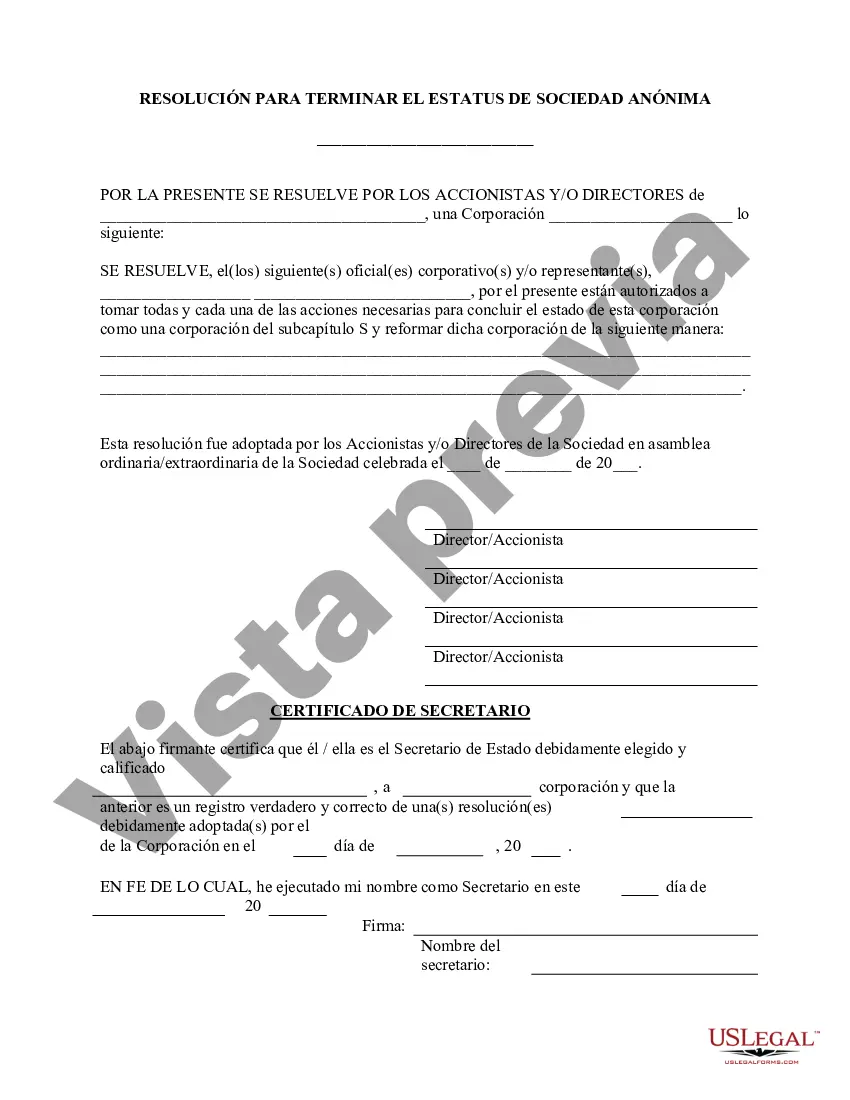

California Terminate S Corporation Status — Resolution For— - Corporate Resolutions is a legal document that enables a California S Corporation to terminate it's S Corporation status. This resolution form is utilized by business owners who want their corporation to revert from being an S Corporation to a regular C Corporation. By completing this form, corporations can effectively terminate their S Corporation status and transition to a new tax structure. The California Terminate S Corporation Status — Resolution For— - Corporate Resolutions is an essential tool for corporations seeking to make changes to their tax status. It provides a standardized format for documenting the decision to terminate S Corporation status and guides corporations through the necessary steps to ensure compliance with California state regulations. When using the California Terminate S Corporation Status — Resolution For— - Corporate Resolutions, there are typically two primary types of termination that can be pursued: 1. Voluntary Termination: This type of termination occurs when the shareholders and board of directors of the S Corporation voluntarily decide to cease operating as an S Corporation. They may choose this option if they believe it is more advantageous for the company to operate as a regular C Corporation. In such cases, the S Corporation must adopt a formal resolution to terminate it's S status and file the necessary paperwork with the California Secretary of State. 2. Involuntary Termination: This type of termination occurs when the S Corporation fails to meet the eligibility requirements set by the Internal Revenue Service (IRS). The IRS may revoke the S Corporation status if the corporation exceeds the maximum allowable number of shareholders (100) or if any shareholder is not eligible to hold S Corporation stock. In such cases, the corporation must take the necessary steps to terminate it's S Corporation status and revert to a C Corporation. Regardless of the type of termination, the California Terminate S Corporation Status — Resolution For— - Corporate Resolutions serves as the official record of the corporation's decision to terminate it's S Corporation status. The form typically includes details such as the corporation's name, date of adoption, the specific resolution to terminate the S status, and the signatures of the individuals authorizing the termination. It is vital to consult with an attorney or tax professional when using the California Terminate S Corporation Status — Resolution For— - Corporate Resolutions to ensure that all legal requirements are met and that the proper steps are followed for a smooth transition from an S Corporation to a C Corporation. Failure to comply with state and federal regulations could result in legal and financial consequences for the corporation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.California Terminar el estado de la corporación S - Formulario de resolución - Resoluciones corporativas - Terminate S Corporation Status - Resolution Form - Corporate Resolutions

Description

How to fill out California Terminar El Estado De La Corporación S - Formulario De Resolución - Resoluciones Corporativas?

You can utilize your time online searching for the sanctioned document template that meets your local and national requirements.

US Legal Forms offers a vast array of legal templates that have been reviewed by professionals.

It's easy to obtain or print the California Terminate S Corporation Status - Resolution Form - Corporate Resolutions from their service.

If available, click the Review button to examine the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Acquire button.

- After that, you can complete, modify, print, or sign the California Terminate S Corporation Status - Resolution Form - Corporate Resolutions.

- Every legal document template you acquire belongs to you permanently.

- To access another copy of any downloaded template, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the appropriate document template for the state/city you desire.

- Review the document description to confirm you have chosen the correct template.

Form popularity

FAQ

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

Board resolutions should be written on the organization's letterhead. The wording simply describes the action that the board agreed to take. It also shows the date of the action and it names the parties to the resolution.

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

A corporate resolution form is used by a board of directors. Its purpose is to provide written documentation that a business is authorized to take specific action. This form is most often used by limited liability companies, s-corps, c-corps, and limited liability partnerships.

Types of Corporate Resolutions A resolution might outline the officers that are authorized to act (trade, assign, transfer or hedge securities and other assets) on behalf of the corporation. The resolution would outline who is authorized to open a bank account, withdraw money, and write checks.

In fact, all states require C-corporations and S-corporations to issue corporate resolutions to document important board of director decisions. Resolutions are required even if you're the sole shareholder of your corporation and the only member of the board.

Who needs to sign a board resolution? The board members need to sign the board resolution. The President and Secretary only need to sign when the resolution is certified. But they can sign an uncertified board resolution as well, but it is not required.

All Resolved clauses within a resolution should use the objective form of the verb (for example, Resolved, that the American Library Association (ALA), on behalf of its members: (1) supports...; (2) provides...; and last resolved urges....") rather than the subjunctive form of the verb (for example, Resolved,

A resolution can be made by a corporation's board of directors, shareholders on behalf of a corporation, a non-profit board of directors, or a government entity.