Merger Between Corp For Dummies

Description

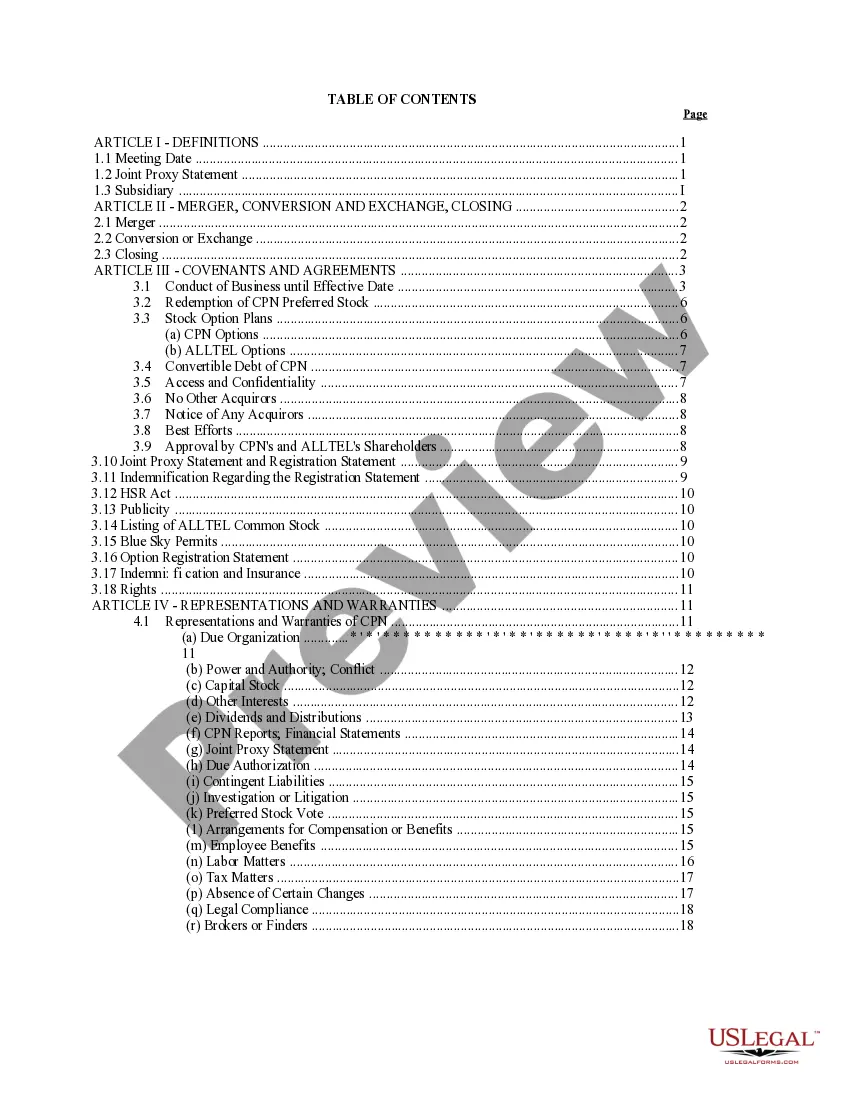

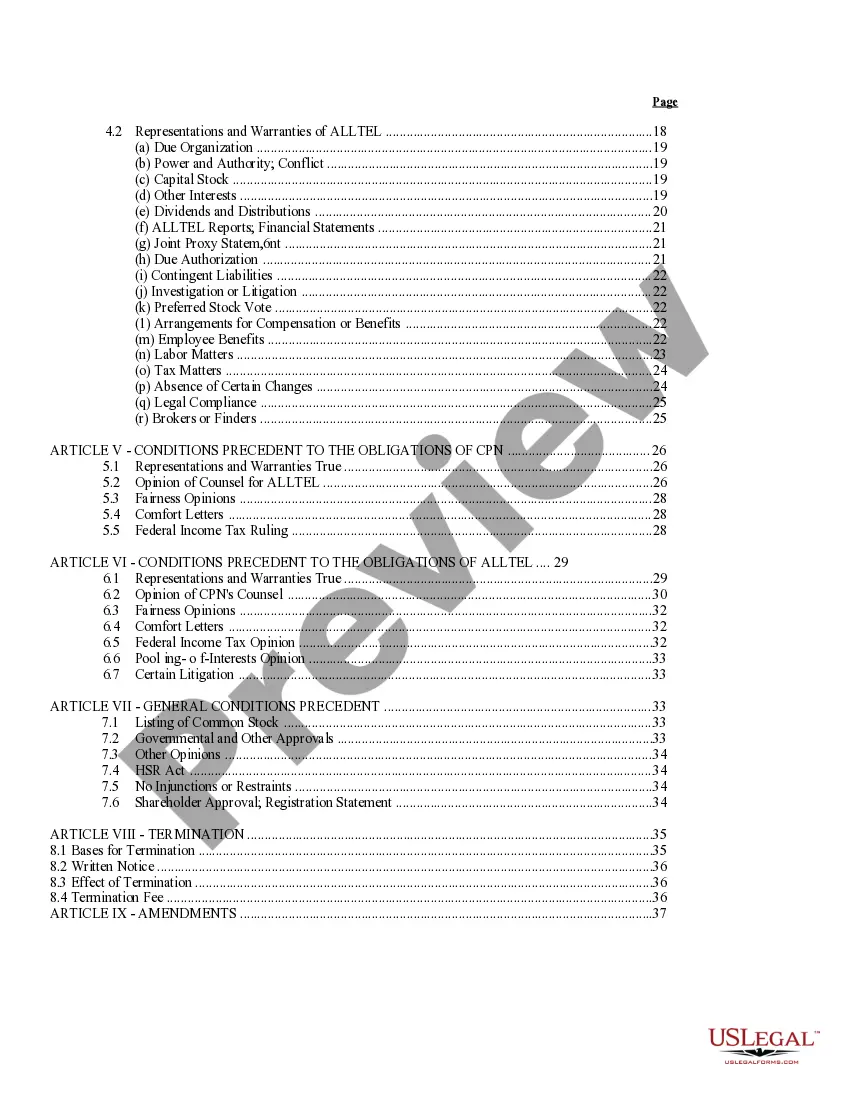

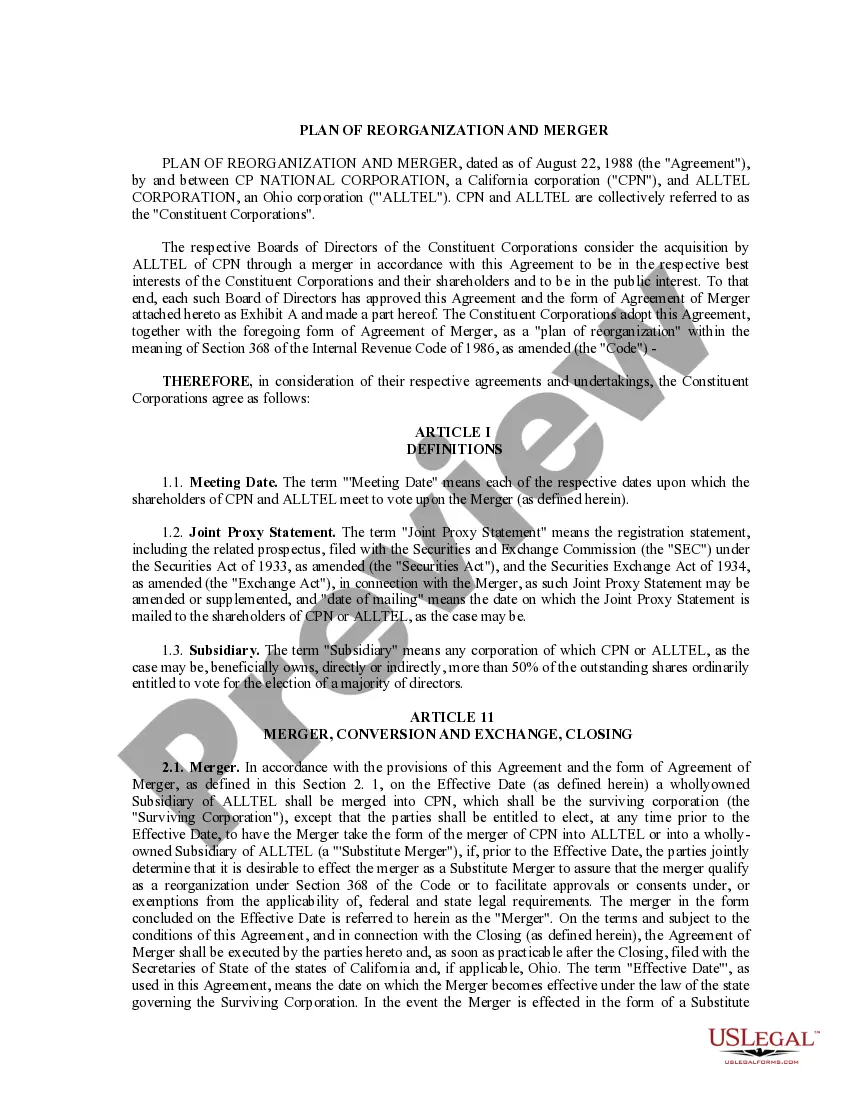

How to fill out Plan Of Reorganization And Merger Between CP National Corp. And Alltel Corp.?

It’s obvious that you can’t become a law expert overnight, nor can you learn how to quickly prepare Merger Between Corp For Dummies without the need of a specialized background. Putting together legal forms is a long process requiring a particular training and skills. So why not leave the creation of the Merger Between Corp For Dummies to the professionals?

With US Legal Forms, one of the most comprehensive legal template libraries, you can find anything from court documents to templates for internal corporate communication. We understand how crucial compliance and adherence to federal and local laws are. That’s why, on our website, all forms are location specific and up to date.

Here’s how you can get started with our website and obtain the form you require in mere minutes:

- Discover the form you need by using the search bar at the top of the page.

