Secured Claims In Chapter 7

Description

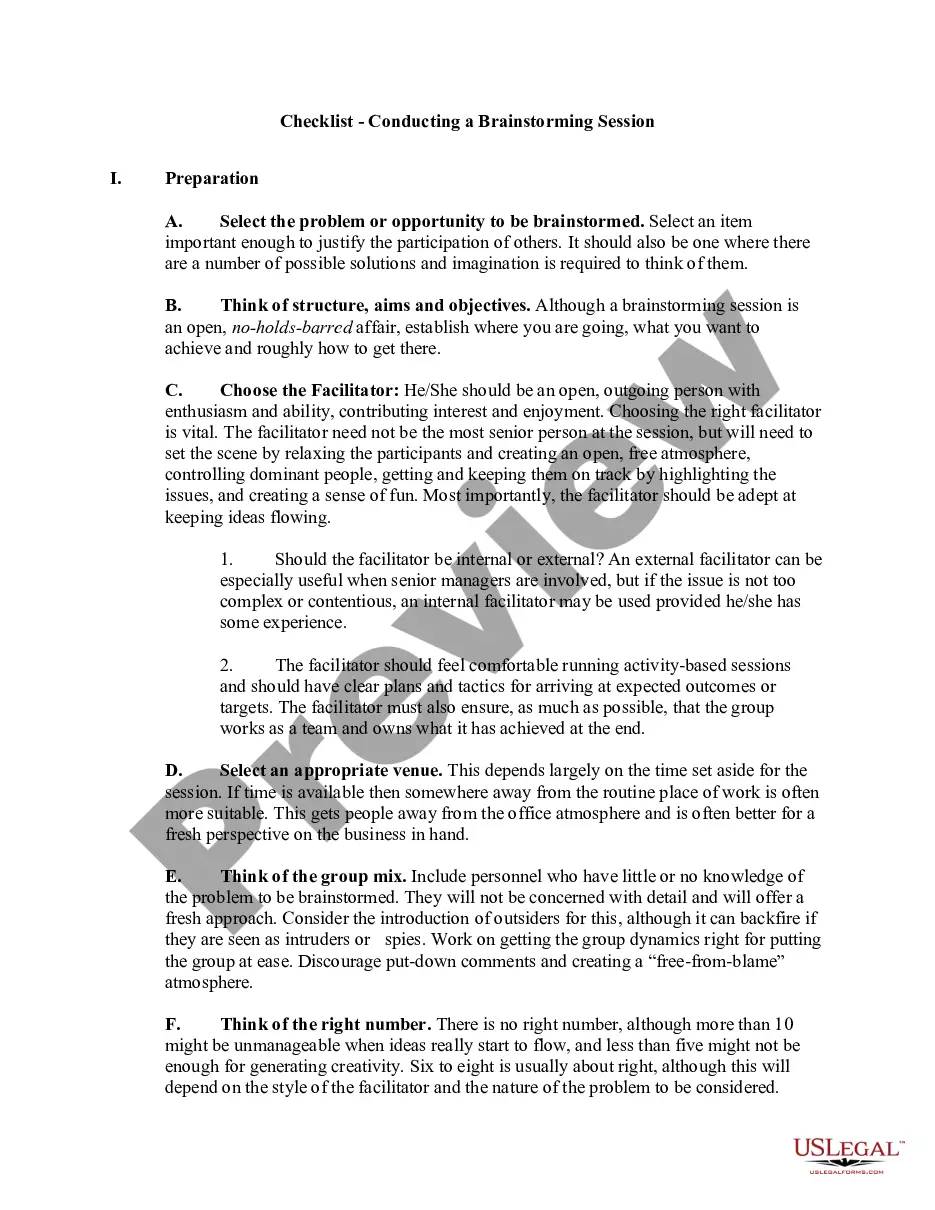

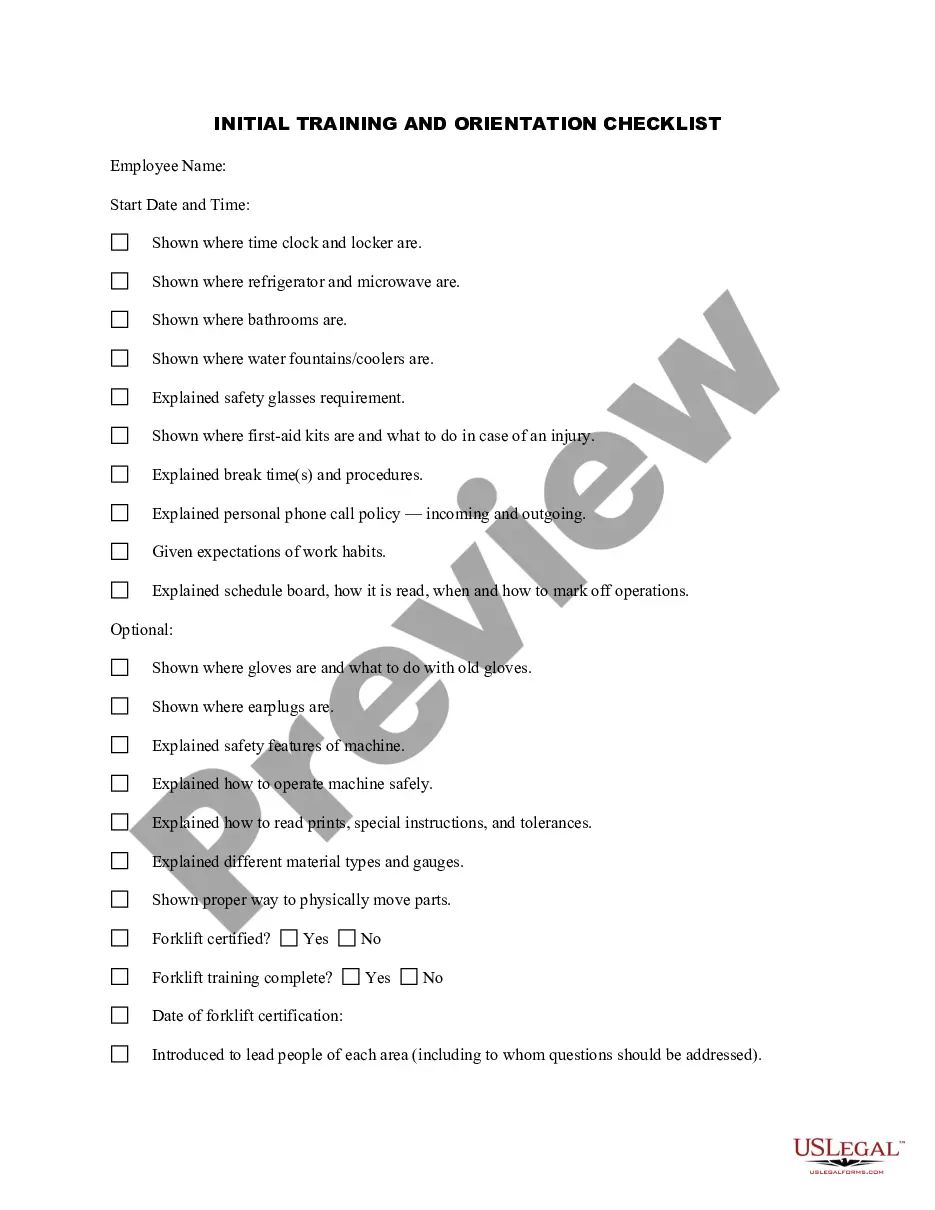

