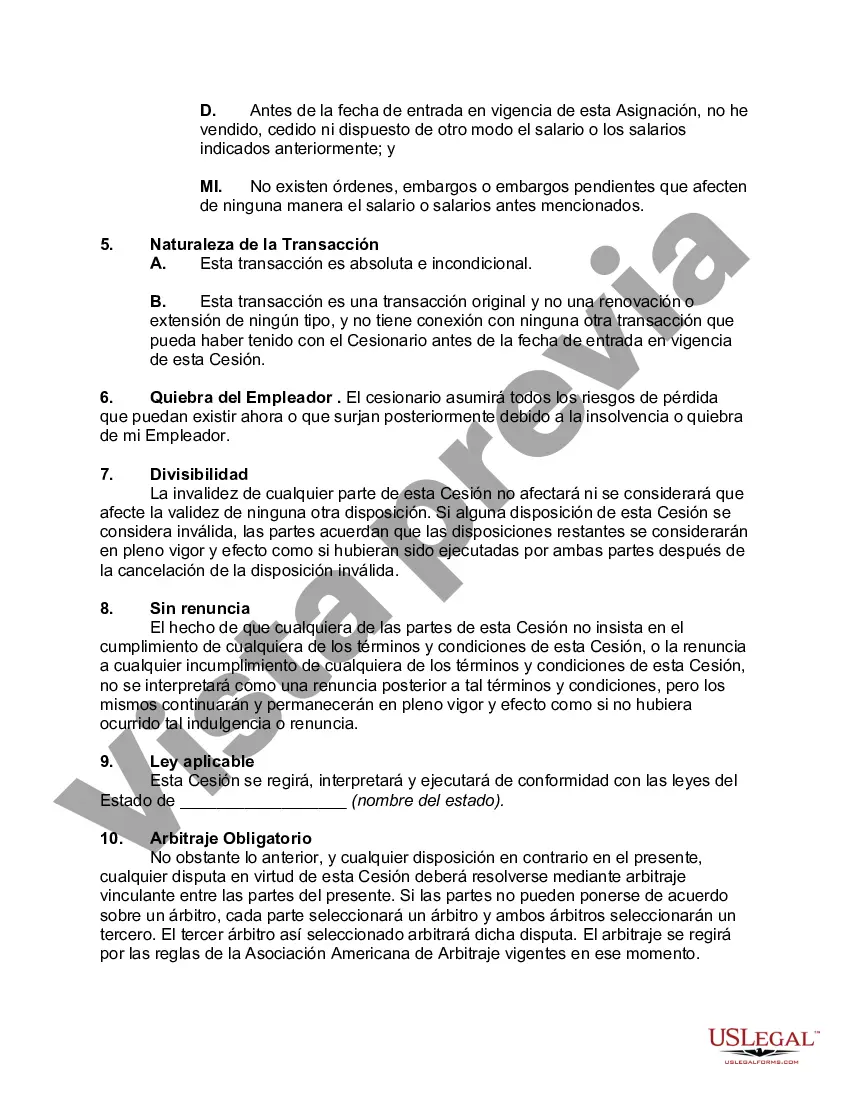

An assignment of wages should be contained in a separate written instrument, signed by the person who has earned or will earn the wages or salary. The assignment should include statements identifying the transaction to which the assignment relates, the personal status of the assignor, and a recital, where appropriate, that no other assignment or order exists in connection with the same transaction.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

