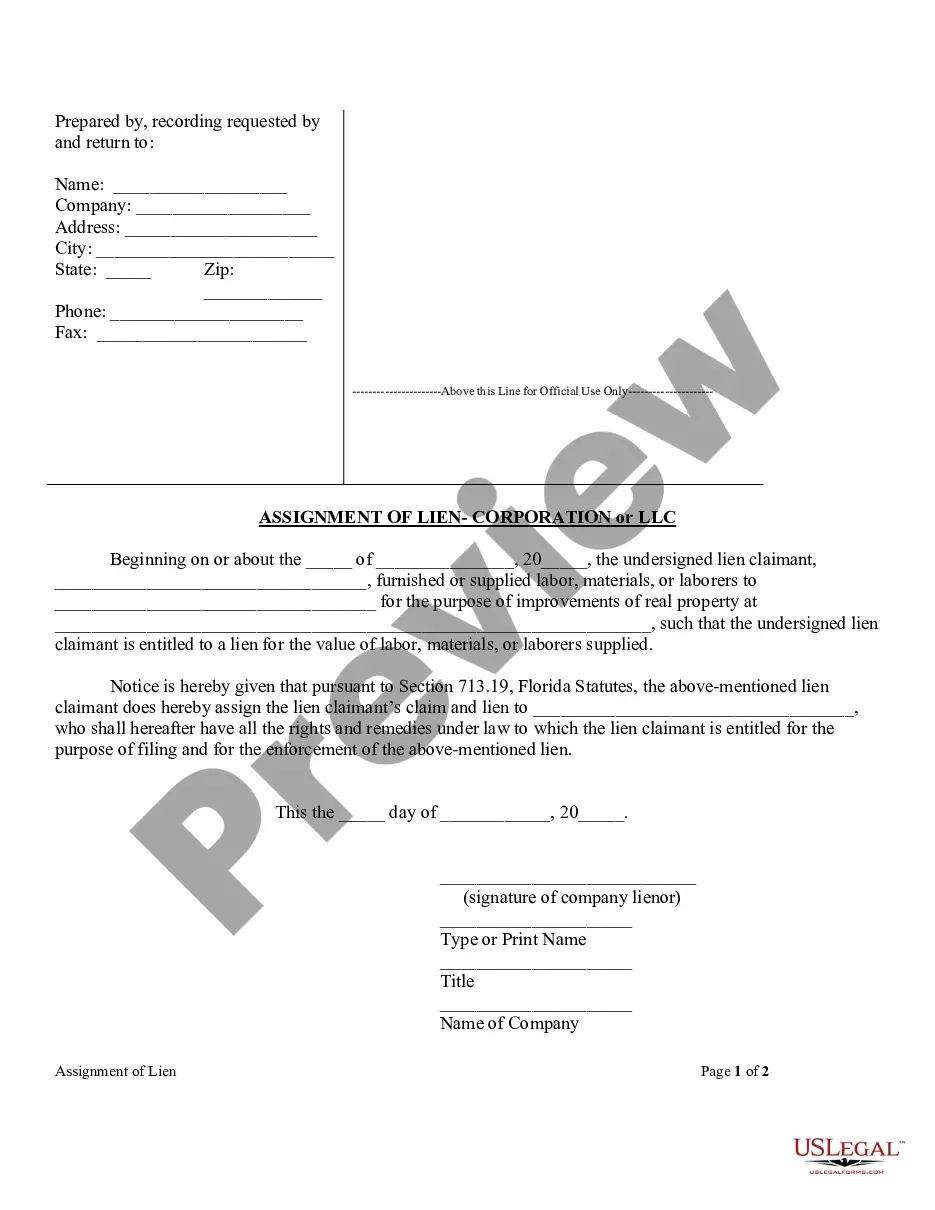

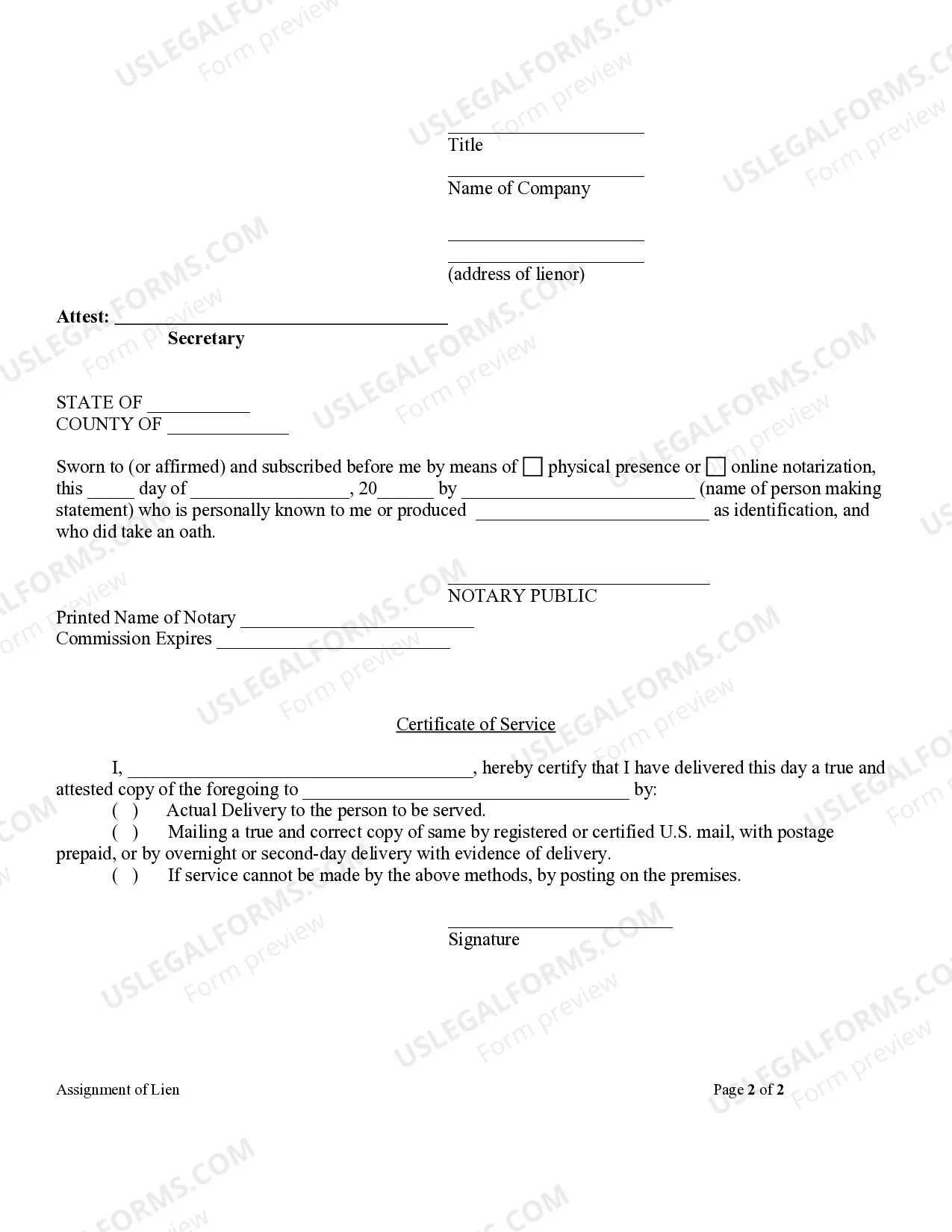

Florida Assignment of Lien - Corporation or LLC

Description

How to fill out Florida Assignment Of Lien - Corporation Or LLC?

The greater the number of documents you need to produce - the more apprehensive you feel.

You can discover countless Florida Assignment of Lien - Corporation or LLC templates online, but it’s challenging to discern which ones are reliable.

Remove the complications and simplify finding examples using US Legal Forms. Obtain expertly crafted forms tailored to meet state regulations.