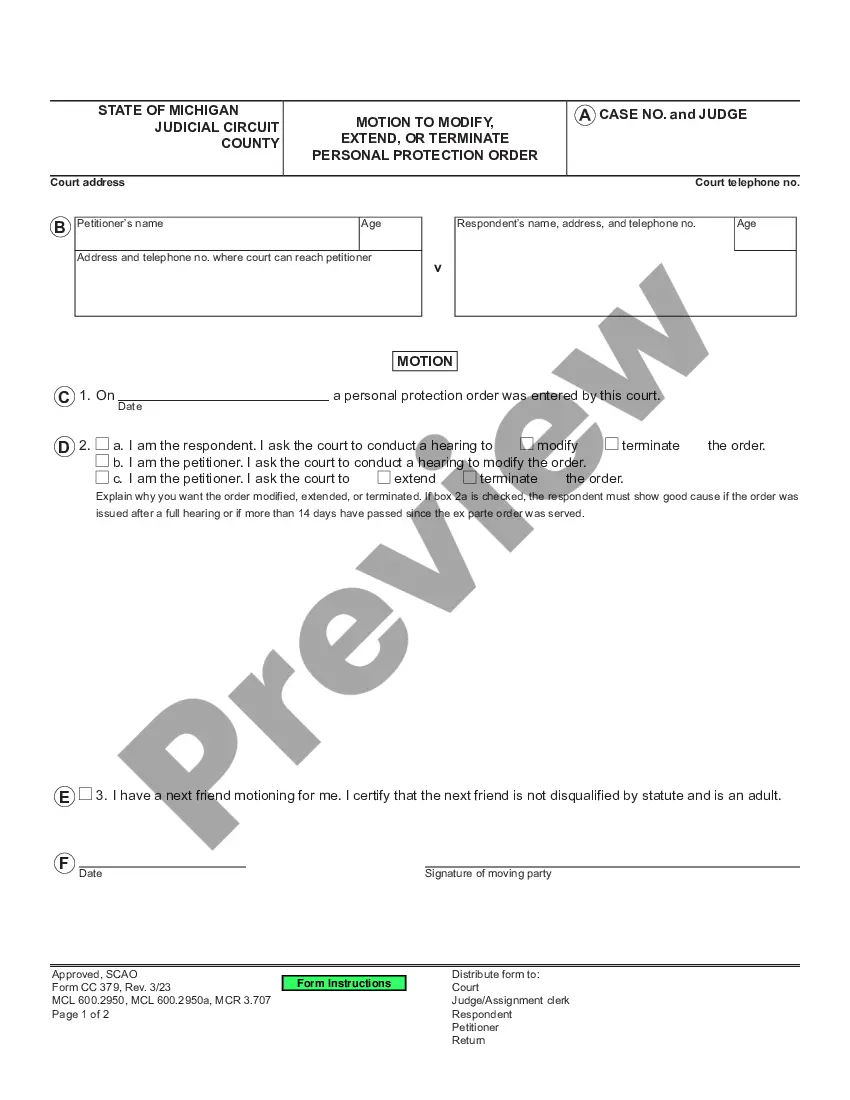

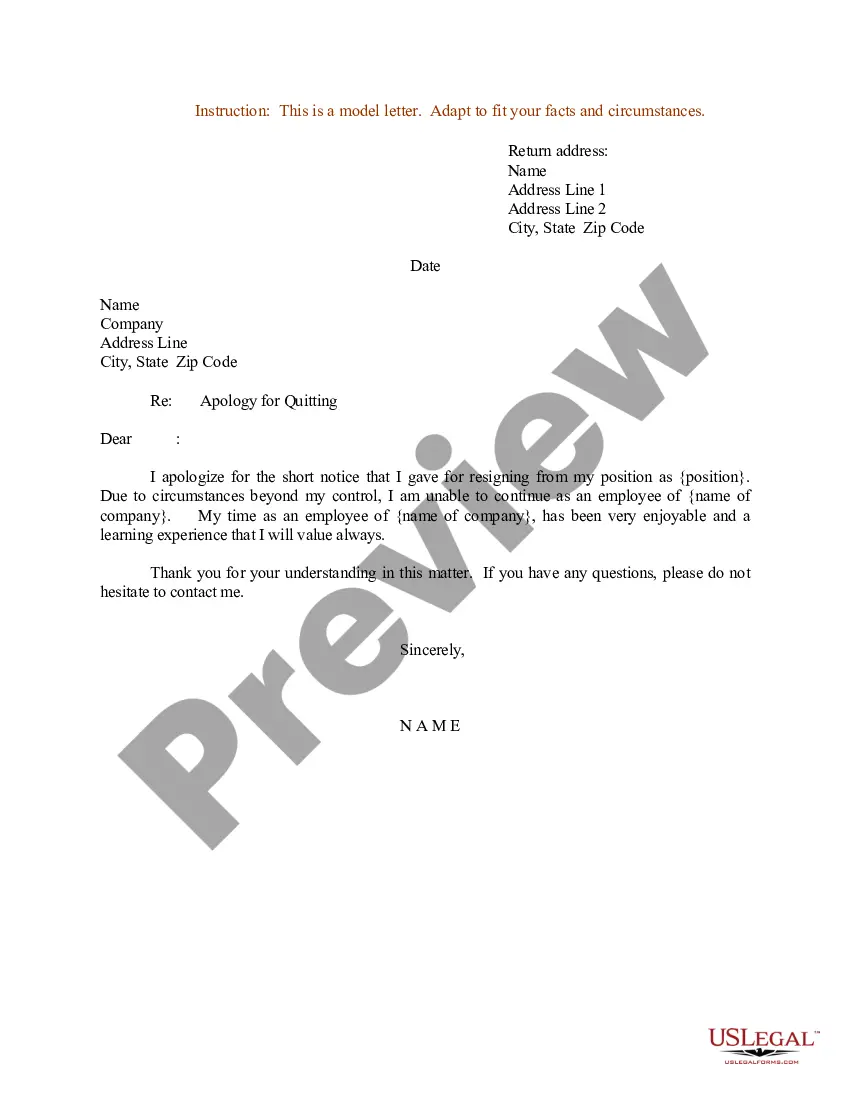

How to fill out List Of Creditors Holding 20 Largest Secured Claims - Not Needed For Chapter 7 Or 13 - Form 4 - Post 2005?

