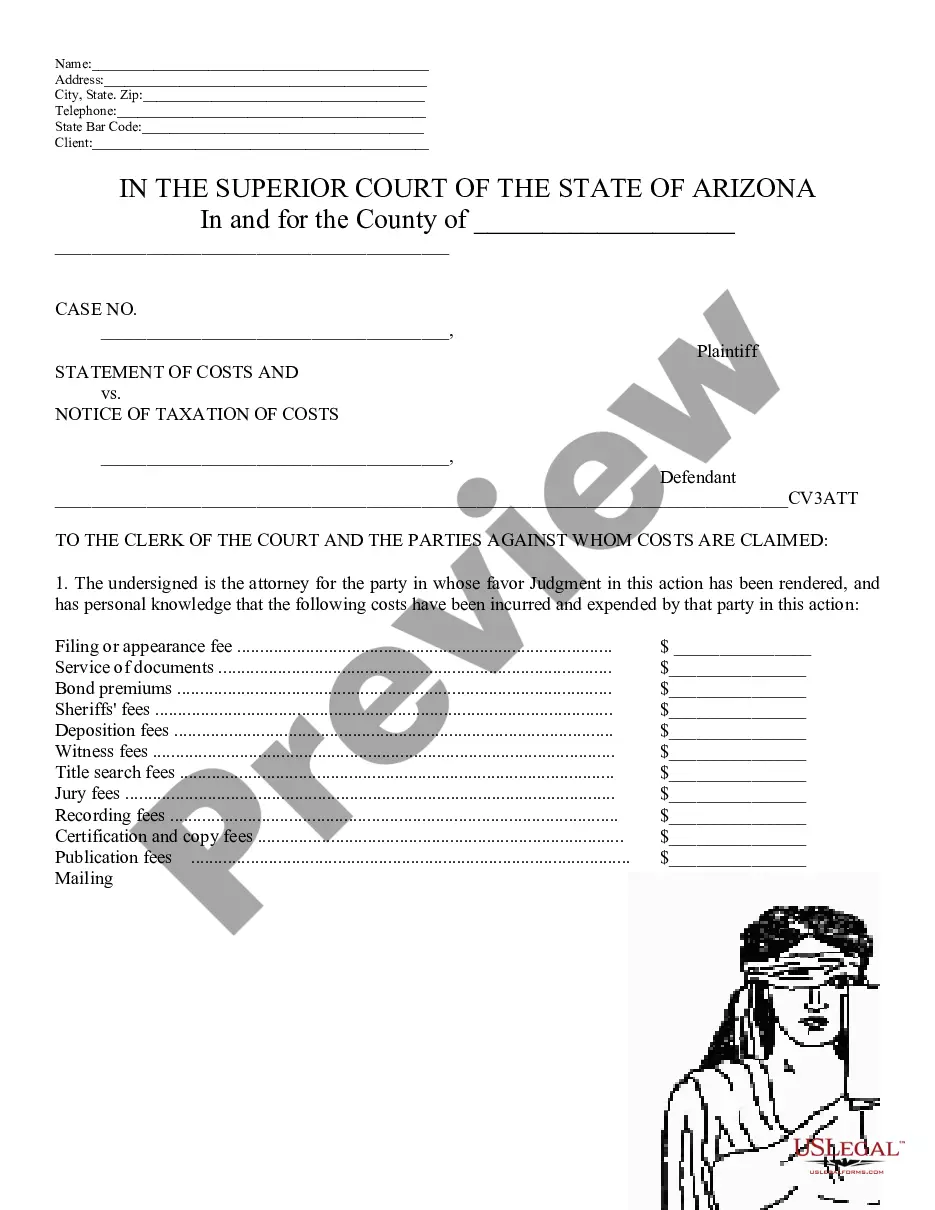

Arizona Statement of Costs and Notice of Taxation of Costs

Definition and meaning

The Arizona Statement of Costs and Notice of Taxation of Costs is a legal document used in court proceedings to claim costs associated with a lawsuit. This document serves as a formal request for the court to tax costs against the opposing party after a judgment has been rendered in favor of one party. The costs documented can include filing fees, witness fees, and other litigation-related expenses.

How to complete a form

To properly complete the Arizona Statement of Costs and Notice of Taxation of Costs, follow these steps:

- Begin by filling out your name and address at the top of the form.

- Include the case number and the names of the plaintiff and defendant.

- Detail the costs incurred in the action, listing each type of cost separately along with the amount claimed.

- Review the entire form for accuracy.

- Sign the document before a notary public to authenticate it.

Who should use this form

The Arizona Statement of Costs and Notice of Taxation of Costs should be used by parties who have successfully obtained a judgment in a civil case and who wish to recover litigation costs from the opposing party. This typically includes attorneys representing clients in various types of cases, such as personal injury, breach of contract, or family law matters.

Key components of the form

Important sections of the Arizona Statement of Costs and Notice of Taxation of Costs include:

- Filing or Appearance Fee: The amount paid to submit documents to the court.

- Service of Documents: Costs incurred to deliver legal documents to parties involved.

- Witness Fees: Compensation for witnesses who testify in court.

- Total Costs: The sum of all expenses claimed in the document.

Common mistakes to avoid when using this form

When submitting the Arizona Statement of Costs and Notice of Taxation of Costs, consider the following common mistakes:

- Failing to include all relevant costs, which can reduce the recoverable amount.

- Incorrectly completing the form or providing incomplete information.

- Not signing the form in front of a notary public, which is essential for its validity.

- Submitting the form late or missing filing deadlines.