Right Inheritance Wife For A Hat

Description

How to fill out Agreement Waiving Right Of Inheritance Between Husband And Wife In Favor Of Children By Prior Marriages?

Creating legal documents from scratch can occasionally be daunting.

Some situations might require extensive research and significant financial investment.

If you're searching for an easier and more economical method of preparing Right Inheritance Wife For A Hat or any other documents without unnecessary complications, US Legal Forms is always available to assist you.

Our online repository of over 85,000 current legal documents covers almost every aspect of your financial, legal, and personal affairs. With just a few clicks, you can swiftly access state- and county-specific forms meticulously prepared by our legal experts.

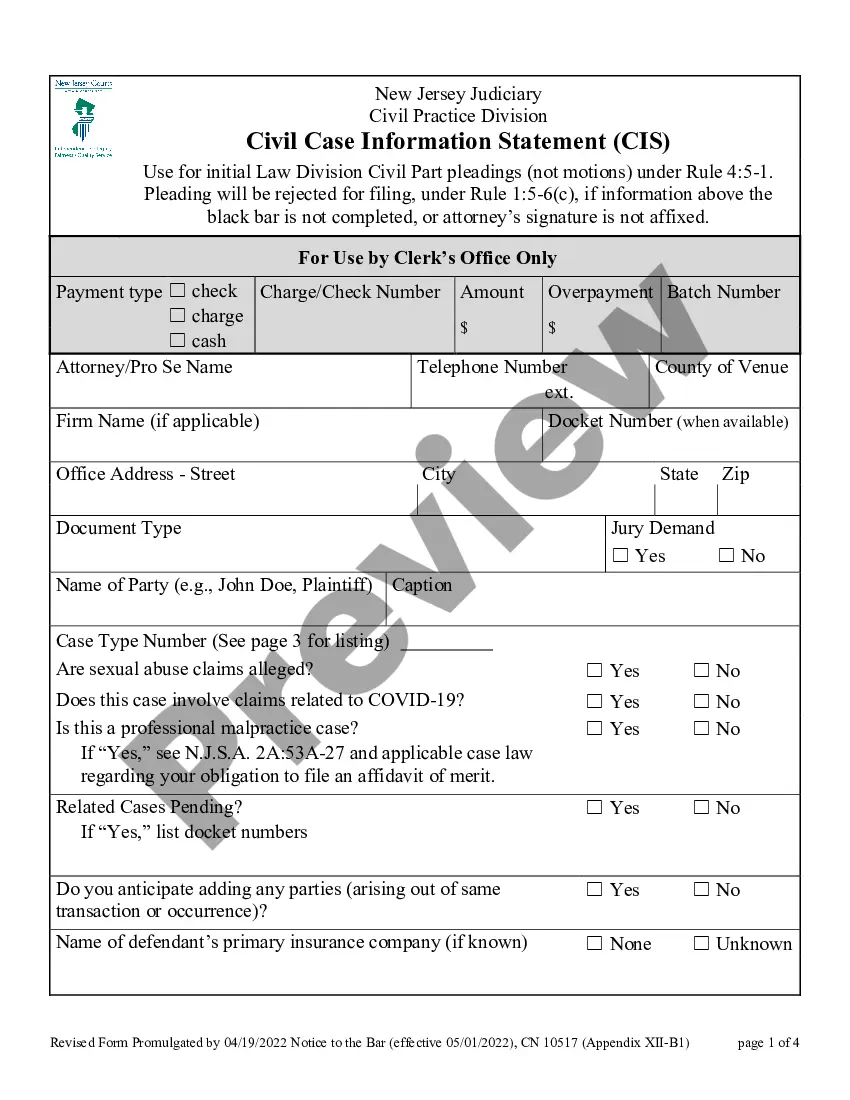

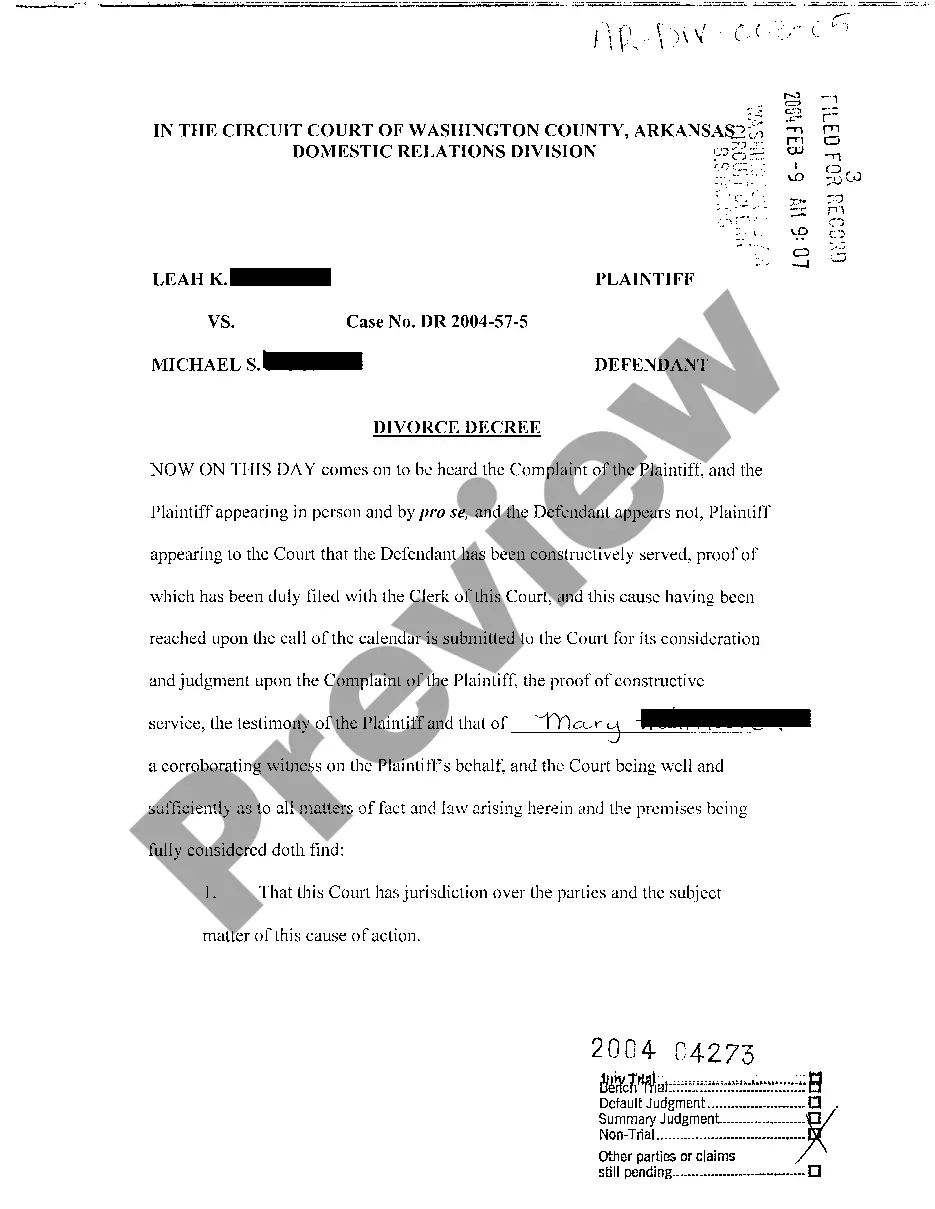

Examine the form preview and descriptions to ensure you are on the right document. Ensure the form you select meets your state and county regulations. Choose the most suitable subscription option to purchase the Right Inheritance Wife For A Hat. Download the form, then complete it, sign it, and print it out. US Legal Forms is well-regarded and has over 25 years of experience. Join us now and transform document completion into a simple and efficient process!

- Utilize our platform whenever you require trustworthy and dependable services through which you can easily find and download the Right Inheritance Wife For A Hat.

- If you’re already familiar with our services and have previously created an account with us, simply Log In to your account, find the template and download it or retrieve it later in the My documents section.

- Not registered yet? No problem. It only takes a few minutes to set up and explore the catalog.