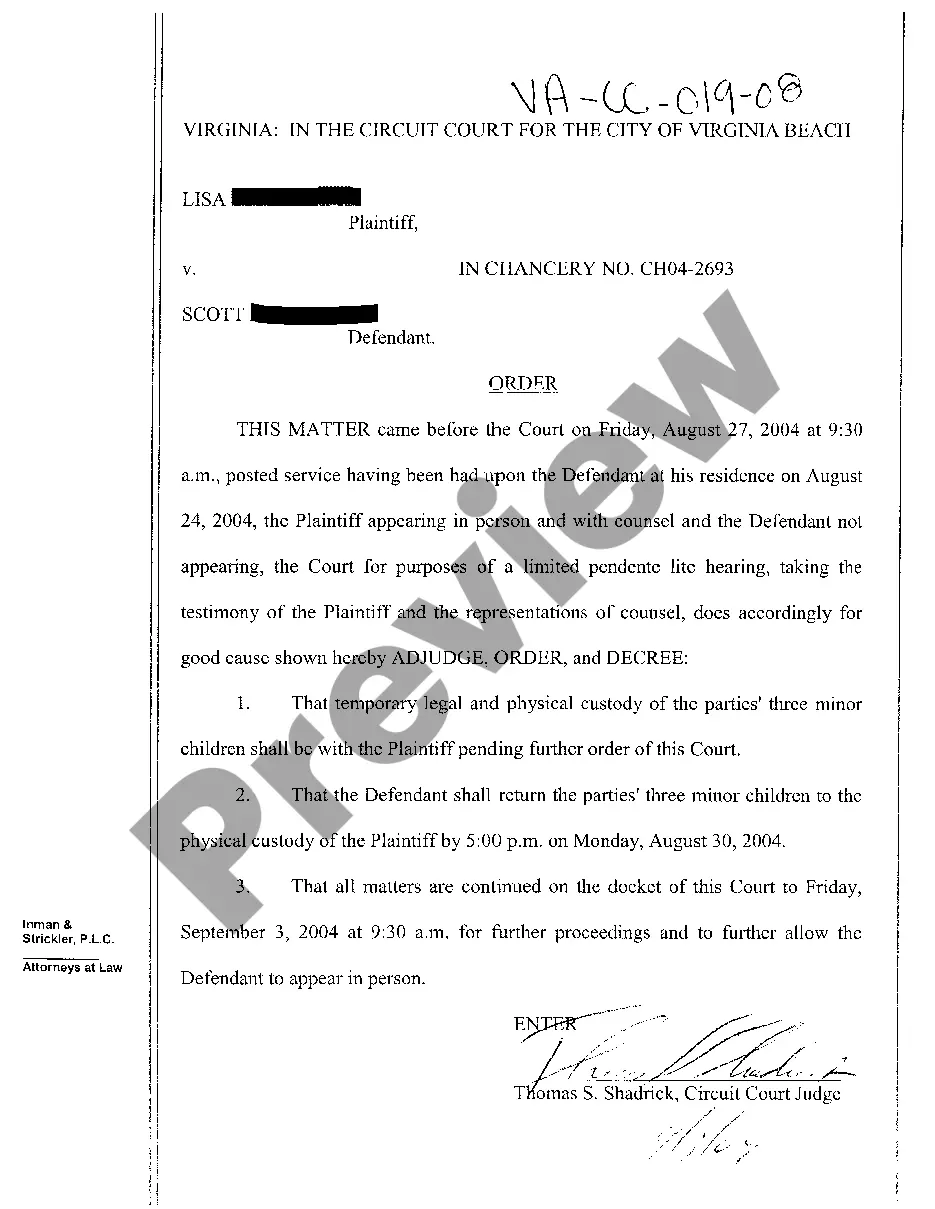

Florida Assignment of a Specified Amount of Wages is a legal document that allows an employee to assign a specific portion of their wages to a creditor for the purpose of repaying a debt. This assignment can be made voluntarily by the employee in order to satisfy an existing financial obligation. In Florida, there are two types of Assignment of a Specified Amount of Wages: Voluntary and Court-ordered. A Voluntary Assignment of a Specified Amount of Wages is initiated by the employee themselves. It is an agreement between the employee and the creditor, where the employee consents to having a predetermined amount deducted from their wages on a regular basis until the debt is repaid. This type of assignment is typically used when an employee wants to proactively address their financial responsibilities. On the other hand, a Court-ordered Assignment of a Specified Amount of Wages is mandated by a court as part of a legal process, such as in the case of bankruptcy or when an employee owes child support or alimony payments. In these situations, the court can order a portion of the employee's wages to be assigned to the creditor or the custodial parent for the purpose of fulfilling these obligations. The Florida Assignment of a Specified Amount of Wages serves as a legal document that outlines the terms and conditions of the assignment, including the amount to be assigned, the duration, and any relevant fees or interest rates. It provides protection for both the employee and the creditor, ensuring that the assigned amount is deducted accurately and in a timely manner. It is important to note that under Florida law, an assignment of wages cannot exceed 25% of the employee's disposable earnings. This limitation is in place to safeguard the rights and well-being of the employee, ensuring that they have enough income to meet their basic living expenses. In conclusion, the Florida Assignment of a Specified Amount of Wages allows employees to assign a specific portion of their wages to a creditor in order to repay a debt. Whether it is a voluntary agreement or a court-ordered assignment, this legal document ensures the terms of the assignment are clearly defined and adhered to, providing security for both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.