Title: Connecticut Escrow Agreement Checklist: A Comprehensive Guide for Drafting Introduction: An escrow agreement is a crucial legal document for various financial transactions in Connecticut. Whether you are involved in real estate deals, mergers and acquisitions, or other complex financial transactions, a well-drafted escrow agreement ensures a smooth and secure process. This article will provide a detailed description of what comprises a Connecticut Checklist of Matters to be Considered in Drafting an Escrow Agreement, with a focus on relevant keywords. 1. Background and Parties Involved: — Clearly define the agreement's background, including the name and purpose of the escrow arrangement. — Identify and accurately represent all parties involved in the escrow agreement, including the escrow agent, the depositor(s), and the beneficiary(s). 2. Escrow Agent's Duties and Obligations: — Specify the roles, responsibilities, and fiduciary duties of the escrow agent. — Describe the level of care and skill expected from the escrow agent, ensuring compliance with all relevant laws and regulations. 3. Deposit and Disbursement Terms: — Outline the terms and conditions for depositing funds or assets into escrow, including the amount, timing, and method of deposit. — Detail the conditions under which the escrow funds or assets will be disbursed to the designated beneficiary(s), ensuring proper milestones, events, or closing requirements are met. 4. Escrow Account Management: — Specify the requirements for maintaining the escrow account, including any applicable interest, taxes, or fees. — Ensure compliance with all relevant banking and accounting standards, including periodic account statements and auditing procedures. 5. Escrow Termination and Dispute Resolution: — Define the circumstances leading to the termination of the escrow agreement. — Include provisions for dispute resolution, mediation, or arbitration, reducing potential conflicts among the parties involved. 6. Confidentiality and Non-Disclosure: — Impose strict confidentiality obligations on the escrow agent to protect sensitive information or documents related to the escrow arrangement. — Specify the limitations of disclosure and the consequences of breaching confidentiality provisions. Additional Types of Connecticut Escrow Agreement Checklists: 1. Real Estate Escrow Agreement Checklist: — Covers specific considerations for real estate transactions, including property titles, liens, mortgages, and closing terms. 2. Mergers and Acquisitions Escrow Agreement Checklist: — Focuses on the unique requirements and provisions relevant to M&A transactions, such as indemnification claims, purchase price adjustments, and post-closing obligations. 3. Intellectual Property Escrow Agreement Checklist: — Addresses intellectual property transfer, licensing, and protection matters within the escrow agreement, addressing patent, trademark, copyright, or trade secret-related details. Conclusion: Drafting a well-structured and comprehensive escrow agreement is essential for any financial transaction involving an escrow arrangement in Connecticut. By adhering to a detailed checklist that covers all pertinent matters, including those specific to real estate, mergers and acquisitions, and intellectual property, parties can navigate the complexities of an escrow agreement, ensuring a secure and efficient process.

