10x30 Storage Unit Cost Fort Worth Tx

Description

How to fill out West Virginia Storage Business Package?

Managing legal documents and procedures can be a lengthy addition to your whole day.

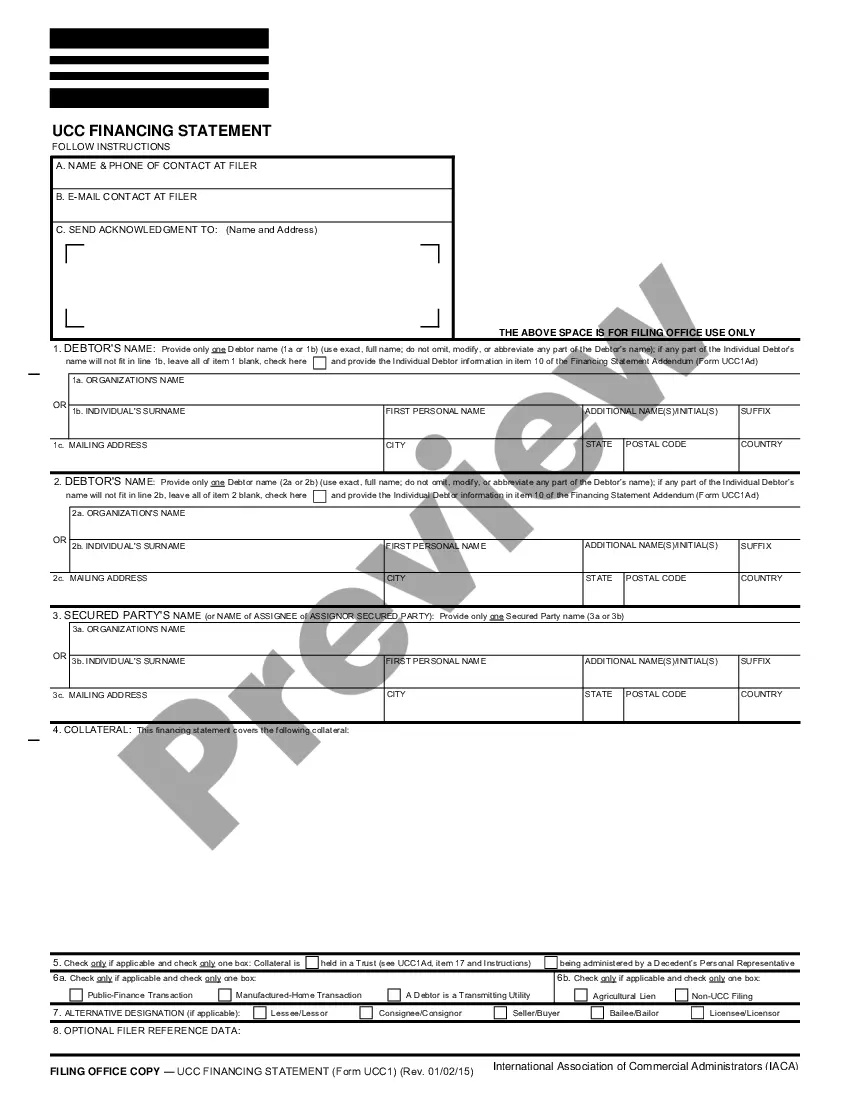

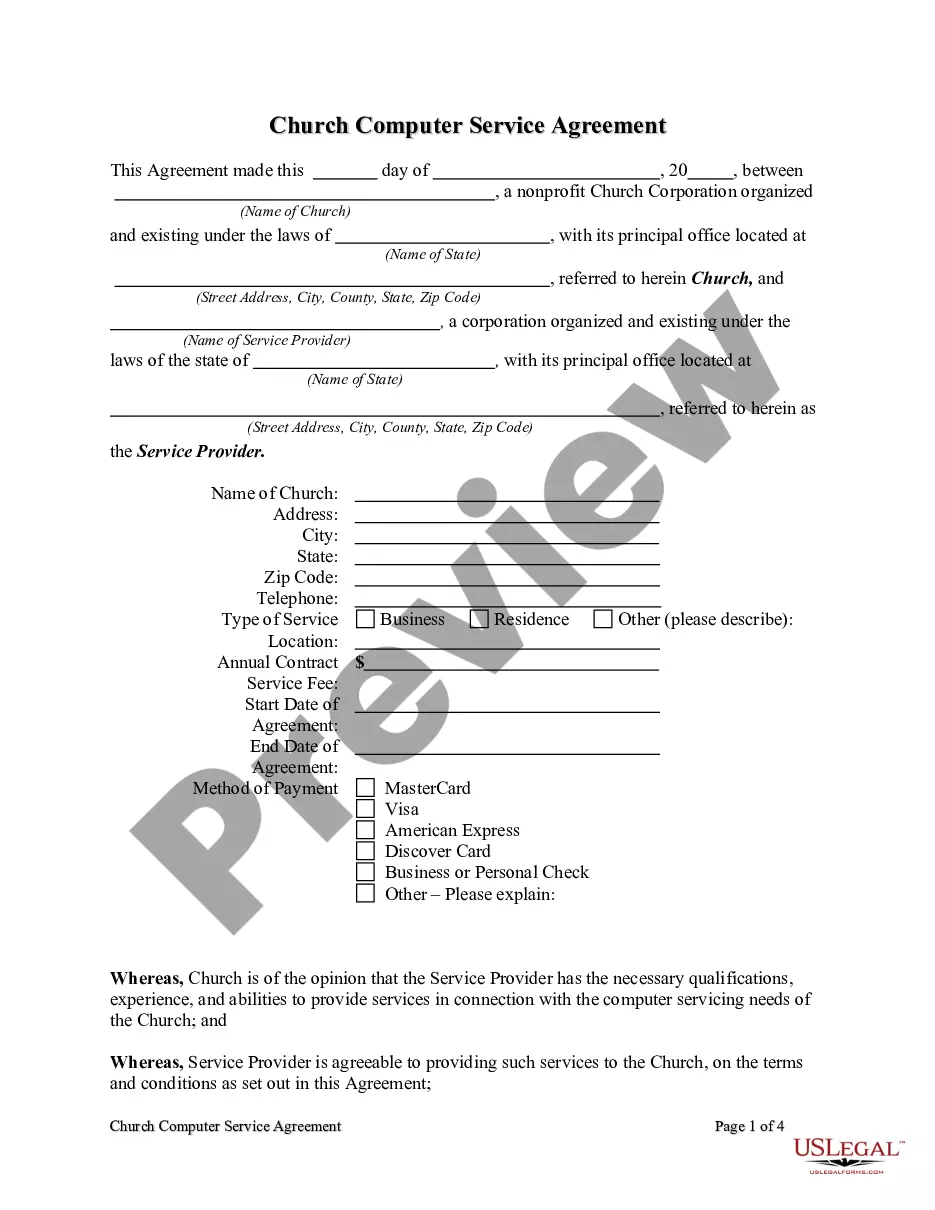

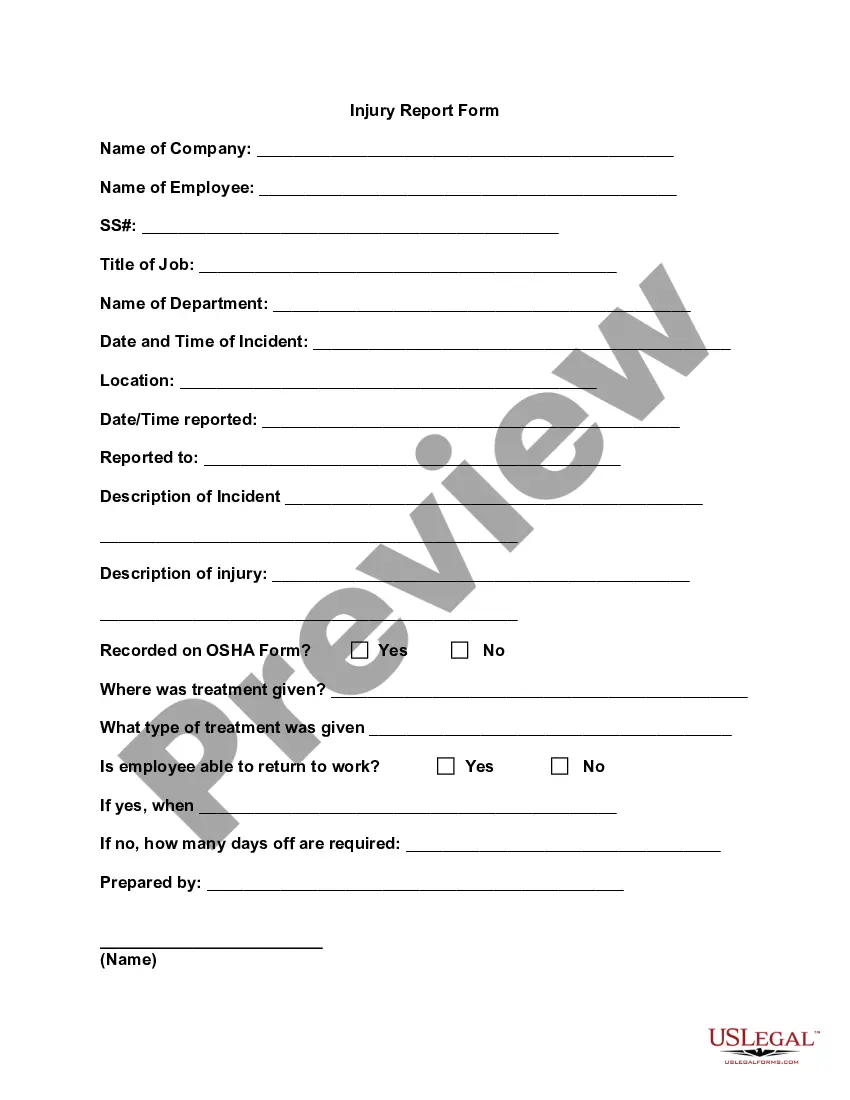

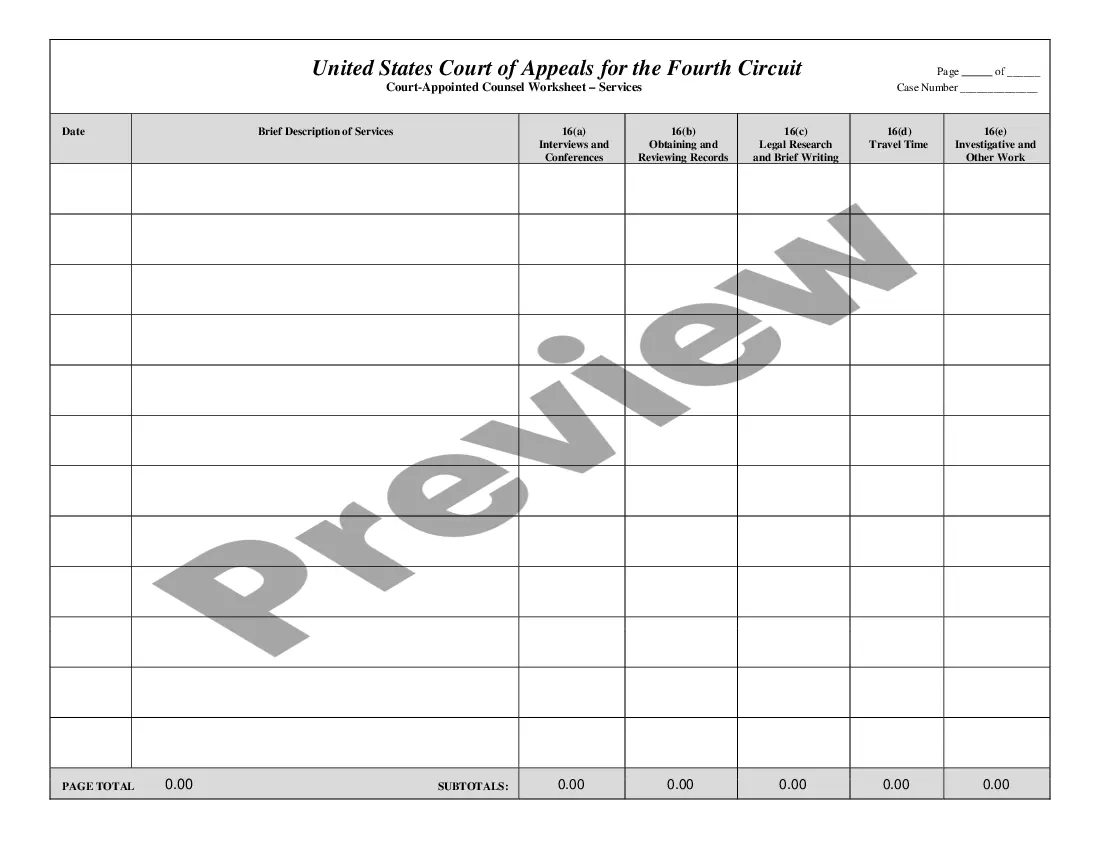

10x30 Storage Unit Price Fort Worth Tx and similar forms typically require you to look for them and navigate how to fill them out correctly.

Therefore, whether you are addressing financial, legal, or personal issues, having a comprehensive and accessible online library of documents at your disposal will be very beneficial.

US Legal Forms is the leading online platform for legal templates, providing over 85,000 state-specific documents along with various tools to help you complete your forms effortlessly.

Is it your first experience with US Legal Forms? Register and create an account in a matter of minutes and you’ll gain access to the document library and 10x30 Storage Unit Price Fort Worth Tx. Then, follow the steps listed below to finalize your document.

