Member Liability Llc Statement With Irs

Description

How to fill out Assignment Of Member Interest In Limited Liability Company - LLC?

Legal administration can be overwhelming, even for experienced professionals.

When you are looking for a Member Liability LLC Statement With IRS and lack the time to invest searching for the suitable and current version, the processes can be challenging.

Access a valuable resource library of articles, guides, handbooks, and materials pertinent to your situation and requirements.

Save time and effort hunting for the documents you need, and use US Legal Forms’ advanced search and Review feature to locate the Member Liability LLC Statement With IRS and download it.

Leverage the US Legal Forms web library, supported by 25 years of expertise and reliability. Streamline your routine document management into a straightforward and user-friendly process today.

- If you have a monthly subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check the My documents tab to see the documents you previously downloaded and to manage your folders as desired.

- If this is your first experience with US Legal Forms, create a free account for unlimited access to all platform benefits.

- Here are the steps to follow after finding the form you want.

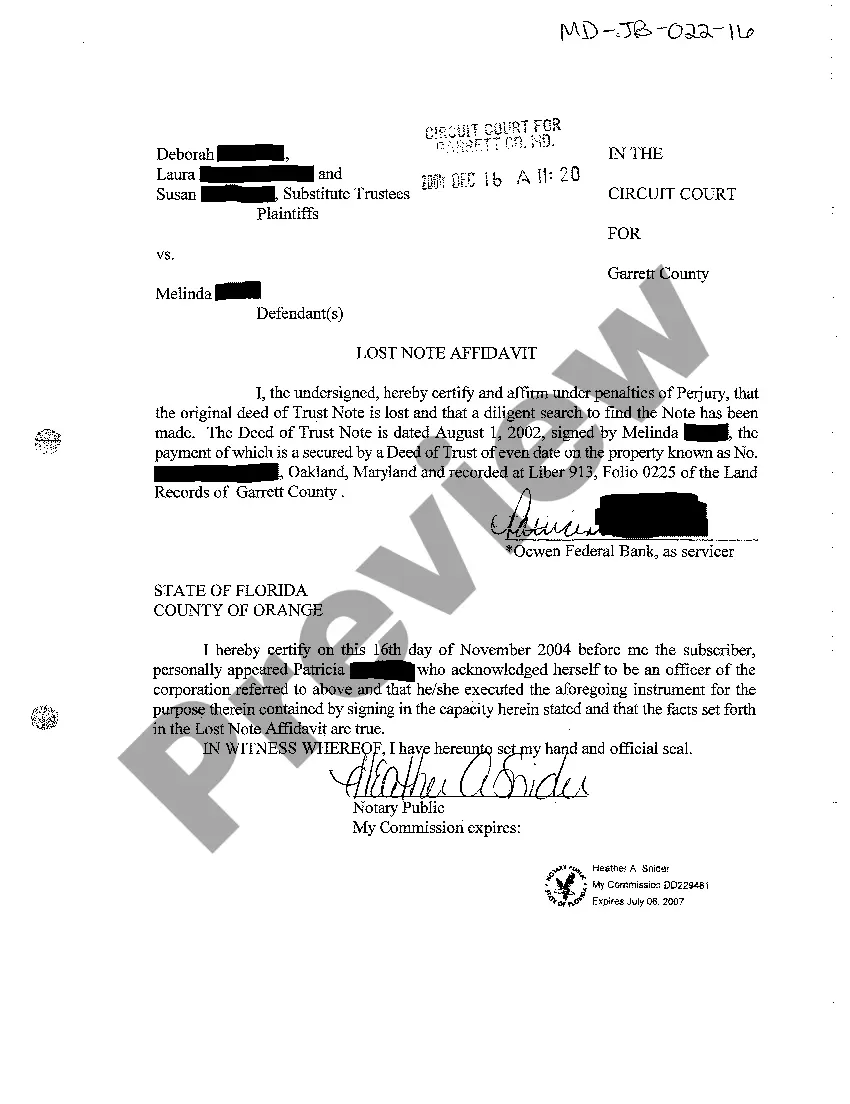

- Verify that this is the right form by previewing it and reviewing its description.

- Ensure that the sample is approved in your state or county.

- Click Buy Now when you are ready.

- Select a monthly subscription plan.

- Choose the file format you want, and Download, complete, eSign, print, and send your document.

- Access state- or county-specific legal and business documents.

- US Legal Forms addresses any needs you might have, ranging from personal to commercial paperwork, all in one location.

- Utilize advanced tools to complete and manage your Member Liability LLC Statement With IRS.

Form popularity

FAQ

Steps for Making a Financial Power of Attorney in Tennessee Create the POA Using a Form, Software or an Attorney. ... Sign the POA in the Presence of a Notary Public. ... Store the Original POA in a Safe Place. ... Give a Copy to Your Agent or Attorney-in-Fact. ... File a Copy With the Register of Deeds.

A power of attorney is ?durable? when the power remains effective even if you are incompetent or unable to communicate. That means, the document is designed to continue to be effective when you are disabled or no longer mentally competent and you cannot act on your own.

File a Copy With the Register of Deeds If you gave your agent the power to conduct transactions with real estate, you should also file a copy of your POA in the land records office (called the register of deeds in Tennessee) in the county or counties where you own real estate.

Under Tennessee law, for a power of attorney to be valid it must either be signed in the presence of a notary or witnessed by two disinterested parties. (A witness cannot be an agent). Conversely, in Kentucky, a power of attorney must have both two witnesses and a notary to be valid.

At any time by the person who granted it, as long as that person is mentally competent. A person who gives a power of attorney can revoke it by having it returned and then destroying it, or by giving the individual to whom the power was granted a written statement revoking it.

If your agent will manage real estate transactions, the Power of Attorney will need to be signed by a notary and filed or recorded with your county.

Under Tennessee law, for a power of attorney to be valid it must either be signed in the presence of a notary or witnessed by two disinterested parties.

The Handbook contains practical information on a wide range of topics, including issues such as applying for Social Security benefits, long-term care considerations and estate planning, as well as completely new sections addressing online security and new health care legislation.