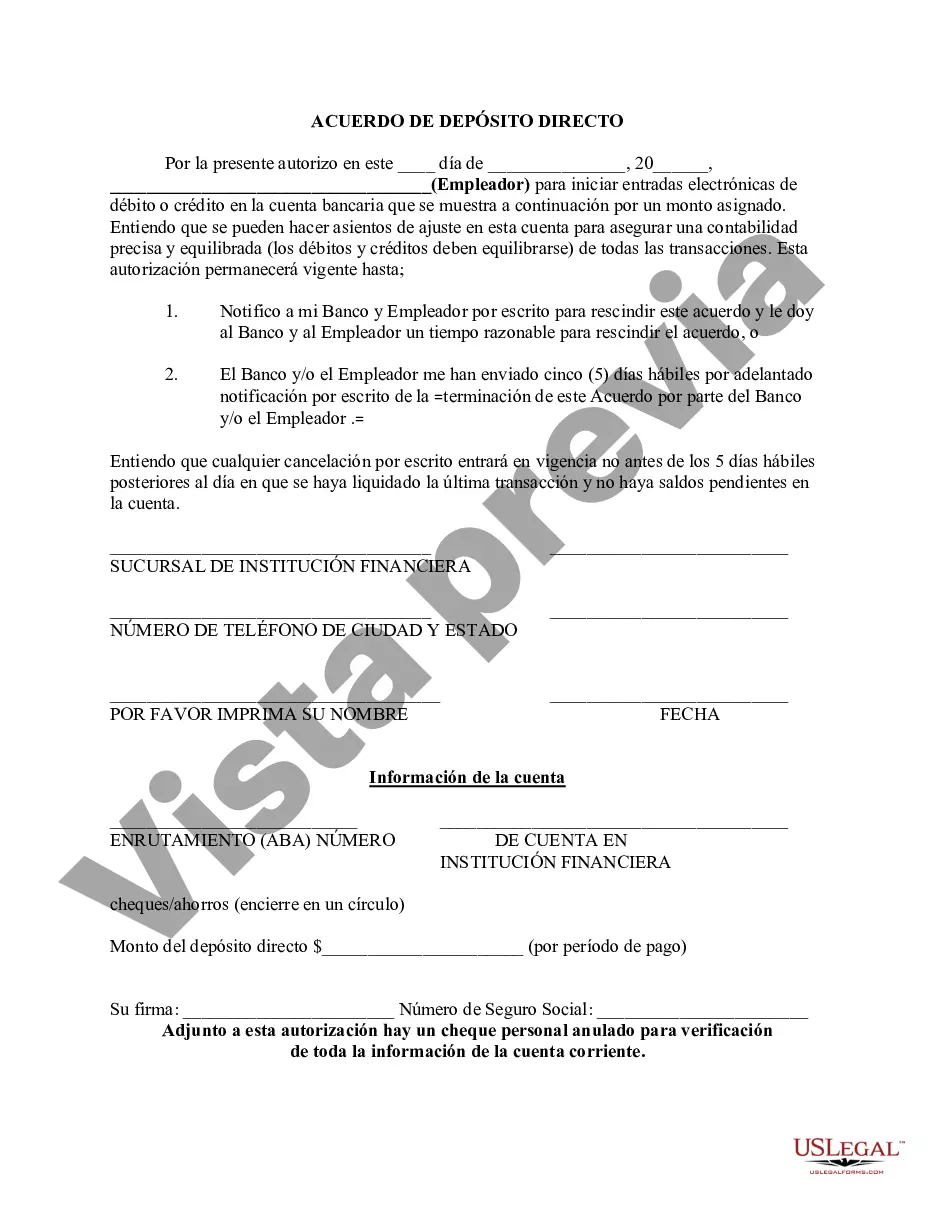

The Connecticut Direct Deposit Form for Stimulus Check is a document used to provide the necessary information to the state government in order to receive a stimulus payment directly into a bank account. It is specifically designed for residents of Connecticut who are eligible for the stimulus check. This form serves as a means for individuals to provide their banking details, such as the routing number and account number, to ensure that the stimulus payment is directly deposited into their chosen bank account. The use of direct deposit eliminates the need to wait for a physical check and allows for quicker access to the funds. There is typically only one type of Connecticut Direct Deposit Form for Stimulus Check, which is generally provided by the Connecticut Department of Revenue Services (DRS). This form is made available to eligible individuals online on the official website of the DRS. The Connecticut Direct Deposit Form for Stimulus Check may require individuals to provide their personal identifying information, such as their full name, social security number, and address. Additionally, they will need to include the specific banking information required for the direct deposit, including the name of the bank, the bank's routing number, and the account number of the recipient. It is important to accurately complete and submit the Connecticut Direct Deposit Form for Stimulus Check to ensure the seamless and timely delivery of the stimulus payment. By providing the correct bank account information through this form, individuals can receive their much-needed stimulus funds in a convenient and efficient manner.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Connecticut Formulario de depósito directo para cheque de estímulo - Direct Deposit Form for Stimulus Check

Description

How to fill out Connecticut Formulario De Depósito Directo Para Cheque De Estímulo?

