Colorado Daily Accounts Receivable

Description

How to fill out Daily Accounts Receivable?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal document templates that you can download or print.

On the website, you’ll find thousands of forms for both business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Colorado Daily Accounts Receivable in just minutes.

If you already hold a membership, Log In to download the Colorado Daily Accounts Receivable from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Process the transaction. Use a credit card or PayPal account to finalize the transaction.

Select the format and download the form onto your device. Make changes. Fill out, edit, print, and sign the downloaded Colorado Daily Accounts Receivable. Each document you add to your account does not have an expiration date and is yours indefinitely. Thus, if you wish to download or print another copy, simply navigate to the My documents area and click on the form you need. Gain access to the Colorado Daily Accounts Receivable with US Legal Forms, the most comprehensive library of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- Ensure that you have selected the correct form for your city/region.

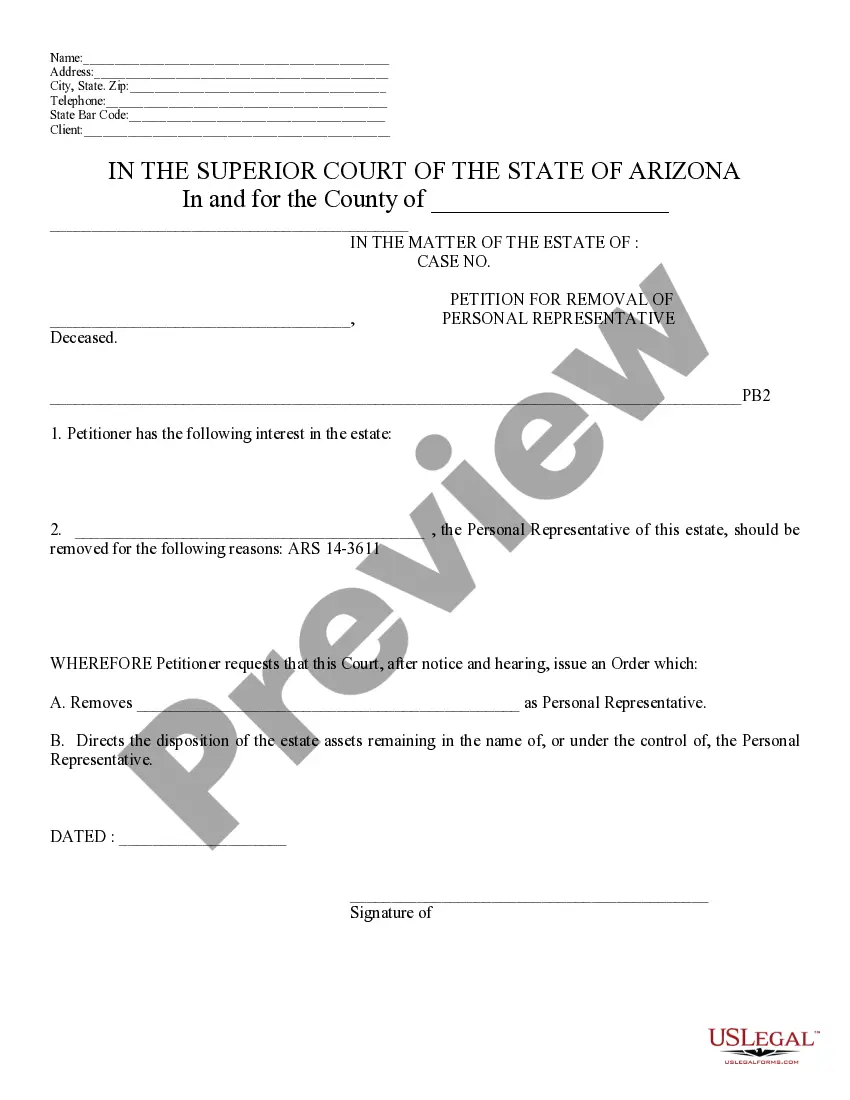

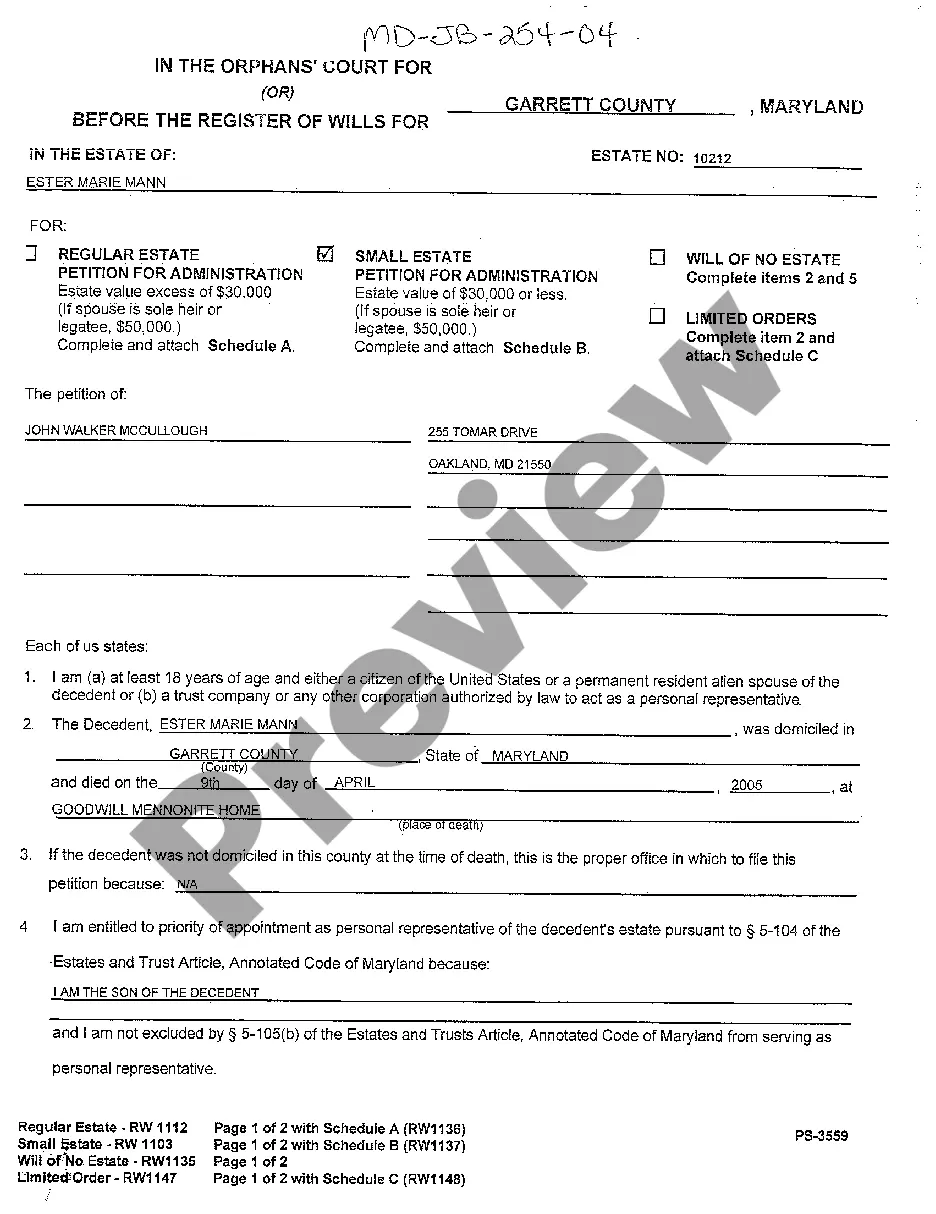

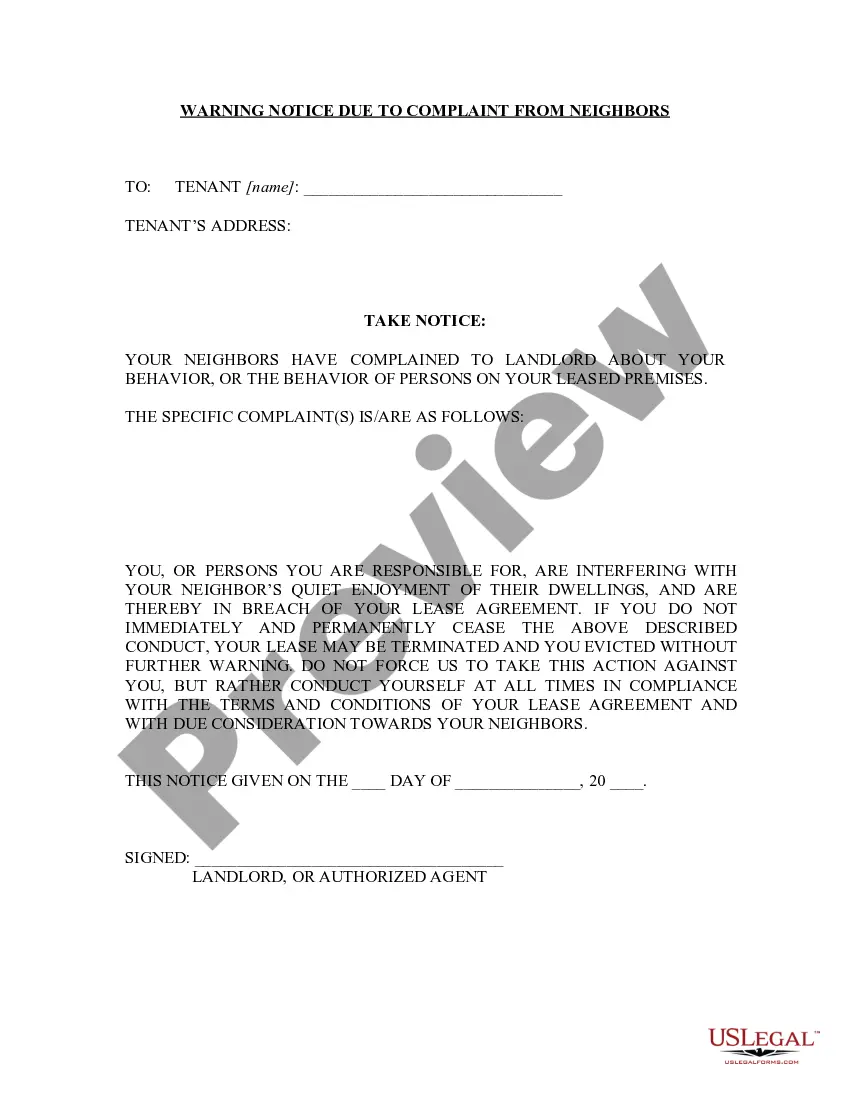

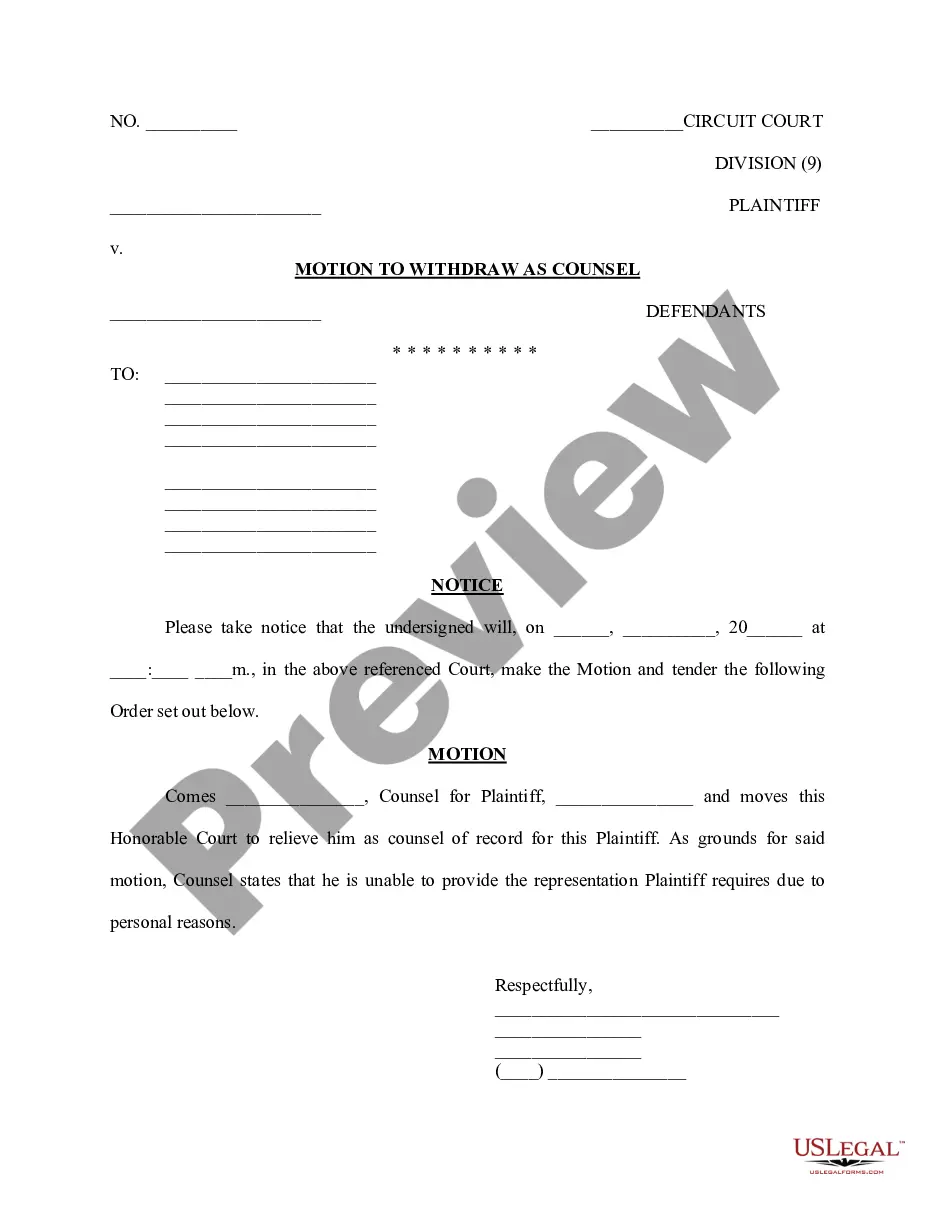

- Click on the Review button to examine the content of the form.

- Check the form details to confirm that you have chosen the appropriate form.

- If the form does not meet your requirements, utilize the Search feature at the top of the screen to find one that does.

- When you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Next, select your preferred pricing plan and provide your credentials to register for an account.

Form popularity

FAQ

You can find your accounts receivable balance under the 'current assets' section on your balance sheet or general ledger. Accounts receivable are classified as an asset because they provide value to your company. (In this case, in the form of a future cash payment.)

Accounts receivable are reported as a line item on the balance sheet. Supplementary reports, such as the accounts receivable aging report, provide further detail. Balance sheet: Accounts receivable are a line item in a balance sheet.

