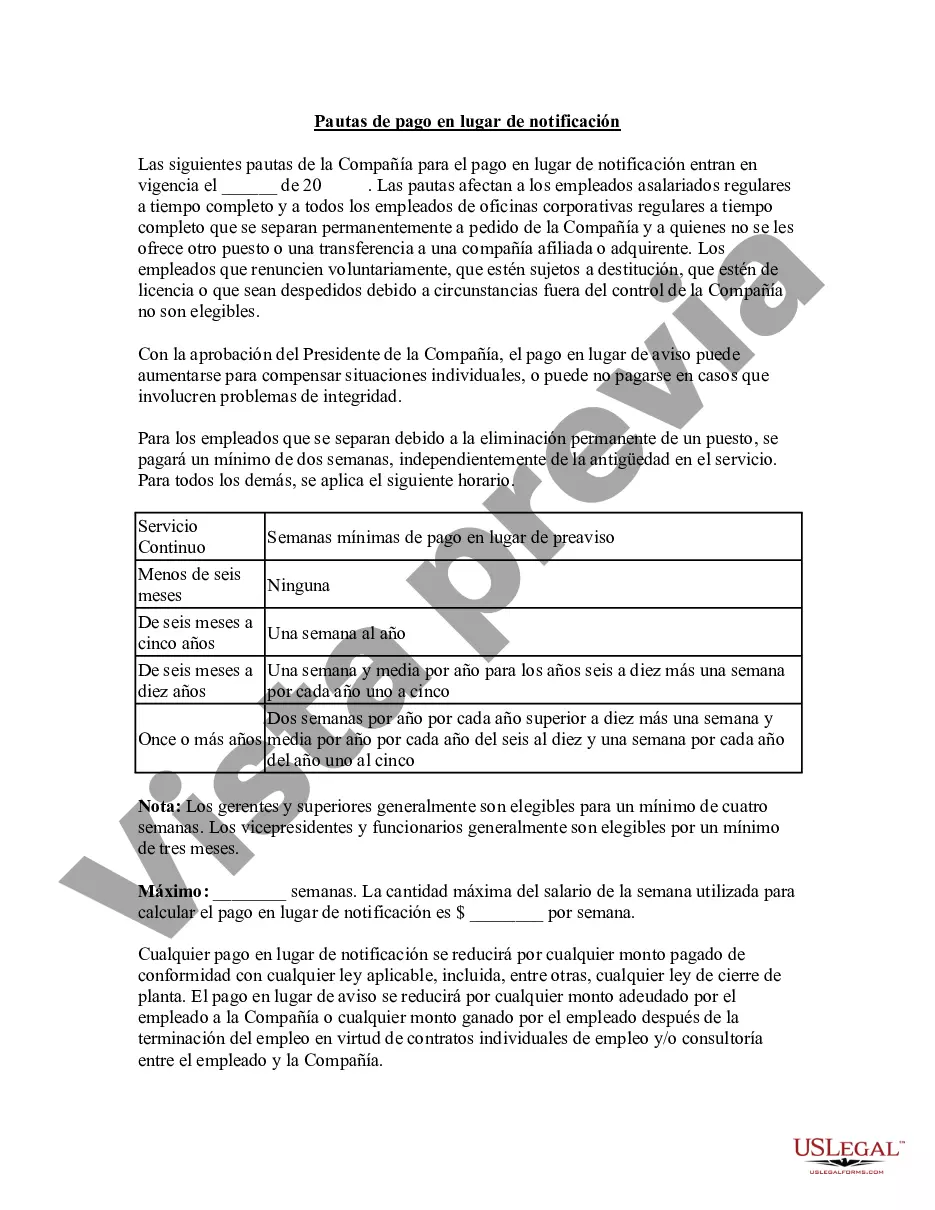

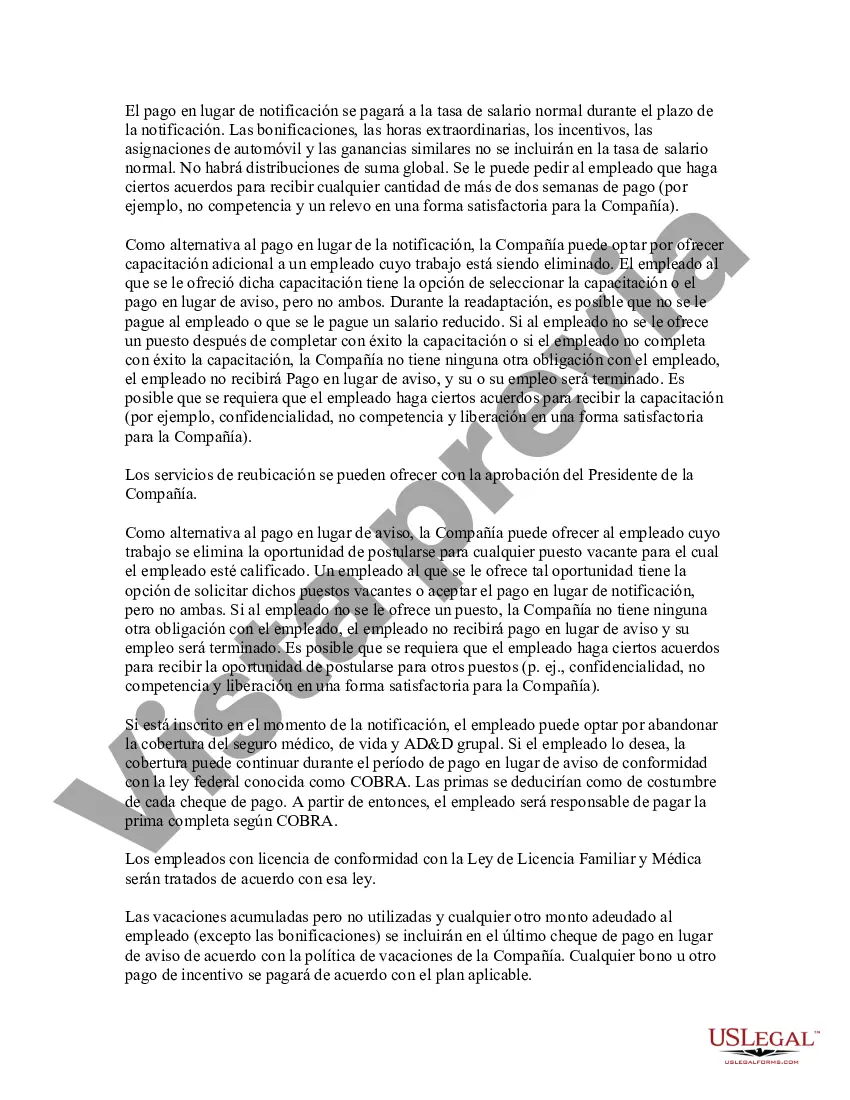

Delaware Pay in Lieu of Notice Guidelines, also known as PILOT, refer to the regulations and rules set by the state of Delaware regarding the payment of employees who are terminated without sufficient notice. PILOT is a legal provision that allows employers to compensate employees for the notice period they would have received if terminated with proper notice. In Delaware, employers have the option to provide pay in lieu of notice to terminated employees in certain situations. This payment is intended to cover the notice period that the employee would have been entitled to receive if terminated under regular circumstances. By providing pay in lieu of notice, employers are compensating employees for the lack of advance notice, allowing them to receive the equivalent pay they would have received during the notice period. There are different types of Delaware Pay in Lieu of Notice Guidelines that employers need to be aware of: 1. Statutory PILOT: Under Delaware law, employers are not legally required to provide pay in lieu of notice. However, employers may choose to offer this compensation voluntarily as part of a severance package or employment agreement. The terms and conditions of this payment are left to the discretion of the employer. 2. Contractual PILOT: Some employment contracts or agreements may include specific provisions regarding pay in lieu of notice. In these cases, employers are obligated to provide compensation in accordance with the terms of the contract. It is crucial for both employers and employees to carefully review and understand any contractual obligations related to PILOT. 3. Company Policy PILOT: Employers may have their own internal policies regarding pay in lieu of notice. These policies are not mandated by Delaware law but are established by the employer for consistency and fairness. Employers should ensure that their policies are communicated clearly to employees and adhered too consistently. It is important for employers