Personal Loan Document Form For Credit Card

Description

How to fill out Personal Loan Agreement Document Package?

Creating legal documents from the ground up can frequently feel a bit daunting.

Some situations may necessitate extensive research and significant financial investment.

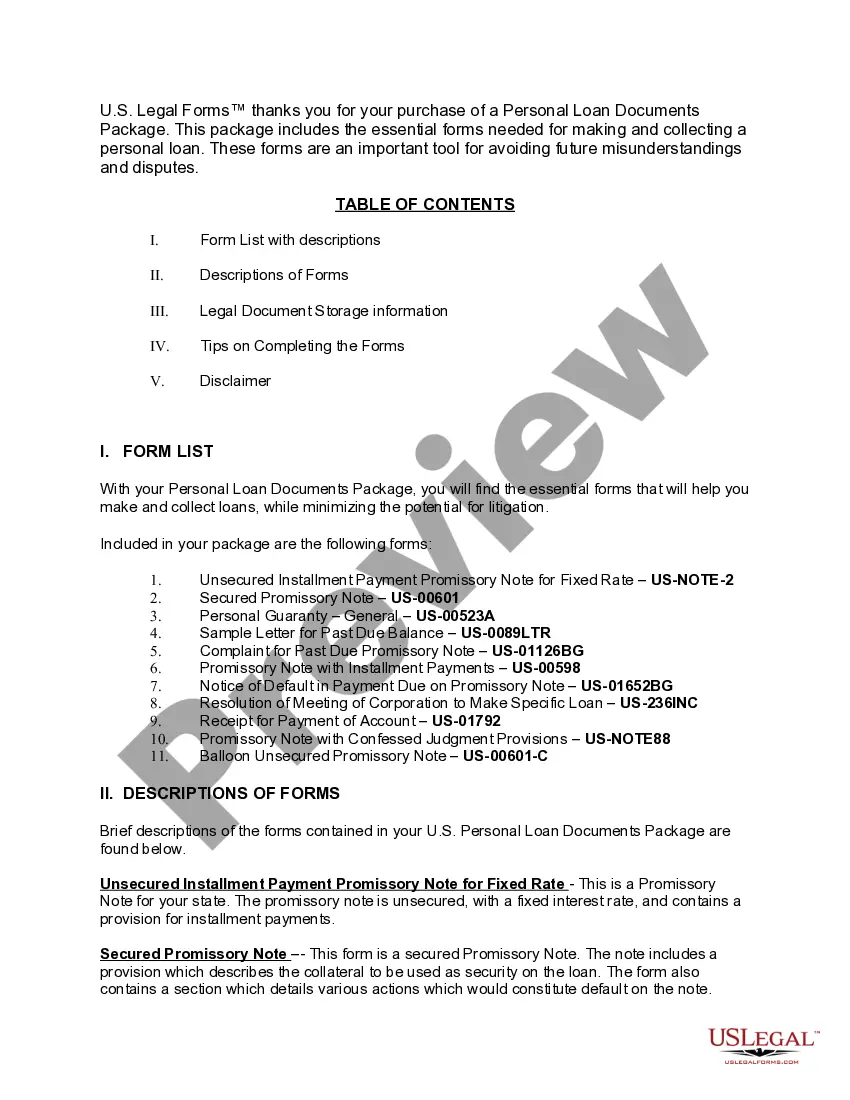

If you're looking for an easier and more affordable method to prepare the Personal Loan Document Form For Credit Card or similar documents without hassle, US Legal Forms is always accessible to you.

Our online library of over 85,000 current legal documents encompasses nearly every aspect of your financial, legal, and personal affairs.

However, before directly downloading the Personal Loan Document Form For Credit Card, adhere to these suggestions: Review the document preview and descriptions to verify you are viewing the document you need. Ensure the form you select meets your state and county's requirements. Choose the appropriate subscription plan to purchase the Personal Loan Document Form For Credit Card. Download the form, then fill it out, sign it, and print it. US Legal Forms boasts an impeccable reputation and over 25 years of expertise. Join us today and simplify document completion into an effortless and efficient process!

- With just a few clicks, you can immediately obtain state- and county-compliant templates meticulously designed for you by our legal experts.

- Utilize our platform whenever you require trustworthy and dependable services to swiftly find and download the Personal Loan Document Form For Credit Card.

- If you're familiar with our site and have set up an account previously, simply Log In to your account, find the template, and download it straight away or re-download it later in the My documents section.

- Don’t have an account? No issue. It takes minimal time to create one and explore the catalog.

