Letter Credit Form With Two Points

Description

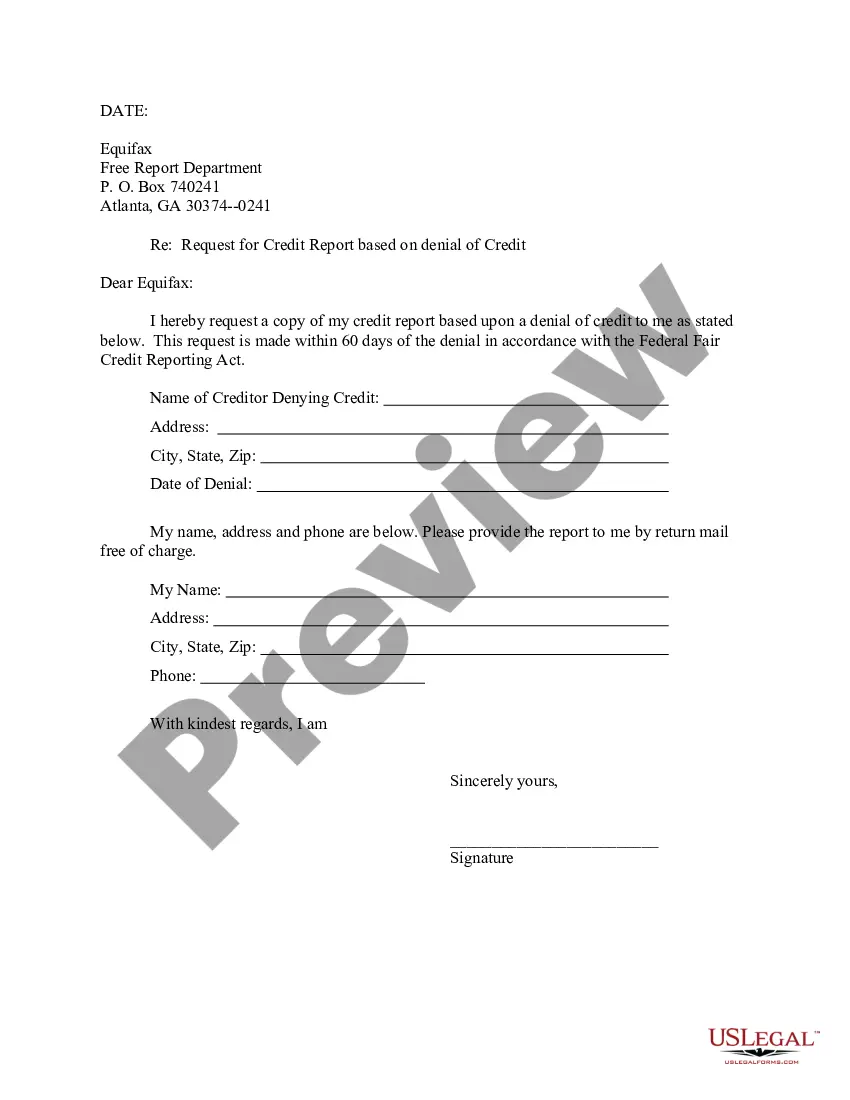

How to fill out Letter To Trans Union Requesting Free Copy Of Your Credit Report Based On Denial Of Credit?

Handling legal paperwork and processes can be a tedious addition to your daily routine.

Letter Credit Form With Two Points and similar forms often require you to seek them out and figure out how to fill them out properly.

For that purpose, if you are managing financial, legal, or personal affairs, utilizing a comprehensive and user-friendly online library of forms as needed will be tremendously beneficial.

US Legal Forms is the leading online platform for legal templates, featuring over 85,000 state-specific forms and a variety of resources to assist you in completing your documents with ease.

If this is your first time using US Legal Forms, create and set up your account in a matter of minutes to access the form library and Letter Credit Form With Two Points. Then, follow the steps listed below to complete your form.

- Explore the collection of suitable documents available to you with a single click.

- US Legal Forms offers you state- and county-specific forms available anytime for downloading.

- Protect your document management processes by using a quality service that allows you to prepare any form in minutes without extra or hidden fees.

- Simply Log In to your account, find Letter Credit Form With Two Points and download it directly from the My documents section.

- You can also access previously downloaded forms.

Form popularity

FAQ

The basic letter of credit procedure: Purchase and sales agreement. The buyer and the seller draw up a purchase and sales agreement. ... Buyer applies for letter of credit. ... Issue letter of credit. ... Advise letter of credit. ... Prepare shipment. ... Present documents. ... Payment. ... Document transfer.

A letter of credit, or a credit letter, is a letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount. If the buyer is unable to make a payment on the purchase, the bank will be required to cover the full or remaining amount of the purchase.

The amount of credit specified in a letter of credit must be taken by the beneficiary in the form of lump-sum payment.

A Letter of Credit is a contractual commitment by the foreign buyer's bank to pay once the exporter ships the goods and presents the required documentation to the exporter's bank as proof. As a trade finance tool, Letters of Credit are designed to protect both exporters and importers.

A letter of credit is an important tool for businesses to ensure safe transactions between parties. It is a guarantee from a bank that the buyer will pay the seller for the goods and services purchased. It is a secure way for businesses to trade as it offers protection for both parties involved in the transaction.