- Explore the collection of pertinent documents available with just one click.

- US Legal Forms grants you access to state- and county-specific papers that you can download at any time.

- Protect your document management processes by utilizing a top-notch service that allows you to create any form in a few minutes without extra or hidden fees.

- Simply Log In to your account, locate 10x30 Storage Unit Price Fort Worth Tx and download it instantly in the My documents section.

- You can also access previously saved documents.

Form popularity

FAQ

Anyone who is self employed with earnings more than $400 has tax obligations. That means paying Colorado self employment tax of 15.3%. Of that amount, 12.4% is dedicated to Social Security, old-age, survivors, and disability insurance, and 2.9% is dedicated to Medicare or hospital insurance.

Independent Contractor Rights and Overtime Pay Because, unlike employees, independent contractors generally are exempt from overtime and other minimum wage requirements, some employers attempt to circumvent Colorado state and federal wage laws by misclassifying employees as contractors.

Employers wishing to establish an independent contractor relationship should execute an agreement stating the individual is an independent contractor, as well as a disclosure in large font stating that the independent contractor is not entitled to unemployment insurance benefits unless unemployment compensation ...

How do I create an Independent Contractor Agreement? State the location. ... Describe the type of service required. ... Provide the contractor's and client's details. ... Outline compensation details. ... State the agreement's terms. ... Include any additional clauses. ... State the signing details.

In the State of Colorado, plumbing and electrical contractors must carry state-issued licenses, while general contractors have no statewide licensing requirements. That said, it doesn't absolve general contractors from licensing altogether. And all businesses need to register with the state.

You are probably an independent contractor if: You work for more than one company at a time. You pay your own business and traveling expenses. You hire and pay your own assistants. You can earn a profit or suffer a loss as result of your work for the company.

Ing to the law in Colorado, independent contractor taxes must be paid by the contractor as they are also classified as self-employed. This means that if you are an independent contractor, you must withhold your own local, state, and federal taxes and submit your tax report to the IRS on your own.

Unlike most other states in the U.S., Colorado does not require a general contractor licensing at the state level. However, most general contractor projects are regulated at the local level. You may have to get a license or permit in the counties and cities where you work.