10x30 Storage Unit Cost For Rent

Description

How to fill out West Virginia Storage Business Package?

Securing a reliable location to obtain the latest and suitable legal templates is a significant part of navigating bureaucracy.

Finding the appropriate legal documents requires precision and meticulousness, which is why it is essential to obtain samples of 10x30 Storage Unit Cost For Rent solely from trustworthy sources, such as US Legal Forms.

Once you have the form on your device, you can modify it using the editor or print it out and complete it manually. Remove the difficulties associated with your legal paperwork. Explore the extensive US Legal Forms catalog where you can discover legal templates, assess their applicability to your situation, and download them immediately.

- Utilize the catalog navigation or search bar to locate your template.

- Examine the description of the form to determine if it meets the standards of your state and locality.

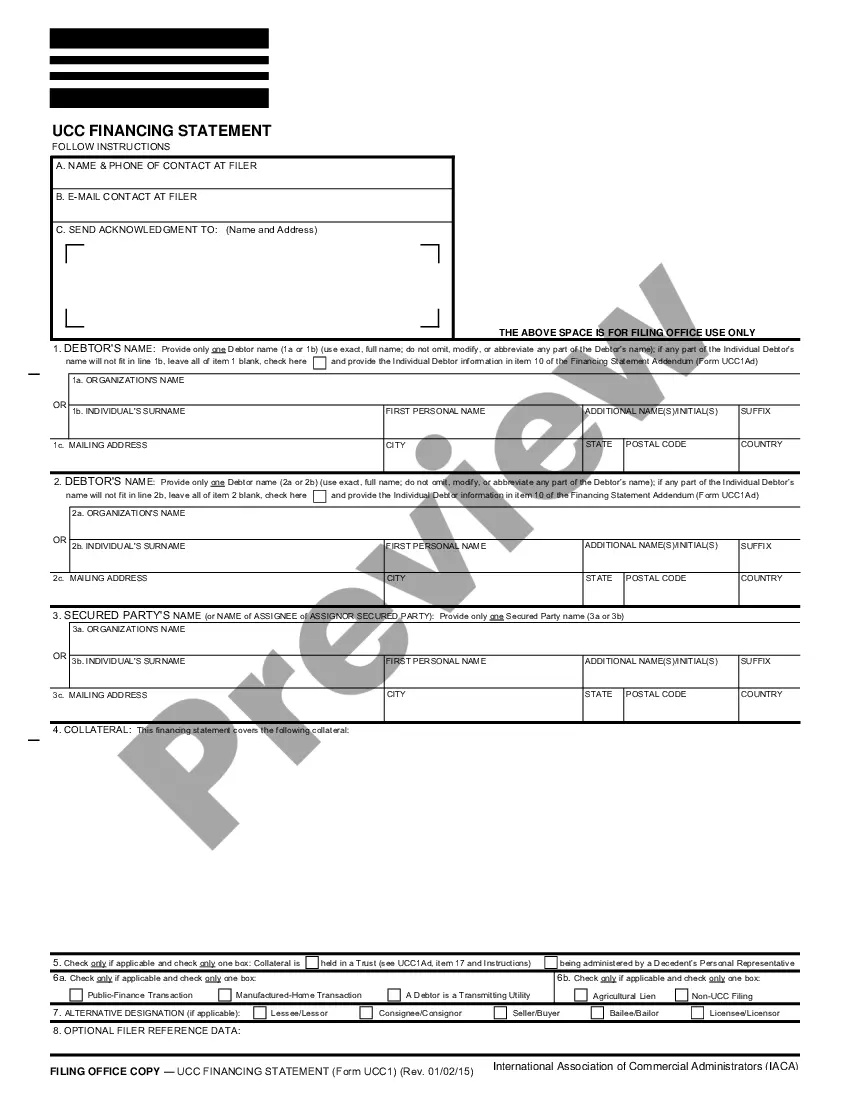

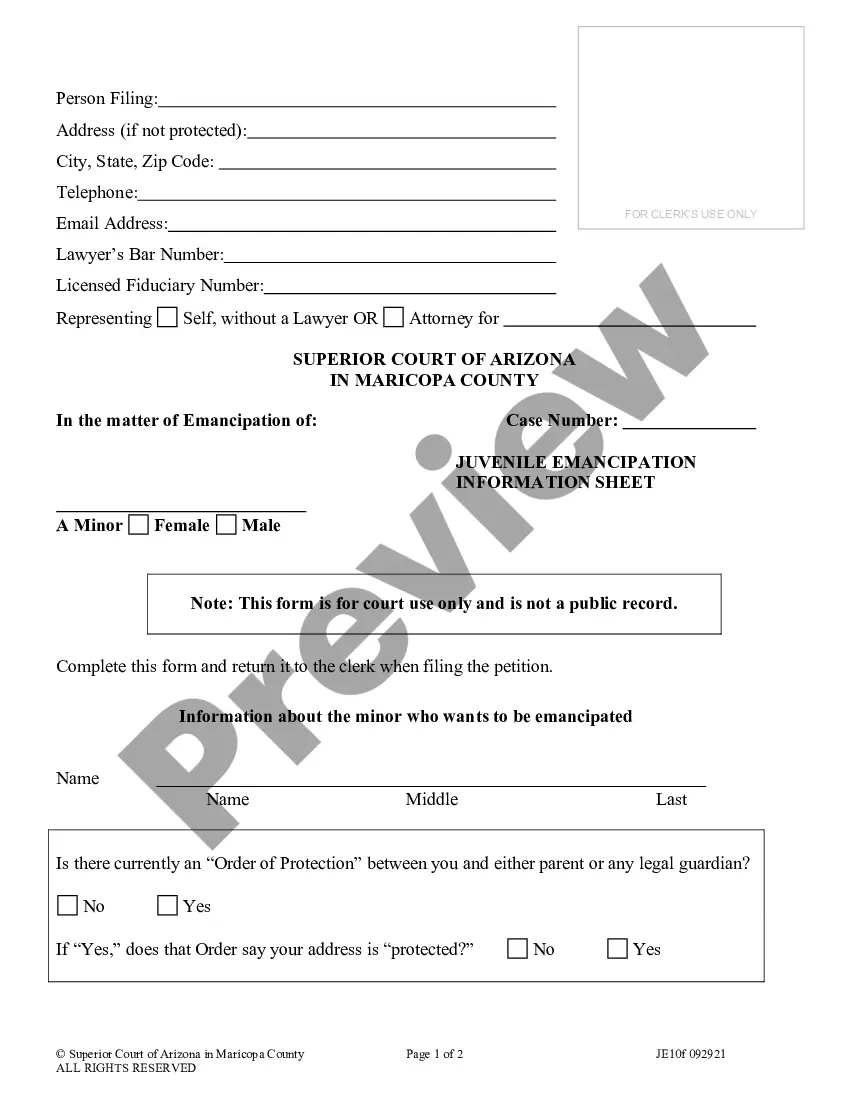

- Check the form preview, if available, to confirm that the document is what you seek.

- Continue your search and identify the correct template if the 10x30 Storage Unit Cost For Rent does not align with your needs.

- Once you are confident of the form’s applicability, download it.

- If you are an authorized user, click Log in to verify and access your selected templates in My documents.

- If you do not have an account yet, click Buy now to acquire the form.

- Choose the pricing plan that meets your preferences.

- Proceed with the registration to complete your purchase.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Select the file format for downloading the 10x30 Storage Unit Cost For Rent.

Form popularity

FAQ

Renting a storage unit, like a 10x30 storage unit, often proves to be cheaper than buying a shed. Consider the upfront costs of a shed, which include materials and construction, along with maintenance expenses. A rental typically offers flexibility; you can choose the duration that suits your needs without long-term commitments.

