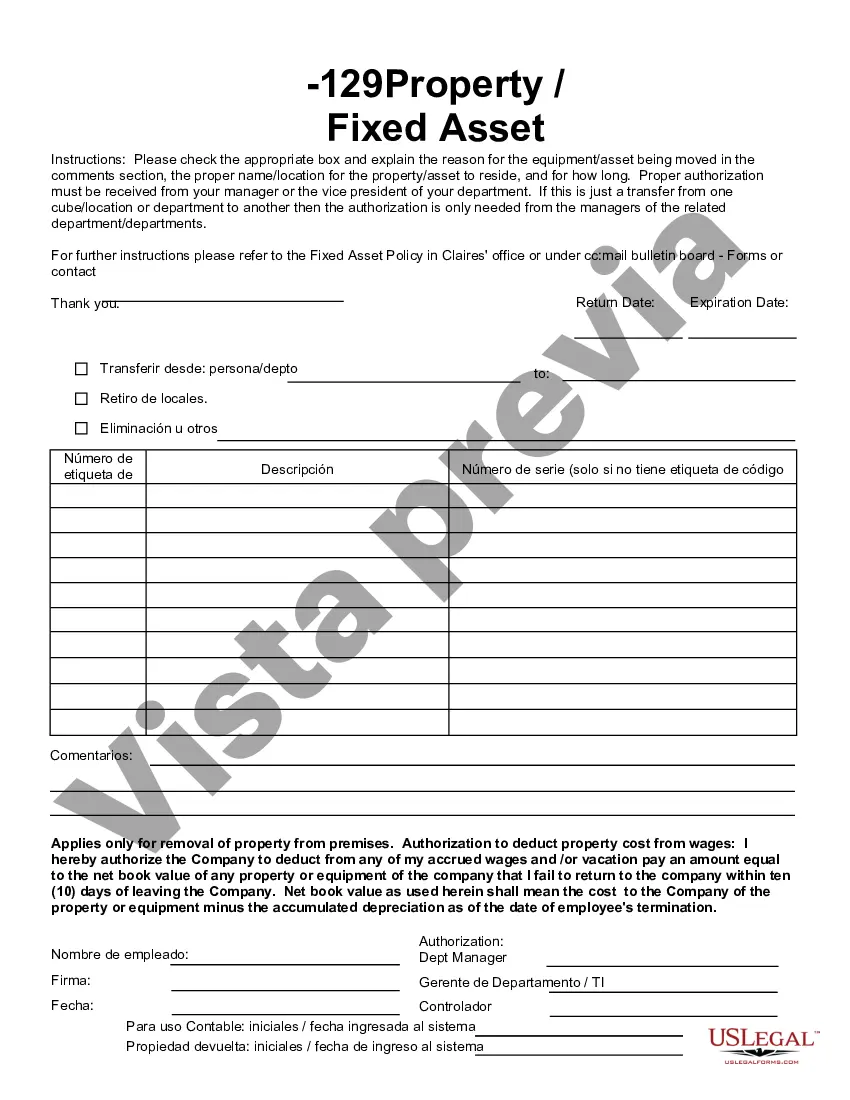

The Delaware Fixed Asset Removal Form is an essential document used in the state of Delaware to initiate the removal of fixed assets from a company's records. This form is typically used when a fixed asset is disposed of, sold, or stolen, and the company needs to update its records accordingly. The Delaware Fixed Asset Removal Form serves as an official record of the removal and ensures accurate asset tracking and reporting. It is vital for companies to keep their fixed asset records up to date to comply with accounting standards and regulations. Keywords: Delaware, Fixed Asset Removal Form, fixed assets, disposed, sold, stolen, records, asset tracking, reporting, accounting standards, regulations. Different Types of Delaware Fixed Asset Removal Forms: 1. Disposal Form: This type of form is used when a fixed asset is discarded or destroyed and no longer has any value to the company. It includes relevant details such as the asset description, reason for disposal, disposal method, and any associated costs. 2. Sale Form: When a company sells a fixed asset, a sale form is utilized to record the transfer of ownership. This form typically includes information about the buyer, sale price, date of sale, and any other relevant details related to the transaction. 3. Theft/Loss Form: In unfortunate instances where a fixed asset is stolen or lost, a theft/loss form is necessary to report the incident and remove the asset from the company's records. This form usually includes a description of the asset, date of theft/loss, estimated value, and any supporting evidence such as police reports or insurance claims. By utilizing these various types of Delaware Fixed Asset Removal Forms, businesses can streamline their processes and ensure accurate records of disposed, sold, or stolen fixed assets, thus maintaining transparency and compliance with state regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Delaware Formulario de retiro de activos fijos - Fixed Asset Removal Form

