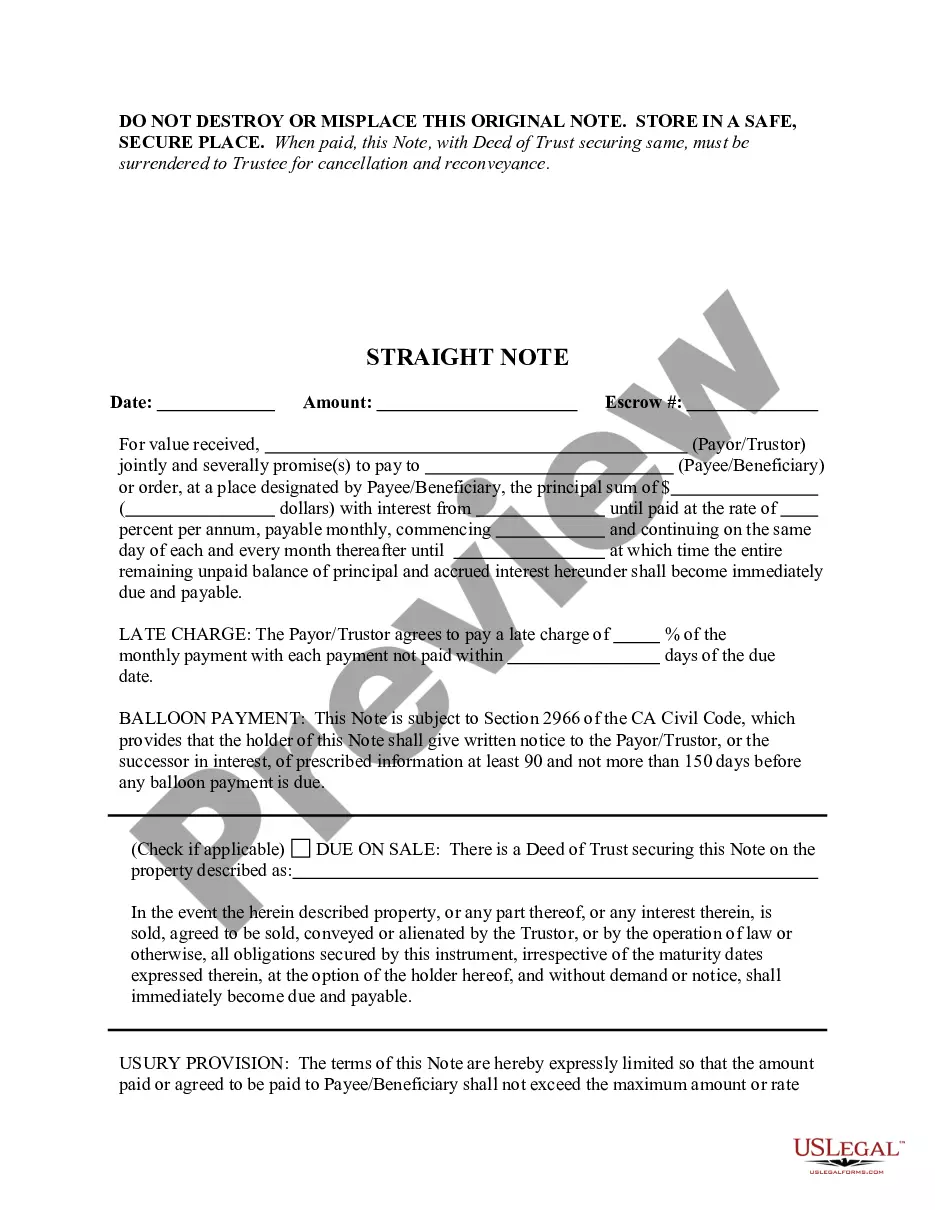

California Straight Note

Definition and meaning

A California Straight Note is a type of promissory note that represents a promise to pay a specific amount of money at a specified date or upon demand. It is a written, legally binding agreement between a borrower (Payor/Trustor) and a lender (Payee/Beneficiary). The borrower agrees to repay the principal amount along with interest as outlined in the note. This instrument is commonly used in real estate transactions and other financial agreements to secure loans or credits.

Key components of the form

The California Straight Note includes several important components that outline the terms of the loan:

- Date: The date the note is executed.

- Principal Amount: The total amount the borrower is agreeing to repay.

- Interest Rate: The rate at which interest will accrue on the principal amount.

- Payment Schedule: The timing of payments, including monthly installments, and the start date for payments.

- Late Charge: The fee incurred for late payments.

- Balloon Payment: Information regarding any large payment due at the end of the note term.

- Usury Provision: A clause ensuring that interest rates do not exceed legal limits.

How to complete a form

When filling out a California Straight Note, follow these steps:

- Enter the date on which the note is executed.

- Specify the total principal amount in both numeric and written form.

- Determine and write the annual interest rate applied to the principal.

- Set the commencement date for payments and indicate the specific schedule.

- Include the late charge percentage and the grace period allowed before the charge applies.

- If applicable, check the appropriate box regarding the due on sale clause and provide property details.

Ensure all parties involved sign and date the document to finalize the agreement.

Who should use this form

The California Straight Note is suitable for:

- Individuals who are borrowing money for personal or business purposes.

- Real estate investors financing a property purchase.

- Lenders looking to formalize a loan agreement with borrowers.

- Parties involved in transactions requiring a clear repayment structure.

Users should ensure compliance with state laws and consult a licensed attorney if necessary.

Form popularity

FAQ

Straight Notes - YouTube YouTube Start of suggested clip End of suggested clip Occasionally though this interest is paid periodically. During the term of the straight. Note suchMoreOccasionally though this interest is paid periodically. During the term of the straight. Note such as monthly payments of only interest with the principal all due at the end of the term.

A straight note calls for the entire amount of its principal together with accrued interest to be paid in a single lump sum when the principal is due. Unlike in the installment note variations, a straight note does not include periodic payments of principal. See RPI Form 423

Straight Note ? payment of interest and principal are due at one time in one lump sum.

What is a Promissory Note Secured By Deed Of Trust? A promissory note secured by deed of trust is a type of loan document that details how and when a borrower will repay money to a lender. A promissory note is a kind of IOU that's secured by property, often property that the borrower owns.

Another instance when the straight note is used in real estate is for evidence of short-term real estate commitments. For example, if someone wants to purchase a property, but the funds necessary for the closing might take a while to be granted, a straight note works as a bridge loan.

Straight Note ? payment of interest and principal are due at one time in one lump sum.

While a deed of trust describes the terms of debt as secured by a property, a promissory note acts as a promise that the borrower will pay the debt. A borrower signs the promissory note in favor of a lender. The promissory note includes the loan's terms, such as payment obligations and the loan's interest rate.