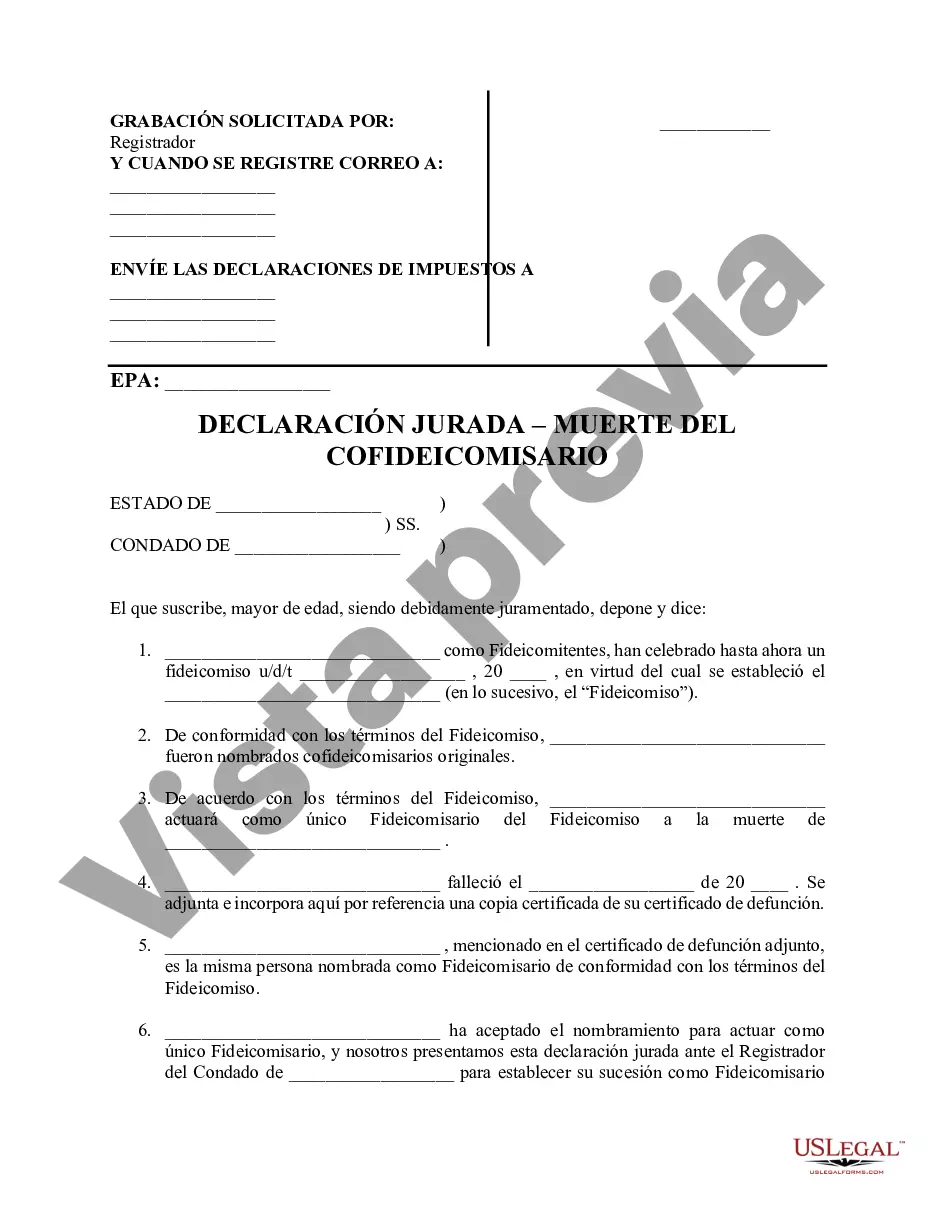

Colorado Declaración Jurada - Fallecimiento del Co-Fideicomisario - Colorado Affidavit - Death of Co-Trustee

Description

Key Concepts & Definitions

Affidavit Death of Co-Trustee: This document confirms the death of a co-trustee within a trust, allowing the surviving trustee or successor trustee to manage the trust assets effectively. Surviving Spouse: The legally married partner of the deceased. Estate Settlement: Refers to the process of transferring the deceased's assets to the beneficiaries as per the trust or will. Successor Trustee: An individual nominated in the trust to handle trust assets and responsibilities after a trustees death.

Step-by-Step Guide: Filing an Affidavit Death of Co-Trustee

- Gather Required Documents: Obtain a death certificate of the deceased trustee and any accompanying trust documents.

- Fill Out the Affidavit Form: Complete the affidavit ensuring accuracy in details about the deceased trustee, surviving spouse, and trust details.

- Signature and Notarization: The successor trustee may need to sign the affidavit in the presence of a notary.

- File the Affidavit: Submit the affidavit to relevant institutions like banks or real estate entities to update records and continue management of the estate without interruption.

