Sample Letter For Violation

Description

How to fill out Letter From Landlord To Tenant As Notice To Terminate For Substantial Violation Of Rental Agreement Or Law That Materially Affects Health And Safety?

Whether for commercial reasons or personal matters, everyone must confront legal issues at some stage in their life.

Completing legal documents requires meticulous care, starting from selecting the appropriate form template.

Once it is saved, you can fill out the form using editing software or print it and complete it by hand. With an extensive US Legal Forms catalog available, you do not need to waste time searching for the correct template online. Utilize the library’s straightforward navigation to find the suitable form for any situation.

- Locate the template you require using the search bar or catalog browsing.

- Review the form’s details to ensure it suits your situation, state, and county.

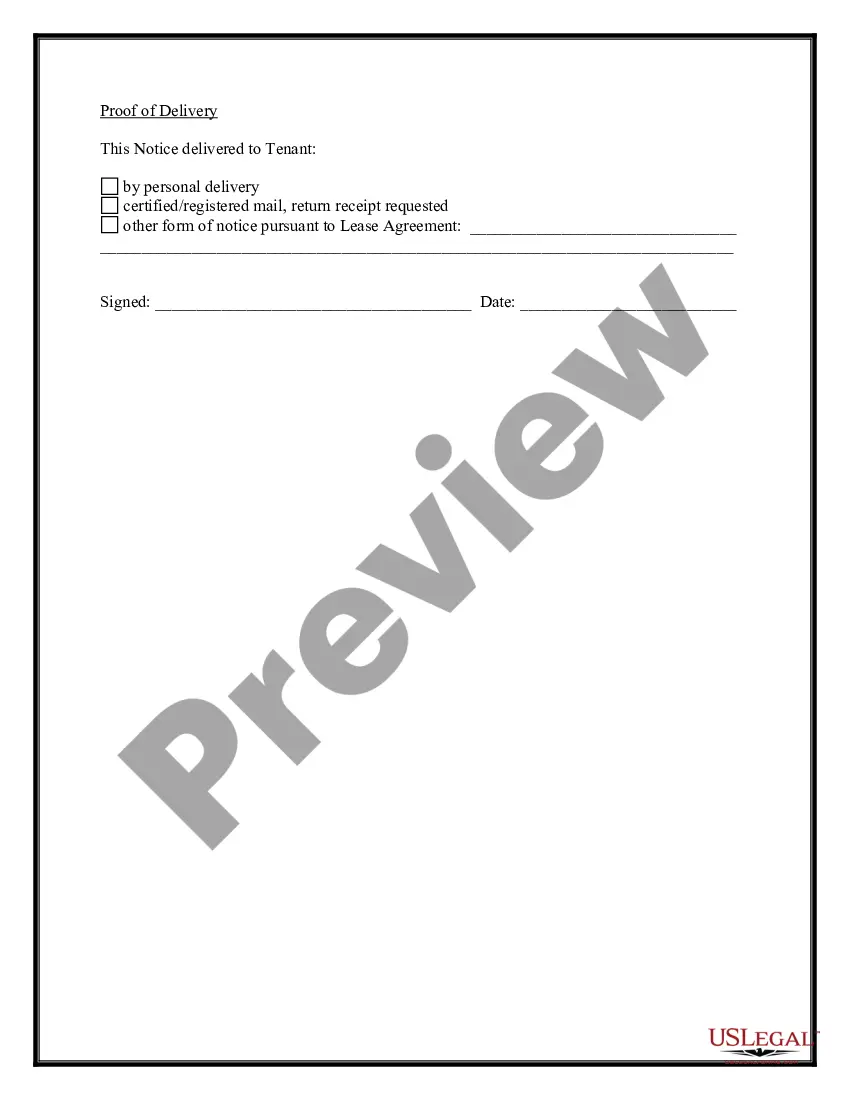

- Select the form’s preview to examine it.

- If it is the incorrect form, return to the search feature to find the Sample Letter For Violation template you are looking for.

- Obtain the file if it corresponds with your requirements.

- If you possess a US Legal Forms account, click Log in to access previously saved templates in My documents.

- If you haven’t created an account yet, you can acquire the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the profile registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the document format you prefer and download the Sample Letter For Violation.

Form popularity

FAQ

A Notice of Intent to Lien (NOI) is a document sent to notify certain parties on a construction project of the consequences of non-payment. An NOI is a warning that if payment isn't made, the claimant intends to file a mechanics lien. It works a lot like a demand letter.

A North Dakota Notice of Intent to Lien is a critical step to secure your ND mechanics lien rights on private construction projects. This North Dakota lien notice form is required to be sent by all potential claimants at least 10 days before filing a mechanics lien claim.

How to file a mechanics lien in North Dakota Your name and address. The property owner's name and address. A description of the property location sufficient for identification. A description of the labor and materials you furnished to the project. The unpaid amount to be claimed with a mechanics lien.

About North Carolina Notice of Intent to Lien Form No one wants to be forced to file a mechanics lien, and this document gives all of the parties involved one final chance to take care of the payment issues on a project. This form advises the party that a lien will be filed if payment is not received within 10 days.

North Dakota Mechanic's Lien (N.D. The lien is actually a two-part process. First, you should serve a notice of intent upon the owner at least 10 days prior to filing the lien. Then, you should file your lien within 90 days from last furnishing.

The mortgage, or deed of trust as it's called in some states, is the legal instrument that creates a lien on your property. This gives the lender the right to foreclose on your property should you not satisfy the terms of the loan agreement. It creates a security interest in the property on behalf of the lender.