- Preview it (if this option available) and read the supporting description to determine whether Merger Between Corp For Dummies is what you’re searching for.

- Start your search over if you need a different form.

- Register for a free account and select a subscription plan to purchase the template.

- Pick Buy now. As soon as the payment is complete, you can get the Merger Between Corp For Dummies, complete it, print it, and send or mail it to the necessary people or organizations.

You can re-gain access to your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and locate and download the template from the same tab.

Regardless of the purpose of your documents-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

7 Components of a Successful Business Merger or Acquisition Liquidity and financial health check. ... Transparency for the full team. ... Well-defined goals and success factors. ... M&A candidate must-haves. ... Planned and executed due diligence. ... A transition team. ... A carefully planned and performed integration.

Small Business Merger Guidelines Compare and analyze the corporate structures. Determine the leadership of the new company. Compare the company cultures. Determine the branding of the new company. Analyze all financial positions. Determine operating costs. Do your due diligence. Conduct a valuation of all companies.

Mergers combine two separate businesses into a single new legal entity. True mergers are uncommon because it's rare for two equal companies to mutually benefit from combining resources and staff, including their CEOs. Unlike mergers, acquisitions do not result in the formation of a new company.

Historically, mergers and acquisitions tend to result in job losses. Most of this is attributable to redundant operations and efforts to boost efficiency. The threatened jobs include the target company's CEO and other senior management, who often are offered a severance package and let go.

Mergers & Acquisitions: The 5 stages of an M&A transaction Assessment and preliminary review. Negotiation and letter of intent. Due diligence. Negotiations and closing. Post-closure integration/implementation.