to familiarize themselves with Delaware Pay in Lieu of Notice Guidelines to ensure compliance with applicable regulations and obligations. Employers should also consult legal professionals or labor experts to ensure they are following the correct procedures and meeting any contractual or policy obligations. Keywords: Delaware Pay in Lieu of Notice Guidelines, PILOT, termination, notice period, compensation, severance package, employment agreement, statutory PILOT, contractual PILOT, company policy PILOT, Delaware law, employment contracts, internal policies, compliance.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Delaware Pautas de pago en lugar de notificación - Pay in Lieu of Notice Guidelines

Description

How to fill out Delaware Pautas De Pago En Lugar De Notificación?

US Legal Forms - one of many greatest libraries of legitimate forms in America - delivers a wide array of legitimate file themes you may acquire or print. Making use of the website, you may get a huge number of forms for enterprise and personal purposes, categorized by types, claims, or key phrases.You will discover the latest versions of forms like the Delaware Pay in Lieu of Notice Guidelines in seconds.

If you already have a subscription, log in and acquire Delaware Pay in Lieu of Notice Guidelines in the US Legal Forms catalogue. The Obtain button can look on every type you perspective. You get access to all in the past downloaded forms within the My Forms tab of the bank account.

If you wish to use US Legal Forms initially, here are basic recommendations to help you get started off:

- Be sure to have chosen the correct type for your area/state. Click the Review button to review the form`s information. See the type explanation to ensure that you have chosen the appropriate type.

- If the type doesn`t fit your specifications, utilize the Lookup discipline on top of the screen to obtain the the one that does.

- If you are pleased with the shape, validate your option by simply clicking the Buy now button. Then, choose the pricing prepare you favor and give your accreditations to sign up for the bank account.

