Credit Add Report Format

Description

How to fill out Statement To Add To Credit Report?

Whether for commercial objectives or for personal matters, everyone must handle legal circumstances at some stage in their life.

Completing legal documents demands careful focus, beginning with choosing the correct form example. For example, if you pick an incorrect version of the Credit Add Report Format, it will be rejected upon submission.

Choose the document format you desire and download the Credit Add Report Format. Once downloaded, you can fill out the form using editing software or print it and complete it manually. With a vast US Legal Forms catalog available, you do not need to waste time searching for the correct template across the web. Utilize the library’s straightforward navigation to locate the suitable form for any occasion.

- It is thus crucial to have a dependable source of legal documents like US Legal Forms.

- If you need to obtain a Credit Add Report Format example, follow these straightforward steps.

- Acquire the template you require using the search box or catalog navigation.

- Review the form’s description to ensure it aligns with your situation, state, and area.

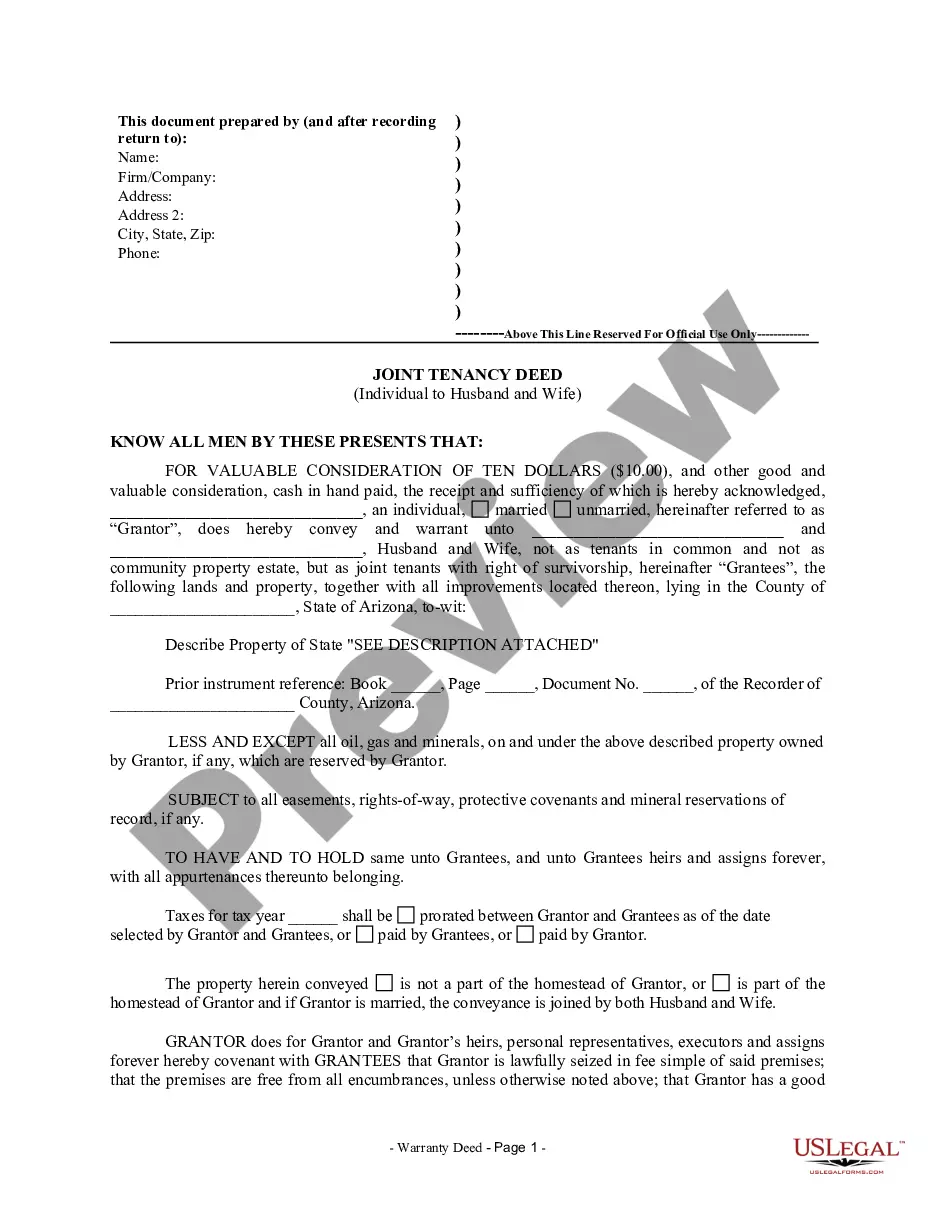

- Click on the form’s preview to examine it.

- If it is the wrong form, return to the search function to find the Credit Add Report Format example you need.

- Retrieve the file when it fulfills your criteria.

- If you possess a US Legal Forms account, click Log in to access previously saved templates in My documents.

- If you do not have an account yet, you may acquire the form by clicking Buy now.

- Choose the relevant pricing option.

- Complete the account registration form.

- Select your payment method: you can use a credit card or PayPal account.

Form popularity

FAQ

Metro2 Format is the current standard format for reporting credit. It meets all the requirements of the Fair Credit Reporting Act (FCRA), the Fair Credit Billing Act (FCBA), and the Equal Credit Opportunity Act (ECOA). It allows most accurate and complete information on consumers' credit history.

Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask that the business that supplied the information take action to have it removed or corrected. You may want to enclose a copy of your report with the item(s) in question circled.

Ask the CRA to Add the Information Send a copy of a recent account statement and copies of canceled checks (never originals) or other proof of payment showing your payment history. Then, ask the credit reporting agencies to add the information to your file.

Information to include in your dispute letter Full name. Date of birth. Current address. Driver's license number. Social Security number (optional). The account number of the tradeline you're disputing (e.g., account number found on your utility bill, student loan bill or mortgage statement).

Your dispute letter should include the following information: Your full name. Your date of birth. Your Social Security number. Your current address and any other addresses at which you have lived during the past two years. A copy of a government-issued identification card such as a driver's license or state ID.