- Before diving into downloading Right Inheritance Wife For A Hat, consider these suggestions.

Form popularity

FAQ

Korsakoff syndrome, highlighted in The Man Who Mistook His Wife for a Hat, is a chronic condition mainly caused by severe alcohol misuse. It affects memory and cognitive functions, leading individuals to create false memories or confabulate. Understanding such conditions can help you appreciate the complexities of human psychology, echoing the themes of right inheritance wife for a hat.

Divvying up your estate in an equal way between your children often makes sense, especially when their histories and circumstances are similar. Equal distribution can also avoid family conflict over fairness or favoritism.

Inheritances are not considered income for federal tax purposes, whether you inherit cash, investments or property. However, any subsequent earnings on the inherited assets are taxable, unless it comes from a tax-free source.

Widow inheritance (also known as bride inheritance) is a cultural and social practice whereby a widow is required to marry a male relative of her late husband, often his brother. The practice is more commonly referred as a levirate marriage, examples of which can be found in ancient and biblical times.

Consider Using a Trust A strategy that many wealthy families use to pass on assets to younger generations is a trust. A trust is a contract between someone who owns property (a grantor) and a person (called a trustee) who agrees to manage and distribute it to those ultimately entitled to receive it (the beneficiaries).

The law considers inherited property to be a personal gift to the recipient and a spouse or domestic partner has no claim to it. When couples divorce, the inherited property generally stays with the person who inherited it. But inherited property must retain its character as separate throughout the marriage.