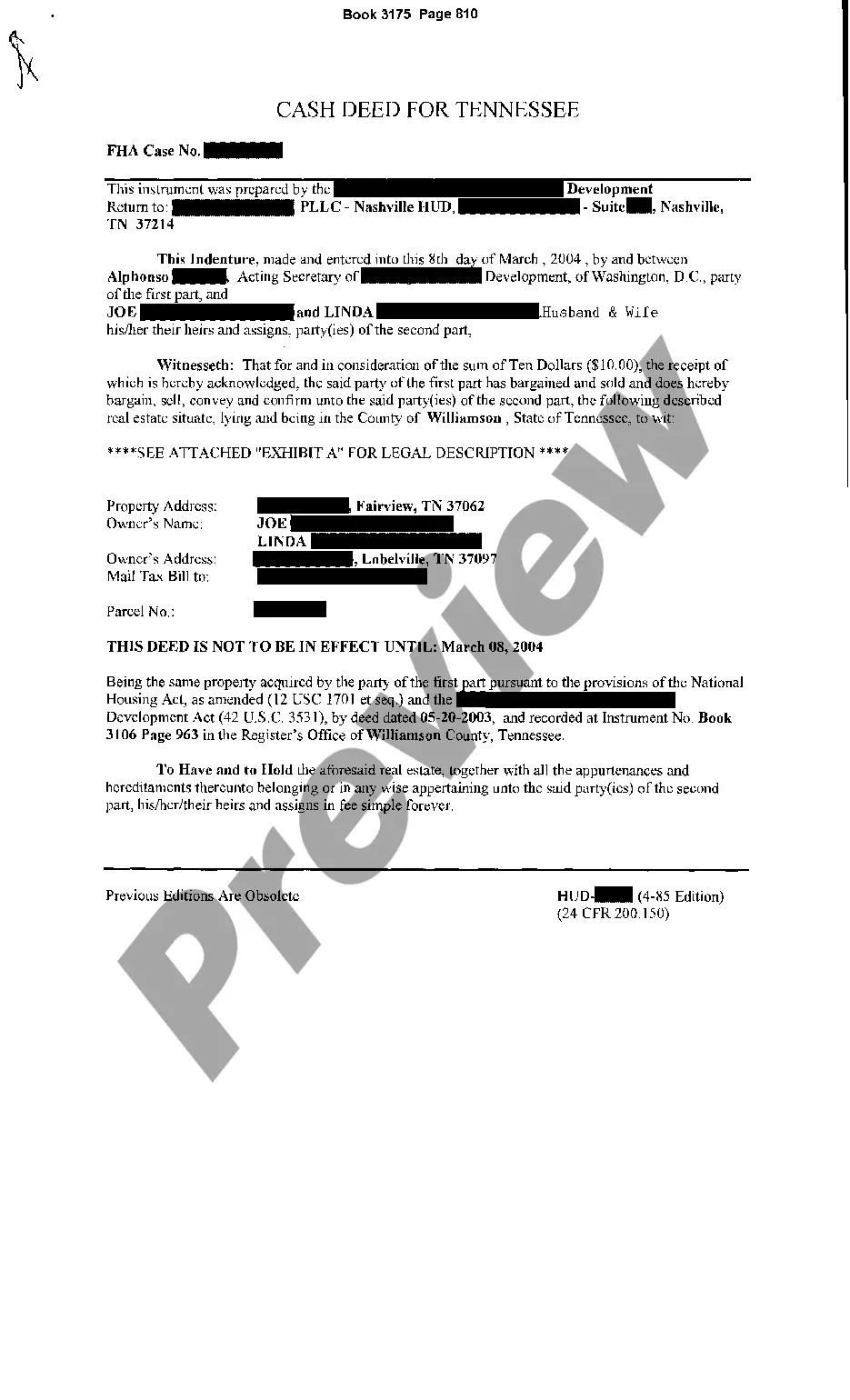

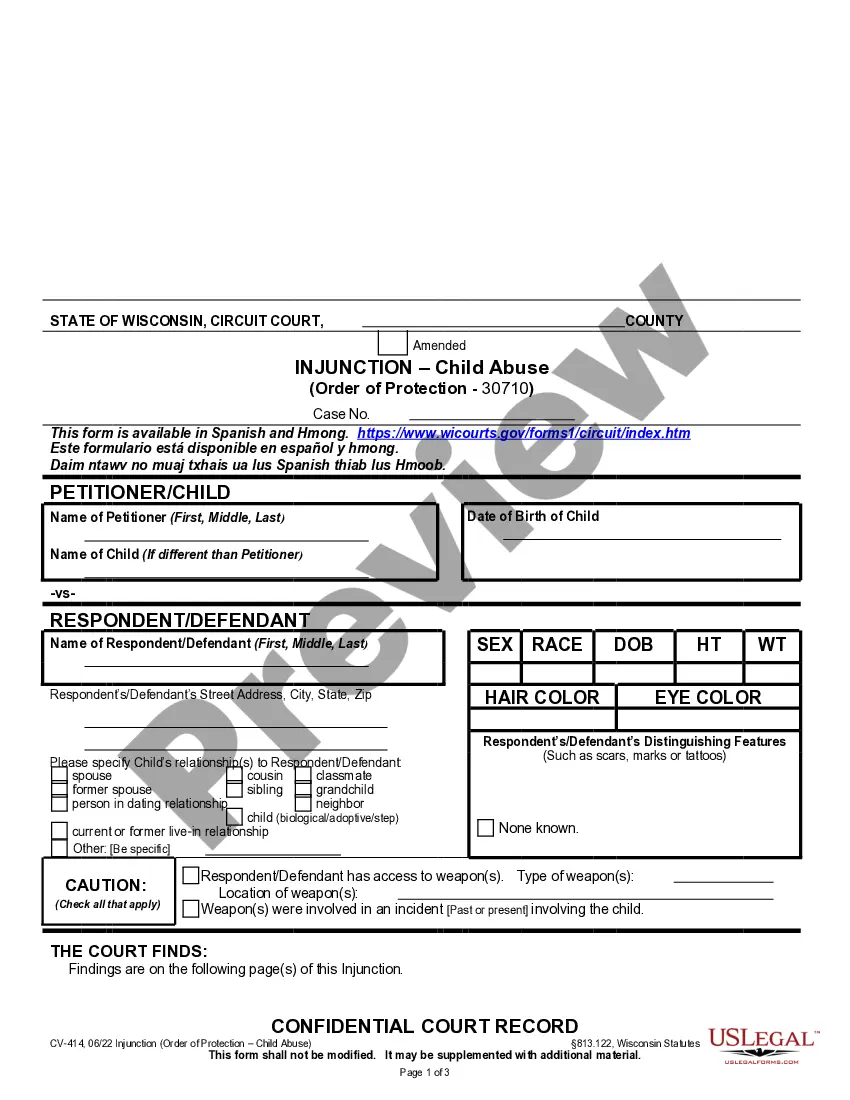

Solicitation Letter Sample With Control Number

Description

How to fill out Schedule 14D-9 - Solicitation - Recommendation Statement?

Whether for corporate intentions or personal issues, everyone must deal with legal circumstances sooner or later in their life.

Completing legal documentation necessitates meticulous care, starting from choosing the right form sample.

Select the document format you prefer and download the Solicitation Letter Sample With Control Number. Once saved, you can fill out the form using editing software or print it and complete it manually. With an extensive US Legal Forms library available, you need not waste time searching for the right template online. Take advantage of the library’s user-friendly navigation to find the suitable form for any scenario.

- For instance, if you pick an incorrect version of the Solicitation Letter Sample With Control Number, it will be rejected upon submission.

- Thus, it is crucial to acquire a reliable source of legal documents like US Legal Forms.

- If you need to obtain a Solicitation Letter Sample With Control Number template, adhere to these uncomplicated steps.

- Locate the template you require utilizing the search feature or catalog navigation.

- Review the form’s description to ensure it corresponds with your case, state, and locality.

- Click on the form’s preview to view it.

- If it is the wrong document, return to the search function to find the Solicitation Letter Sample With Control Number template you need.

- Download the template if it aligns with your requirements.

- If you already maintain a US Legal Forms profile, simply click Log in to access previously saved documents in My documents.

- If you haven't registered yet, you can acquire the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the profile registration form.

- Choose your payment method: you can utilize a credit card or PayPal account.

Form popularity

FAQ

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

A promissory note typically contains all the terms pertaining to the indebtedness, such as the principal amount, interest rate, maturity date, date and place of issuance, and issuer's signature.

Not signed by the borrower In order for a promissory note to be legally binding, it must include the signature of the borrower. You generally are not required by law to have the signatures witnessed or notarized.

A promissory note could become invalid if: It isn't signed by both parties. The note violates laws. One party tries to change the terms of the agreement without notifying the other party.

Even without a signature from a notary public, it can still be a valid promissory note. Getting your loan agreement notarized can strengthen it in sensitive cases: Notarizing your note could make it legally stronger. ? This means it's more likely to stand up in court thanks to the extra witness of a notary public.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

Promissory notes are quite simple and can be prepared by anyone. They do not need to be prepared by a lawyer or be notarized. It isn't even particularly significant whether a promissory note is handwritten or typed and printed.

No. Promissory notes do not need to be notarized. The borrower only needs to sign the document to make it legally enforceable. A witness may be helpful if one party contests the note, but a notary is not necessary.