Locating a reliable source for the most up-to-date and suitable legal templates is a significant portion of dealing with bureaucratic processes.

Identifying the correct legal documents demands accuracy and careful consideration, which is why it is essential to obtain Secured Claims In Chapter 7 samples exclusively from trustworthy providers like US Legal Forms.

Eliminate the stress linked to your legal paperwork. Explore the vast library of US Legal Forms to discover legal templates, confirm their suitability for your circumstances, and download them instantly.

- Utilize the library navigation or search tool to locate your template.

- Examine the form’s description to determine if it meets your state and county specifications.

- Access the form preview, if available, to confirm the template aligns with your needs.

- Return to the search to find the correct template if the Secured Claims In Chapter 7 is not suitable.

- If you are confident in the form’s applicability, proceed to download it.

- If you are a registered user, click Log in to authenticate and retrieve your selected forms in My documents.

- If you do not have an account yet, click Buy now to purchase the template.

- Choose the pricing plan that corresponds to your requirements.

- Proceed to the registration to complete your transaction.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Select the file type for downloading Secured Claims In Chapter 7.

- Once the form is on your device, you may edit it using the provided editor or print it and fill it out by hand.

Form popularity

FAQ

A secured claim means that the lender has a legal right to specific assets in case of default. This gives the lender added protection compared to unsecured claims, which lack collateral. Understanding secured claims in chapter 7 is vital, as they can determine how assets are treated during bankruptcy proceedings. Utilizing resources like US Legal Forms can clarify these concepts and guide you through the process.

Common examples of secured claims include mortgages on homes and auto loans for vehicles. These claims ensure that the lender has rights to the property if the borrower defaults. It is important to recognize these when considering secured claims in chapter 7, as they can impact the bankruptcy process significantly.

A secured proof of claim is a formal document filed by a creditor in a bankruptcy case, indicating that they have a secured interest in a debtor's property. This document outlines the amount owed and the specific collateral backing the claim. In the context of secured claims in Chapter 7, understanding this process is crucial, as it affects how your debts are managed during bankruptcy. Utilizing resources like US Legal Forms can help you navigate this complex documentation.

Chapter 7 does not automatically eliminate secured debt; instead, it allows you to address those obligations strategically. You may choose to surrender the collateral, reaffirm the debt, or negotiate new terms. While secured claims in Chapter 7 remain intact, the process can help you relieve other burdensome debts, giving you a chance to rebuild your financial life. Seeking professional guidance can clarify your options.

Certain debts cannot be discharged in Chapter 7, including most secured claims, student loans, child support, and certain tax obligations. Secured claims in Chapter 7 can remain enforceable, allowing creditors to reclaim collateral if payments are not made. It is important to identify which debts fall into this category to understand your financial landscape better. Always consult with a bankruptcy attorney for a tailored assessment.

To get rid of secured debt, you can consider filing for Chapter 7 bankruptcy, which allows for the discharge of unsecured debts and may provide a fresh start. In this process, you can surrender the collateral associated with your secured debt, which helps eliminate the obligation. If you want to keep the collateral, negotiating with your lender or reaffirming the debt might be viable options. Exploring secured claims in Chapter 7 can guide your approach.

In Chapter 7 bankruptcy, secured debt typically remains in place, meaning creditors can still pursue the collateral associated with the debt. However, the bankruptcy process provides relief by discharging other unsecured debts. You can choose to either reaffirm the debt, surrender the collateral, or negotiate new terms with the creditor. Understanding secured claims in Chapter 7 is essential for making the best decision for your financial future.

To remove judgments from your house in Chapter 7, you may need to file a motion to avoid the lien. This process involves demonstrating that the judgment is impairing your homestead exemption, which protects a portion of your home’s equity. Secured claims in Chapter 7 can complicate this process, but successfully avoiding the lien can provide you with a fresh start. For assistance with the legal procedures, consider using US Legal Forms to navigate your options.

Chapter 7 does not cover certain types of debt, including most student loans, child support, and some tax obligations. Additionally, secured claims in Chapter 7, like mortgages or car loans, remain attached to the collateral, meaning you may still owe these debts after bankruptcy. It is important to understand these exclusions as they can impact your financial recovery. Utilizing resources like US Legal Forms can help clarify which debts are affected.

A proof of claim in Chapter 7 is a formal document that a creditor submits to establish the amount of the debt owed by the debtor. This document is essential for validating secured claims in Chapter 7, as it allows creditors to assert their rights to repayment. By filing a proof of claim, creditors can participate in the bankruptcy process and potentially recover some of the owed debts. If you need assistance with this process, consider using US Legal Forms for guidance.