- Method the deal. Make use of your credit card or PayPal bank account to accomplish the deal.

- Pick the formatting and acquire the shape on the gadget.

- Make changes. Load, modify and print and sign the downloaded Delaware Pay in Lieu of Notice Guidelines.

Each design you included in your money lacks an expiration day and it is your own property forever. So, if you would like acquire or print one more duplicate, just proceed to the My Forms portion and then click about the type you will need.

Get access to the Delaware Pay in Lieu of Notice Guidelines with US Legal Forms, by far the most extensive catalogue of legitimate file themes. Use a huge number of professional and condition-distinct themes that meet up with your company or personal requirements and specifications.

Form popularity

FAQ

An employer cannot usually impose a pay cut unilaterally on employees. However, there are situations where this may be possible for example, the right to reduce their remuneration package may be covered in the employment contract.

Payout of vacation at termination. In such circumstances, earned vacation will generally be treated as wages pursuant to state wage payment and collection laws. In Delaware, vacation pay is considered a benefit or wage supplement.

The short answer is maybe. Surrendering accrued and unused vacation time to an employee who separates from your company, whether by choice or not, isn't a federal requirement, so there's no federal law that your company has to comply with.

No federal or state law in Delaware requires employers to pay out an employee's accrued vacation, sick leave, or other paid time off (PTO) at the termination of employment.

There are no events under which an employer can entirely withhold a final paycheck under Delaware law. Employers are required to pay the employee their wages due when the pay period has arrived unless the following situations apply: Employer is required to withhold the paycheck under federal or state law.