Llc Member Removal Form With Two Points

Description

How to fill out Assignment Of Member Interest In Limited Liability Company - LLC?

Handling legal documents can be exasperating, even for seasoned experts.

When you seek an LLC Member Withdrawal Document With Two Options and lack the time to invest in finding the correct and current version, the experience can be stressful.

US Legal Forms addresses any requirements you may have, spanning from personal to business documentation, all consolidated in a single location.

Utilize cutting-edge tools to fill out and manage your LLC Member Withdrawal Document With Two Options.

After securing the desired document, follow these steps: Confirm it is the correct document by previewing it and checking its description, ensure that the document is acceptable in your state or county, click on Buy Now when you're prepared, choose a monthly subscription plan, select your preferred format, and Download, complete, eSign, print, and send your documents. Benefit from the US Legal Forms online repository, backed by 25 years of expertise and reliability. Simplify your routine document management into a straightforward and user-friendly process today.

- Explore a comprehensive resource library of articles, guides, and materials relevant to your circumstances and needs.

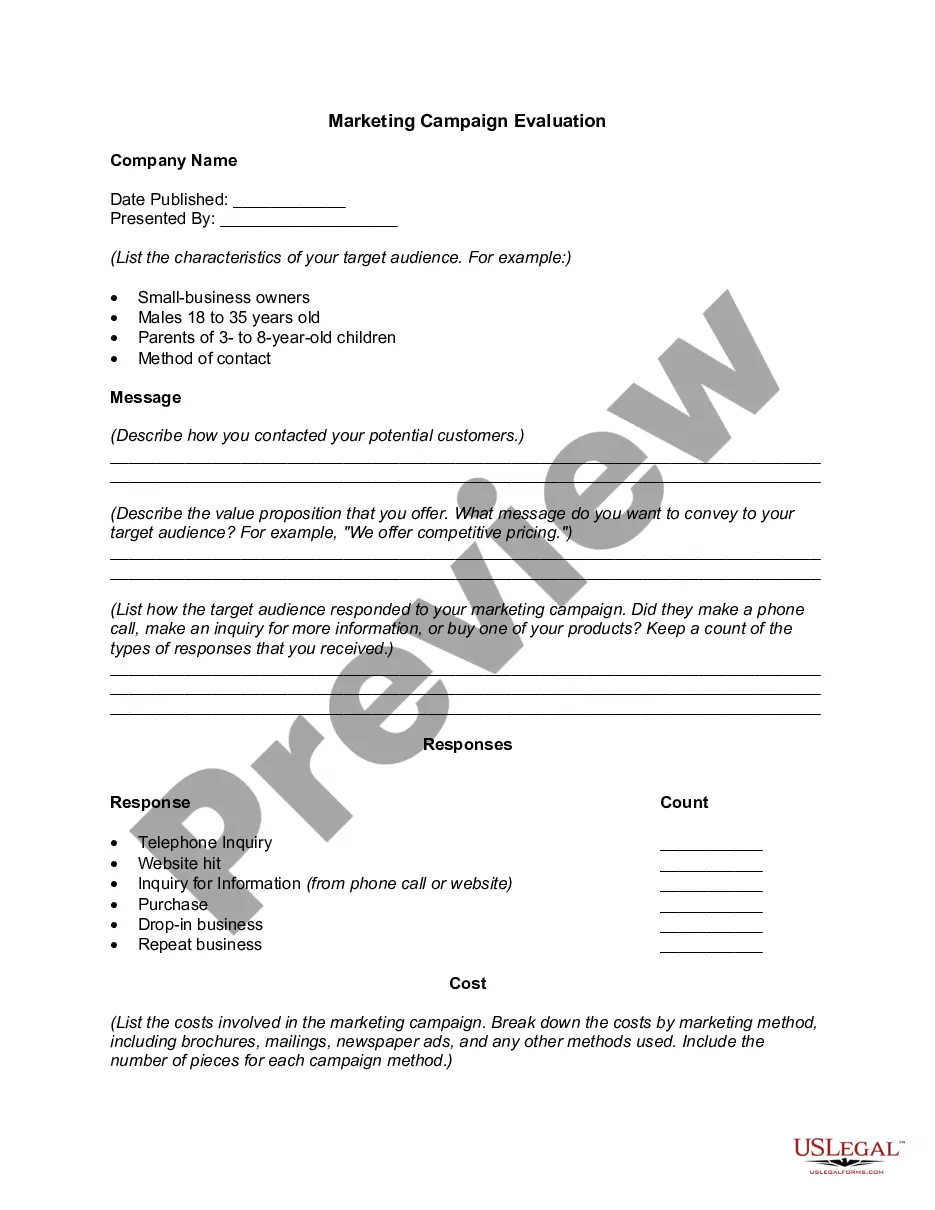

- Save time and effort by locating the documents you need, utilizing US Legal Forms’ enhanced search and Review feature to find the LLC Member Withdrawal Document With Two Options.

- If you hold a subscription, Log In to your US Legal Forms account, search for the document, and acquire it.

- Visit the My documents tab to review the documents you’ve previously downloaded and manage your directories as desired.

- If you are using US Legal Forms for the first time, create an account for unlimited access to the entire library's benefits.

- A robust online form repository could significantly enhance the efficiency for anyone looking to navigate these matters.

- US Legal Forms stands out as a frontrunner in the realm of digital legal documents, boasting over 85,000 state-specific legal forms available at any moment.

- With US Legal Forms, you are able to access legal and organizational forms tailored to your state or county.

Form popularity

FAQ

IRS Form 706 is used for estate tax returns, typically required when a deceased person’s estate exceeds a certain value. In contrast, Form 709 is used for gift tax returns, reporting taxable gifts made during a tax year. Knowing the difference is important for proper tax planning and compliance. Proper documentation in the context of LLC changes, such as an LLC member removal form, keeps your business aligned with IRS requirements.

Form 8978 is used by partnerships to report tax attributes resulting from the election to apply the Section 754 adjustment. This form allows partners to adjust their basis in partnership interests, which could impact tax liabilities. It is important for tax reporting accuracy. Understanding such forms can benefit LLC members, especially during changes involving an LLC member removal form.