If you wish to be thorough, obtain, or create legal document templates, utilize US Legal Forms, the primary repository of legal forms available online.

Leverage the site’s simple and convenient search functionality to find the documents you require. Various templates for business and personal purposes are categorized by types and states, or keywords.

Employ US Legal Forms to access the Connecticut Direct Deposit Form for Stimulus Check in just a few clicks.

Every legal document template you purchase is yours indefinitely. You can access every document you downloaded in your account. Click on the My documents section and select a document to print or download again.

Stay ahead and download, as well as print the Connecticut Direct Deposit Form for Stimulus Check with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the Connecticut Direct Deposit Form for Stimulus Check.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form corresponding to the appropriate city/state.

- Step 2. Use the Review option to look over the content of the form. Don’t forget to read the description.

- Step 3. If you are not satisfied with the template, use the Search field at the top of the screen to find alternative versions of the legal document template.

- Step 4. Once you have located the form you need, click the Get now button. Select the pricing plan that suits you and enter your credentials to register for an account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Fill out, edit, and print or sign the Connecticut Direct Deposit Form for Stimulus Check.

Form popularity

FAQ

If you did not receive your stimulus checks, you can still obtain them by filing your tax return accurately. Make sure to include any amounts owed as recovery rebate credits on your form. Submitting a Connecticut Direct Deposit Form for Stimulus Check can simplify the process of receiving these funds directly to your bank account. If you have further questions, consider reaching out to the IRS or a tax expert for more assistance.

Yes, you can claim your $1400 stimulus check if you qualify, even if you missed the initial distribution. By filing your tax return, you can include the amount as a recovery rebate credit. Utilizing the Connecticut Direct Deposit Form for Stimulus Check can expedite the deposit of your payment into your bank account. Be sure to provide accurate information to avoid any delays in your claim.

To check your eligibility for the recovery rebate credit, start by reviewing your tax return for the year in question. You need to meet specific income criteria, and ensure you have filed your taxes correctly. Using the Connecticut Direct Deposit Form for Stimulus Check can help streamline the process of receiving your credit, should you qualify. For further guidance, you may visit the IRS website or consult a tax professional.

To check if you qualify for the stimulus check, review the income thresholds based on your tax filing status. Additionally, if you filed your taxes, you will receive notifications from the IRS about your eligibility. You can streamline receiving your stimulus by utilizing the Connecticut Direct Deposit Form for Stimulus Check to ensure direct deposit of funds.

You may qualify for the recovery rebate credit if your income in the tax year falls within the eligible limits. This credit is typically available to those who did not receive their full stimulus payment. Using the Connecticut Direct Deposit Form for Stimulus Check can help in receiving any expected credits directly into your bank account.

To change your direct deposit for a stimulus check, you will need to complete the IRS's direct deposit update process. You can do this using the Connecticut Direct Deposit Form for Stimulus Check, ensuring your new banking information is submitted correctly. Remember to check that your new bank account supports direct deposits.

You can track your $1400 stimulus check status using the IRS's online tool, ‘Get My Payment.’ Simply enter your personal information to see if your payment has been issued. If you opted for direct deposit, using the Connecticut Direct Deposit Form for Stimulus Check can expedite this process.

To determine if you qualify for the $1400 stimulus, check your adjusted gross income on your tax return. If your income falls within the qualifying range, you are likely eligible for the check. Using the Connecticut Direct Deposit Form for Stimulus Check can help ensure that you receive your funds promptly if you qualify.

Individuals with an adjusted gross income of up to $75,000, or $150,000 for married couples filing jointly, typically qualify for the $1400 IRS stimulus checks. Additionally, dependents under the age of 18 may also qualify for this benefit. To receive your payment quickly, you can use the Connecticut Direct Deposit Form for Stimulus Check to ensure direct deposit to your bank account.

Qualification for the stimulus check broadly includes individuals and families meeting specific income thresholds. Many Connecticut residents will qualify if they filed their taxes and accurately completed the Connecticut Direct Deposit Form for Stimulus Check. It’s beneficial to refer to IRS guidelines for detailed qualification criteria.

More info

Form for the personal and business user. Payment to the bill collector. The Eviction Notices Form United States Government Official website of Eviction forms which collects and manages eviction notices online. Form for the personal and business user. Payment to the bill collector. The Personal Advance Directive (PAD) Document United States Government Official website of Advance directive documents which helps you change your mind about the living will, will or advance-draft statement. This important document is not usually given to the hospital and medical institutions. The document is required to be filed with a medical facility by the person who makes the advance directive. The Power of Attorney for Personal and Business Affairs (SOFA) Document United States Government Official website of Power of attorney for personal and business affairs document that is used by the deceased to make final living acts and decisions. This is not a person living will document.