Description

How to fill out Delaware Formulario De Retiro De Activos Fijos?

It is possible to spend time on the Internet looking for the authorized papers web template that meets the state and federal specifications you require. US Legal Forms gives 1000s of authorized kinds that happen to be analyzed by pros. You can easily down load or printing the Delaware Fixed Asset Removal Form from my services.

If you already have a US Legal Forms accounts, you are able to log in and click the Download button. Next, you are able to complete, modify, printing, or indicator the Delaware Fixed Asset Removal Form. Every authorized papers web template you get is the one you have forever. To acquire another duplicate for any bought form, visit the My Forms tab and click the related button.

If you are using the US Legal Forms website the first time, keep to the basic instructions listed below:

- Very first, be sure that you have selected the correct papers web template for that county/city that you pick. Browse the form outline to make sure you have picked the correct form. If offered, take advantage of the Review button to search through the papers web template as well.

- If you wish to get another edition from the form, take advantage of the Look for area to get the web template that fits your needs and specifications.

- Once you have identified the web template you want, just click Get now to move forward.

- Pick the pricing strategy you want, enter your credentials, and register for a free account on US Legal Forms.

- Full the purchase. You can utilize your bank card or PayPal accounts to pay for the authorized form.

- Pick the format from the papers and down load it to your system.

- Make changes to your papers if necessary. It is possible to complete, modify and indicator and printing Delaware Fixed Asset Removal Form.

Download and printing 1000s of papers themes while using US Legal Forms Internet site, which offers the largest collection of authorized kinds. Use expert and express-distinct themes to take on your business or person needs.

Form popularity

FAQ

Writing an asset off in business is the same as claiming that it no longer serves a purpose and has no future value. You're effectively telling the IRS that the value of the asset is now zero. Old equipment can be written off even if it still has some potential functionality.

In the Accounting menu, select Advanced, then click Fixed assets.Select the status tab for the asset you want to delete.Click the asset number to open the asset details.Click Options, then click Delete.Click Delete to confirm.

When there is a loss on the sale of a fixed asset, debit cash for the amount received, debit all accumulated depreciation, debit the loss on sale of asset account, and credit the fixed asset.

When there is a loss on the sale of a fixed asset, debit cash for the amount received, debit all accumulated depreciation, debit the loss on sale of asset account, and credit the fixed asset.

The entry to remove the asset and its contra account off the balance sheet involves decreasing (crediting) the asset's account by its cost and decreasing (crediting) the accumulated depreciation account by its account balance.

When an asset reaches the end of its useful life and is fully depreciated, asset disposal occurs by means of a single entry in the general journal. The accumulated depreciation account is debited, and the relevant asset account is credited.

Disposal of fixed assets is accounted for by removing cost of the asset and any related accumulated depreciation and accumulated impairment losses from balance sheet, recording receipt of cash and recognizing any resulting gain or loss in income statement.

To remove a group disposition:Select Asset List (tab).Go to Assets > Group Disposition.Highlight the group disposition you want to remove.Click Delete.

The Fixed Asset Disposition (FD) document records the disposition of assets. This results from a sale, destruction, obsolescence, etc. of an asset.

When there is a loss on the sale of a fixed asset, debit cash for the amount received, debit all accumulated depreciation, debit the loss on sale of asset account, and credit the fixed asset.