Personal Loan Form Document With Bank Account

Description

How to fill out Personal Loan Agreement Document Package?

Regardless of whether it is for corporate objectives or personal issues, everyone eventually has to deal with legal matters at some point in their lives.

Filling out legal documents requires diligent focus, beginning with choosing the appropriate form template.

With an extensive catalog of US Legal Forms available, you won't need to waste time searching for the correct template online. Utilize the library’s straightforward navigation to find the ideal form for any circumstance.

- Locate the form you require by utilizing the search bar or browsing the catalog.

- Review the description of the form to ensure it aligns with your scenario, state, and area.

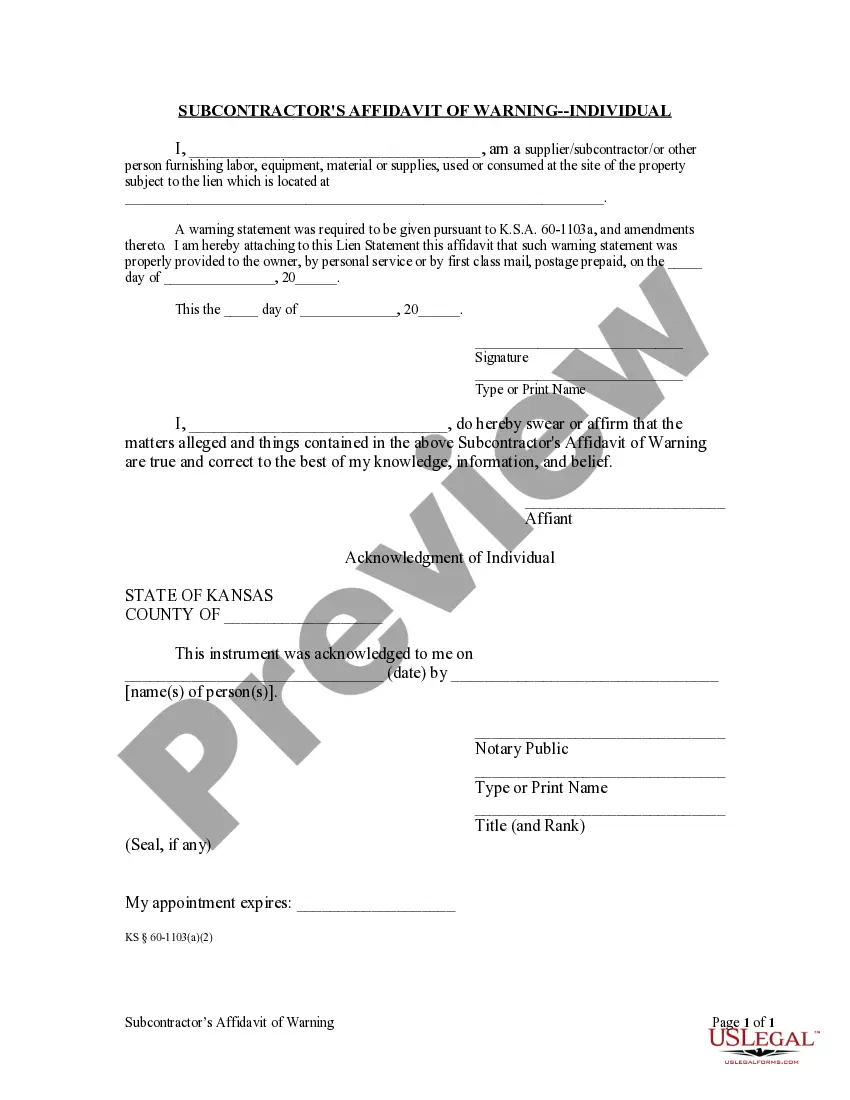

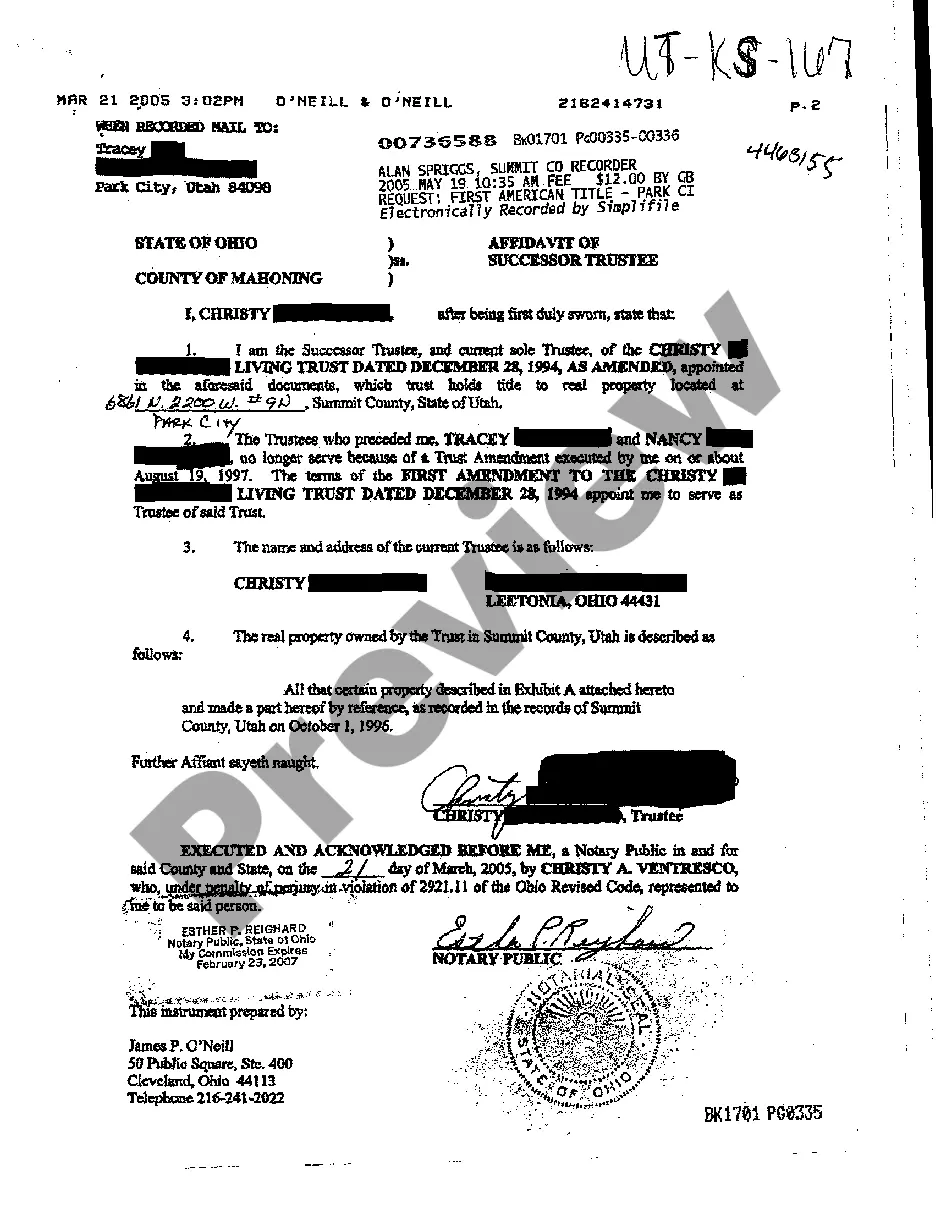

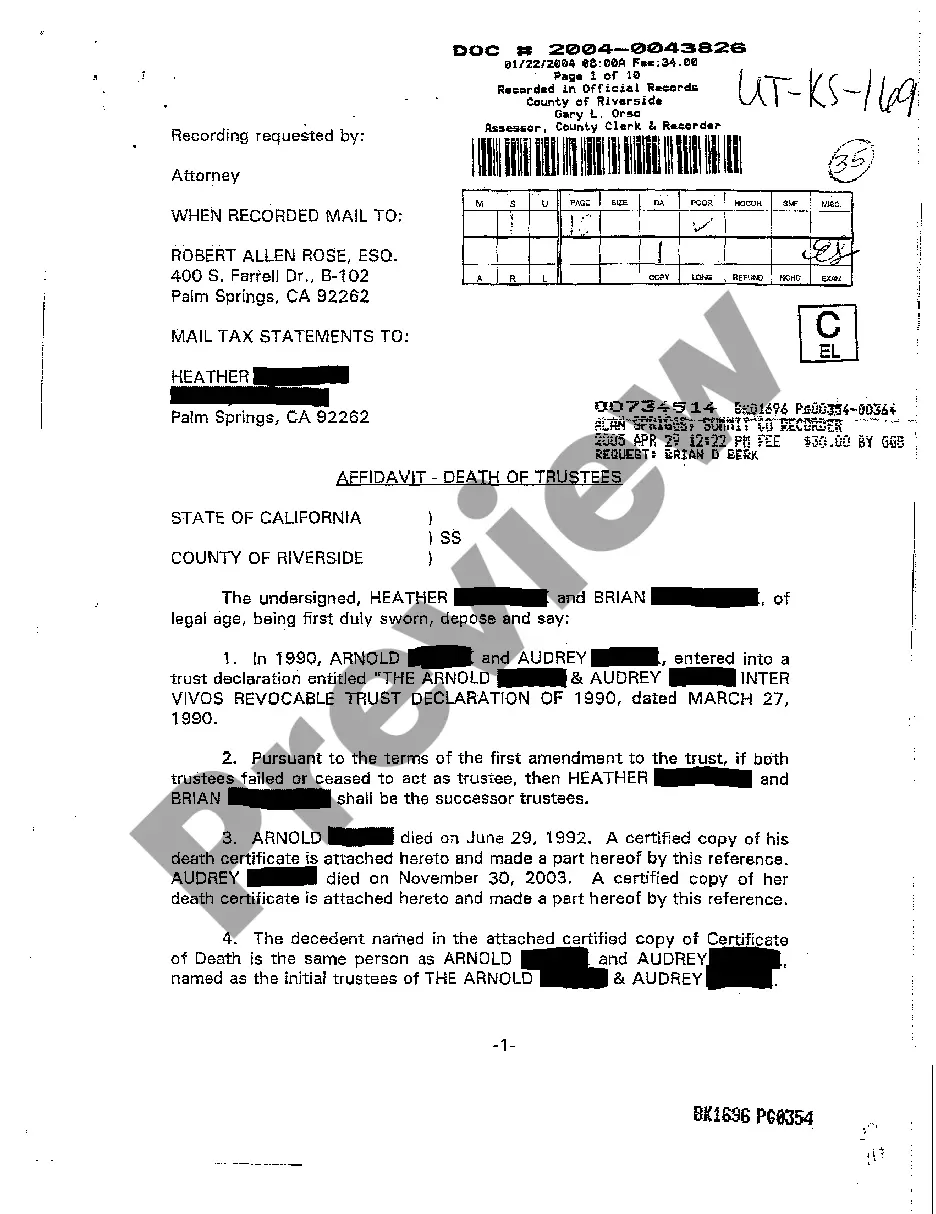

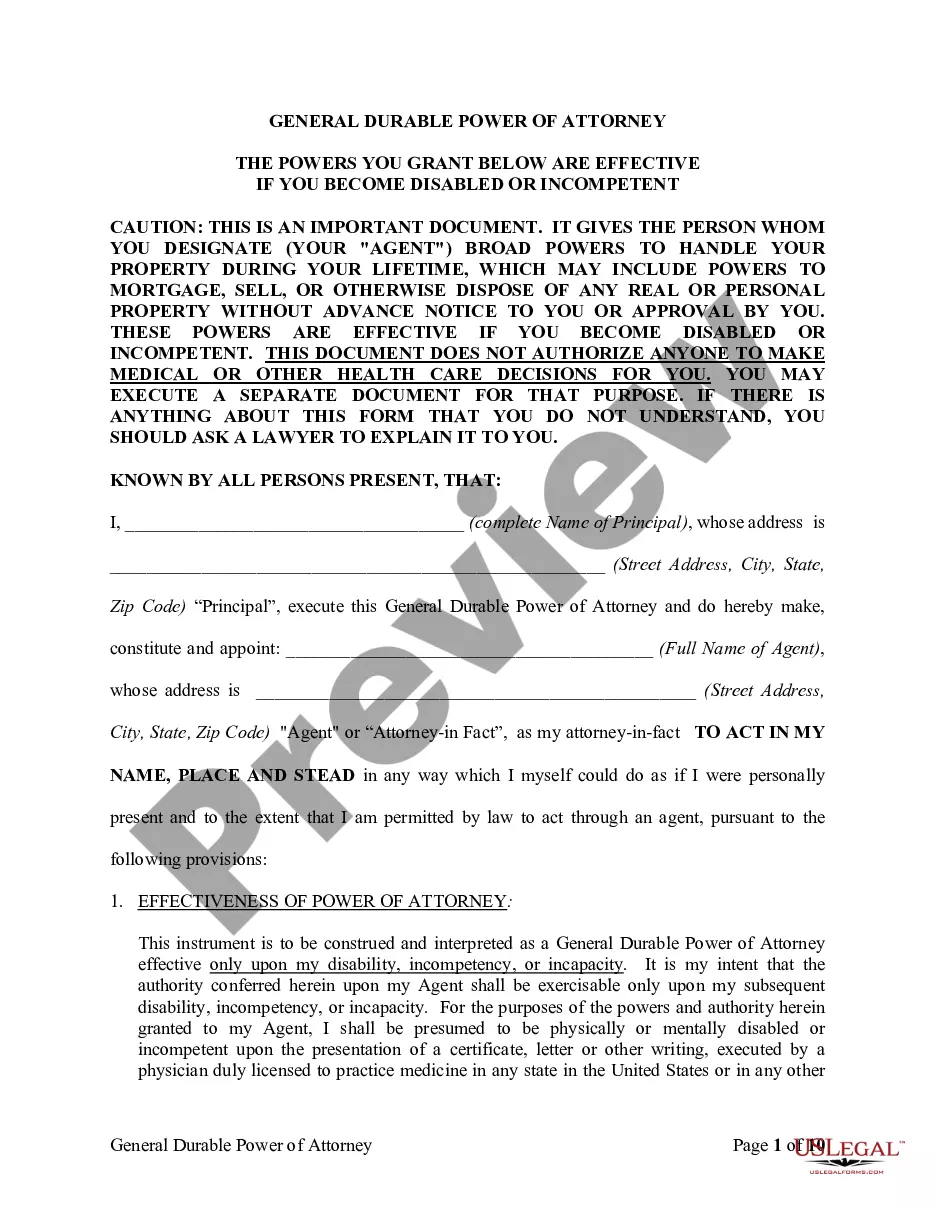

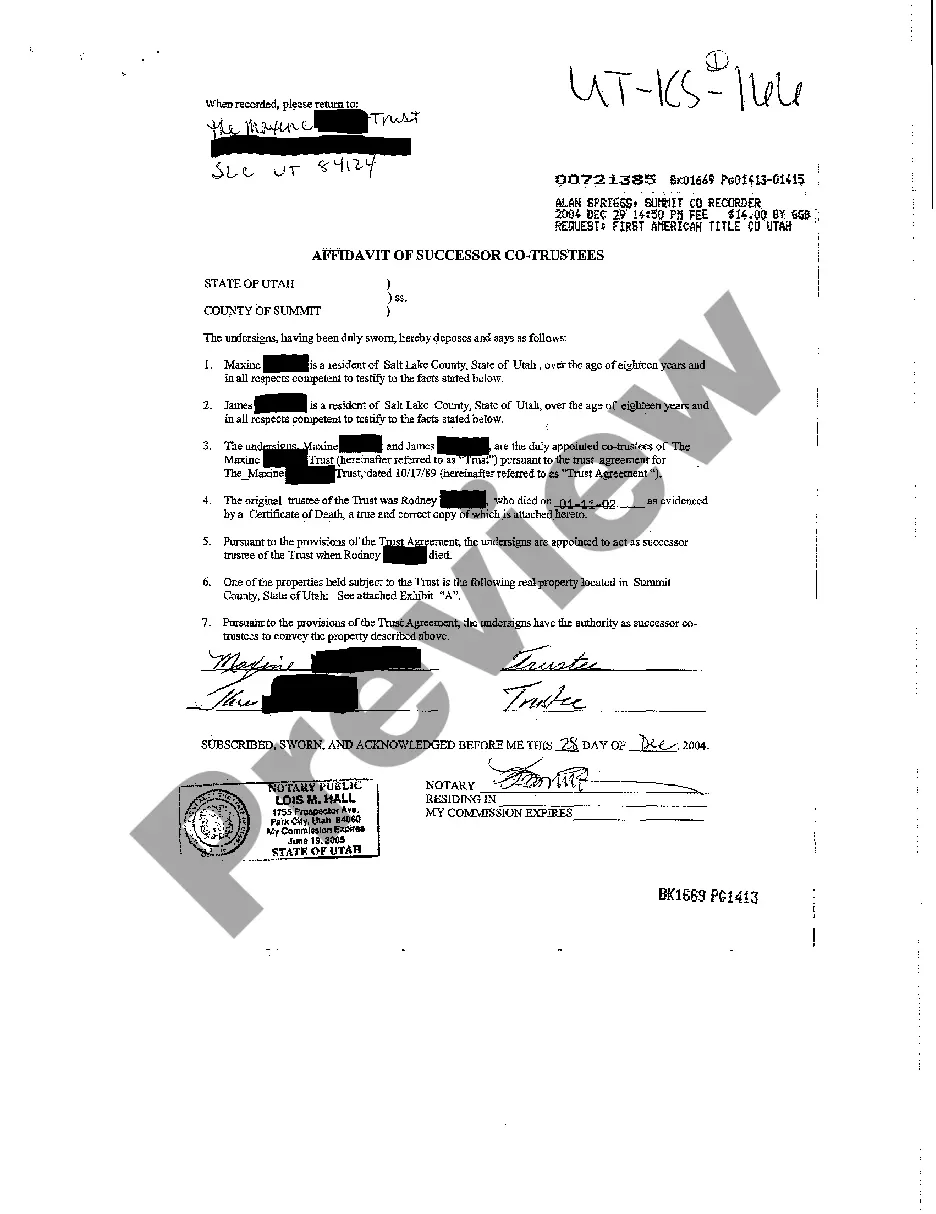

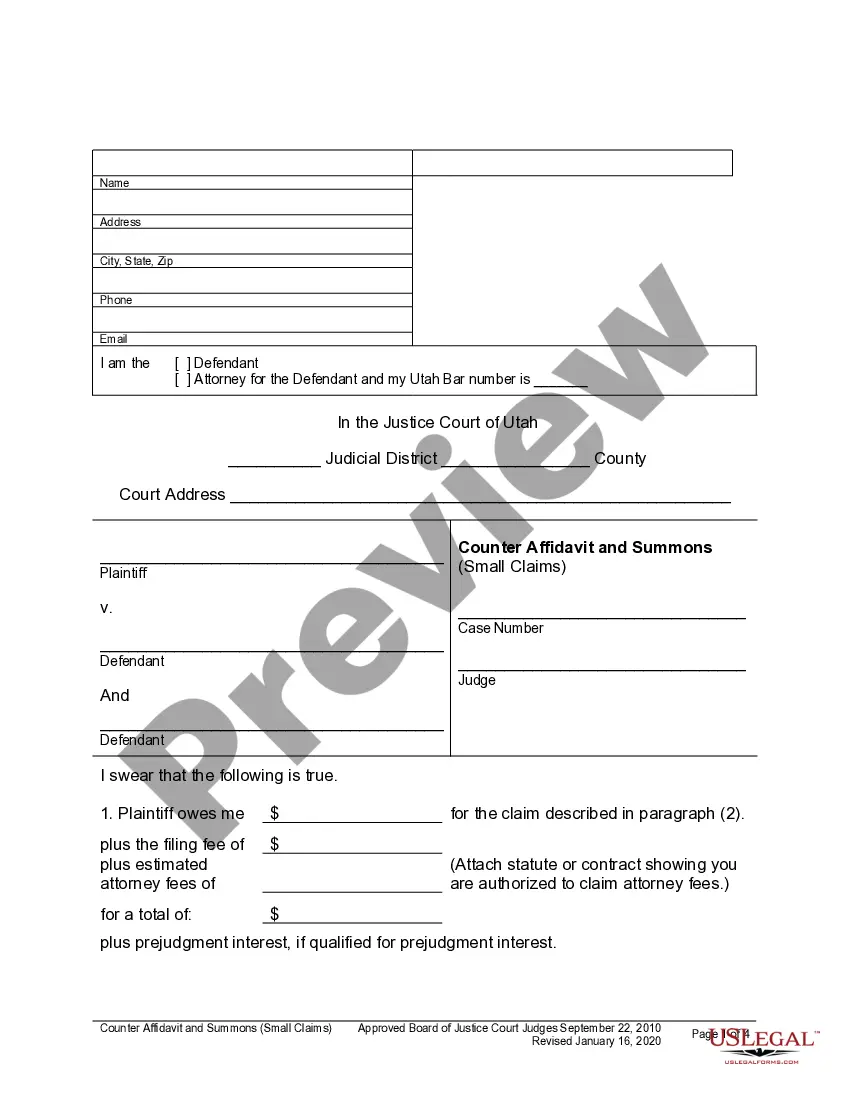

- Select the preview of the form to examine it.