Yes, you can often deduct storage expenses if they relate directly to your rental property. This includes renting a 10x30 storage unit to hold items necessary for managing the property. Make sure to keep good records and differentiate between personal and rental-related storage costs. Consulting with a tax professional can help clarify this deduction.

To claim your storage unit on your taxes, you should maintain accurate records of your expenses. Ensure you separate personal from business expenses since only the latter is deductible. You can use a form like Schedule C to report these costs if you run a business from your rented 10x30 storage unit. This can help reduce your overall taxable income.

How Much Does a Business License Cost in Colorado? In the state of Colorado, the price for a standard business operating license can vary from city to city and some cities even exempt smaller businesses from paying any fees. The cost ranges from $15 to $30 on the low end and several hundred on the high end.

Formation StateINC FeesLLC FeesColorado$50$50Connecticut$315$185D.C.$220$220Delaware$89$9047 more rows

Once you file Colorado Articles of Organization with the Secretary of State, your Colorado LLC officially exists as a legal entity. Filing in Colorado is way less burdensome than in most other states?the fee is just $50.

Colorado LLC Articles of Organization Filing Fee ($50) The Articles of Organization are filed with the Colorado Secretary of State. And once approved, this is what creates your LLC. The $50 fee is a one-time fee. You don't have to pay any monthly (or annual) fees to start your Colorado LLC.

Costs to forming a Colorado LLC There is a $50 (one-time) fee to form an LLC. There are also ongoing fees (like a $10 Annual Report fee), which we discuss below.

The website has a guide that walks you through that process as well. Step 1: Name your Colorado LLC. Your first step is to decide on a name for your Colorado LLC. ... Step 2: Appoint a registered agent in Colorado. ... Step 3: File Colorado Articles of Organization. ... Step 4: Create an operating agreement. ... Step 5: Apply for an EIN.

Colorado Corporation: $185 You must file online and pay the $50 filing fee. The SOS will process the Articles of Incorporation usually within 24 hours. Once your corporation is formed, you will need to obtain an Employer Identification Number from the IRS.