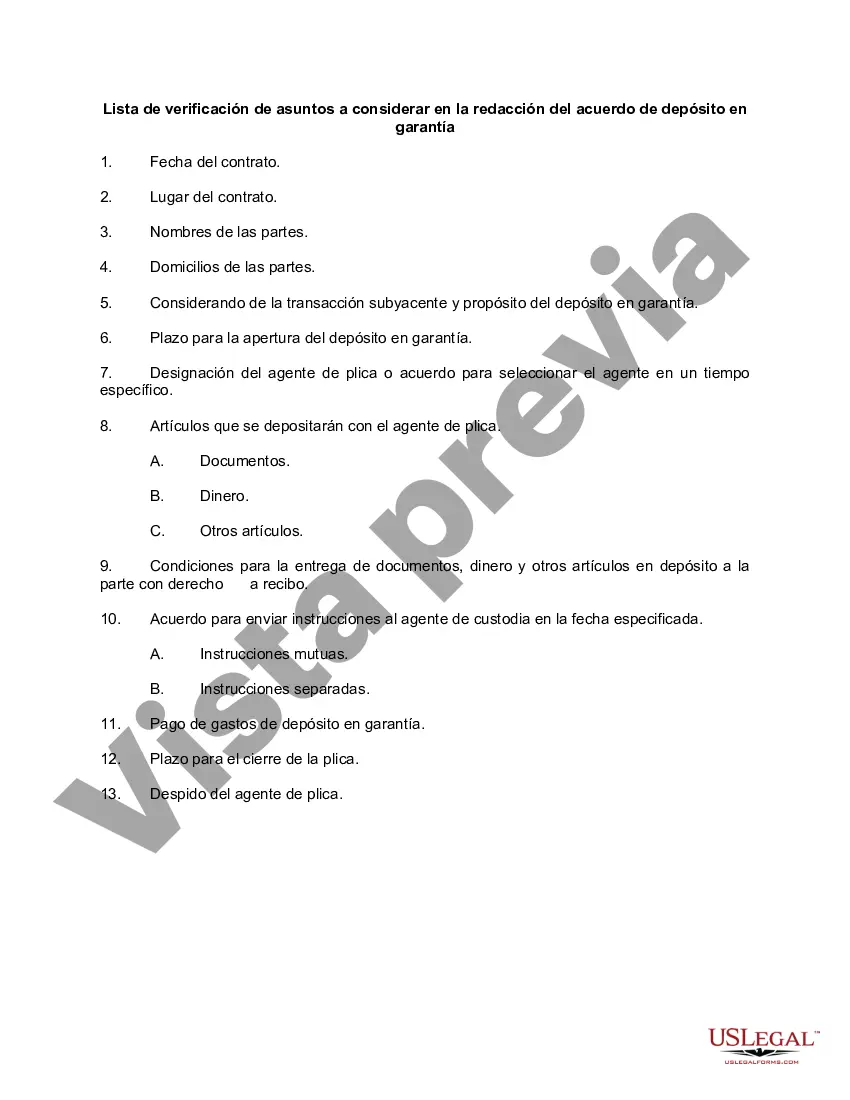

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Connecticut Lista de verificación de asuntos a considerar en la redacción del acuerdo de depósito en garantía - Checklist of Matters to be Considered in Drafting Escrow Agreement

Description

How to fill out Connecticut Lista De Verificación De Asuntos A Considerar En La Redacción Del Acuerdo De Depósito En Garantía?

If you wish to comprehensive, acquire, or produce authorized papers themes, use US Legal Forms, the greatest assortment of authorized kinds, that can be found on-line. Use the site`s simple and handy lookup to discover the documents you want. Different themes for company and person functions are categorized by classes and states, or key phrases. Use US Legal Forms to discover the Connecticut Checklist of Matters to be Considered in Drafting Escrow Agreement in just a number of clicks.

Should you be currently a US Legal Forms consumer, log in for your accounts and click the Download switch to obtain the Connecticut Checklist of Matters to be Considered in Drafting Escrow Agreement. You can also entry kinds you in the past acquired from the My Forms tab of your accounts.

If you are using US Legal Forms the first time, follow the instructions listed below:

- Step 1. Be sure you have selected the form for that right area/land.

- Step 2. Take advantage of the Preview choice to look through the form`s articles. Do not forget to learn the information.

- Step 3. Should you be unhappy with the form, make use of the Search area at the top of the display screen to locate other versions of the authorized form design.

- Step 4. After you have identified the form you want, click the Get now switch. Pick the rates program you like and add your references to sign up for the accounts.

- Step 5. Process the financial transaction. You should use your credit card or PayPal accounts to perform the financial transaction.

- Step 6. Choose the formatting of the authorized form and acquire it in your device.

- Step 7. Total, revise and produce or indication the Connecticut Checklist of Matters to be Considered in Drafting Escrow Agreement.

Each authorized papers design you buy is yours forever. You possess acces to each form you acquired with your acccount. Select the My Forms section and pick a form to produce or acquire yet again.

Compete and acquire, and produce the Connecticut Checklist of Matters to be Considered in Drafting Escrow Agreement with US Legal Forms. There are thousands of skilled and state-distinct kinds you can utilize to your company or person demands.

Form popularity

FAQ

Essential elements of a valid escrow arrangement are:A contract between the grantor and the grantee agreeing to the conditions of a deposit;Delivery of the deposited item to a depositary; and.Communication of the agreed conditions to the depositary.

An escrow agreement is a contract that outlines the terms and conditions between parties involved, and the responsibility of each. Escrow agreements generally involve an independent third party, called an escrow agent, who holds an asset of value until the specified conditions of the contract are met.

A thorough escrow agreement will list out the information that should be included in JWI or any instructions, such as the amount to be released, the party to whom the funds should be delivered, payment instructions and tax characterizations, or alternatively attach an instructions template to the escrow agreement.

In addition, the escrow agent must be someone who is not otherwise associated with the transaction. For example, the buyer's real estate agent or the seller's attorney cannot hold the escrow account. They may, however, recommend escrow agents that they have used before.

THE ESCROW AGENT As a service to buyers and sellers, your office can arrange for an escrow attorney, agent or company to prepare closing documents. This service is designed to assist both parties in the transaction.

Canada: Escrow Services In Canada. 11 January 2019. by Lisa Wilcox. TMF Group BV. Escrow is a term used to describe a component of a commercial transaction between two or more parties where assets are held by a third party, called an escrow agent, pending completion of certain conditions to the commercial transaction.

Escrow instructions normally identify the escrow holder's contact information and escrow number, license number, important dates including the date escrow opened, as well as the date it is scheduled to close, the names of the parties to the escrow, the property address and legal description, purchase price and terms,

Most escrow agreements are put into place when one party wants to make sure the other party meets certain conditions or obligations before it moves forward with a deal. For instance, a seller may set up an escrow agreement to ensure a potential homebuyer can secure financing before the sale goes through.

A demand letter provides an escrow or title company with the amount needed to pay off your current mortgage. It is the actual request for a payoff statement. The payoff statement is a binding balance the existing lender must honor when the loan is paid off at close of escrow.

According to Escrow law, escrow services must be a corporation who are in the business of receiving escrows for deposit or delivery. That corporation must be licensed by the California Corporations Commissioner. This doesn't mean there aren't any exceptions to that law.