Enter the necessary details to create your account and pay for your order using PayPal or credit card. Choose a convenient document format and collect your template. Access all documents you acquire in the My documents section. Simply visit there to prepare a new version of the Florida Assignment of Lien - Corporation or LLC. Even when utilizing well-drafted templates, it’s still advisable to consult a local attorney to review the completed form to ensure your document is correctly filled out. Achieve more for less with US Legal Forms!

- If you already have a US Legal Forms subscription, sign in to your account, and you will see the Download button on the Florida Assignment of Lien - Corporation or LLC’s page.

- If you have not used our platform before, complete the registration process by following these steps.

- Confirm whether the Florida Assignment of Lien - Corporation or LLC is recognized in your state.

- Verify your selection by reviewing the description or using the Preview feature if available for the chosen document.

- Click Buy Now to initiate the registration process and choose a subscription plan that meets your requirements.

Form popularity

FAQ

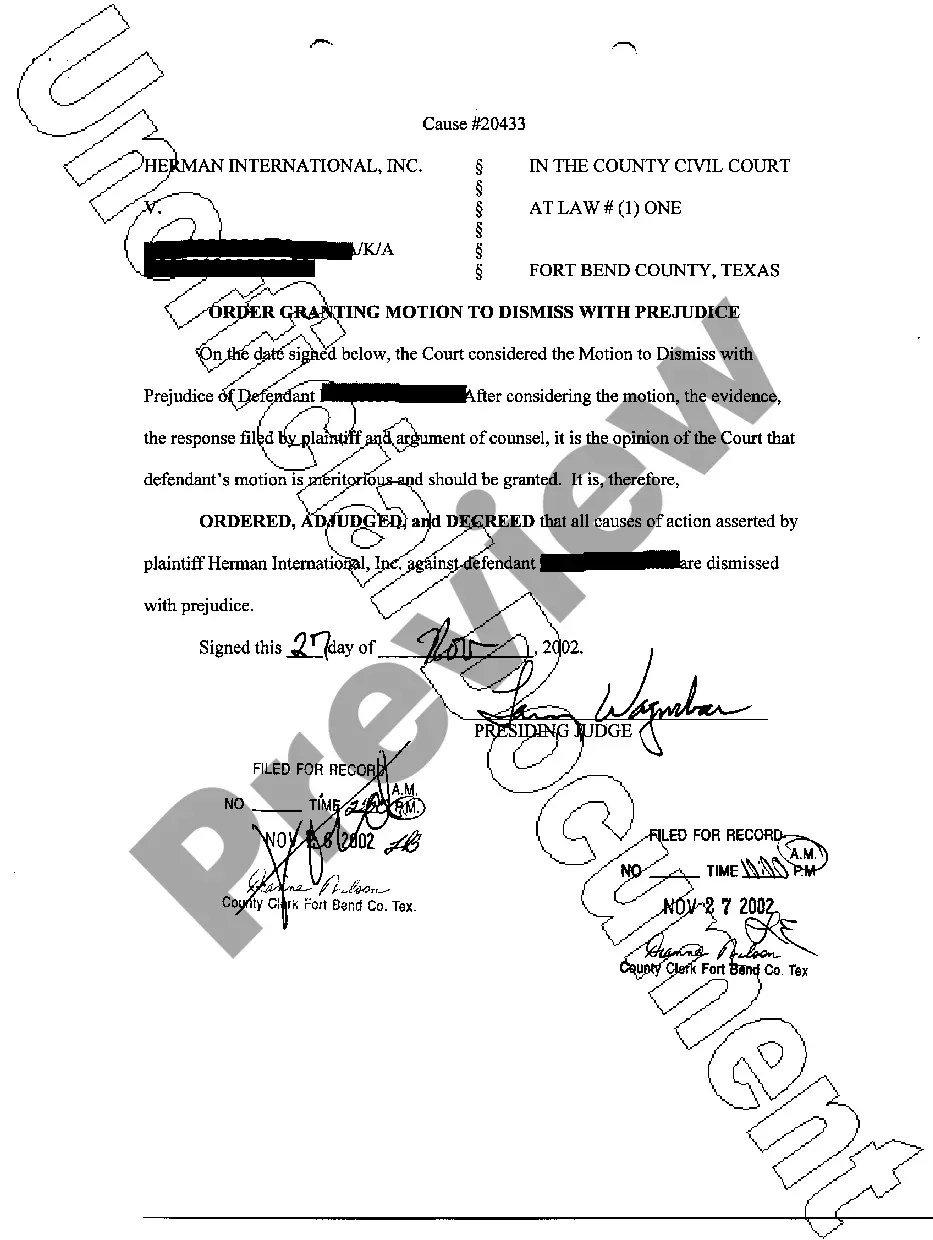

The disadvantages of a lien include potential damage to your credit score and legal complexities in enforcing it. Additionally, liens can complicate the sale of a property, as the outstanding debt must be addressed before a sale can proceed. A Florida Assignment of Lien - Corporation or LLC may offer protection, but understanding its implications is crucial. Consulting uslegalforms can help clarify these concerns and provide resources for effective management of liens.

Yes, you can place a lien on something you own through the Florida Assignment of Lien - Corporation or LLC process. This legal claim grants you the right to the property until a debt is satisfied. It is essential to properly understand the procedures involved to ensure your lien is enforceable. By utilizing a platform like uslegalforms, you can find the necessary forms and guidance to streamline this process.