If one partner wants to leave the LLC, the first step is to refer to the operating agreement for guidance on the exit process. The agreement typically outlines the steps to follow, including buyout procedures or transfer of ownership interests. It's crucial to document this change properly through an LLC member removal form. This ensures compliance and clarity among remaining members regarding the new structure of the business.

To remove members from your LLC, you typically start by reviewing your operating agreement. This document usually outlines the procedures for member removal, including any voting requirements. Once the process is followed, you may need to file an LLC member removal form to document the change officially. Platforms like US Legal Forms provide resources that simplify the creation of these necessary documents.

There isn't a specific IRS form solely designated for removing a partner from an LLC. However, a combination of an amendment to the operating agreement and potentially filing Form 1065 for tax reporting may be necessary. Always consult your operating agreement first, as it may outline the process for member removal. Utilizing an LLC member removal form can help maintain proper documentation during this change.

IRS Form 1065 is used for reporting income, deductions, gains, and losses from partnerships and LLCs that are treated as partnerships for tax purposes. This form provides essential information to the IRS about the financial activities of the business. Filing Form 1065 helps maintain transparency and compliance. Understanding this form becomes important when managing changes related to an LLC, including an LLC member removal form.

Form 8822-B is used to notify the IRS of a change in the business's address or responsible party. This ensures the IRS has accurate information to send important notices and documents. Keeping your LLC's information up to date is crucial for maintaining compliance. When dealing with an LLC member removal form, accurate records will help streamline the process.

To remove a partner from an LLC with the IRS, first, ensure that your operating agreement outlines this process. After obtaining consent from other members, fill out the LLC member removal form. This form helps to formally notify the IRS of any changes to your LLC’s ownership structure. Lastly, file the necessary updates with the IRS when you submit your tax returns.

Filling out an LLC membership certificate requires specific details about the member and the LLC. Start by including the LLC’s name, the member’s name, and their ownership interest percentage. Then, sign and date the certificate to validate it. This documentation serves as proof of membership, so ensure you complete it accurately.

To remove someone from your LLC, you must refer to your operating agreement. This document usually outlines the procedures for member removal, which often involves a vote among remaining members. After reaching an agreement, you should complete the LLC member removal form to formalize the decision. Additionally, update state records to reflect this change in your LLC's membership.