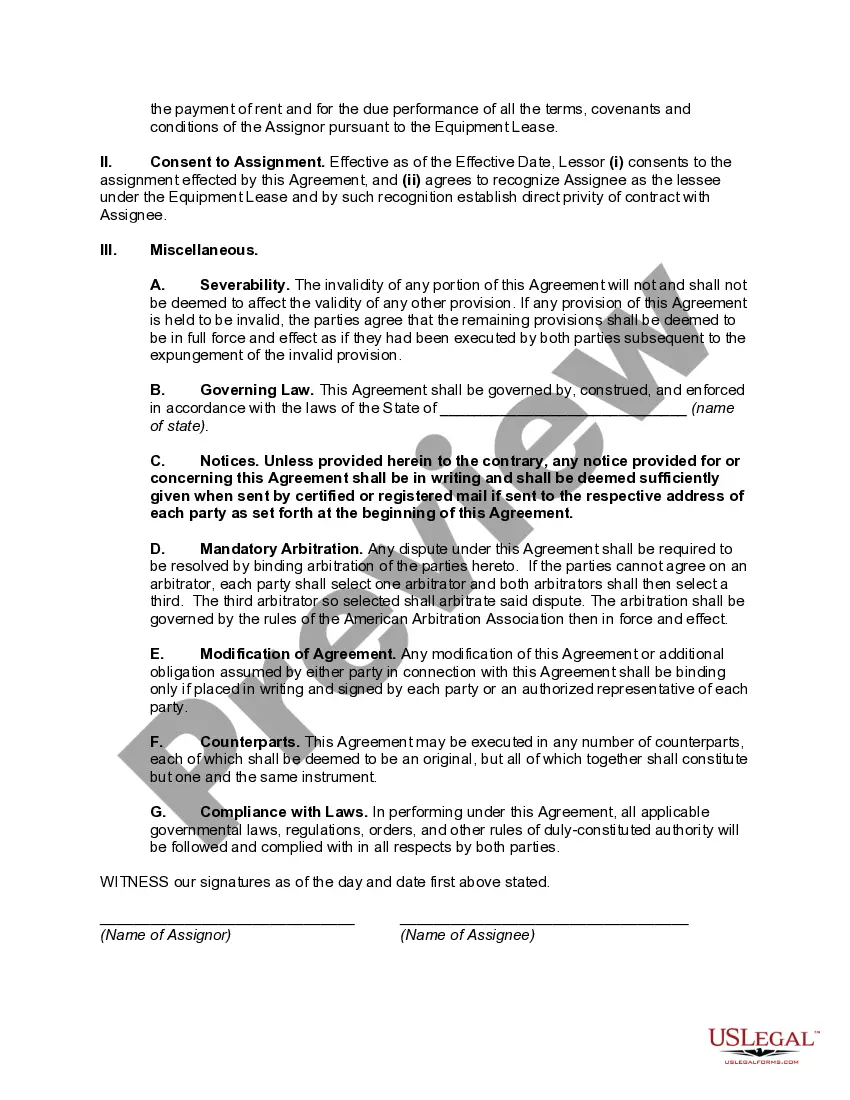

Connecticut Assignment and Assumption of Equipment (Personal Property) Lease Pursuant to Asset Purchase Agreement

Description

How to fill out Assignment And Assumption Of Equipment (Personal Property) Lease Pursuant To Asset Purchase Agreement?

Finding the appropriate legal document template can be quite a challenge.

Certainly, there are numerous templates available online, but how do you locate the legal form you desire.

Utilize the US Legal Forms website. The platform offers a vast collection of templates, including the Connecticut Assignment and Assumption of Equipment (Personal Property) Lease Pursuant to Asset Purchase Agreement, which can be utilized for both business and personal purposes.

If the form does not meet your requirements, use the Search field to find the right document.

- All forms are reviewed by professionals and satisfy state and federal requirements.

- If you are already registered, Log In to your account and click on the Download button to retrieve the Connecticut Assignment and Assumption of Equipment (Personal Property) Lease Pursuant to Asset Purchase Agreement.

- Use your account to check the legal forms you have purchased previously.

- Navigate to the My documents tab in your account to obtain another copy of the document you need.

- If you are a new customer of US Legal Forms, here are simple steps you should follow.

- First, ensure you have selected the correct form for your city/state. You can review the form using the Preview button and examine the form description to confirm it is indeed the right one for you.

Form popularity

FAQ

Yes, assignment of contract in real estate is legal. However, contract assignment will not be enforced in the following circumstances: There is no written consent Before a real estate assignment contract is enforced, all the parties involved must give written consent.

Primary tabs. Assignment is a legal term whereby an individual, the assignor, transfers rights, property, or other benefits to another known as the assignee. This concept is used in both contract and property law. The term can refer to either the act of transfer or the rights/property/benefits being transferred.

What is an Asset Acquisition? An asset acquisition is the purchase of a company by buying its assets instead of its stock. An individual who owns stock in a company is called a shareholder and is eligible to claim part of the company's residual assets and earnings (should the company ever be dissolved).

An assignable contract is a provision allowing the holder of a contract to transfer or give away the obligations and rights of the contract to another party or person before the contract's expiration date.

Some contracts may contain a clause prohibiting assignment; other contracts may require the other party to consent to the assignment. Here's an example of a basic assignment of a contract: Tom contracts with a dairy to deliver a bottle of half-and-half to Tom's house every day.

An asset purchase is when a buyer agrees to purchase certain liabilities and assets from a company. As such, it also means that the buyer takes on the rewards and risks of the assets or business purchase. Asset purchases can include the buying of: Licenses.

In an asset purchase transaction, the vendor is the company that owns the assets. The vendor sells some or all of its assets to the purchaser resulting in a transfer of such assets, including those desired contracts to which the company is a party to. Such transfer of the contracts will be done by way of an assignment.

Conversely, stock purchases usually do not require the assignment of contracts, so third-party consents are not required unless the contracts contain change of control provisions. Further, stock purchases are often not subject to as many filing requirements that need to be satisfied by the parties (if any).

Unlike an asset purchase, where the buyer simply buys the assets of the company, an equity purchaser actually buys the company itself, which can be beneficial if the company is performing well or has additional value as a going concern.

A purchase contract assignment is between a holder (assignor) that transfers their interest in buying real estate to someone else (assignee). Before the closing, it is common to assign a purchase contract to a business entity or the person whom the loan or mortgage will be under.