Risk Analysis for Not Properly Handling Affidavit Death of Co-Trustee

- Legal Complications: Failure to promptly and accurately file can lead to potential legal challenges or issues in estate settlement.

- Assets Mismanagement: Delay in updating trustee information can affect the management and distribution of trust assets.

- Financial Delays: Inaccurate or late filings might cause delays in operations involving real estate and other assets, affecting beneficiaries financially.

Best Practices in Managing Estate Settlement

- Ensure all documents, including the death certificate and trust agreements, are readily available.

- Work closely with a legal advisor to understand the implications of the affidavit death on the estate settlement.

- Notify all relevant parties involved, including financial institutions and real estate offices, about the trustee change.

Common Mistakes & How to Avoid Them

- Incomplete Documentation: Double-check all forms for completeness before filing. Missing information can delay the process.

- Delay in Filing: File the affidavit death of co-trustee as soon as possible to avoid complications in managing the estate.

- Not Consulting Legal Experts: Its advisable to engage with legal professionals, especially in complex estates, to ensure compliance with all legal requirements.

How to fill out Colorado Declaración Jurada - Fallecimiento Del Co-Fideicomisario?

Utilize US Legal Forms to acquire a printable Colorado Affidavit - Death of Co-Trustee.

Our court-admissible documents are composed and routinely revised by qualified lawyers.

Our collection comprises the most comprehensive Forms catalog online and provides economical and precise templates for individuals, attorneys, and small to medium-sized businesses.

Examine the document by reading its description and using the Preview feature. Press Buy Now if it’s the document you require. Create your account and complete payment via PayPal or credit card. Download the form to your device and feel free to reuse it multiple times. Employ the Search engine if you need to locate another document template. US Legal Forms provides a vast array of legal and tax samples and packages for both business and personal requirements, including the Colorado Affidavit - Death of Co-Trustee. Over three million users have already successfully employed our service. Choose your subscription plan and obtain high-quality forms in just a few clicks.

- Templates are sorted into state-specific categories.

- Numerous templates can be previewed prior to downloading.

- In order to download samples, users must possess a subscription and Log In to their account.

- Click Download next to any template required and locate it in My documents.

- For those who do not have a subscription, follow these steps to rapidly find and download the Colorado Affidavit - Death of Co-Trustee.

- Ensure you obtain the correct template corresponding to the relevant state.

Form popularity

FAQ

En caso de que en el testamento figure el nuevo dueno de la propiedad del difunto, este testamento debe legitimarse para poder cambiar el propietario. Se debe presentar el testamento en el tribunal testamentario y el albacea de la herencia darA¡ inicio al proceso de legitimaciA³n.

Si muere sin conyuge y sin hijos, lo mA¡s probable es que la herencia pase a sus padres si todavAa viven. Si no hay padres a quien heredar. Entonces la propiedad podrAa ir a manos de sus hermanos, y si no hay hermanos, el patrimonio se destinarAa a los abuelos, o tAos, o primos cercanos de la persona fallecida.

En primer lugar, heredaran los hijos o descendientes del fallecido o causante. Si el fallecido deja viudo o viuda, tendrA¡ derecho al usufructo de una tercera parte de la herencia (tercio de mejora) En segundo lugar, si el fallecido no tuviera hijos o nietos, heredarA¡n los ascendientes del fallecido o causante.

La declaratoria de herederos es una resolucion dictada por un juezpor la cual se reconoce el carA¡cter de heredero universal a una o varias personas. Se declara que una o varias personas son las herederas del fallecido. Se necesita previo a realizar la sucesiA³n o en caso de querer vender los bienes del causante.

Para que una propiedad pueda ser entregada a los familiares de un fallecido o a un tercero en los terminos legales correspondientes. Lo primero que se debe hacer es acudir ante un notario o juez familiar y solicitar un juicio de SUCESIAN INTESTAMENTARIA.

- Si el fallecido no tuviera hijos o nietos, heredaran los ascendientes, el padre y la madre por partes iguales. Si el fallecido deja viudo o viuda, tendrA¡ derecho al usufructo de la mitad de la herencia. Si a la fecha de fallecimiento vive uno solo de los padres serA¡ el que herede todo.

Lo que necesitas hacer es demandar al albacea de cujus al juicio de otorgamiento de firma.

¿QuA© pasa si una persona muere y no deja testamento? Si una persona muere y no dejA³ testamento (muere intestada), entonces se abrirA¡ la sucesiA³n legAtima. Es decir, heredarA¡n los familiares siguiendo un orden de parentesco y de acuerdo a lo establecido en la ley.

Este bien puede ser una vivienda, por supuesto. Este derecho puede constituirse por un tiempo determinado hasta un maximo de 30 aA±os, o de manera vitalicia, es decir, hasta el fallecimiento del usufructuario. Existen, por lo tanto, dos modalidades en funciA³n del acuerdo llevado a cabo entre las dos partes.