On a trial balance, accounts receivable is a debit until the customer pays. Once the customer has paid, you'll credit accounts receivable and debit your cash account, since the money is now in your bank and no longer owed to you. The ending balance of accounts receivable on your trial balance is usually a debit.

To calculate days in AR,Compute the average daily charges for the past several months add up the charges posted for the last six months and divide by the total number of days in those months.Divide the total accounts receivable by the average daily charges. The result is the Days in Accounts Receivable.

At its simplest, accounts receivable days is a mathematical formula that lets you work out how long your accounts receivable takes to clear. The easiest way to think of it is the number of days the average invoice will remain outstanding before payment is made.

While recording the invoice journal entry, you need to debit the accounts receivable account for the amount due from your customer and credit the sales account for the same amount. You also need to post the cost of goods sold journal entry to update your inventory.

Account Receivable is an account created by a company to record the journal entry of credit sales of goods and services, for which the amount has not yet been received by the company. The journal entry is passed by making a debit entry in Account Receivable and corresponding credit entry in Sales Account.

Divide the total number of accounts receivable during a given period by the total dollar value of credit sales during the same period, then multiply the result by the number of days in the period being measured.

How to create an accounts receivable aging reportStep 1: Review open invoices.Step 2: Categorize open invoices according to the aging schedule.Step 3: List the names of customers whose accounts are past due.Step 4: Organize customers based on the number of days outstanding and the total amount due.

Account receivables are classified as current assets assuming that they are due within one year. To record a journal entry for a sale on account, one must debit a receivable and credit a revenue account. When the customer pays off their accounts, one debits cash and credits the receivable in the journal entry.