Revocación de Fideicomiso en Vida - California Revocation of Living Trust

Description

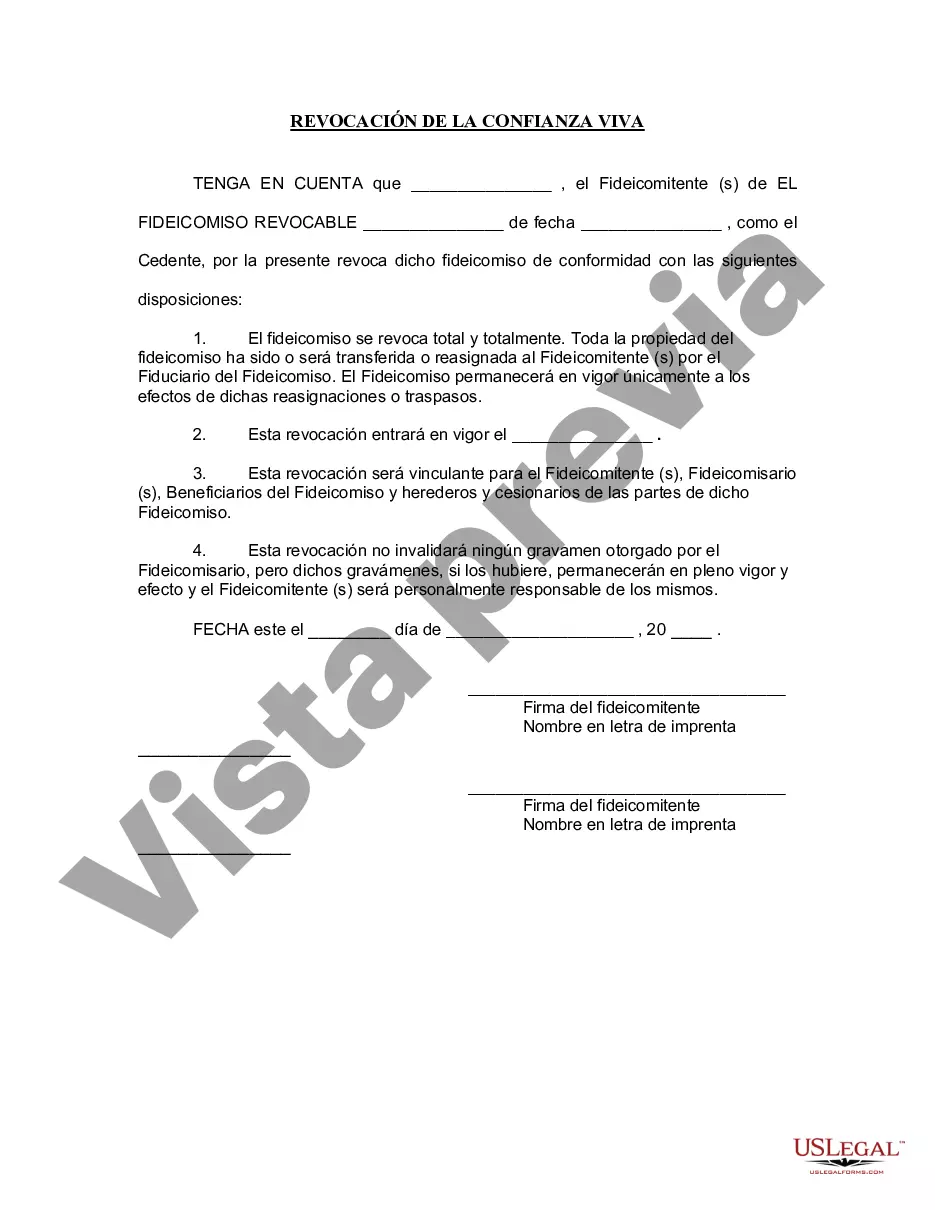

How to fill out California Revocación Del Fideicomiso En Vida?

If you seek precise California Revocation of Living Trust forms, US Legal Forms is the solution you require; obtain documents crafted and verified by state-certified attorneys.

Using US Legal Forms not only spares you from worries about legal documents; it also conserves your time, effort, and finances! Downloading, printing, and submitting a professional template is notably more economical than hiring an attorney to do it for you.

And that’s it. In just a few straightforward steps, you possess an editable California Revocation of Living Trust. Once your account is established, all future requests will be handled even more effortlessly. If you have a US Legal Forms subscription, just Log In to your profile and click the Download button visible on the form’s page. Then, when you need to use this template again, you’ll always be able to find it in the My documents section. Don’t waste your time and energy comparing countless forms across various websites. Purchase accurate templates from a single reliable source!

- To start, complete your registration process by entering your email and creating a password.

- Follow the instructions outlined below to set up your account and locate the California Revocation of Living Trust example to address your situation.

- Employ the Preview feature or review the document details (if available) to ensure that the form is the one you need.

- Verify its relevance in your residing state.

- Click Buy Now to place your order.

- Choose a preferred pricing plan.

- Create your account and pay using your credit card or PayPal.

- Select a convenient format and save the form.

Form popularity

FAQ

El art. 25 dispone que el Fideicomiso se extingue por a) cumplimiento del plazo o condicion o el vencimiento del plazo mA¡ximo legal (30 aA±os).

El articulo 822 del CA³digo Civil colombiano, enumera seis causales por las cuales se extingue el fideicomiso:Por la restituciA³n.Por retroventa.Por la destrucciA³n de la cosa.Por la renuncia del fideicomisario.Por faltar la condiciA³n o no haberse cumplido en tiempo hA¡bil.More items...a¢Feb 15, 2021

Un fideicomiso en vida revocable (conocido en ingles como un revocable living trust) es un documento legal que le da la autoridad para tomar decisiones sobre el dinero o los bienes de otra persona mantenidos en un fideicomiso.

El articulo 822 del CA³digo Civil colombiano, enumera seis causales por las cuales se extingue el fideicomiso:Por la restituciA³n.Por retroventa.Por la destrucciA³n de la cosa.Por la renuncia del fideicomisario.Por faltar la condiciA³n o no haberse cumplido en tiempo hA¡bil.More items...a¢Feb 15, 2021

Un fideicomiso revocable es un fideicomiso donde el dinero permanece liquido; Se puede sacar de nuevo. Un fideicomiso irrevocable es un fideicomiso donde el dinero no puede ser retirado nuevamente.

Un fideicomiso irrevocable no se puede modificar, enmendar ni rescindir sin el permiso del beneficiario o beneficiarios nombrados por el otorgante. El otorgante, tras haber transferido los activos al fideicomiso, elimina efectivamente todos sus derechos de propiedad sobre los activos y el fideicomiso.

7) EL FIDUCIANTE NO PUEDE REVOCAR EL FIDEICOMISO: es la so- lucion de la ley. Pero el fiduciante puede cambiarla, reservA¡ndose esa facultad en el contrato (art. 25A° inc.

Adj. Que se puede o se debe revocar.