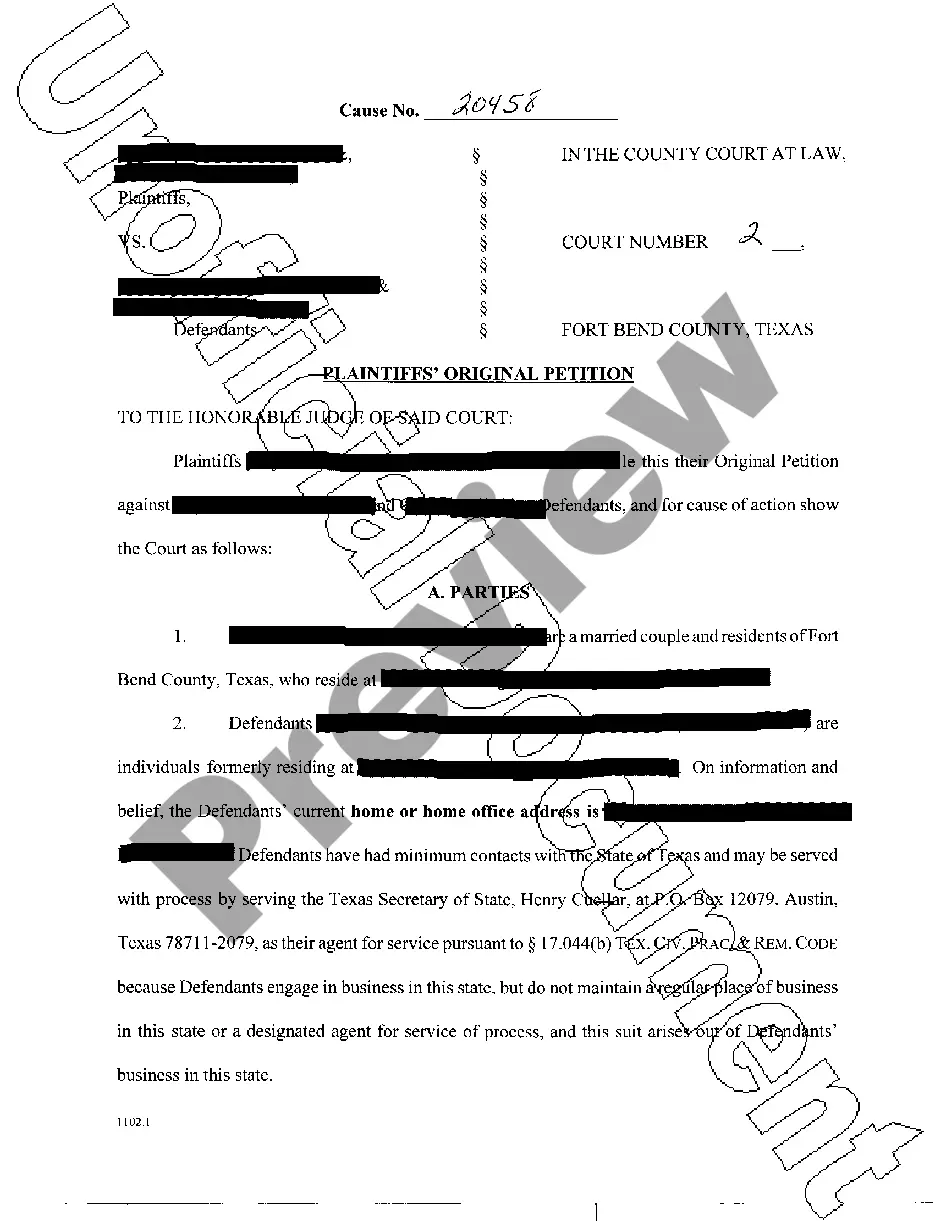

Yes, you can put a lien on a corporation if there is a valid debt owed. The process typically involves filing a notice of lien with the state or relevant authority, accompanied by the appropriate documentation. Doing so helps protect your interests and establish your right to collect on the debt. For assistance with the Florida Assignment of Lien - Corporation or LLC, our US Legal Forms platform provides forms and resources to facilitate this process effectively.

While you can form an LLC in Florida without a lawyer, having professional guidance can be beneficial. A lawyer ensures all legal requirements are met and helps you navigate the complexities of forming an LLC. This assistance can save you time and prevent potential legal issues down the line. For those looking for additional resources on forming an LLC, consider using our US Legal Forms platform, which provides templates and guidance.

Filing a lien against an LLC involves a few crucial steps. First, prepare the necessary lien documentation that includes the details of the debt owed to you. Subsequently, file the lien with the state, usually at the Secretary of State’s office. When dealing with the Florida Assignment of Lien - Corporation or LLC, our US Legal Forms platform streamlines this process, guiding you through each step to protect your interests.

To file a notice of lien in Florida, start by preparing the necessary documents, which include the lien form and any supporting paperwork. Next, file these documents with the appropriate county clerk’s office where the property is located. Make sure to also send a copy to the property owner, as required by law. Utilizing our platform, US Legal Forms, can simplify this process, ensuring you meet all legal requirements for the Florida Assignment of Lien - Corporation or LLC.

The three main types of liens are consensual liens, statutory liens, and judgment liens. Consensual liens are agreed upon by both parties, such as mortgages. Statutory liens arise under specific laws without an agreement, while judgment liens are established through court rulings. Understanding these differences is crucial when considering a Florida Assignment of Lien - Corporation or LLC for your business needs.

To put a lien against a company, you start by identifying the company’s proper legal name and the nature of the debt. You then prepare a lien document that meets the statutory requirements and file it with the relevant government authority. It's essential to follow the correct procedures to secure your rights effectively. Uslegalforms offers tools to guide you through this process without complications.

Yes, you can put a lien on a Limited Liability Company (LLC) in Florida. Filing a lien allows creditors to secure their interests in the LLC's assets, providing some level of protection. This process requires filing the appropriate documents with the county clerk and ensuring compliance with state regulations. Let uslegalforms assist you with the complexities of a Florida Assignment of Lien - Corporation or LLC.

In Wisconsin, a lien typically lasts for a period of six years, but the duration may vary based on the type of lien. It is crucial to keep track of lien expiration to ensure your interests remain protected. If you need assistance with compliance and filing, consider using reliable resources like uslegalforms for guidance on managing your liens effectively.