- If it is the incorrect document, return to the search option to find the Personal Loan Form Document With Bank Account template you need.

- Download the document if it fulfills your requirements.

- If you already possess a US Legal Forms account, click Log in to retrieve previously saved templates in My documents.

- If you do not yet have an account, you can obtain the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the account registration form.

- Select your payment method: either a credit card or PayPal account.

- Choose the desired file format and download the Personal Loan Form Document With Bank Account.

- After the file is downloaded, you may fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

Yes, lenders typically require bank statements when reviewing your personal loan form document with a bank account. They use these statements to assess your financial stability and ability to repay the loan. Providing accurate bank statements can enhance your credibility as a borrower, making it easier to secure the loan you need. To streamline the process, consider using a platform like US Legal Forms, which can help you prepare the necessary documents efficiently.

You'll fill in how much you pay for housing (rent or mortgage payments) and might have to include information on any other debts you have. You typically need to provide your annual or monthly income as well. Bank statements and tax returns might be required to back up your information.

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.

Increase your odds of getting approved for a personal loan with these 4 tips Find a lender that meets your financial needs. There are personal loan lenders that cater to a variety of circumstances and financial needs. ... Increase your credit score. ... Don't apply for more than you need. ... Apply with a co-applicant.

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

You may also be required to state your desired loan amount and repayment term, loan purpose as well as additional financial details like your gross monthly income and monthly rent or mortgage payment.