Form popularity

FAQ

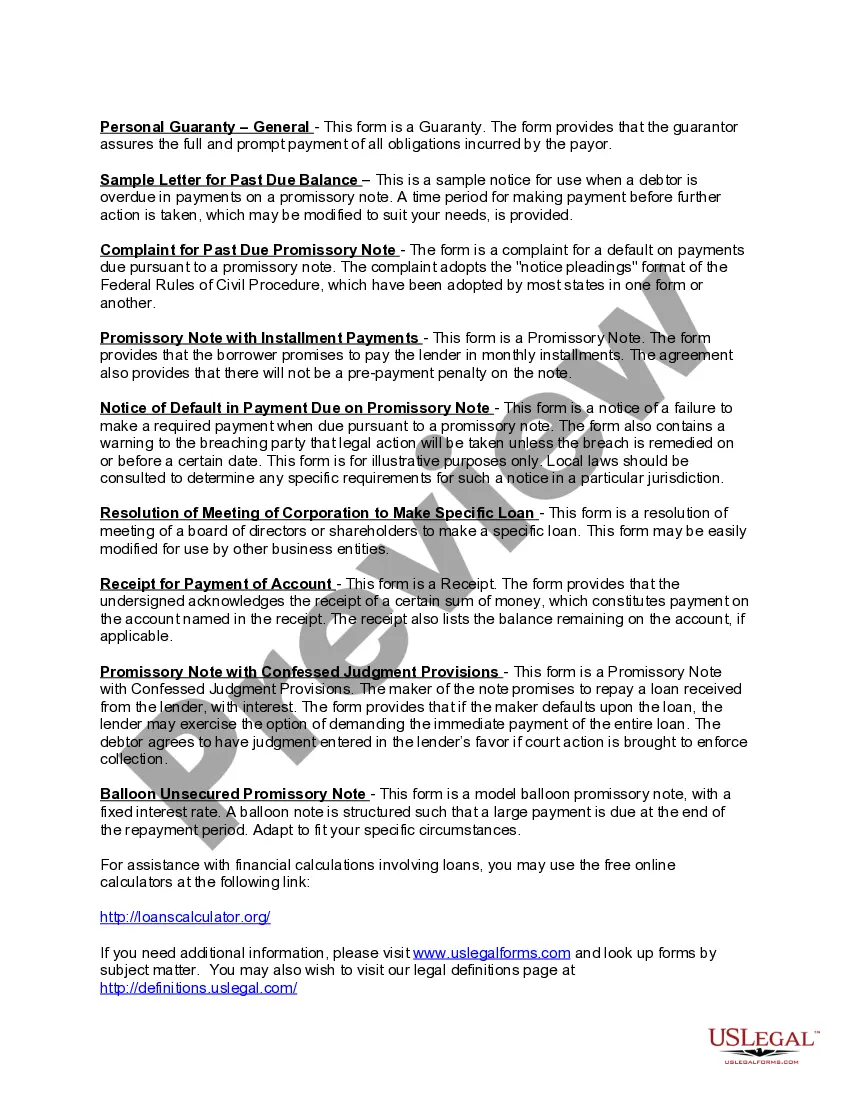

This Deed of Assignment of Loan covers the situation where a lender assigns its rights relating to a loan agreement to a new lender. Only the original lender's rights under the loan agreement (i.e. the right to receive repayment of the loan, and to receive interest) are assigned.

Before a bank can institute a foreclosure proceeding, the bank must record the assignment of the note. The bank must also be in actual possession of the note. If the bank fails to ?produce the note,? that is, cannot demonstrate that the note was assigned to it, the bank cannot demonstrate it owns the note.

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property.

The purpose of the mortgage or deed of trust is to provide security for the loan that's evidenced by a promissory note. Loan Transfers. Banks often sell and buy mortgages from each other. An "assignment" is the document that is the legal record of this transfer from one mortgagee to another.

An allonge to promissory note is different from an assignment. An assignment in this context is what gives a party the legal designation and right to move forward with legal action on a property, whereas an allonge is an endorsement that allows you to collect on the promissory note.

Mortgage deeds are legal documents or instruments that pass over a property's legal rights to the loan provider, which they can exercise in case of a loan default. This document gives lenders the property rights to sell the foreclosed property and recoup their defaulted loan amount to protect their interest.

Mortgages are assigned using a document called an assignment of mortgage. This legally transfers the original lender's interest in the loan to the new company. After doing this, the original lender will no longer receive the payments of principal and interest.

This document was created when a mortgagee wished to recover his money, but the mortgagor could not pay it back. The mortgagee would assign the mortgage to another person, who would pay him the money he was owed.